Traditional international payments cost businesses billions in fees and delays. Companies wait days for transfers while banks collect hefty charges at every step.

Stablecoin cross border payments change everything. We at Web3 Enabler see businesses cutting payment times from days to minutes while slashing transaction costs by up to 90%.

The revolution is already happening across treasury operations, vendor payments, and global commerce.

Why Traditional Cross-Border Payments Are Broken

Cross-border wire transfers drain corporate budgets with fees that range from $25 to $35 per transaction, according to banking industry data. These costs multiply across multiple intermediaries, with correspondent banks that add their own charges at each step. A survey by EY found that 41% of organizations face hidden foreign exchange markups, processing delays, and compliance fees that push total costs above 8% of transaction value when they use traditional payment methods.

Finance teams often discover additional charges weeks after they initiate transfers, which makes budget planning nearly impossible.

The Multi-Day Settlement Problem

Traditional international payments crawl through correspondent banking networks and take 3 to 5 business days for standard transfers. Complex routing through multiple banks creates bottlenecks that leave businesses waiting for critical vendor payments and supplier settlements. Weekend and holiday delays extend settlement times even further, which forces companies to maintain larger cash reserves just to manage payment timing uncertainties. This sluggish infrastructure costs businesses real money through delayed revenue recognition and missed early payment discounts (often 2-3% savings for prompt payment).

Banking Network Complexity Kills Efficiency

Each cross-border payment travels through an average of 3 to 6 correspondent banks before it reaches its destination. Traditional banks orchestrate a parade of intermediaries that each take their cut. Finance teams waste hours as they track payments through these networks, often relying on outdated SWIFT messaging systems that provide limited visibility into transaction status. The complexity forces businesses to maintain banking relationships in multiple countries, which multiplies compliance requirements and operational overhead.

Hidden Costs That Destroy Profit Margins

Banks rarely disclose the full cost structure upfront. Foreign exchange spreads can add 2-4% to transaction values, while intermediary fees stack up unpredictably (sometimes reaching $100+ for complex routing). Processing delays create opportunity costs as businesses lose early payment discounts and face cash flow gaps. These hidden expenses make traditional cross border payments a profit killer for companies that operate globally.

