Your international payment just got stuck in banking limbo again. Three days later, you’re still explaining to clients why their money is taking a scenic tour through correspondent banks.

We at Web3 Enabler know this pain all too well. Global settlements shouldn’t feel like sending a letter by horseback in the digital age.

Blockchain technology is flipping this script entirely. What used to take days now happens in minutes, with fees that won’t make your CFO cry.

How Blockchain Transforms Cross-Border Payments

Traditional Banking Makes Global Payments Feel Like Torture

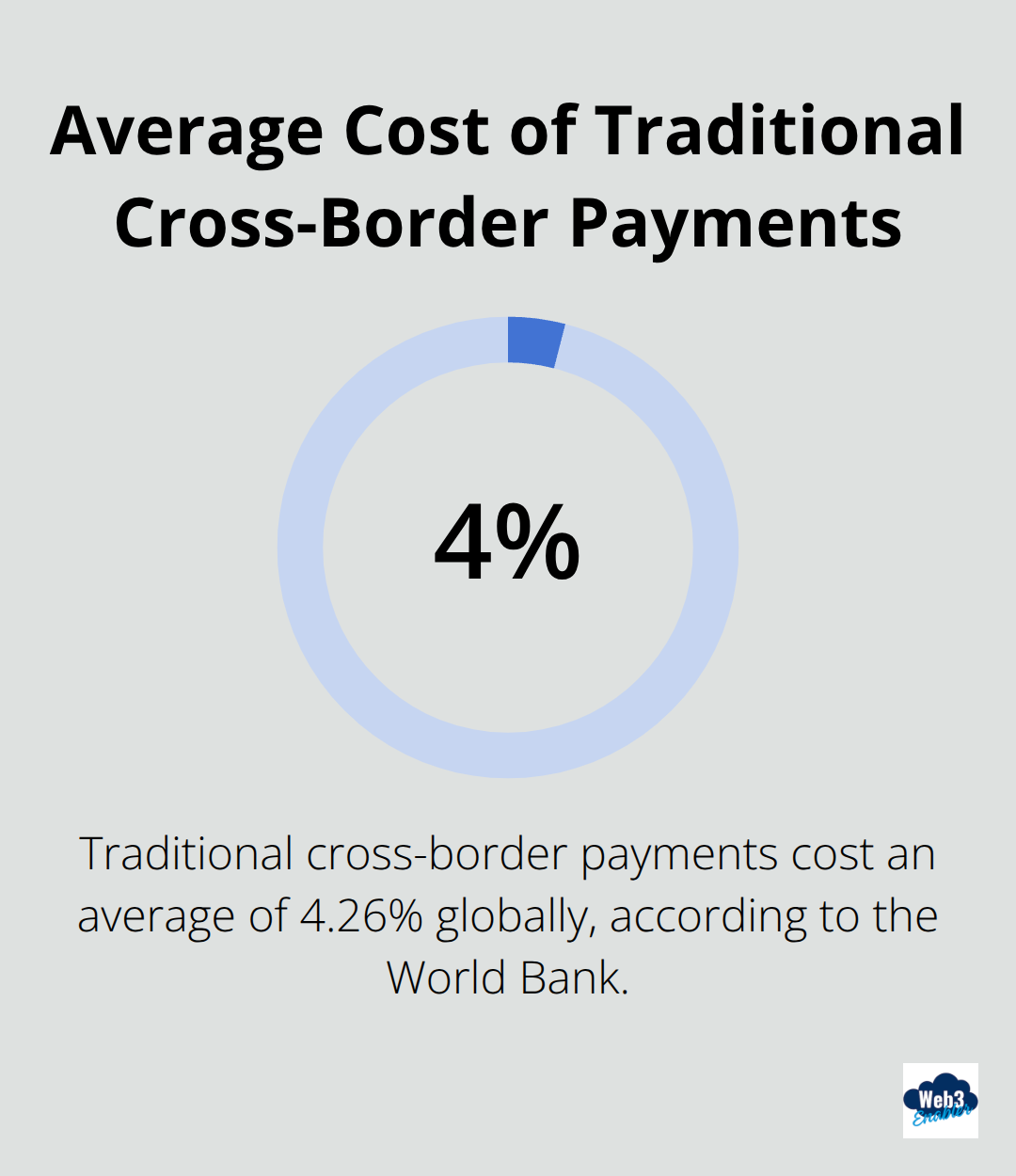

Your $50,000 supplier payment to Germany starts its journey through a maze that would make a hedge fund quant weep. First stop: your local bank, where it sits for 24 hours while they verify everything twice. Next, it hops to a correspondent bank in New York, then another in Frankfurt, each one takes their sweet time and their cut. The World Bank reports that traditional cross-border payment costs average 4.26% globally, with processing times that stretch 3-5 business days for what should be instant money movement.

