We at Web3 Enabler see companies switching to stablecoin invoicing and cutting their payment costs by up to 90%. The results speak for themselves: instant settlements, minimal fees, and happy clients who actually pay on time.

Why Traditional Invoicing is Stuck in the Stone Age

Your payment processor just charged you $47 for a $2,000 international wire transfer that took five business days to clear. Traditional banking systems extract roughly $120 billion annually in transaction fees from businesses worldwide, with cross-border payments creating significant costs for businesses.

Wire transfers routinely take 3-10 business days to process, leaving your cash flow in limbo while banks profit from the float. International payments face even worse conditions with correspondent banking relationships that add layers of fees, compliance delays, and exchange rate markups that can push total costs above 10% for smaller transactions.

High Transaction Fees Eat Your Profits

Every wire transfer, ACH payment, and international transaction comes with fees that banks design to maximize their revenue streams. Processing fees range from $15-50 per wire transfer domestically, while international transfers can cost $80-150 before factoring in exchange rate spreads. Credit card processors charge 2.9% plus $0.30 per transaction, which adds up fast when you’re processing thousands of invoices monthly.

Banks layer additional charges through correspondent banking relationships, where each intermediary takes a cut. A single international payment might pass through 3-4 different banks, each adding their own fee structure (typically 0.5-1.5% of the transaction value).

Slow Payment Processing Kills Cash Flow

Traditional payment rails operate on outdated infrastructure that treats speed as a luxury service. SWIFT networks only function during business hours in specific time zones, meaning weekend and holiday transactions sit idle while your business waits for money.

Companies lose an estimated 2-3% annually on working capital efficiency due to payment settlement delays, with B2B invoices averaging 47 days to payment completion globally. This delay forces businesses to maintain larger cash reserves, limits growth investments, and creates unpredictable cash flow patterns that complicate financial planning.

Cross-Border Payments Create Operational Nightmares

International invoicing requires navigation through multiple banking relationships, currency conversion fees, and regulatory compliance requirements that vary by country. Each intermediary bank in the payment chain adds 1-3% in fees while extending processing time another 12-24 hours.

Exchange rate fluctuations during multi-day processing windows can erode profit margins by 2-5% on international contracts, making pricing predictions nearly impossible. Small and medium businesses face the highest relative costs, often paying 3x more in percentage terms than large corporations for identical international payment services.

The complexity doesn’t stop at fees and delays. Documentation requirements, compliance checks, and error resolution can stretch simple payments into week-long ordeals that frustrate clients and strain business relationships.

But what if there was a payment method that could settle in minutes, cost less than a dollar per transaction, and work 24/7 across any border?

How Stablecoin Payments Revolutionize Business Invoicing

Stablecoin payments transform your invoicing process by settling transactions within minutes instead of days. The crypto market has experienced explosive growth, with stablecoin data showing expansion from $2B to $114B in just 2 years, which proves businesses recognize the massive efficiency gains. Transaction costs drop to less than $1 per payment compared to traditional wire fees of $47-150, while your funds become available immediately rather than sitting in banking limbo for up to 10 business days.

Companies that use stablecoin payments report customers are twice as likely to be new clients, which expands your market reach while improving cash flow management. The blockchain operates 24/7 without banking holidays or time zone restrictions, so weekend payments process instantly instead of waiting until Monday morning.

Instant Settlement Changes Everything

Traditional payment rails force you to wait 3-10 business days for international transfers while stablecoins settle in under 10 minutes. This speed improvement transforms working capital management since you access funds immediately after payment confirmation. Studies show companies lose 2-3% annually on working capital efficiency due to payment delays, but stablecoin adoption eliminates this drag on profitability.

Your accounting team can reconcile payments in real-time rather than track pending transfers across multiple banking relationships (which reduces administrative overhead and improves financial forecasting accuracy).

