Salesforce-powered businesses are constantly seeking ways to innovate and stay ahead of the curve. At Web3 Enabler, we’ve identified several groundbreaking blockchain use cases that can transform how these companies operate.

From revolutionizing payment processing to enhancing compliance and customer loyalty programs, blockchain technology offers a wealth of opportunities. Let’s explore how integrating blockchain can drive efficiency, security, and growth for Salesforce users.

How Blockchain Revolutionizes Payment Processing

Faster and Cheaper Global Payments

Blockchain technology transforms payment processing for Salesforce-powered businesses. This innovative approach offers significant advantages over traditional methods, particularly in cross-border transactions, fee reduction, and security enhancement.

International payments have long been a pain point for businesses. Traditional bank transfers take days and incur hefty fees. Blockchain changes this landscape dramatically. With blockchain-based payments, cross-border transactions complete in minutes, not days. This speed is a game-changer for businesses operating globally.

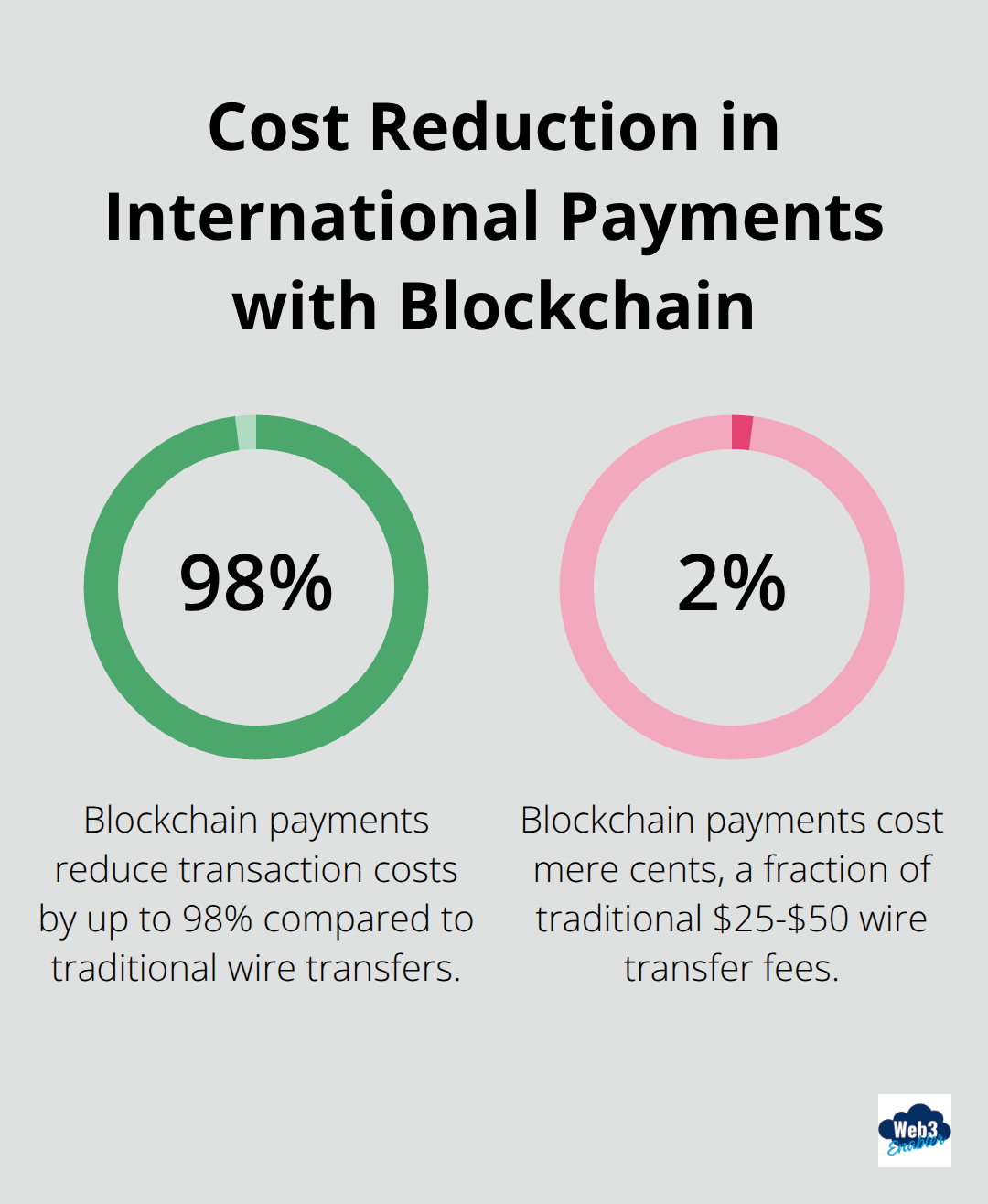

The cost savings are substantial. While traditional wire transfers cost $25-$50 per transaction, blockchain payments reduce this to mere cents. For businesses making frequent international payments, these savings add up quickly.

It is estimated that the CCC legislation could save businesses $15 billion in annual interchange savings.