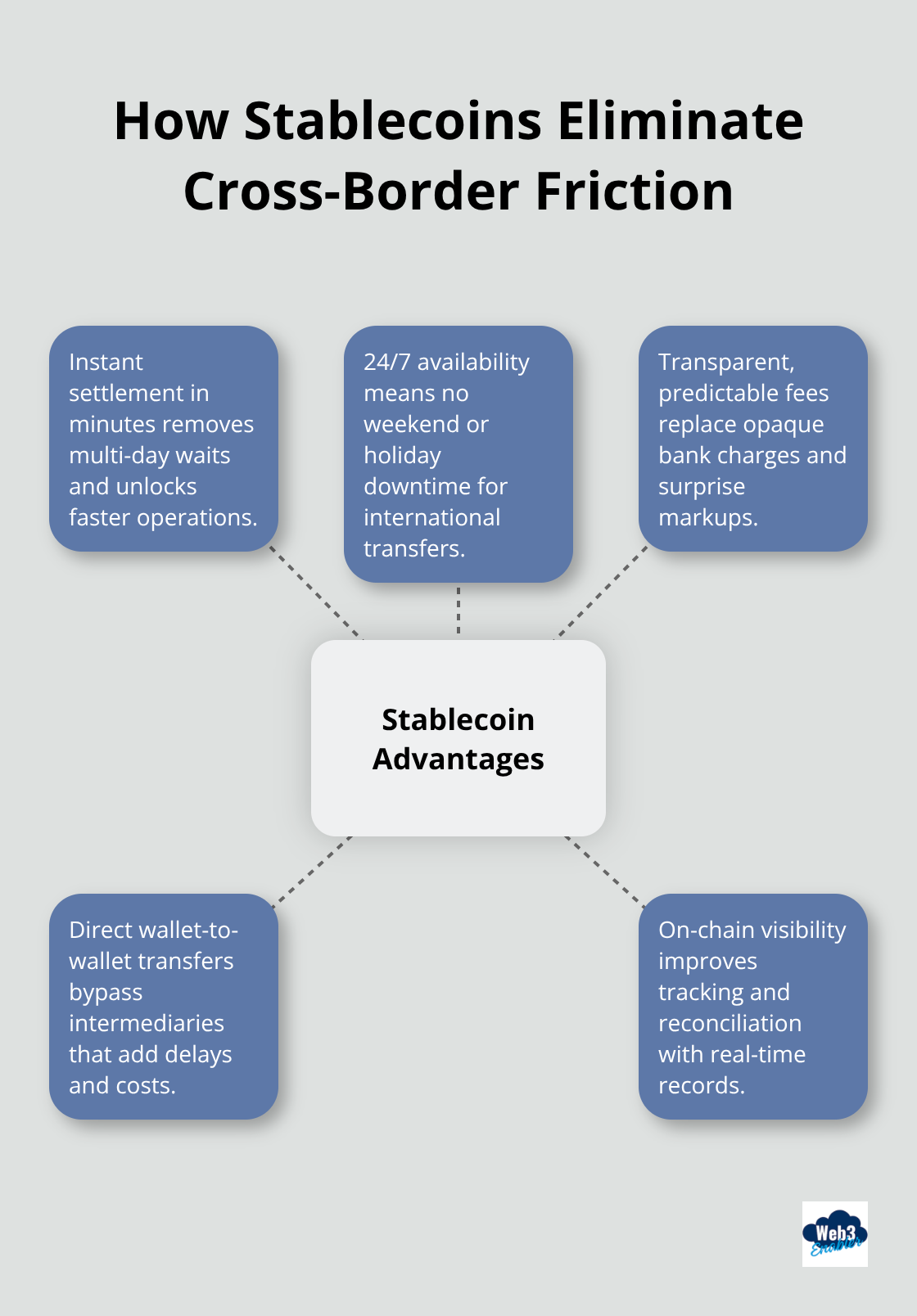

Stablecoins eliminate these pain points entirely through direct blockchain settlements that bypass traditional banking networks.

How Stablecoins Transform International Payments

Instant Settlement Without Banking Delays

Stablecoins process international payments in under 10 minutes through blockchain networks that operate continuously. Traditional banks close for weekends and holidays, but stablecoin transactions settle 24/7 without interruption. Finance teams send payments to suppliers in Asia on Friday evening and have funds available immediately. This eliminates the multi-day waits that plague traditional wire transfers.

Circle’s USDC and PayPal’s PYUSD demonstrate settlement speeds that reduce payment times from 3-5 business days to mere minutes across any global corridor. Companies no longer face the operational bottlenecks that force them to maintain larger cash reserves just to manage payment schedules.

Transparent Costs That Finance Teams Can Predict

Stablecoin transactions cost pennies compared to traditional fees that range from $25-35 per transfer. EY research shows organizations report cost savings above 10% on cross-border transactions, with total fees often below 1% of transaction value. These blockchain-based payments eliminate hidden foreign exchange spreads and intermediary charges that banks layer onto international transfers.

Finance departments budget accurately because stablecoin networks publish transparent fee structures upfront. This removes the surprise charges that traditional correspondent networks impose weeks after transactions complete (sometimes adding $100+ in unexpected fees).

Direct Transfers That Bypass Banking Networks

Stablecoins move directly between digital wallets without correspondent banks or intermediary institutions. This peer-to-peer architecture cuts the average 3-6 bank routing steps down to zero. Each eliminated institution removes markup and processing delays that drain corporate budgets.

Legitimate stablecoin transaction volumes reached $5.68 trillion in 2024, demonstrating real business adoption beyond speculative trading. Companies maintain direct control over payment flows while gaining complete visibility into transaction status through blockchain records that update in real-time.

These technical advantages translate into massive operational benefits for treasury teams, vendor relationships, and global commerce operations.