Blockchain Settlements Happen in Real Time

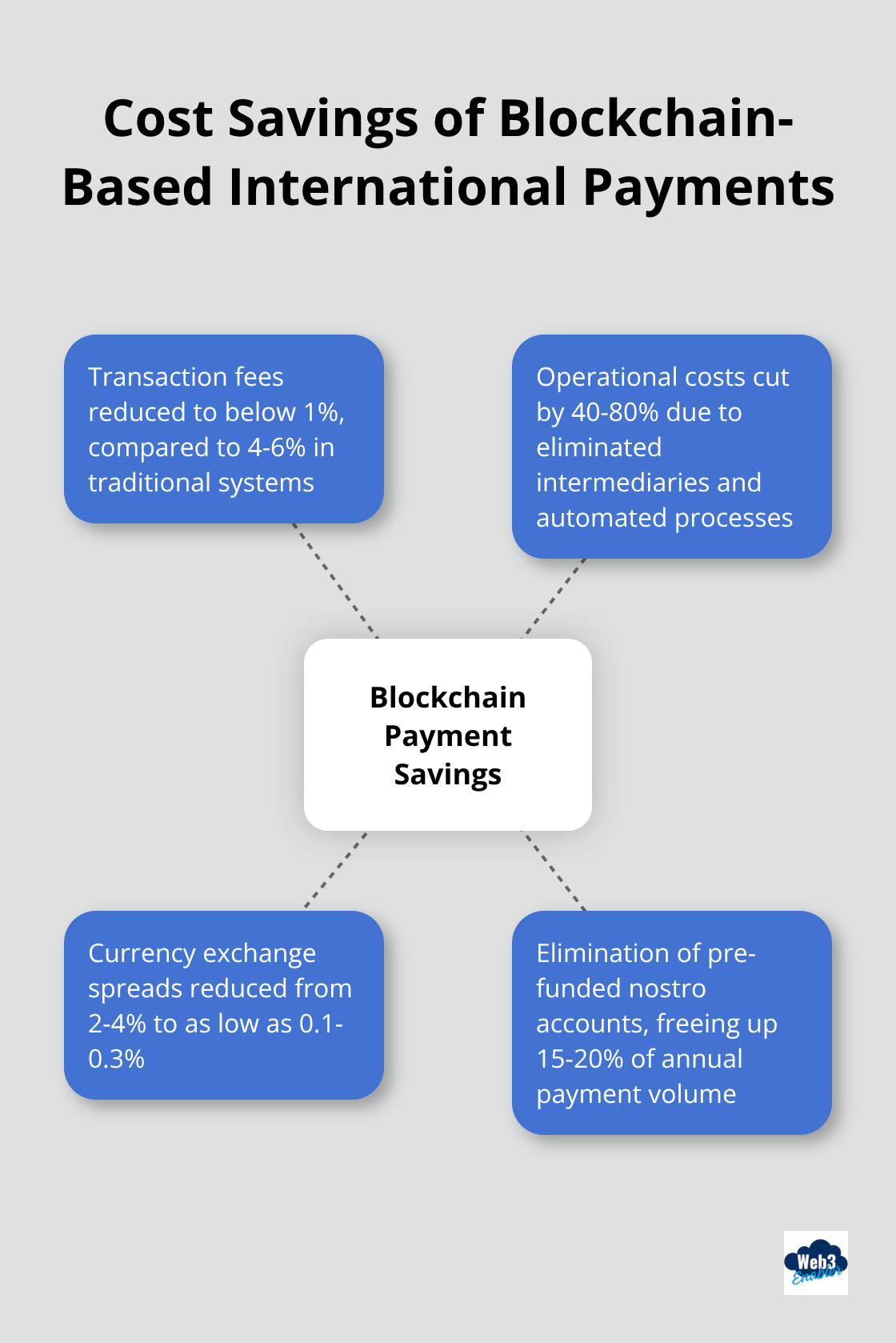

Blockchain payments skip this entire circus. UBS Digital Cash proved this during their pilot program with multinational companies-they processed transactions in seconds rather than days. The system operates 24/7, which means your Friday afternoon payment actually arrives on Friday, not the following Tuesday. McKinsey research shows blockchain can reduce cross-border transaction fees to below 1%, compared to traditional banking systems. Companies that use blockchain-based solutions report transaction confirmations within minutes, with some platforms that achieve settlement times under 30 seconds.

