Cross-border payments have been stuck in the slow lane for decades. Traditional banking systems take days to process international transfers while charging hefty fees.

Ripple and their Ripplenet business represents a revolutionary approach to global payments, using blockchain technology to move money across borders in seconds rather than days. We at Web3 Enabler see businesses saving thousands in fees and gaining competitive advantages through faster payment processing.

How Ripple Transforms Payment Technology

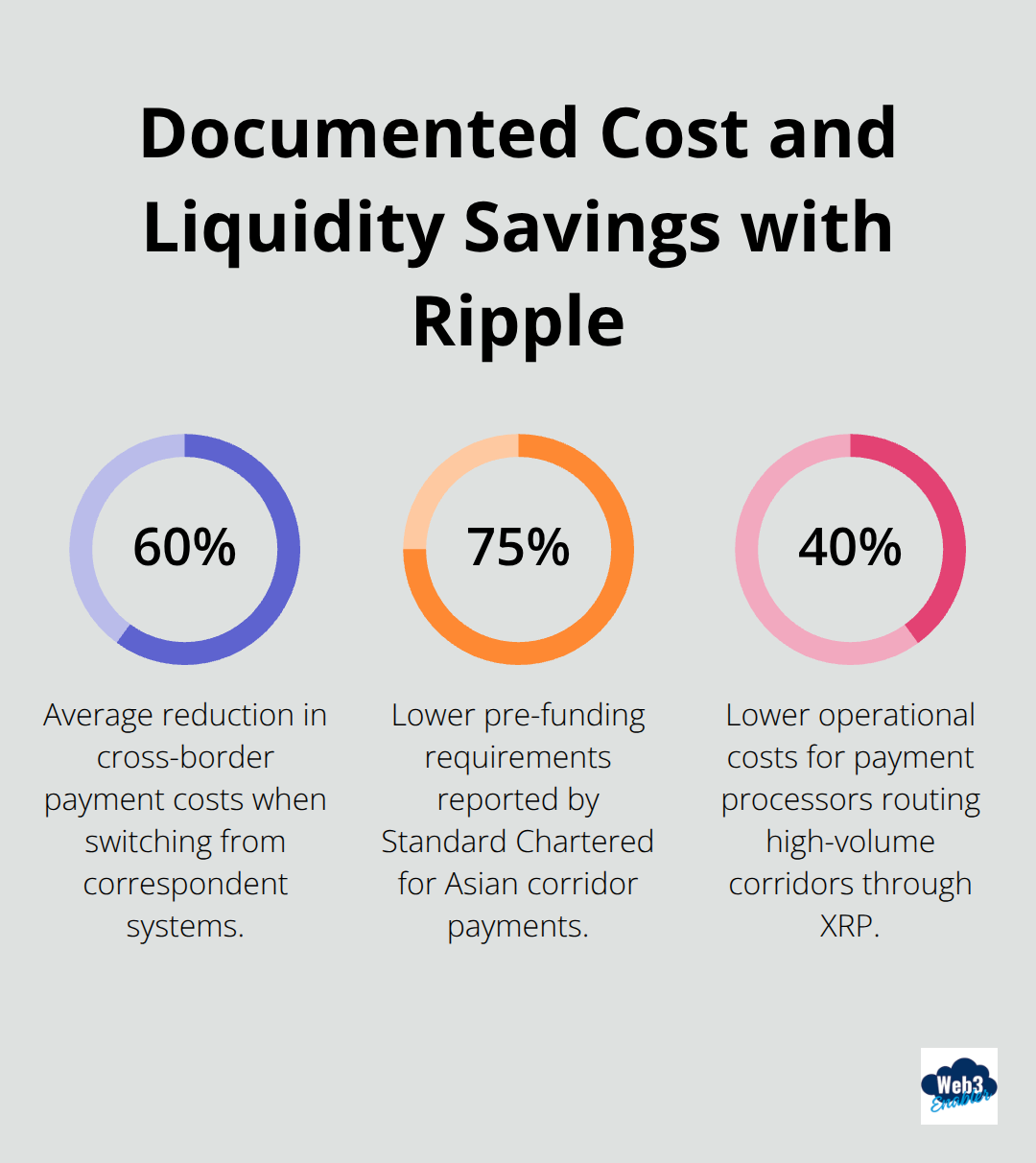

Ripple operates as a distributed ledger technology that processes payments in 4 seconds compared to traditional systems that require 3-5 business days. The network handles 1,500 transactions per second while Bitcoin processes only 7 and Ethereum manages 21. XRP serves as the native digital asset that facilitates these rapid transfers, with transaction fees that average $0.0002 compared to wire transfer costs of $15-50. Financial institutions save 60% on cross-border payment costs when they use Ripple technology instead of correspondent relationships.

RippleNet Connects Global Financial Networks

RippleNet connects over 300 financial institutions across 40 countries through a single API integration. Banks like Santander and Standard Chartered process payments through this network without the need to maintain multiple nostro accounts in different currencies. Each transaction settles in real-time with full transparency, which eliminates the uncertainty of traditional correspondent systems where payments can get delayed or lost between intermediary banks. Payment service providers gain access to pre-funded liquidity pools (reducing capital requirements typically needed for cross-border operations).

Consensus Protocol Delivers Superior Speed

Ripple uses a unique consensus mechanism with validator nodes that confirm transactions without energy-intensive operations. This HashTree consensus requires the same energy consumption as standard email servers, making it 99.9% more efficient than Bitcoin operations. The network maintains security through a distributed network of validators operated by universities, exchanges, and financial institutions rather than reliance on centralized clearing houses that process payments during limited business hours (typically 9-5 weekdays only).

