Stablecoins have quietly become the backbone of digital finance, processing over $7 trillion in transactions during 2024 alone. But what are stablecoins used for beyond just holding value?

Stablecoins have quietly become the backbone of digital finance, processing over $7 trillion in transactions during 2024 alone. But what are stablecoins used for beyond just holding value?

We at Web3 Enabler see businesses discovering these digital dollars solve real problems – from instant cross-border payments to streamlined B2B transactions. The applications go far beyond crypto trading.

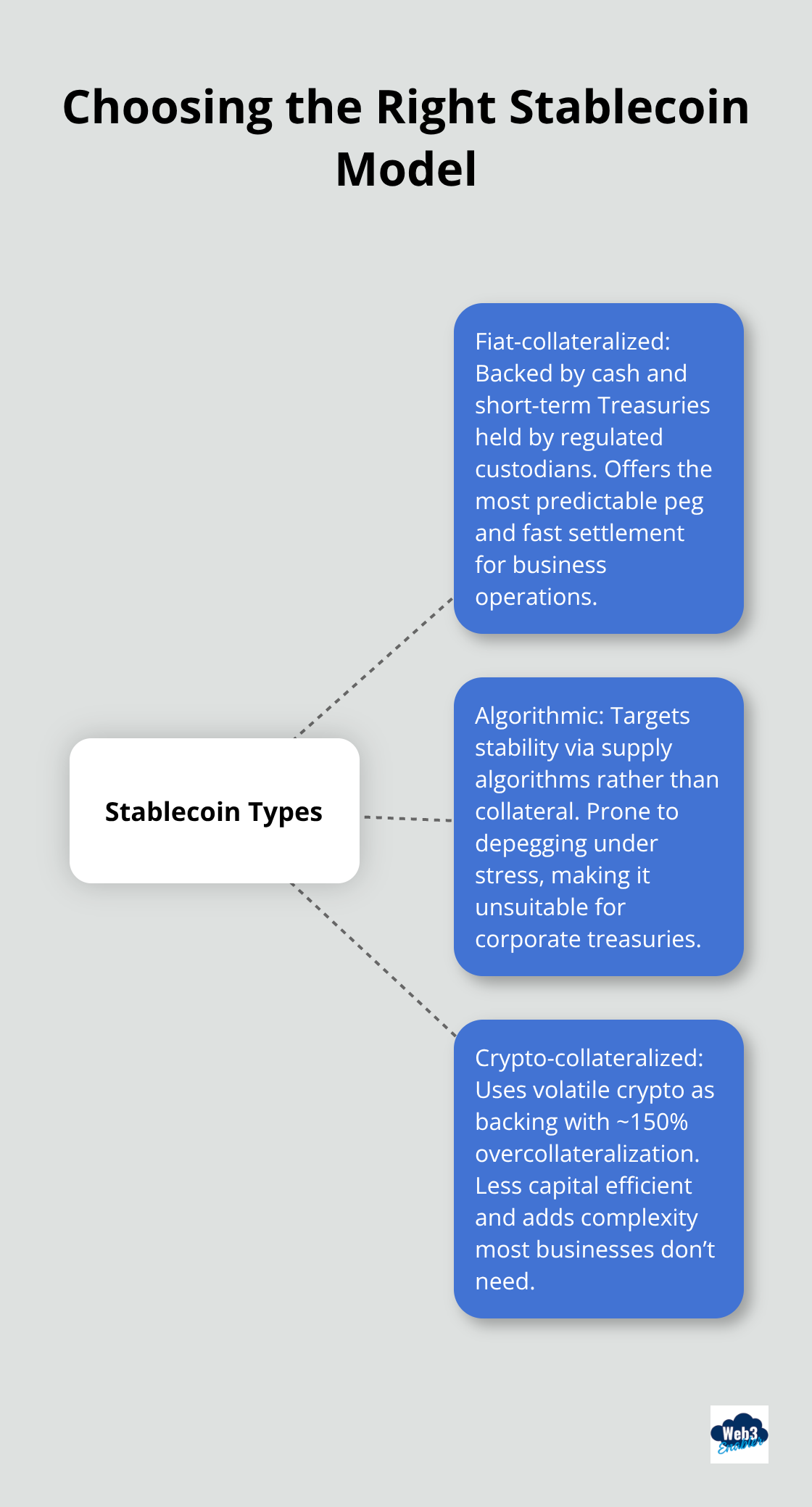

Which Stablecoin Type Fits Your Business

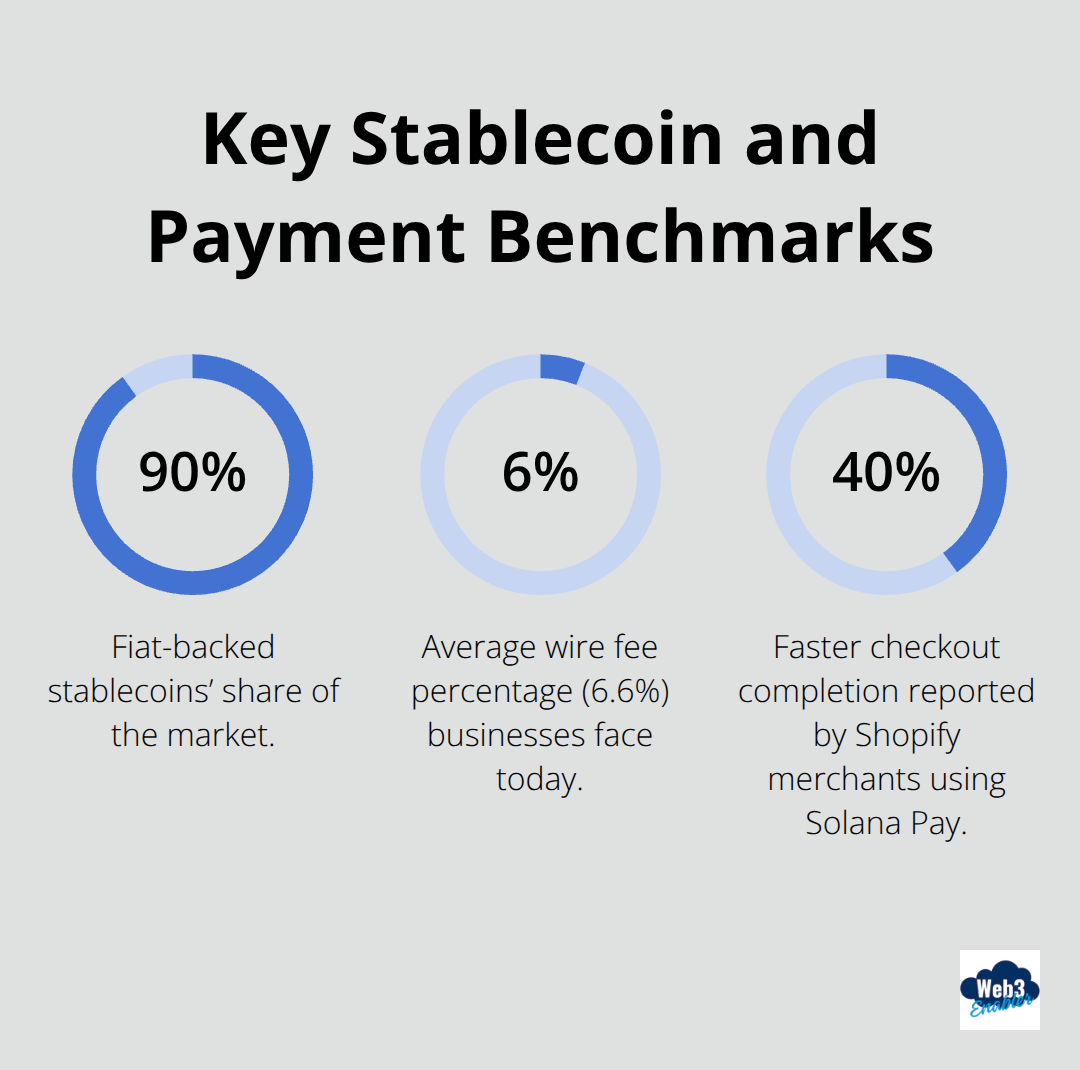

Think of stablecoins as three different flavors of digital money, each with distinct trade-offs for business use. Fiat-collateralized stablecoins like USDC and Tether dominate the market with over 90% market share, and for good reason. These tokens maintain their dollar peg through actual cash reserves that regulated custodians hold. Circle backs USDC with US Treasury bills and cash equivalents, while Tether holds a mix of cash, government securities, and commercial paper to support USDT’s $150 billion circulation (according to Bloomberg reports).

The Safe Bet for Business Operations

For businesses that enter the stablecoin space, fiat-backed options offer the most predictable experience. USDC provides monthly attestation reports from Grant Thornton, which gives finance teams the transparency they need for compliance. USDT provides broader wallet support but carries regulatory uncertainty that makes compliance teams nervous. Both settle transactions in seconds compared to traditional wire transfers that take days.

Why Algorithmic Stablecoins Spell Trouble

Algorithmic stablecoins promise stability through smart contract mechanisms rather than collateral support, but Terra’s UST collapse in 2022 erased nearly $40 billion in value almost overnight. These experimental tokens adjust supply based on demand, which creates inherent instability during market stress. Business treasury departments should avoid algorithmic stablecoins entirely – the theoretical benefits never outweigh the catastrophic risk of complete depegging.

Crypto-Backed Options Need Extra Caution

Crypto-collateralized stablecoins like DAI use other cryptocurrencies as backing (typically requiring 150% overcollateralization to maintain stability). While these offer more decentralization, they introduce additional complexity and volatility risk that most businesses don’t need. The overcollateralization requirement means capital efficiency suffers compared to fiat-backed alternatives.

