Financial innovation through blockchain technology has moved beyond experimental phases into mainstream enterprise adoption. Major banks and financial institutions now deploy distributed ledger solutions for everything from cross-border payments to digital asset management.

Financial innovation through blockchain technology has moved beyond experimental phases into mainstream enterprise adoption. Major banks and financial institutions now deploy distributed ledger solutions for everything from cross-border payments to digital asset management.

We at Web3 Enabler see finance teams struggling to navigate this complex landscape while maximizing operational efficiency. This guide provides actionable strategies for implementing blockchain solutions that drive measurable business results.

Current State of Blockchain in Financial Services

Financial institutions have moved past blockchain pilot programs into full production deployments. JP Morgan processes over $1 billion daily through JPM Coin, while Visa’s blockchain network handles cross-border payments for major corporations at 70% lower costs than traditional wire transfers. Goldman Sachs tokenized $100 million in bonds in 2024, which proves institutional appetite for distributed ledger solutions.

Traditional Banks Adopt Distributed Ledger Technology

Bank of America processes $150 million weekly through blockchain settlement systems and cuts transaction time from three days to under one hour. Wells Fargo’s digital trade finance platform reduced documentary credit processing from 10 days to 24 hours for international clients. HSBC’s blockchain letters of credit system handles $2.5 billion annually with 90% fewer disputes than paper-based processes.

