Traditional supplier payments drain enterprise resources through excessive fees, delayed settlements, and complex cross-border processes. Finance teams lose millions annually to inefficient payment rails.

Traditional supplier payments drain enterprise resources through excessive fees, delayed settlements, and complex cross-border processes. Finance teams lose millions annually to inefficient payment rails.

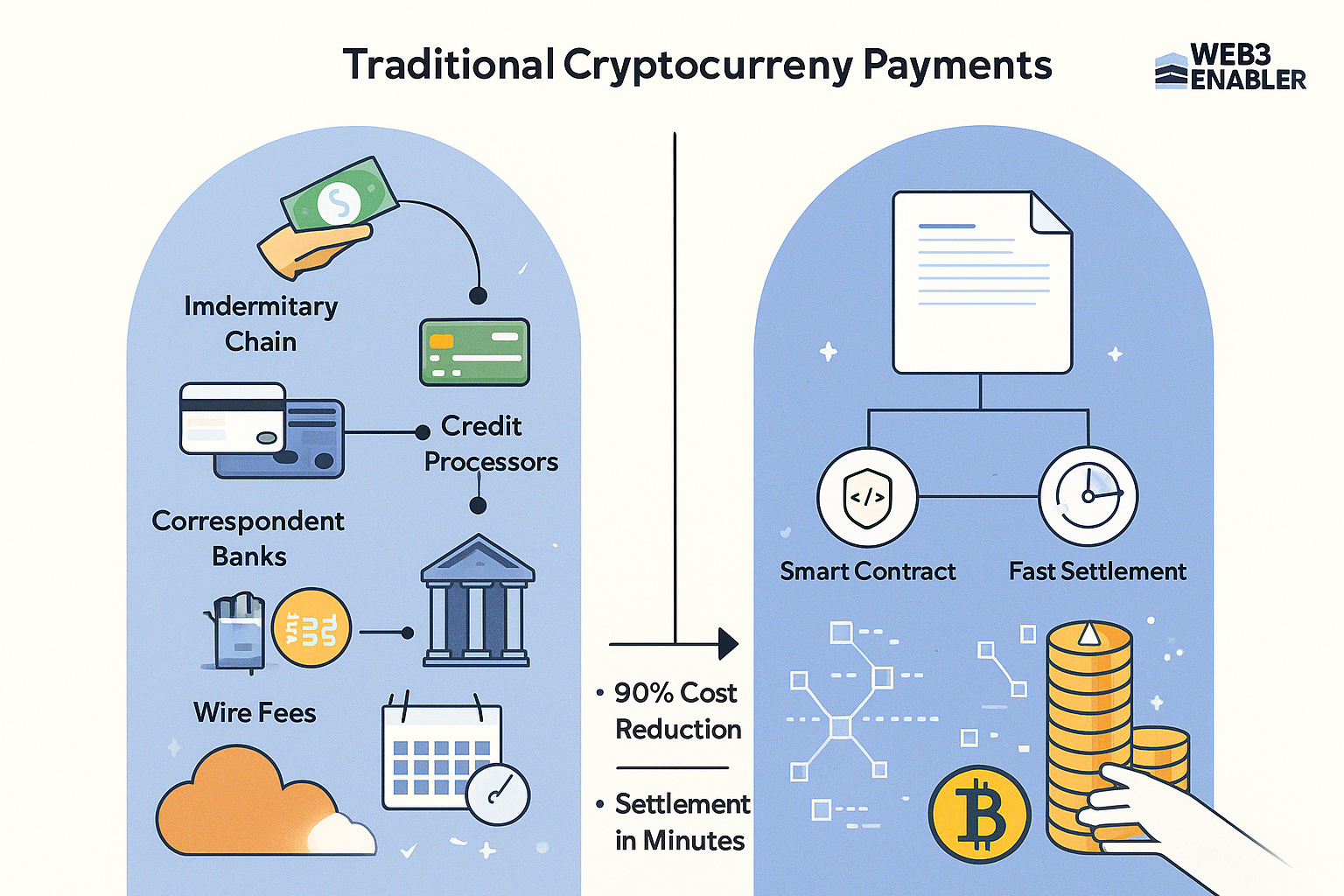

Cryptocurrency offers a transformative alternative. We at Web3 Enabler help enterprises implement crypto payment solutions that reduce costs by up to 90% while accelerating settlement times from days to minutes.

Smart finance leaders are already making the switch to modernize their payment infrastructure.