Each stablecoin type serves different business needs, but the real question becomes: how do companies actually put these digital dollars to work?

Where Do Businesses Actually Use Stablecoins

Cross-border payments represent the most compelling business case for stablecoins today. Traditional wire transfers cost businesses an average of 6.6% in fees according to World Bank data, while stablecoin transfers typically cost under $5 regardless of amount. MoneyGram processes over $2 billion annually through stablecoin rails and cuts settlement times from days to minutes.

Companies that send regular payments to suppliers in emerging markets save thousands monthly while they gain real-time transaction visibility that legacy systems cannot match.

Treasury Management Gets a Digital Upgrade

Enterprise treasury operations benefit significantly from stablecoin integration, particularly for companies that manage cash across multiple subsidiaries. JPMorgan’s platform Kinexys has processed over $1.5 trillion in transaction volume cumulatively. Smart contracts automate supplier payments based on delivery confirmations, which eliminates manual invoice delays. Companies that hold USDC can earn yields through tokenized Treasury products while they maintain instant liquidity access (something traditional money market funds cannot provide with same-day settlement requirements).

DeFi Yields Come With Real Risks

Decentralized finance platforms offer stablecoin holders yields that range from 3-15% annually through protocols like Aave and Compound. However, these returns carry substantial smart contract risks that most corporate treasurers should avoid. The collapse of several DeFi protocols in 2022 demonstrated that code vulnerabilities can wipe out funds instantly. Conservative businesses should stick to regulated stablecoin issuers and traditional relationships rather than chase DeFi yields that threaten principal preservation.

E-commerce Merchants Embrace Instant Settlement

Online retailers increasingly accept stablecoins to reduce payment processor fees (which typically range from 1.5% to 3.5% per transaction). Companies like Shopify and Microsoft accept USDC payments because stablecoins eliminate chargeback fraud that costs merchants $31 billion yearly. International customers avoid currency conversion fees while merchants receive instant settlement without waiting periods. This creates a win-win scenario that traditional payment rails struggle to match.

The real magic happens when businesses move beyond simple payments into more complex operational workflows.

How Companies Actually Implement Stablecoins

E-commerce businesses that integrate stablecoin payments see immediate operational benefits beyond just cost savings. Shopify merchants who use Solana Pay report 40% faster checkout completion rates because customers avoid lengthy credit card authorization processes. The absence of chargeback risk means retailers can ship high-value items immediately rather than wait for payment confirmation. Fashion retailer Newegg processes over $50 million annually in USDC payments and eliminates the $2.3 million in annual chargeback losses they previously absorbed. International customers particularly appreciate that they avoid the 3-4% foreign exchange markup that traditional payment processors impose (which makes luxury purchases significantly more attractive).

Supply Chain Payments Go Digital

Manufacturing companies transform their supplier relationships through programmable stablecoin payments that execute automatically upon delivery confirmation. Walmart’s blockchain-based supply chain processes over $1 billion in supplier payments through smart contracts that release USDC funds when IoT sensors confirm product receipt. This eliminates the 45-day average payment delays that strain supplier cash flow and reduces administrative overhead by 60%. Trade finance operations benefit enormously because letters of credit that traditionally take weeks to process can settle in minutes through stablecoin rails. DHL reports that it processes over $500 million in trade settlements through digital assets, which cuts documentation requirements from dozens of forms to simple blockchain transactions.

Global Workforce Gets Instant Pay

Companies with distributed teams revolutionize payroll operations through stablecoin payments that reach contractors worldwide within minutes. Traditional international wire transfers cost businesses $25-50 per transaction and take 3-5 days to settle, while USDC payments cost under $2 and complete instantly. Freelancer platform Deel processes over $2 billion annually in contractor payments through stablecoins, which eliminates the banking delays that frustrated remote workers in emerging markets. Philippine-based developers can receive their full payment amount without losing significant amounts to correspondent banking fees that traditional remittance services impose (something that dramatically improves their take-home pay).

Final Thoughts

The stablecoin revolution extends far beyond crypto speculation. Companies across industries now leverage these digital dollars for instant cross-border payments, automated supply chain settlements, and global payroll operations that traditional banks cannot match. Major corporations from Walmart to JPMorgan already process billions through stablecoin rails, which proves these aren’t experimental technologies but practical business tools.

Regulatory frameworks like the GENIUS Act and MiCA provide the clarity businesses need to adopt stablecoins confidently. The question isn’t whether stablecoins will reshape business operations, but how quickly your company can capitalize on their advantages. Instant settlement, reduced fees, and programmable payments create competitive advantages that early adopters enjoy while competitors struggle with legacy systems.

What are stablecoins used for becomes clear when you see the operational benefits they deliver (from treasury management to supply chain automation). We at Web3 Enabler help businesses integrate stablecoin capabilities directly into their existing Salesforce infrastructure through 100% native blockchain solutions that support payments, compliance, and automation. Companies can now access these advantages without requiring extensive crypto expertise or complex technical implementations.