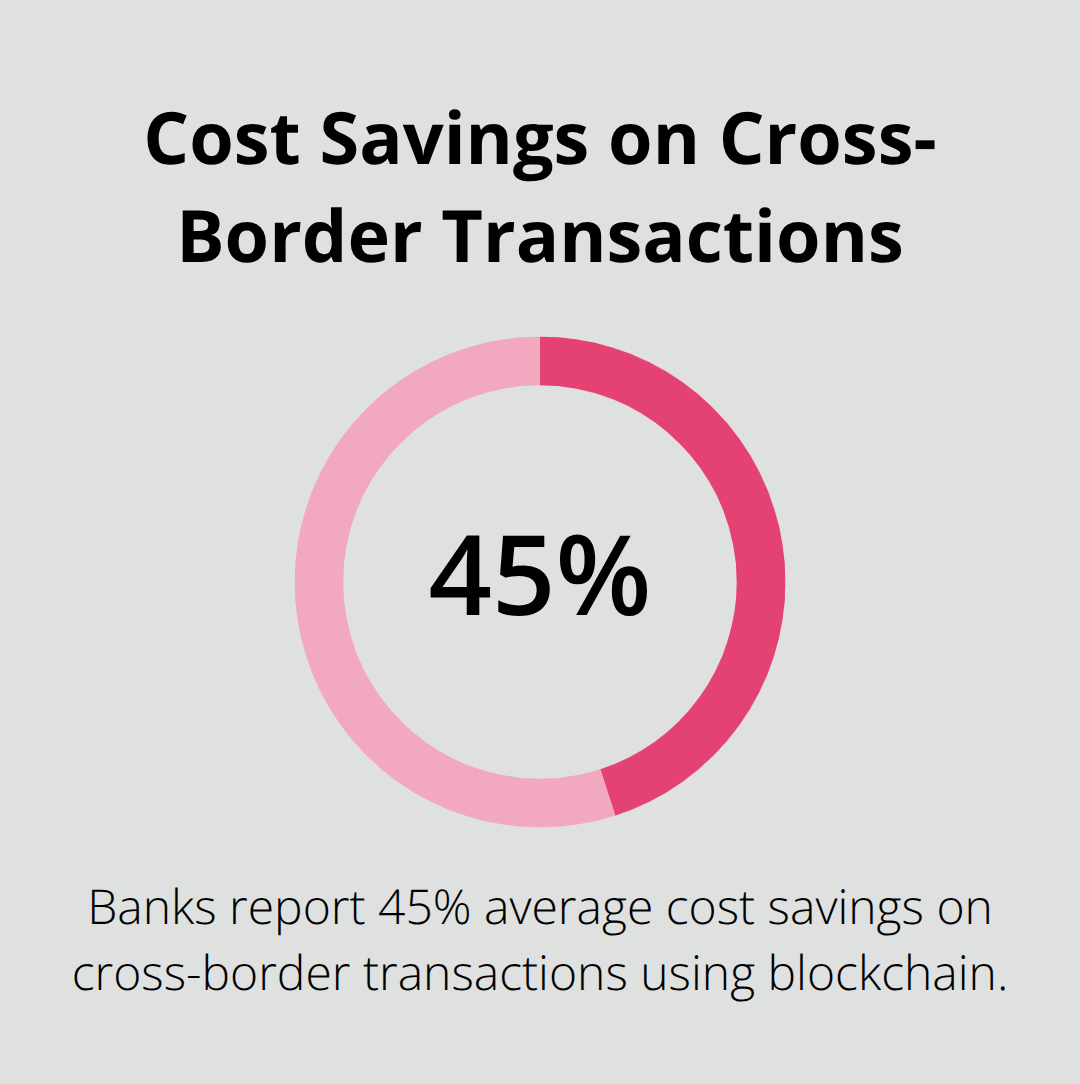

These implementations demonstrate measurable operational improvements rather than theoretical benefits. Participating banks report average cost savings of 45% on cross-border transactions while maintaining regulatory compliance standards.

Corporate Treasury Operations Transform Through Digital Assets

Treasury departments at Fortune 500 companies now hold cryptocurrency reserves that average $50 million per firm (according to Deloitte’s 2024 corporate treasury survey). Tesla maintains $1.5 billion in Bitcoin, while MicroStrategy holds over $7 billion across multiple digital assets. These companies report 35% faster international settlements and 60% reduced counterparty risks compared to traditional channels.

Corporate treasurers use blockchain for currency exposure hedging, with 78% of surveyed executives planning expanded crypto allocations through 2026. Financial advisory services integrate digital assets into existing treasury management systems to streamline operations and reduce settlement delays.

Major Financial Institutions Report Concrete Results

Leading banks now publish specific metrics from their blockchain implementations. Standard Chartered processes trade finance transactions worth $8 billion annually through blockchain platforms, reducing processing costs by 40%. Santander’s blockchain payment network handles over $20 billion in cross-border transfers with same-day settlement capabilities.

