Your Salesforce CRM is probably doing its job, but let’s be honest – it’s stuck in the financial stone age. While your sales team closes deals like champions, payment processing still feels like waiting for a carrier pigeon.

We at Web3 Enabler see businesses missing massive opportunities because their CRM can’t handle modern payment realities. Salesforce innovation meets blockchain technology, and suddenly your customer relationships get a serious upgrade.

Why Traditional CRM Falls Short in Modern Business

Payment Processing Limitations and Delays

Your Salesforce CRM handles customer data beautifully, but payment processing feels like sending smoke signals. Traditional bank transfers take 3-5 business days for domestic payments, while international transfers crawl along for up to 10 business days. Your sales team closes deals on Friday, but clients can’t pay until the following Wednesday (assuming everything goes smoothly).

Wire transfers cost $15-50 per transaction and eat into profit margins faster than you can say quarterly targets. Credit card processing fees range from 2.9% to 3.5% per transaction, plus monthly gateway fees. Small businesses especially feel this pinch when every percentage point matters for survival.

Lack of Transparency in Financial Transactions

Traditional payment systems operate like black boxes. You send money into the void and hope it arrives safely. Banks provide minimal visibility into transaction status, which leaves both you and your customers guessing about payment progress. PwC research shows that 80% of asset and wealth managers believe transparency drives revenue growth, yet most CRM systems offer zero real-time payment tracking.

Customer disputes become nightmares without clear transaction trails. Chargeback rates average 0.6% across industries but can spike to 2% for businesses with poor payment transparency. Each dispute costs $15-25 in administrative fees, plus the original transaction amount and potential penalties.

Limited Global Reach and Cross-Border Capabilities

Salesforce connects you to worldwide opportunities, but traditional banking systems create artificial borders. Cross-border payments through SWIFT networks involve multiple intermediary banks, each taking fees and adding delays. International transfer costs range from 5-7% of transaction value (making small global deals economically unfeasible).

Currency conversion adds another layer of complexity and cost. Exchange rate fluctuations can eat 2-4% of transaction value between deal closure and payment completion. Many businesses simply avoid international customers rather than navigate these financial obstacles, which limits growth potential in an increasingly global marketplace.

These payment roadblocks don’t just slow down transactions – they actively sabotage your competitive edge. Blockchain integration offers a completely different approach to these age-old problems.