Treasury Management Benefits Drive Adoption

Modern businesses face significant challenges with traditional payment rails that tie up working capital for days. Ripple technology allows companies to optimize cash flow by settling vendor payments instantly, which improves supplier relationships and negotiation power. Corporate treasurers can now manage liquidity across multiple currencies without the complexity of maintaining correspondent accounts in each market, leading to better capital allocation decisions and reduced operational overhead. Transforming supplier payments with cryptocurrency eliminates the 2.9-4.5% transaction fees that drain enterprise resources.

How Does Ripple Process Cross-Border Payments

Ripple transforms international money transfers through a streamlined three-step process that eliminates traditional banking bottlenecks. When a business initiates a payment, RippleNet first validates the transaction through its consensus mechanism within 4 seconds. The system then converts the sender’s currency into XRP, transfers the XRP across borders instantly, and converts it into the recipient’s local currency at the destination.

This process bypasses correspondent relationships that typically require 3-5 business days and multiple intermediary fees.

XRP Functions as the Universal Bridge Currency

XRP serves as a neutral bridge asset that connects any two currencies without direct pairs. Banks no longer need to maintain nostro accounts worth billions of dollars in foreign currencies across different markets. Standard Chartered reported a 75% reduction in their pre-funding requirements after implementation of XRP for Asian corridor payments. The token’s 100 billion pre-mined supply provides sufficient liquidity for institutional-scale transactions without the volatility concerns that affect mined cryptocurrencies like Bitcoin.

SWIFT Alternative Delivers Measurable Savings

Traditional SWIFT payments cost businesses $15-50 per transaction while XRP transfers average $0.0002 in network fees. Santander’s One Pay FX app processes payments in under 60 seconds compared to SWIFT’s 24-48 hour settlement windows. Corporate treasurers save an average of 60% on cross-border payment costs when they switch from correspondent systems to Ripple technology. The network operates 24/7/365 without the business hour restrictions that delay SWIFT transactions over weekends and holidays (complete control over payment timing and cash flow management).

Real-Time Settlement Changes Business Operations

Instant settlement capabilities allow businesses to optimize their working capital in ways that traditional systems cannot match. Companies can now release payments to suppliers at the exact moment goods arrive, rather than days in advance to account for processing delays. This precision transforms vendor relationships and creates opportunities for better payment terms. The transparency of blockchain technology also provides complete audit trails that simplify compliance and reconciliation processes for finance teams across multiple jurisdictions.

Which Businesses Actually Use Ripple Technology

Financial institutions worldwide have moved beyond pilot programs to deploy Ripple technology for production-scale operations. Santander processes payments through their One Pay FX application, which settles payments in 14 countries within minutes rather than days. Standard Chartered handles Asian corridor payments with 75% lower pre-funding requirements since it implemented XRP liquidity solutions. MoneyGram reported it processed $2.4 billion in cross-border transactions through Ripple partnerships in 2023, which demonstrates that traditional money transfer operators can compete effectively against digital-native fintech companies when they adopt blockchain infrastructure.

Corporate Treasury Operations Transform Payment Workflows

Enterprise treasury departments gain immediate operational benefits when they integrate Ripple technology into their financial systems. Companies like American Express and PNC Bank now offer instant settlement capabilities to their corporate clients, which eliminates the working capital constraints that traditional correspondent systems impose on international trade. Treasury managers can release supplier payments at the exact moment goods arrive rather than days in advance to account for delays. The 24/7 operational capability means businesses can execute payments during Asian market hours from North American offices (optimizing cash flow timing across global operations).

Legacy Banks Adapt Through API Integration

Banks integrate Ripple technology through single API connections that work alongside their core banking systems rather than require complete infrastructure overhauls. JPMorgan and Bank of America maintain their traditional clearing relationships while they offer Ripple-powered express lanes for time-sensitive payments. This hybrid approach allows financial institutions to test blockchain capabilities with specific customer segments before they expand to full-scale deployment. Credit unions and community banks gain access to enterprise-grade payment rails that previously required massive capital investments (leveling the competitive playing field against larger institutions through shared liquidity pools and standardized settlement protocols).

Payment Service Providers Scale Operations

Money transfer operators like Western Union and Remitly now compete directly with fintech startups by adopting Ripple’s settlement infrastructure. These companies reduce their correspondent relationships from dozens to single-digit partnerships while they maintain global reach across 200+ countries. Payment processors report 40% lower operational costs when they route high-volume corridors through XRP rather than traditional nostro account systems.

The technology allows smaller operators to offer competitive rates on popular routes like US-Mexico and UK-India without the capital requirements that previously limited their market participation.

Final Thoughts

Ripple has proven that blockchain technology can solve real business problems without the complexity that often accompanies cryptocurrency adoption. Companies save 60% on cross-border payment costs while they gain instant settlement capabilities that transform cash flow management. The technology processes 1,500 transactions per second at $0.0002 per transfer, which makes it a practical alternative to traditional systems that charge $15-50 per wire transfer.

The $40 billion valuation and recent $500 million funding round demonstrate strong institutional confidence in Ripple’s future. Major acquisitions like GTreasury for $1 billion signal expansion into corporate treasury management beyond payments. Financial institutions continue to adopt RippleNet at scale, with over 300 organizations now connected across 40 countries.

Businesses ready to modernize their payment infrastructure should evaluate blockchain solutions that integrate with existing systems. Web3 Enabler provides native blockchain integration for Salesforce users, which enables companies to accept stablecoin payments and send global transfers faster while they maintain compliance within familiar workflows (eliminating the need for complex technical implementations). The technology has matured beyond experimental phases into production-ready solutions that deliver measurable cost savings and operational improvements for forward-thinking organizations.