JPMorgan Chase expanded JPM Coin usage to include institutional clients beyond internal operations, processing payments for corporate customers across 40 countries. These real-world applications set the foundation for broader blockchain adoption across various financial services sectors.

Key Blockchain Applications Reshaping Finance

Cross-border payments represent the most immediate blockchain opportunity for finance teams, with transaction volumes expected to reach $3 trillion in 2025. Companies that use blockchain payment rails report 70% cost reductions compared to SWIFT networks, while settlement times drop from 3-5 business days to under 10 minutes. Walmart Canada eliminated 70% of freight invoice disputes through smart contract automation, while Maersk processes $14 billion in trade finance annually through blockchain platforms. These implementations generate measurable ROI within 6-12 months of deployment.

Cross-Border Payments and Settlement Systems

Traditional correspondent networks charge 4-6% fees for international transfers, while blockchain alternatives like JPM Coin and Visa’s B2B Connect operate at 0.1-0.5% transaction costs. Standard Chartered processes $8 billion annually through blockchain trade finance with 90% faster document verification than paper-based systems. DBS Bank reduced trade finance processing from 10 days to 4 hours with distributed ledger technology, handling over $12 billion in transactions since 2022.

Major corporations now bypass traditional banking rails entirely for international payments. PayPal and Square process more than $12 billion in blockchain payments in 2025, while their corporate clients save up to 45% on transaction fees compared to wire transfers.