Complete Payment Visibility Changes Everything

Traditional payments disappear into a black hole once you hit send. Blockchain gives you real-time tracking that makes FedEx look primitive. Every transaction step gets recorded on an immutable ledger, so you know exactly where your money sits at any moment. This transparency eliminates those awkward client calls that ask where their payment went. Smart contracts automate compliance checks like KYC and AML without extra paperwork, which streamlines operations while they maintain regulatory standards. Financial institutions that adopt blockchain report 40-80% reductions in operational costs due to eliminated intermediaries and automated processes.

These efficiency gains create a ripple effect that transforms how businesses manage their international finances-but the real magic happens when you look at the cost savings.

Cost Benefits of Blockchain International Settlements

Traditional Banking Fees Stack Up Fast

Every international payment through traditional banks collects fees like a toll road from hell. Your $100,000 payment to suppliers in Asia gets hit with bank fees, correspondent charges, and currency conversion spreads that reach 4-6% of the total amount. Companies that process $10 million annually in international payments typically spend $400,000-$600,000 on fees alone. Blockchain platforms eliminate these intermediary costs entirely when they connect sender and receiver directly on the network.

Infrastructure Costs Drop to Nearly Zero

Traditional payment systems require expensive relationships with correspondent banks, dedicated treasury teams, and complex reconciliation systems that cost enterprises millions annually to maintain. UBS reported their Digital Cash pilot reduced operational overhead by 65% compared to traditional settlement processes. Businesses that switch to blockchain-based international payments eliminate the need for pre-funded nostro accounts (which typically tie up 15-20% of annual payment volume in idle cash). The Bank for International Settlements found that blockchain settlements require 90% fewer manual interventions than traditional systems, which translates to significant labor cost reductions.

Currency Exchange Spreads Vanish

Traditional banks profit heavily from currency exchange spreads that can add 2-4% to your international payments. These hidden costs compound when payments route through multiple correspondent banks, each one takes their cut on the conversion. Blockchain payments use stablecoins or direct cryptocurrency exchanges that operate with spreads as low as 0.1-0.3%. Companies report savings of $50,000-$200,000 annually just from reduced foreign exchange costs when they process payments through blockchain networks instead of traditional banking channels.

The cost savings create a compelling business case, but the real question becomes how to actually implement these systems without disrupting your current operations.

