We at Web3 Enabler believe your digital assets deserve the same level of integration as your traditional financial data. Managing USDC directly within Salesforce transforms how you track, move, and report on your stablecoin holdings.

What USDC Liquidity Management Actually Means for Business Operations

USDC liquidity management within Salesforce means you have complete visibility and control over your stablecoin holdings without the need to jump between different platforms. Your finance team can monitor balances, track payment flows, and manage treasury operations from the same dashboard where they handle customer relationships and sales pipelines. This integration eliminates the manual reconciliation work that typically consumes 4-6 hours weekly for companies that process significant stablecoin volumes.

Native Integration Changes Everything

Traditional cryptocurrency management forces your team to log into separate exchanges, check multiple wallets, and manually update spreadsheets. Businesses with integrated stablecoin solutions benefit from improved payment system efficiency and reduced costs compared to fragmented approaches. Native Salesforce blockchain integration means your CFO sees USDC balances alongside revenue forecasts, your accounts payable team processes vendor payments without the need to leave their workflow, and your compliance team generates reports with the same tools they use for traditional bank relationships.

Speed Beats Complexity Every Time

Traditional bank transfers take 3-5 business days and cost $25 per international wire, while USDC settlements complete in minutes for pennies. The real advantage isn’t just speed – it’s predictability. Your treasury team knows exactly when payments clear, vendors receive funds instantly, and cash flow forecasts become accurate instead of guesswork. Companies that process over $1 million monthly in B2B payments typically save $180,000 annually when they switch from traditional bank rails to stablecoin infrastructure.

The Real Question: Why Keep Your Digital Assets Separate?

Most businesses treat their USDC holdings like a side project – separate wallets, different reporting systems, and disconnected workflows. This approach creates unnecessary friction and limits your ability to make informed financial decisions. When your digital assets live in the same ecosystem as your customer data and revenue pipeline, you can optimize cash flow with the same precision you apply to sales forecasting.

The next step involves understanding why Salesforce native solutions matter more than you might think for your financial operations.

What Benefits Does USDC Management Actually Deliver

USDC liquidity management within Salesforce delivers three concrete advantages that transform how your finance team operates. Your treasury dashboard shows real-time USDC balances alongside traditional bank accounts, which eliminates the 15-minute delay between wallet checks and internal report updates.

Finance teams with integrated stablecoin solutions report 67% faster month-end closes because they skip manual reconciliation entirely. Payment processing becomes automatic rather than reactive – your accounts payable team initiates USDC transfers directly from vendor records, and settlements complete within 10 minutes instead of the standard 3-day ACH window.

Real-Time Visibility Changes Financial Decision Speed

Cross-border payments to suppliers cost $0.02 per transaction compared to $25 wire fees, and your cash flow projections become accurate because you know exactly when payments clear. Your CFO sees USDC balances in the same dashboard that displays revenue forecasts and customer pipeline data.

Treasury teams can make informed decisions without switching between platforms or waiting for external wallet confirmations. This visibility advantage becomes particularly valuable during high-volume payment periods (like month-end vendor settlements) when timing matters most.

Compliance Tracking Shifts from Reactive to Proactive

Your audit team accesses complete transaction histories without requesting data from multiple exchanges, and regulatory reports generate automatically from the same system that tracks your sales pipeline. Companies processing significant monthly volumes in stablecoin payments benefit from streamlined compliance workflows.

The audit trail becomes bulletproof because every USDC transaction links to specific customer records, purchase orders, and approval workflows. Your CFO sees digital asset exposure in standard financial dashboards rather than piecing together data from spreadsheets and wallet interfaces.

Workflow Integration Eliminates Department Silos

Sales representatives confirm payment receipt instantly instead of waiting for finance confirmation. Customer success teams resolve payment disputes with complete transaction visibility, and your accounts receivable team processes international collections without currency conversion delays.

Treasury management becomes proactive because automated alerts notify your team when USDC balances fall below operational thresholds. Rebalancing happens through familiar Salesforce workflows rather than external exchange interfaces, which means your team spends less time on platform management and more time on strategic financial decisions.

The real question becomes: how do you implement these advantages without disrupting your existing financial processes?