Digital Asset Management and Investment Tracking

Investment firms now manage $2.3 trillion in tokenized assets (according to Boston Consulting Group research), with real estate tokenization reaching $1.4 trillion market size in 2025. BlackRock’s BUIDL fund processes $500 million in tokenized treasury bills, while Franklin Templeton operates blockchain-based money market funds worth $380 million. These platforms offer 24/7 trading capabilities and fractional ownership options that traditional securities cannot match.

Fortune 500 companies hold cryptocurrency reserves that average $50 million per firm according to Deloitte’s 2024 corporate treasury survey. Tesla maintains $1.5 billion in Bitcoin, while MicroStrategy holds over $7 billion across multiple digital assets with 35% faster international settlements.

Smart Contracts for Automated Financial Processes

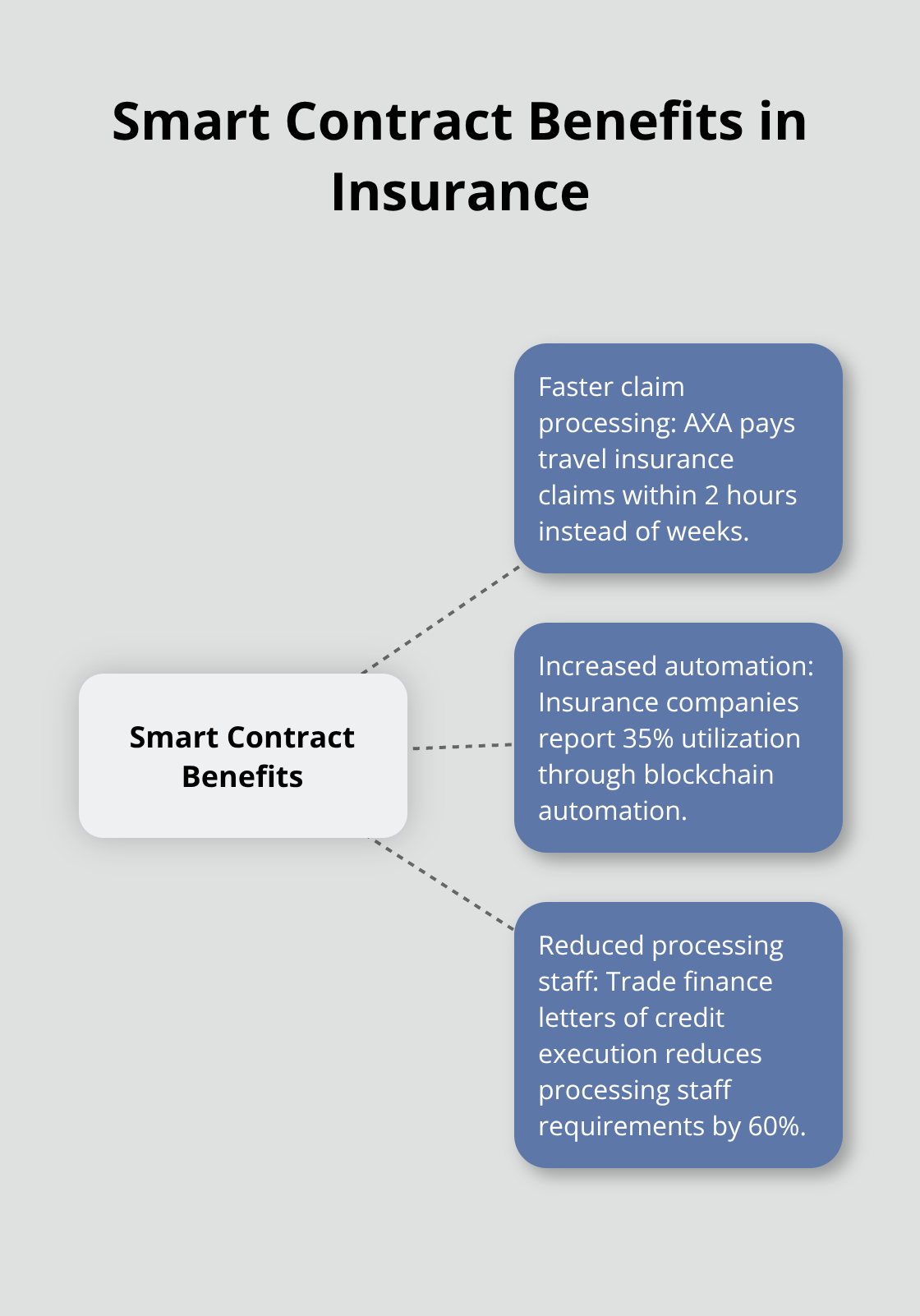

Smart contracts eliminate manual reconciliation tasks that cost banks an average of $6 million annually per institution (according to Accenture analysis). Insurance companies report 35% utilization through blockchain automation, with AXA paying travel insurance claims within 2 hours instead of weeks. Trade finance letters of credit execute automatically when shipping conditions are met, reducing processing staff requirements by 60% while maintaining compliance standards.

These automated systems create the foundation for enterprise blockchain integration strategies that finance teams can implement within existing corporate infrastructure.

How Should Finance Teams Implement Blockchain Technology

Finance teams need structured deployment strategies that integrate blockchain capabilities with existing Salesforce infrastructure rather than replace entire systems. We at Web3 Enabler see organizations achieve 60% faster implementation when they build on proven CRM platforms instead of create standalone blockchain solutions. Early enterprise deployments reveal substantial returns: manufacturers report higher defect detection through automated visual checks, logistics operators see improved efficiency through integrated blockchain solutions.

Start with Payment Processing Integration

Finance departments should prioritize cross-border payments as their initial blockchain use case since these generate immediate ROI within 90 days. Organizations that integrate blockchain payment rails with Salesforce report 70% cost savings on international transfers while they reduce settlement times from 3-5 days to under 10 minutes. Web3 Enabler provides seamless Salesforce integration that connects blockchain transactions to existing corporate infrastructure, enabling faster and cheaper global payments with transactions settling in seconds.

Treasury teams can manage digital assets, track investment returns, and handle international contractor payments directly within their familiar Salesforce environment. Deutsche Bank reduced international payment processing costs by 50% after it implemented blockchain solutions that connect with their existing CRM systems, while it maintained full compliance with banking regulations.