Enhanced Security and Fraud Prevention

Blockchain’s inherent characteristics make it a powerful tool for improving payment security. The technology’s decentralized nature and cryptographic protections make fraudulent activities extremely difficult. Each transaction records on a distributed ledger, creating an immutable record that can be easily audited.

This level of transparency and traceability is invaluable for businesses. It not only helps prevent fraud but also quickly identifies and resolves any discrepancies.

Streamlined Reconciliation and Reporting

One of the most time-consuming aspects of payment processing is reconciliation. Blockchain automates this process, eliminating the need for manual matching of payments with invoices. This automation saves businesses countless hours and reduces errors significantly.

For Salesforce users, integrating blockchain payments provides real-time visibility into transaction statuses. This integration allows for seamless updating of customer records and financial reports, improving overall business efficiency.

Real-World Applications

Many businesses have already started to reap the benefits of blockchain-based payment processing. For instance, a large e-commerce platform (which uses Salesforce) reduced its cross-border transaction fees by integrating a blockchain payment method.

Another example is a multinational corporation that cut its payment processing time from 3-5 days to just minutes, significantly improving its cash flow management and vendor relationships.

These real-world applications demonstrate the transformative power of blockchain in payment processing. As we move forward, the next logical step is to explore how this technology can enhance compliance and transparency in business operations.

How Blockchain Boosts Compliance and Transparency

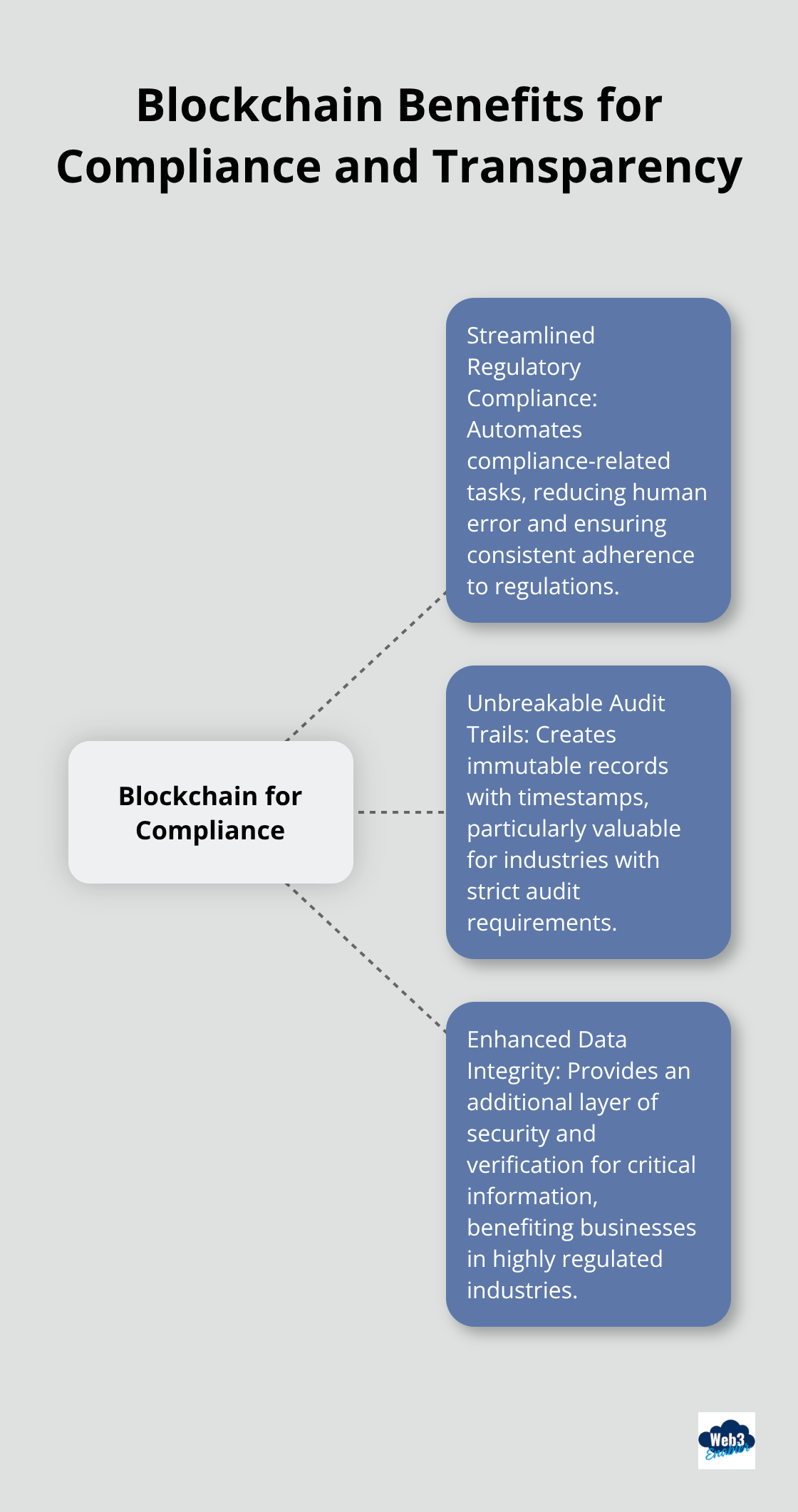

Blockchain technology reshapes how Salesforce-powered businesses handle compliance and transparency. This innovative approach offers significant advantages in automating regulatory processes, creating unalterable audit trails, and enhancing data integrity.