How Businesses Actually Use Stablecoins Today

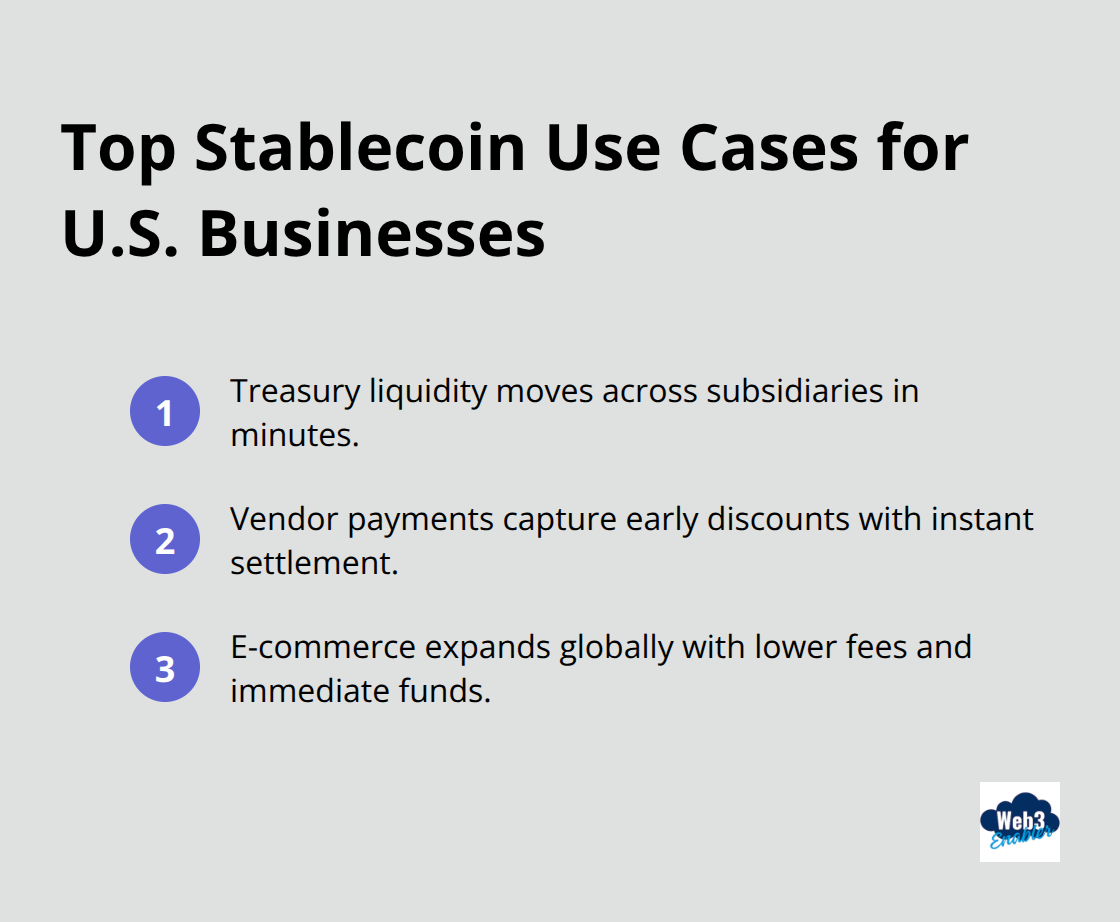

Treasury Teams Slash Working Capital Requirements

Multinational corporations move funds between subsidiaries in minutes instead of days through stablecoin transfers. JPMorgan and Citi are exploring stablecoin solutions for high-volume B2B transactions, particularly in volatile currency corridors where traditional banks fail to provide reliable service. Finance teams at companies across Asia-Pacific regions send stablecoin payments on Friday afternoons and access funds for Monday operations without weekend delays.

This 24/7 liquidity access cuts working capital requirements because treasury departments no longer hold excess cash reserves to buffer payment delays. Companies in regions with capital controls use stablecoins to bypass restrictions that freeze international transfers for weeks (sometimes indefinitely). Treasury operations benefit most from stablecoin adoption in markets that lack competitive FX rates or reliable correspondent networks.

Vendor Payments Transform Supply Chain Operations

Manufacturing companies pay suppliers instantly across continents with stablecoins, which eliminates the 3-5 day settlement delays that disrupt production schedules. Early payment discounts of 2-3% become accessible when vendors receive funds immediately instead of waiting for traditional bank clearances. Supply chain finance operations cut transaction costs from $25-35 per wire transfer down to under $1 for stablecoin payments.

Global freelancers and contract workers receive stablecoin payments in regions where traditional banks create expensive bottlenecks. Companies with distributed workforces avoid the complexity of maintaining accounts in dozens of countries while they provide instant payment access to contractors worldwide.

E-commerce Revenue Collection Expands Market Reach

Online merchants accept stablecoins to expand into markets where credit card penetration remains low or where traditional processors impose geographic restrictions. Transaction fees drop from 2-4% for credit card processing to under 1% for stablecoin payments, which directly improves profit margins on international sales. Revenue recognition speeds up because stablecoin payments settle immediately on blockchain networks instead of pending for days through traditional processors that hold funds in escrow.

Cross-border e-commerce benefits most from stablecoin adoption when merchants sell into emerging markets where local banks create payment friction for international customers. Instant settlement eliminates chargebacks and reduces fraud risks that plague traditional payment methods.

Final Thoughts

Stablecoin cross border payments deliver measurable results that traditional banks cannot match. Companies cut transaction costs from $25-35 per wire transfer to under $1 while they reduce settlement times from days to minutes. The $5.68 trillion in legitimate stablecoin transactions processed in 2024 proves this technology has moved beyond speculation into real business operations.

Financial institutions respond rapidly to this shift. More than half of banks plan to explore stablecoin services within the next year, with projections that show stablecoins will handle 12% of global cross-border payment volumes by 2030 (representing $2.1 to $4.2 trillion in annual transaction value). The regulatory landscape continues to evolve in favor of blockchain-based payments, with recent legislation like the GENIUS Act that signals government support for digital payment infrastructure.

Companies that delay adoption risk falling behind competitors who gain operational advantages through instant settlements and transparent costs. Web3 Enabler helps organizations integrate stablecoin payments directly within Salesforce, which enables finance teams to modernize cross-border operations without disruption to existing workflows. Early adopters position themselves to capture the full benefits of this payment revolution while they build the infrastructure needed for future financial innovation.

![Ensuring Regulatory Compliance in Crypto Transactions [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/crypto-compliance-hero-1758197377.jpeg)