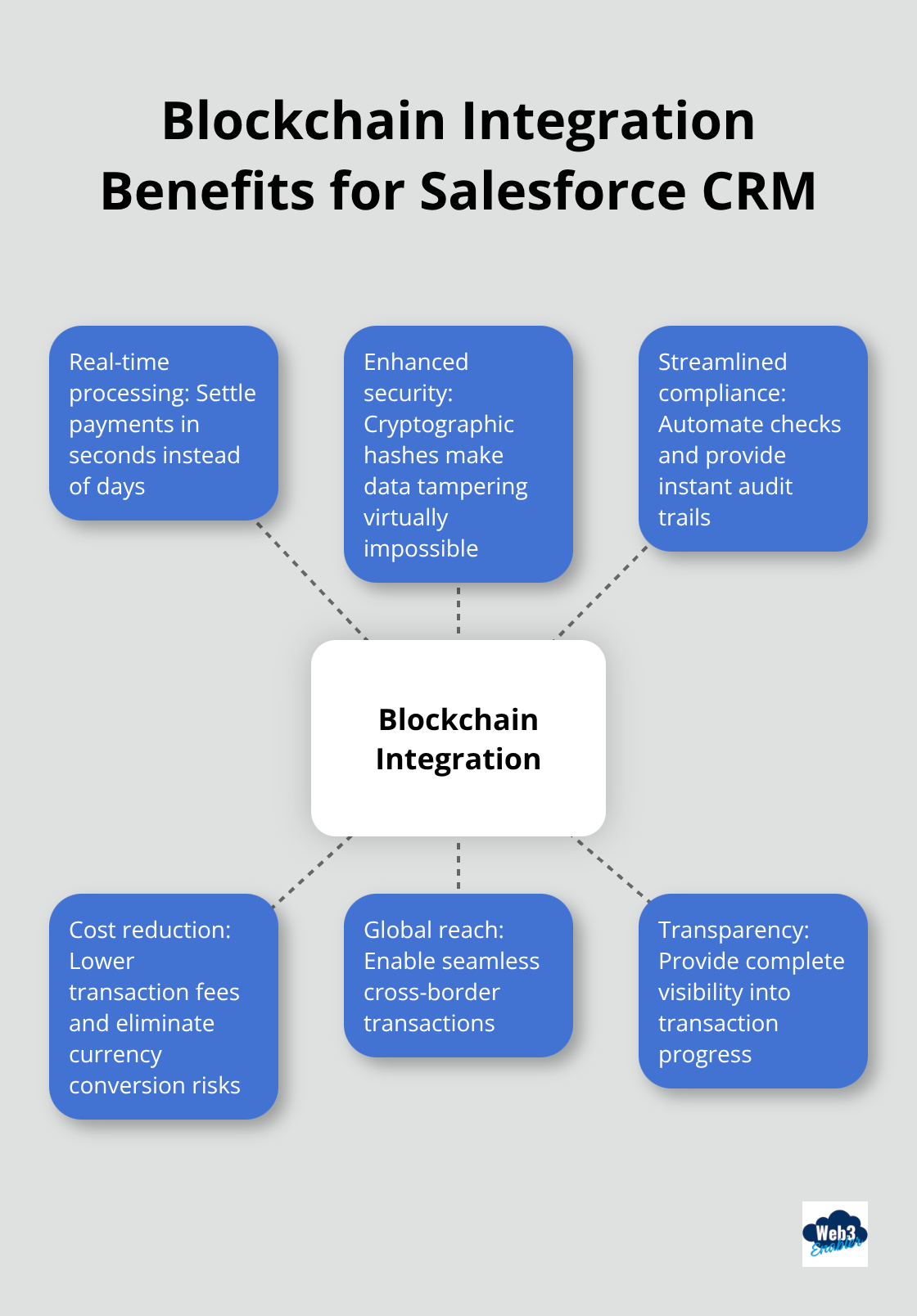

Blockchain Integration Transforms Salesforce CRM

Blockchain integration transforms your Salesforce CRM from a payment dinosaur into a financial powerhouse. Stablecoin payments settle in seconds rather than days, which eliminates the 3-5 day wait times that frustrate customers and delay cash flow. USDC and other stablecoins process transactions on networks like Ethereum and Polygon for under $1 per transaction, compared to $15-50 wire transfer fees. Your sales team can now accept payments from Tokyo clients at 3 AM and see funds available instantly, not next Tuesday.

Real-Time Payment Processing with Stablecoin Support

Cross-border payments through blockchain networks bypass traditional correspondent banks entirely. Ripple processes that same payment in seconds-for under $1, while SWIFT transfers crawl along for days at higher costs. Your CRM can now track payment status in real-time through blockchain explorers, which gives both you and customers complete visibility into transaction progress. Companies that use blockchain payments report 50% reduction in payment disputes because every transaction creates an immutable record that settles arguments instantly.

Enhanced Security and Transaction Transparency

Blockchain transactions use cryptographic hashes that make data tampering virtually impossible. Each payment creates a permanent audit trail that satisfies regulators and simplifies compliance reports. Traditional payment systems rely on centralized databases that hackers target, while blockchain distributes transaction records across thousands of nodes. Financial institutions report 94% fewer data quality issues when they implement blockchain solutions (directly addressing the revenue losses that affect most businesses). Your Salesforce environment gains enterprise-grade security without additional infrastructure investments.