What Makes Traditional Supplier Payments So Expensive

Hidden Fees Destroy Profit Margins

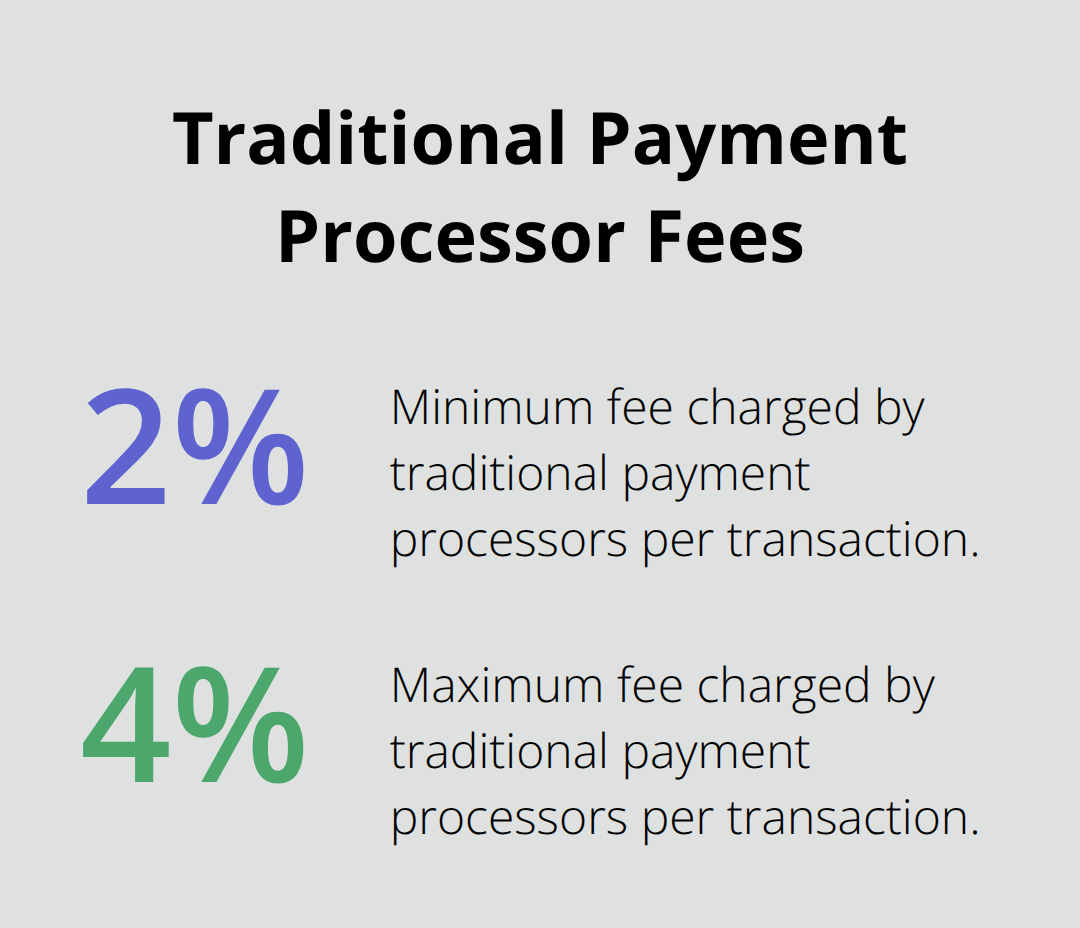

Traditional payment processors charge enterprises between 2.9% and 4.5% per transaction, but the real costs run much deeper. Wire transfer fees average $25 domestically and $50 internationally, while correspondent banks add another 1-2% in hidden markups. Foreign exchange spreads typically cost businesses an additional 3-5% on cross-border payments. The IBM 2024 Cost of a Data Breach Report reveals that traditional payment systems cost organizations an average of $6 million per data breach incident (adding security risks to already expensive infrastructure).