Build Comprehensive Staff Training Programs

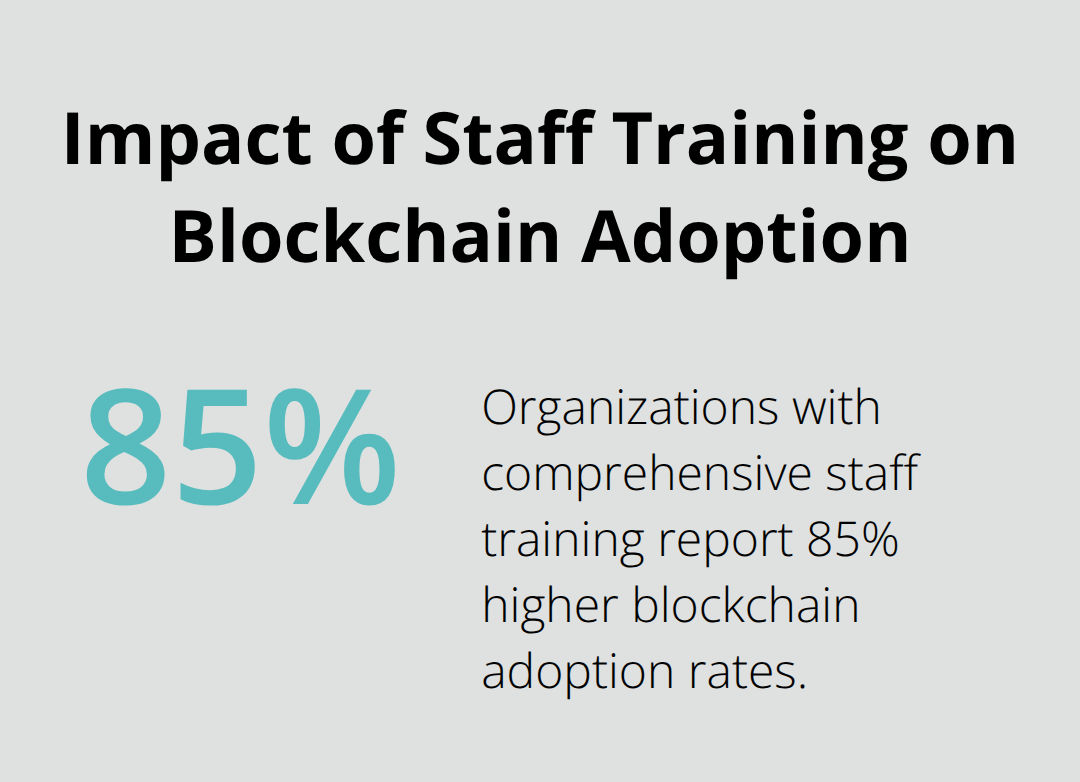

Finance teams must develop blockchain literacy across all department levels to maximize implementation success. Organizations that invest in comprehensive staff training report 85% higher adoption rates compared to companies that rely on external consultants alone. Training programs should cover blockchain fundamentals, regulatory requirements, and hands-on experience with integrated Salesforce tools.

Staff members need practical experience with digital asset management, smart contract execution, and blockchain transaction monitoring. Companies achieve best results when they combine theoretical knowledge with real-world practice sessions that simulate actual business scenarios (including cross-border payments and digital asset transfers).

Address Regulatory Compliance Through Systematic Documentation

Blockchain implementations must satisfy existing financial reporting requirements that auditors understand and regulatory bodies accept. Finance teams should establish blockchain transaction documentation that maps to traditional accounting standards, with each digital asset transfer creating standard journal entries in existing ERP systems.

The SEC requires detailed digital asset disclosures that match conventional securities reporting, while the CFTC mandates specific record-keeping for cryptocurrency transactions that exceed $1 million annually. Organizations achieve regulatory compliance by treating blockchain transactions as extensions of current financial processes rather than separate systems that require new audit procedures. Digital currency accounting requires specialized approaches to maintain compliance while capturing blockchain transaction benefits.

Establish Risk Management Protocols

Finance departments must implement comprehensive risk management frameworks that address blockchain-specific challenges while they maintain existing internal controls. Organizations should establish clear policies for digital asset custody, transaction limits, and approval workflows that integrate with current corporate governance structures.

Risk management protocols should include multi-signature wallet requirements, regular security audits, and incident response procedures that align with existing corporate security policies. Companies that establish these frameworks before implementing blockchain in business report 75% fewer security incidents and faster regulatory approval processes.

Final Thoughts

Financial innovation through blockchain technology will accelerate dramatically through 2026, with McKinsey projecting stablecoin usage to reach $2 trillion by 2028. Finance leaders who implement blockchain solutions now position their organizations ahead of competitors still relying on legacy payment systems that cost 4-6% per international transfer. Business leaders should prioritize cross-border payments as their initial blockchain deployment since these generate immediate ROI within 90 days.

Organizations achieve best results when they integrate blockchain capabilities with existing Salesforce infrastructure rather than replace entire systems. Companies that build on proven CRM platforms report 60% faster implementation compared to standalone blockchain solutions. The regulatory landscape continues to evolve favorably for enterprise blockchain adoption, with the SEC’s Spring 2025 Regulatory Agenda clarifying legal frameworks for crypto assets while joint SEC-CFTC efforts harmonize digital asset regulations (reducing compliance uncertainty that previously hindered corporate blockchain adoption).

Web3 Enabler provides the bridge between traditional finance operations and blockchain innovation through native Salesforce integration. Our platform enables finance teams to manage digital assets, process international payments, and track investment returns within their familiar CRM environment. We maintain full regulatory compliance and operational efficiency while finance teams access blockchain capabilities without disrupting existing workflows.