Streamlined Compliance and Audit Trails

Every blockchain transaction generates an immutable record that auditors love and regulators accept. Smart contracts automate compliance checks within the payment process, which reduces manual oversight and human error. Traditional audit trails require weeks to compile and verify, but blockchain provides instant access to complete transaction histories. This transparency cuts audit preparation time by up to 75% and eliminates the paperwork nightmares that plague traditional financial systems. Your business gains competitive advantages through these practical applications that transform daily operations.

Practical Applications for Business Growth

Global payment acceptance becomes trivial when your Salesforce CRM handles stablecoins natively. Japanese clients can pay invoices with USDC at midnight Tokyo time, and funds appear in your account within minutes instead of the usual 7-10 business day wait through traditional banks. European customers avoid the 5-7% cross-border transfer fees that SWIFT networks impose, while you eliminate currency conversion risks that typically cost 2-4% of transaction value. Companies report 40% faster deal closure rates when they accept crypto payments because clients can pay immediately after contract signature rather than initiate bank transfers that create artificial delays.

Accept Crypto Payments from Global Customers

Your sales team can now close deals with clients across six continents without payment friction. A software company in Austin can invoice a manufacturing client in Singapore and receive USDC payment within 10 minutes (compared to the week-long wire transfer process). Transaction costs drop from $50 wire fees to under $2 for stablecoin transfers. Currency fluctuation risks disappear when clients pay in USDC or USDT, which maintain stable dollar parity. International expansion becomes financially viable for small businesses that previously couldn’t absorb cross-border payment costs.

Automate Financial Workflows with Smart Contracts

Smart contracts eliminate the administrative burden that plagues traditional payment processes. Your Salesforce environment can automatically trigger commission calculations when stablecoin payments arrive, which removes the 16-month dispute resolution timelines that manual systems create. Payment confirmations flow directly into your CRM without human intervention, which reduces processing errors by 94%. Automated workflows cut operational costs by 50% while providing audit trails that satisfy regulatory requirements instantly. The blockchain market growth from $41.15 billion in 2025 to $1.879 trillion by 2034 reflects businesses recognizing these operational advantages over legacy financial systems.

Gain Real-Time Client Portfolio Visibility

Traditional portfolio tracking relies on monthly statements and manual data entry that creates information gaps lasting weeks. Blockchain integration provides financial advisors with live portfolio updates that include both traditional assets and crypto holdings within a single Salesforce dashboard. Client meetings become more productive when advisors access complete financial pictures rather than outdated snapshots. Tokenization platforms enable fractional real estate investments and art ownership that diversify client portfolios beyond traditional stocks and bonds. This comprehensive visibility helps advisors identify rebalancing opportunities immediately rather than wait for quarterly reviews to discover allocation issues.

Final Thoughts

Your competitors wrestle with 5-day payment delays while you close deals with instant stablecoin settlements. Blockchain-enabled Salesforce CRM transforms payment friction into competitive advantage through real-time global transactions and automated compliance workflows. Forward-thinking businesses achieve 40% faster deal closure rates and eliminate the 5-7% cross-border fees that traditional banks impose on international growth.

Implementation benefits extend beyond payment speed alone. Your business gains enterprise-grade security through cryptographic transaction records and reduces audit preparation time by 75%. Financial advisors access complete client portfolios (including crypto holdings) within familiar Salesforce dashboards, which positions your company ahead of businesses stuck with legacy payment systems.

Salesforce innovation meets blockchain technology through proven solutions that integrate seamlessly with existing workflows. We at Web3 Enabler provide blockchain tools that enable stablecoin payments, global transfers, and crypto portfolio visibility without speculation risks. Ready to modernize your Salesforce environment? Web3 Enabler offers custom implementations for businesses ready to gain competitive advantages through blockchain integration.

![Navigating Compliance in the Blockchain Era [2025]](https://web3enabler.com/wp-content/uploads/emplibot/blockchain-compliance-hero-1761160171.jpeg)