Transaction Economics Favor Stablecoins

Processing fees for stablecoin payments consistently cost under $1 regardless of transaction size, while traditional banking extracts $120 billion annually through various fee structures. International stablecoin transfers avoid correspondent banking relationships that typically add 0.5-1.5% per intermediary, plus exchange rate spreads that can reach 3-5% on smaller transactions.

Businesses that switch to stablecoins report cost reductions of 90% or more on cross-border payments, with predictable fee structures that simplify financial planning. The elimination of float means your capital works immediately rather than generates profits for banks during multi-day processing windows (a practice that costs businesses billions annually).

Global Payments Without Borders

Stablecoins operate identically whether you send $100 to Toronto or $100,000 to Tokyo. Traditional banking requires different correspondent relationships, compliance procedures, and processing times for each country, but stablecoins treat all destinations equally. This consistency eliminates the complexity of managing multiple banking relationships and reduces the risk of payment failures due to intermediary bank issues.

Ready to implement this payment revolution in your business? The setup process is simpler than you might expect.

Getting Started with Stablecoin Invoice Payments

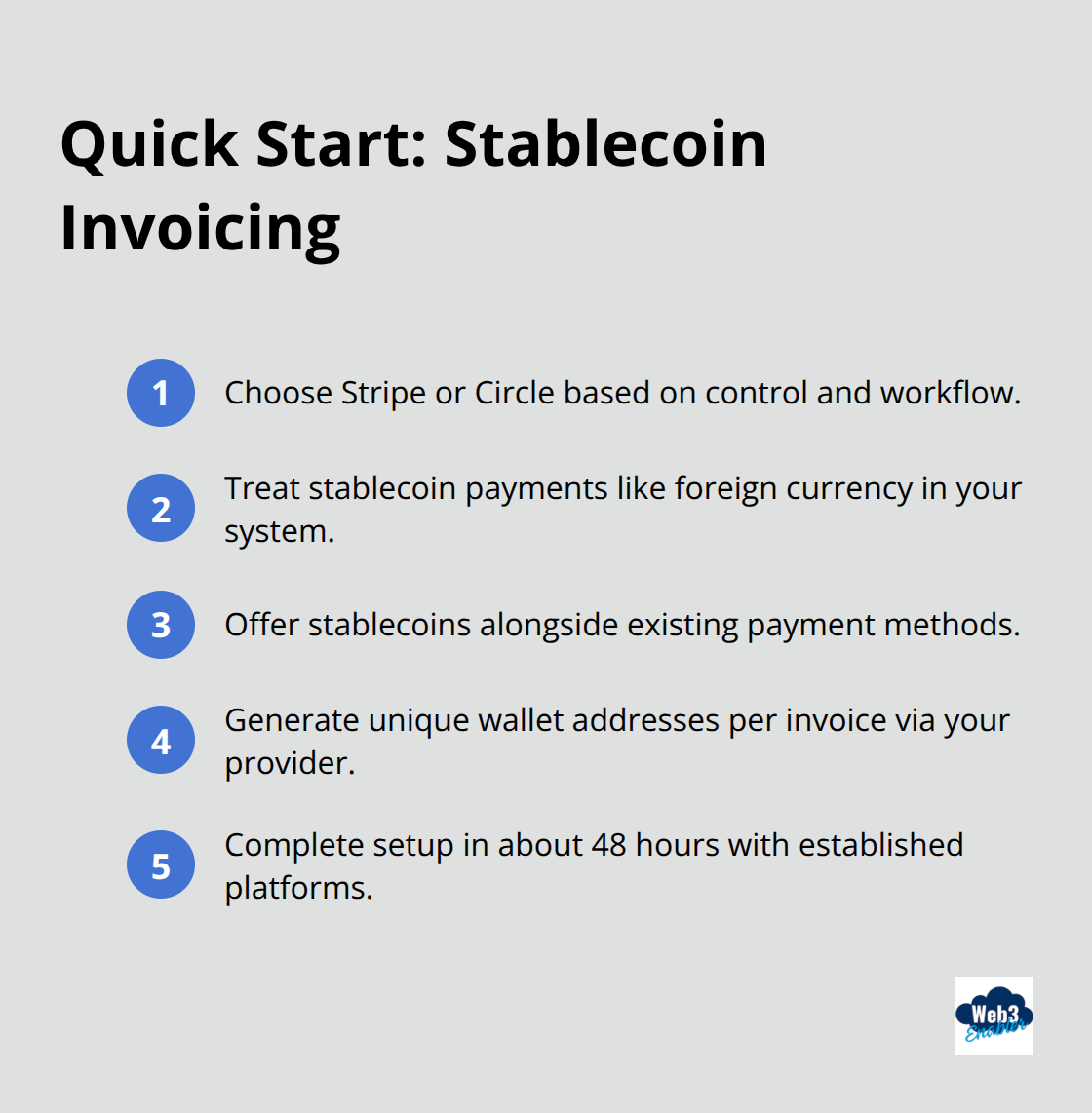

Your stablecoin payment implementation requires three strategic decisions that determine success or failure. Choose Stripe for seamless integration since they handle the technical complexity while they maintain your existing workflow, or select Circle for direct blockchain access with more control over transaction fees. Avoid experimental platforms that lack proper regulatory compliance since the GENIUS Act makes clear that payment stablecoins are neither a security nor a national currency.

Platform Selection Determines Your Success Rate

Stripe dominates business stablecoin adoption because their API integrates with existing systems without blockchain expertise from your team. Their platform processes USDC payments with the same simplicity as credit card transactions, and charges predictable fees that eliminate the surprise costs typical of traditional banking. Circle offers more advanced features for businesses that want direct control over their stablecoin reserves, which allows you to earn interest on holdings while you maintain instant payment capabilities. Both platforms provide the KYC and AML compliance features that current regulations mandate, but smaller providers often lack these requirements.

Implementation Takes Days Not Months