Settlement Delays Cripple Cash Flow Management

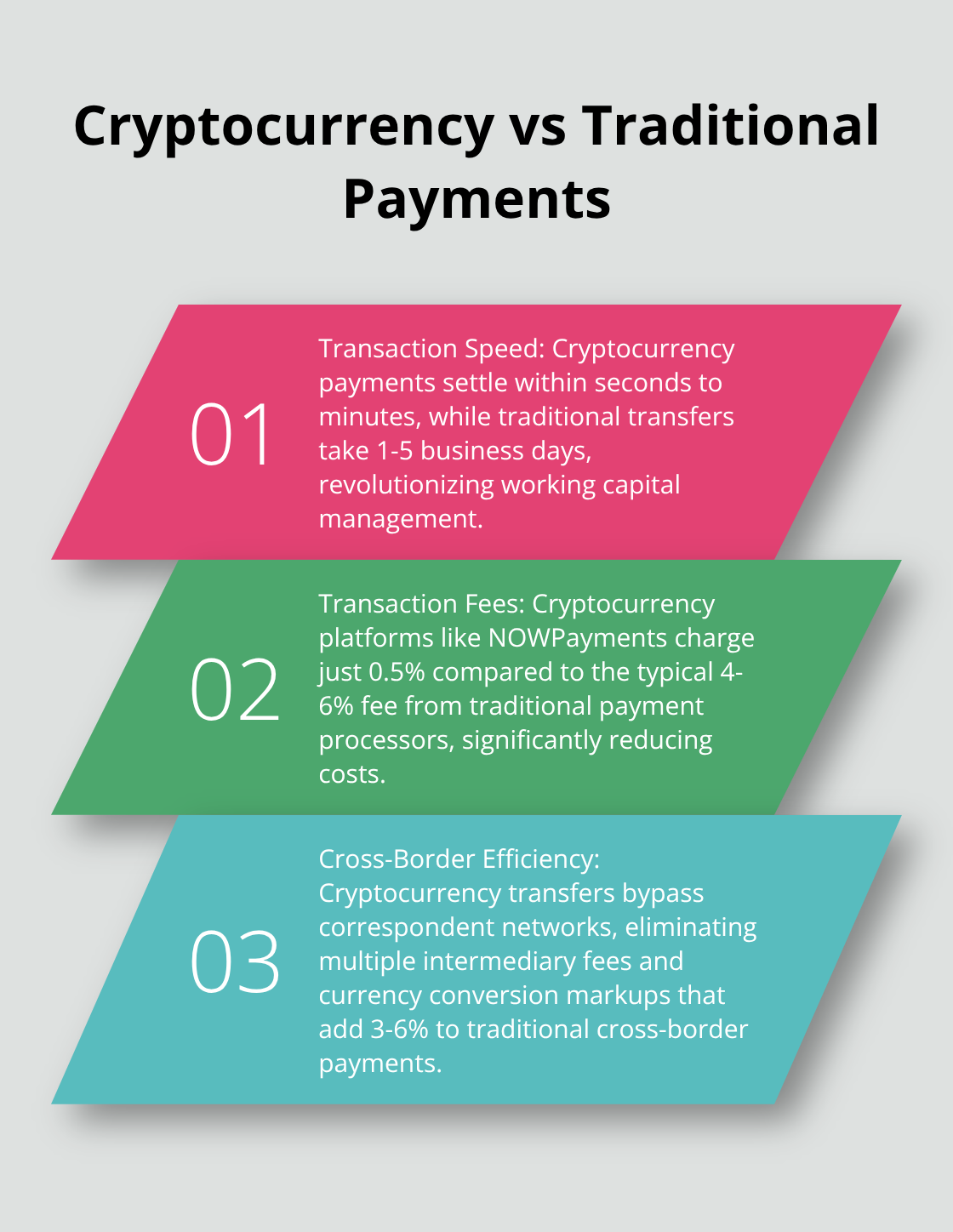

Standard ACH payments take 1-3 business days to settle, while international wire transfers require 3-5 business days. These delays force finance teams to maintain larger cash reserves and complicate working capital management. Walmart Canada reduced invoice disputes from 70% to just 1% after smart contracts replaced their traditional payment processes. Nine out of ten firms now explore blockchain payments specifically to address these timing issues, according to recent industry surveys.

Cross-Border Complexity Multiplies Costs

International supplier payments involve multiple intermediary banks, each adding fees and processing time. Currency conversion through traditional channels costs 3-6% above mid-market rates, while compliance requirements across different jurisdictions create administrative burdens. McKinsey research shows that stablecoin usage will reach $2 trillion by 2028 (driven primarily by businesses seeking alternatives to expensive correspondent networks). Major financial institutions like JP Morgan and Visa actively integrate blockchain technologies as core strategy to address these inefficiencies.

Processing Bottlenecks Create Operational Friction

Traditional payment rails create bottlenecks that extend far beyond simple transaction costs. Manual reconciliation processes consume hours of finance team productivity, while payment failures require costly intervention and delay supplier relationships. These operational inefficiencies compound the direct costs and create ripple effects throughout the entire procurement cycle.

Cryptocurrency payments eliminate these fundamental limitations through programmable money and automated settlement processes.