Streamlining Regulatory Compliance

Regulatory compliance often presents a complex and time-consuming process for businesses. Blockchain technology simplifies this by automating many compliance-related tasks. Smart contracts can automatically execute and document compliance-related actions, which reduces the risk of human error and ensures consistent adherence to regulations.

Unbreakable Audit Trails

One of blockchain’s most powerful features for compliance is its ability to create immutable audit trails. Every transaction or change recorded on the blockchain receives a timestamp and cannot be altered retroactively. This feature proves particularly valuable for industries with strict audit requirements (such as finance and healthcare).

Enhancing Data Integrity

Data integrity proves crucial for businesses, especially those handling sensitive information. Blockchain’s decentralized nature and cryptographic protections make it extremely difficult for data to be tampered with or corrupted.

For Salesforce users, integrating blockchain technology can provide an additional layer of security and verification for customer data, financial records, and other critical information. This integration can particularly benefit businesses operating in highly regulated industries or those dealing with sensitive data.

Real-World Applications

Many companies have already started to harness the power of blockchain for compliance and transparency. For example, a global logistics firm (which uses Salesforce) implemented a blockchain-based system to track and verify the authenticity of high-value goods throughout their supply chain. This system not only improved compliance with international trade regulations but also significantly reduced instances of counterfeit products.

Another case involves a financial services company that used blockchain to create an immutable audit trail of all client interactions and transactions. This implementation not only streamlined their compliance processes but also reduced audit costs while increasing the accuracy and reliability of their reports.

These real-world applications demonstrate the transformative potential of blockchain in enhancing compliance and transparency. As businesses continue to explore the benefits of this technology, the next logical step involves examining how blockchain can revolutionize customer loyalty programs and create new opportunities for engagement and retention.

How Blockchain Transforms Customer Loyalty

Tokenized Rewards: A Revolution in Customer Engagement

Blockchain technology transforms customer loyalty programs, offering new opportunities for businesses to engage and retain customers. This innovative approach brings benefits to both companies and consumers, creating a win-win scenario in the loyalty landscape.

Tokenized reward systems revolutionize how businesses approach customer loyalty. Companies can create digital tokens that represent loyalty points by leveraging blockchain. These tokens hold real value, transfer easily, and can be redeemed across multiple platforms.

A major airline implemented a blockchain-based loyalty program, allowing customers to earn and spend points seamlessly across partner businesses. This enhanced transparency, authenticity, and decentralized reward systems.

Cross-Brand Loyalty: Expanding Customer Benefits

Blockchain enables seamless cross-brand loyalty programs, breaking down the silos that traditionally existed between different companies’ reward systems. This interoperability allows customers to earn and redeem points across a network of partnered businesses, significantly enhancing the value proposition of loyalty programs.

A consortium of retailers in Australia launched a blockchain-based loyalty network, connecting over 100 brands. Within the first year, participating businesses reported an average increase in customer retention and a rise in repeat purchases.

Enhanced Security and Transparency

Blockchain’s inherent characteristics of immutability and transparency bring a new level of trust to loyalty programs. Customers can easily track their points, ensuring they receive the rewards they’ve earned. This transparency also helps businesses prevent fraud and abuse within their loyalty systems.

A global hotel chain implemented a blockchain-based loyalty program, reducing fraud and increasing customer trust scores. The enhanced security measures led to an increase in active program participants within six months.

Practical Implementation for Businesses

To implement blockchain-based loyalty solutions, businesses should:

- Assess their current loyalty program (if any)

- Identify areas where blockchain can add value

- Choose a blockchain platform that integrates with their existing systems (such as Salesforce)

- Design a tokenized reward system that aligns with their brand and customer preferences

- Test the system thoroughly before full deployment

Future-Proofing Customer Relationships

As blockchain technology continues to evolve, businesses that adopt these innovative loyalty solutions will be well-positioned for the future. They’ll be able to offer more value to their customers, foster stronger relationships, and stay ahead of the competition in an increasingly digital marketplace.

Final Thoughts

Blockchain use cases transform how Salesforce-powered businesses operate in the digital age. These innovations improve payment processing, enhance compliance, and reimagine customer loyalty programs. Companies that adopt blockchain technology gain a competitive edge through increased efficiency, security, and growth potential.

We at Web3 Enabler help businesses integrate blockchain technology into their Salesforce ecosystems. Our platform offers solutions for stablecoin payments and global transactions, tailored to meet specific business needs. As the blockchain landscape evolves, companies that embrace these solutions position themselves for future success.

The time to act is now. Businesses that implement blockchain solutions unlock new levels of efficiency, security, and customer engagement. Don’t fall behind-take the first step towards a blockchain-powered future today with Web3 Enabler.