Start with USDC since it represents the most audited and transparent stablecoin option, backed by regulated financial institutions and published monthly attestations. Your existing system needs minimal changes since you treat stablecoin payments like foreign currency transactions, and add a payment option alongside traditional methods. Most businesses complete their setup within 48 hours with established platforms (compared to weeks or months required for traditional international banking relationships). The key technical requirement involves unique wallet addresses for each invoice, which platforms like Stripe handle automatically through their API integration.

Your Accounting Team Adapts Faster Than Expected

Stablecoin transactions provide real-time confirmation unlike traditional payments that create reconciliation headaches across multiple banking relationships. Your financial reporting improves immediately since blockchain transparency eliminates the guesswork involved in tracking international wire transfers through correspondent banks. Convert received stablecoins to fiat currency instantly or maintain them as digital assets depending on your treasury strategy, with conversion fees typically under 0.5% (compared to traditional foreign exchange spreads that reach 3-5%).

Final Thoughts

Stablecoin invoicing transforms your payment operations with three advantages that traditional banks cannot provide. Transaction costs plummet from $47-150 per international wire to under $1 per payment, while settlement times collapse from 3-10 business days to under 10 minutes. Companies that adopt stablecoins achieve 90% cost reductions and attract customers who are twice as likely to be new clients, which proves this payment method expands market reach while boosting profitability.

Implementation begins when you choose Stripe or Circle as your platform, then treat stablecoin payments like foreign currency in your current workflow. Most businesses complete setup within 48 hours and experience immediate cash flow improvements since funds become available instantly rather than wait in banking limbo. The payment industry shifts toward blockchain solutions as businesses demand faster, cheaper alternatives to outdated banking infrastructure.

Early adopters secure competitive advantages through lower costs and superior customer experiences, while late movers face pressure from clients who expect modern payment options. We at Web3 Enabler provide Salesforce Native blockchain solutions that connect stablecoin payments directly with your existing CRM and financial systems (eliminating technical complexity while maintaining full regulatory compliance). Our tools make stablecoin adoption accessible for businesses of any size.