How Cryptocurrency Transforms Payment Operations

Cryptocurrency payments eliminate the fundamental bottlenecks that plague traditional supplier payments through programmable money and direct peer-to-peer transfers. The Open Network blockchain processes up to 105,000 transactions per second, far surpassing Visa’s theoretical limit of 65,000 TPS, while settlement occurs in seconds rather than days. Stanford University research demonstrates that smart contracts automate payment processes and reduce processing times through the elimination of manual intervention points that create delays in traditional systems.

Settlement Speed Revolutionizes Working Capital Management

Blockchain payments settle within seconds to minutes compared to 1-5 business days for traditional transfers. This speed improvement directly impacts working capital management and allows finance teams to maintain smaller cash reserves while optimizing investment opportunities. NOWPayments reports transaction fees of just 0.5% compared to the typical 4-6% that traditional payment processors charge, while merchants maintain full control of their funds without intermediary risk. Major companies like PayPal, Microsoft, and Tesla accept Bitcoin payments (demonstrating mainstream adoption that validates cryptocurrency as a viable payment method for enterprise transactions).

Cross-Border Payments Become Effortless

International cryptocurrency transfers bypass correspondent networks entirely and eliminate the multiple intermediary fees and currency conversion markups that add 3-6% to traditional cross-border payments. Stablecoin volumes surged to $250 billion in the past 18 months according to industry data, with businesses driving adoption to avoid expensive foreign exchange spreads and lengthy settlement windows. The immutable nature of blockchain transactions provides complete audit trails while reducing chargebacks to near-zero levels (addressing both compliance requirements and dispute resolution costs that burden traditional payment systems).

Programmable Money Automates Complex Workflows

Smart contracts execute payment terms automatically when predefined conditions are met, eliminating manual approval processes that slow traditional payments. These programmable features allow finance teams to set up automatic payments based on delivery confirmations, quality checks, or milestone completions. The automation reduces errors and disputes while increasing transaction speed and accuracy, creating transparent, auditable payment workflows that satisfy regulatory requirements without additional administrative overhead.

The technical advantages of cryptocurrency payments create clear operational benefits, but successful implementation requires strategic planning and proper system integration to maximize these advantages.