How Do You Set Up Smart USDC Monitoring

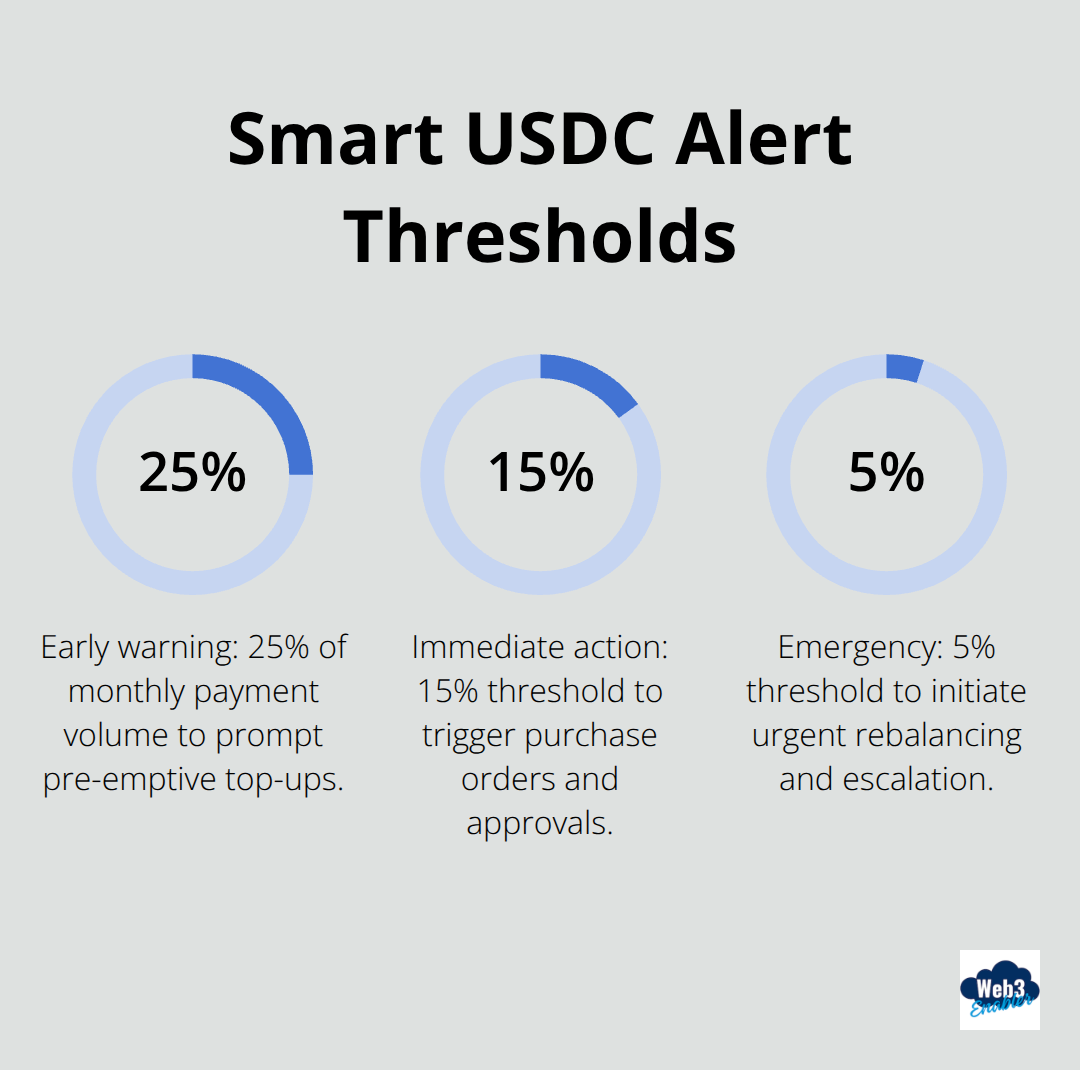

Your USDC liquidity management becomes bulletproof when you automate balance alerts and establish clear risk thresholds within Salesforce. Set automated alerts at three specific levels: 25% of monthly payment volume for early warnings, 15% for immediate action, and 5% for emergency rebalancing.

Centralized treasury operations under unified oversight provide the most effective fraud prevention compared to manual approaches. Configure alerts to trigger automated purchase orders for USDC top-ups through your preferred exchange API, which eliminates the 2-4 hour delay between detection and resolution.