Implementation Strategies for Businesses

Pick Your Platform Based on Transaction Volume, Not Hype

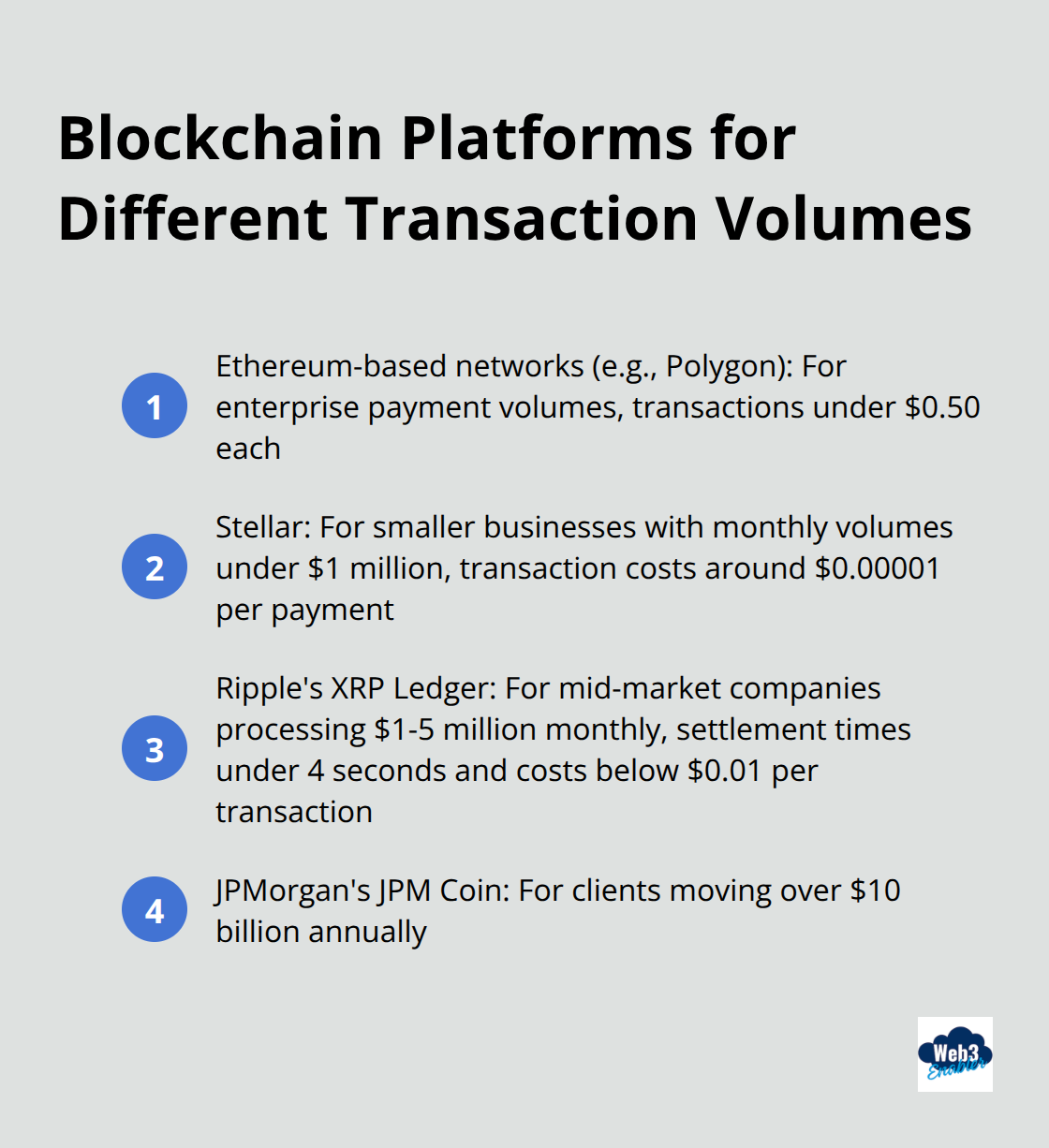

Enterprise payment volumes work best on Ethereum-based networks like Polygon, which processes transactions for under $0.50 each. Smaller businesses with monthly volumes under $1 million should consider Stellar, where transaction costs hover around $0.00001 per payment. Ripple’s XRP Ledger handles mid-market companies that process $1-5 million monthly with settlement times under 4 seconds and costs below $0.01 per transaction. JPMorgan’s JPM Coin serves clients who move over $10 billion annually, though access requires existing bank relationships. Circle’s USDC on BASE and Tether’s USDT on Tron are extremely popular in global trade. The key factor isn’t which blockchain sounds coolest-it’s how you match your payment volume and geographic reach to platform capabilities.

Integration Happens Through APIs, Not System Overhauls

Your existing ERP and accounting systems connect to blockchain networks through payment gateway APIs that require zero changes to current workflows. Companies like Nium offer blockchain payment APIs that plug directly into SAP, Oracle, and QuickBooks within 2-3 weeks. Treasury teams can initiate blockchain payments through the same interfaces they use for wire transfers, while finance departments receive the same settlement confirmations and reconciliation data they always have. Banks like UBS offer hybrid solutions where blockchain settlements happen behind the scenes while your team uses familiar portals (no retraining required). The implementation doesn’t disrupt daily operations because the blockchain layer sits underneath existing processes.

Regulatory Compliance Gets Built Into the Platform

Choose platforms that embed compliance features rather than bolt them on afterward. Stellar and Ripple networks include built-in AML screening and KYC verification that meets EU MiCA regulations and US FinCEN guidelines automatically. Your compliance team needs to verify that chosen platforms maintain proper licenses in target countries-Ripple holds money transmitter licenses in 40+ states, while Circle’s USDC stablecoin operates under full reserve regulations. The biggest mistake companies make is they select technically superior platforms that lack regulatory approvals in key markets, which forces expensive workarounds or complete platform switches later. Understanding crypto legislation helps enterprises navigate these regulatory requirements effectively.

Test Small Before You Scale Big

Start with pilot programs that process 5-10% of your international payment volume through blockchain networks. This approach lets you measure actual settlement times, transaction costs, and system reliability without major operational risk. UBS ran their Digital Cash pilot with select multinational companies before full deployment (smart move that prevented costly mistakes). Most enterprises report 2-3 months of testing provides enough data to make informed scaling decisions about blockchain payment adoption.

Final Thoughts

Your competitors still explain to clients why payments take three days while you settle transactions in minutes. That’s the competitive advantage blockchain delivers right now. Companies that adopt blockchain payments today position themselves ahead of businesses that wait for perfect solutions tomorrow.

Global settlements through blockchain aren’t experimental anymore. UBS, JPMorgan, and major enterprises prove these systems work at scale. Early adopters capture market share when they offer clients faster payments, lower costs, and complete transaction transparency that traditional banks can’t match.

The window for competitive advantage closes as blockchain adoption accelerates. McKinsey projects blockchain’s economic impact could reach $1.5 trillion within the next decade (that’s serious money). Ready to transform your international payments? Web3 Enabler provides blockchain solutions that connect directly with your current infrastructure. We help businesses implement faster, cheaper global payment systems without the headaches.

![Accepting Crypto Payments in Salesforce [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/salesforce-crypto-payments-hero-1763468205.jpeg)