How Do You Actually Deploy Crypto Payments

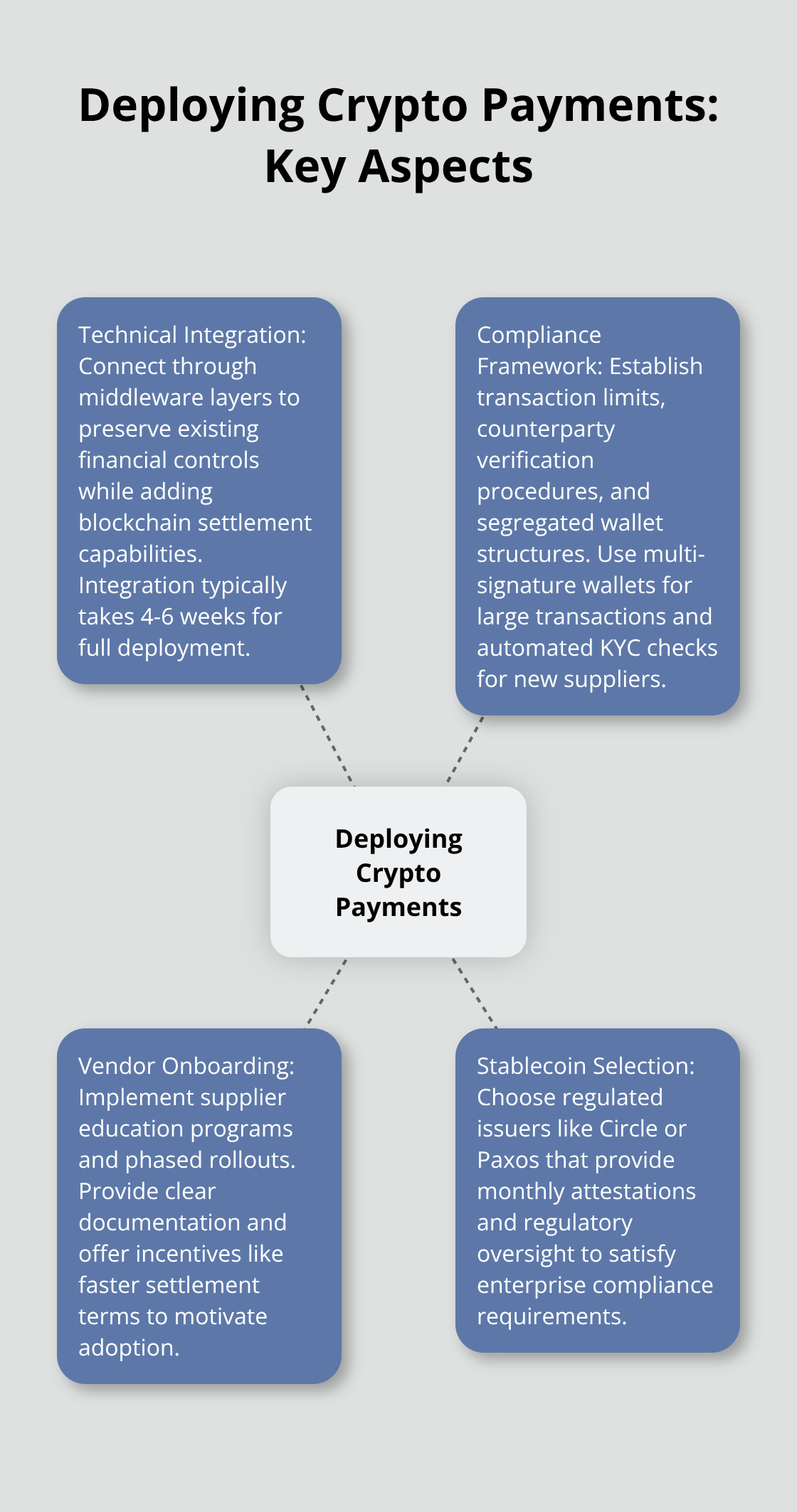

Finance teams need systematic approaches that connect cryptocurrency payments with existing enterprise systems without disruption to current operations. API-first platforms integrate directly with ERP systems like SAP, Oracle, and NetSuite through standardized REST endpoints while they maintain existing approval workflows and accounting structures. The integration process typically requires 4-6 weeks for full deployment, with pilot programs that start within 2-3 weeks according to implementation data from enterprise deployments.

Technical Integration Without System Overhaul

Modern crypto payment platforms connect through middleware layers that preserve existing financial controls while they add blockchain settlement capabilities. Finance teams configure payment thresholds, approval hierarchies, and reconciliation processes within their current ERP environment (with cryptocurrency transactions that appear as standard payment entries in general ledgers). Automated compliance reports generate documentation for audits and regulatory requirements, while smart contract templates handle standard payment terms like net-30 or milestone-based releases. The key is to select platforms that offer native integrations rather than require custom development work that creates maintenance overhead.

Compliance Framework That Actually Works

Risk management starts with stablecoin selection tied to regulated issuers like Circle or Paxos, which provide monthly attestations and regulatory oversight that satisfy enterprise compliance requirements. Treasury policies should establish transaction limits, counterparty verification procedures, and segregated wallet structures that separate operational payments from investment holdings. Multi-signature wallet configurations require multiple approvals for large transactions (while automated KYC checks validate new suppliers before payment authorization). Documentation workflows capture blockchain transaction hashes alongside traditional invoice numbers and create complete audit trails that regulators accept as valid compliance records.

Vendor Onboarding Strategy

Supplier education programs accelerate adoption through structured training sessions that cover wallet setup, transaction verification, and payment reconciliation processes. Finance teams should provide clear documentation that explains cryptocurrency payment benefits and addresses common concerns about volatility and security. Phased rollouts start with willing early adopters before they expand to the broader supplier base, which allows teams to refine processes and build internal expertise. Payment incentives like faster settlement terms or reduced processing fees motivate suppliers to adopt crypto payments over traditional methods.

Final Thoughts

Cryptocurrency eliminates the 2.9-4.5% transaction fees and 3-5 day settlement delays that drain enterprise resources from supplier payments. Smart contracts automate payment workflows while blockchain technology provides transparent audit trails that satisfy regulatory requirements. The operational benefits extend beyond cost savings to include improved cash flow management and streamlined cross-border transactions.

Finance teams who implement crypto payments must focus on ERP integration, compliance frameworks, and structured vendor onboarding programs. Success requires platforms that connect with existing systems through standardized APIs while they maintain current approval processes and accounting structures. The payment landscape shifts rapidly, with McKinsey projecting stablecoin usage to reach $2 trillion by 2028.

Early adopters gain competitive advantages through reduced costs and faster settlement times that improve supplier relationships. We at Web3 Enabler provide native Salesforce integration for cryptocurrency payments, which enables businesses to manage digital assets and process international transactions within their existing corporate infrastructure. Our platform delivers the technical foundation finance teams need to modernize payment operations while they maintain enterprise-grade security and compliance standards.