Risk Controls That Actually Work

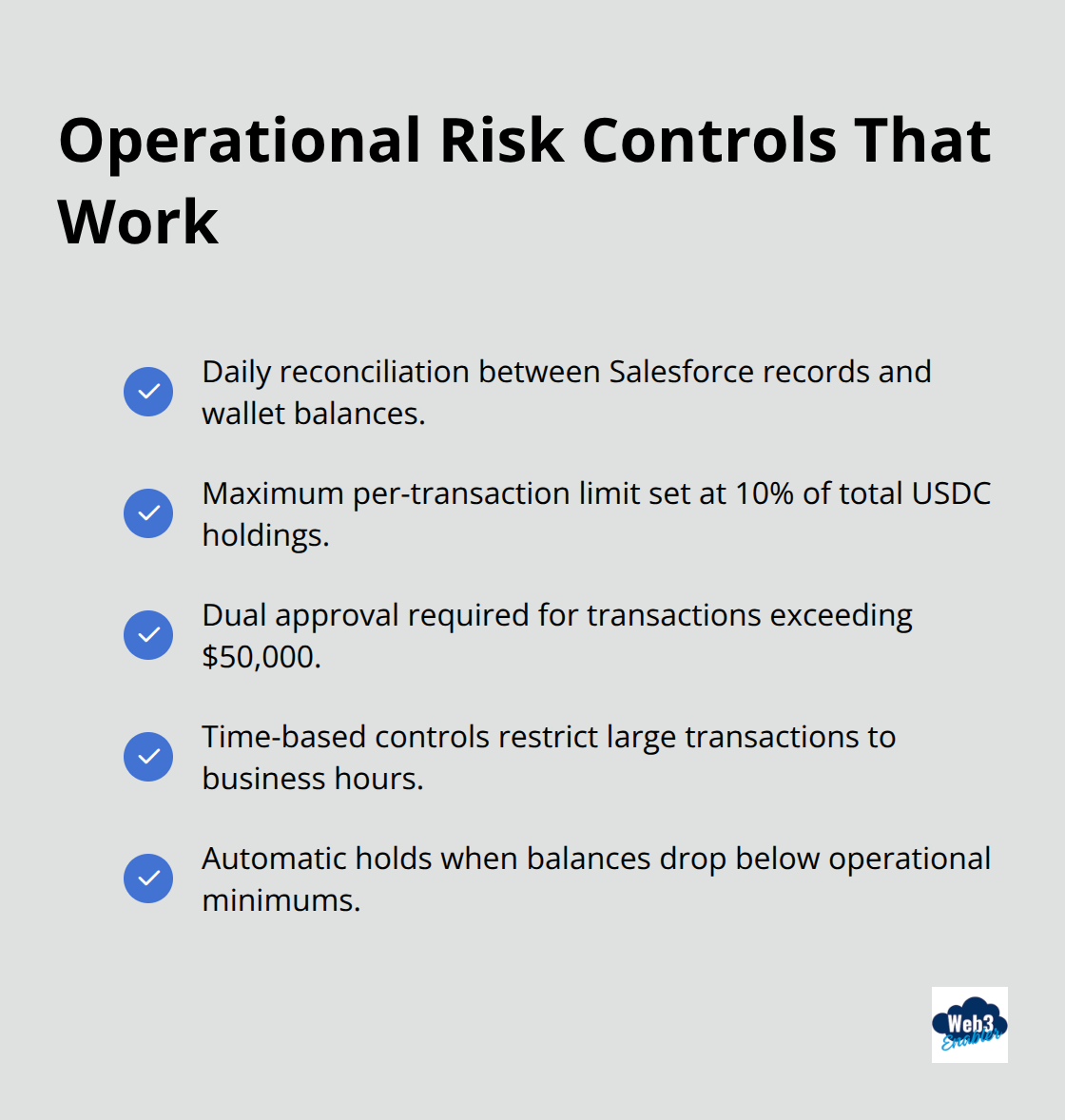

Implement daily balance reconciliation between your Salesforce records and actual wallet holdings, because even small discrepancies compound quickly. Set maximum transaction limits at 10% of total USDC holdings for individual payments and require dual approval for transactions that exceed $50,000. Finance teams that process high-volume payments benefit from time-based controls that restrict large transactions to business hours when treasury staff can respond immediately. Your risk management framework should include automatic transaction holds when wallet balances fall below operational minimums (this prevents payment failures that damage vendor relationships).

Workflow Integration Without the Headaches

Connect your accounts payable approval workflows directly to USDC payment initiation, which means your team uses familiar processes for digital asset transactions. Configure automatic USDC-to-fiat conversion triggers when balances exceed 30-day operational requirements, which protects against unnecessary exposure while you maintain payment readiness. Your month-end process accelerates when USDC transactions automatically populate general ledger entries with the same account structure your team already uses for traditional payments (no additional training required).

Final Thoughts

USDC liquidity management within Salesforce eliminates the platform-jumping that slows down your finance team and creates gaps in financial oversight. Your treasury operations become predictable when digital asset balances appear alongside traditional financial data. Payment processing accelerates from days to minutes without sacrificing compliance oversight.

The implementation path starts with connecting your existing USDC wallets to Salesforce through automated balance monitoring and risk controls. Your team continues to use familiar approval workflows while gaining real-time visibility into digital asset holdings and transaction status. This approach transforms how your finance department handles stablecoin operations without disrupting established processes.

We at Web3 Enabler provide native blockchain solutions available on the AppExchange that connect your stablecoin operations directly to your existing corporate infrastructure. Our tools support payments, compliance, and automation rather than crypto speculation (with backing from trusted partners like Circle and Ripple). Your finance team gets the integration benefits without the complexity of managing separate blockchain platforms or learning new systems. Contact us today to see how USDC liquidity management transforms your Salesforce environment.