We at Web3 Enabler see businesses losing thousands monthly to outdated payment rails. Stablecoin margins tell a different story – near-zero fees, instant settlements, and transparent operations that put money back where it belongs: your bottom line.

How Stablecoin Payments Reduce Transaction Costs

Traditional Credit Cards Drain Your Revenue

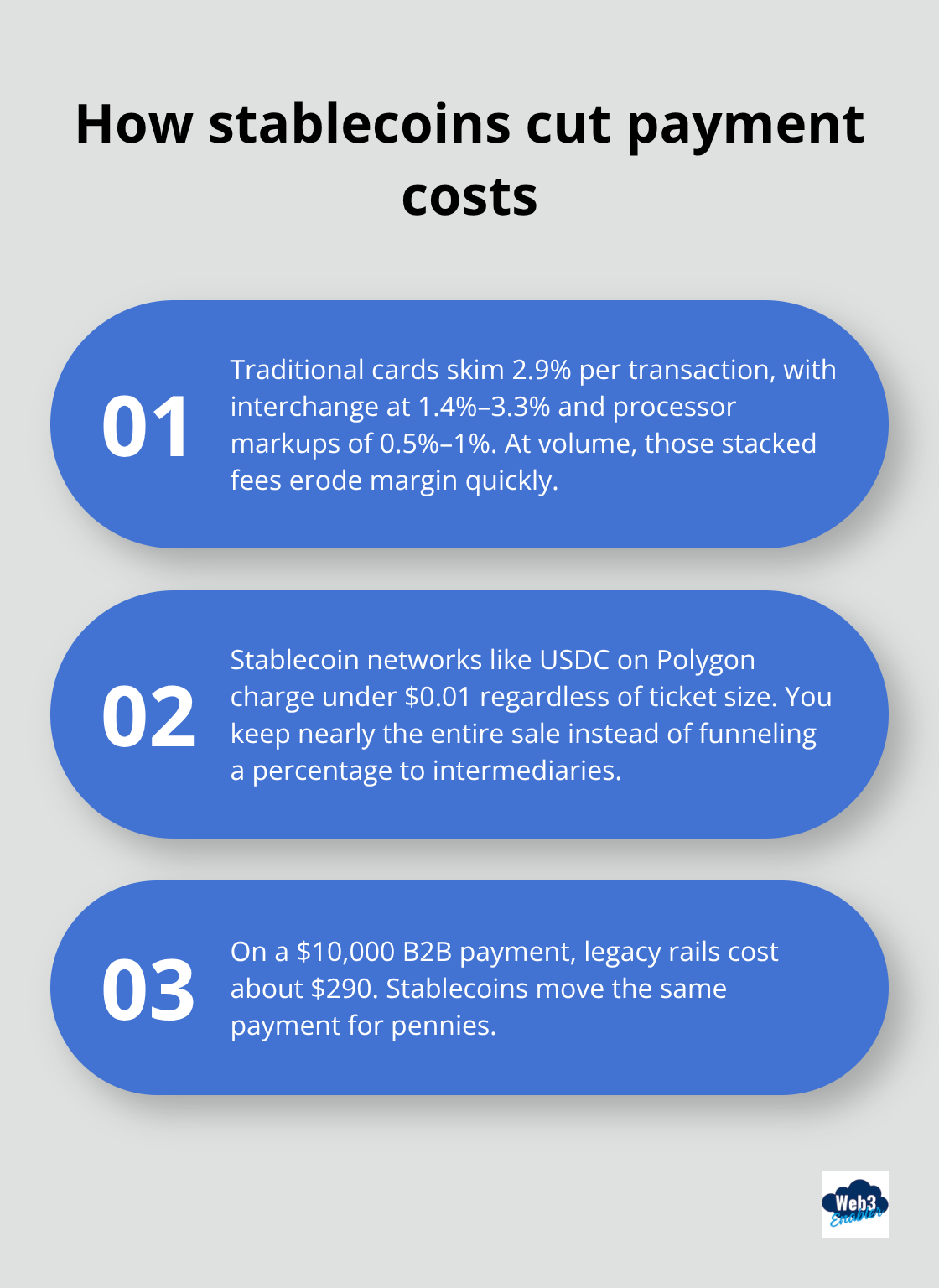

Traditional credit card processors take a 2.9% bite out of every transaction, plus additional fees that stack up like parking tickets. Visa and Mastercard charge interchange fees from 1.4% to 3.3%, while payment processors add another 0.5% to 1% on top. These percentages add up fast when you process volume.

Stablecoin networks like USDC on Polygon charge under $0.01 per transaction, regardless of payment size. A $10,000 B2B payment costs $290 through traditional rails but pennies through stablecoin networks. The math speaks louder than any sales pitch.

International Payments Stop Bleeding Money

Cross-border payments through SWIFT networks cost 6.8% on average according to World Bank data, with currency conversion fees that add another 2-4% margin. Banks pocket these spreads while businesses wait 3-5 days for settlement (because apparently money moves slower than snail mail in 2024).

Stablecoins eliminate currency conversion entirely since USDC maintains dollar parity globally. Your European client pays the same USDC your US bank account receives, with zero conversion losses. No more watching profits evaporate in exchange rate spreads.

Fraud Protection Comes Standard

Chargebacks cost merchants $3.20 for every dollar of disputed transactions according to Mastercard’s 2023 report. Traditional payment systems allow customers to reverse transactions up to 120 days later, which leaves businesses vulnerable to friendly fraud. That’s like selling someone a car and letting them return it four months later for any reason.

Stablecoin transactions become final once networks confirm them, typically within seconds. This eliminates the chargeback ecosystem that costs businesses significant amounts annually. While this approach requires stronger customer service upfront, it protects your revenue from post-sale surprises.

These cost reductions create immediate impact, but the real advantage comes from how fast your money actually moves.

Faster Settlement Times Boost Cash Flow

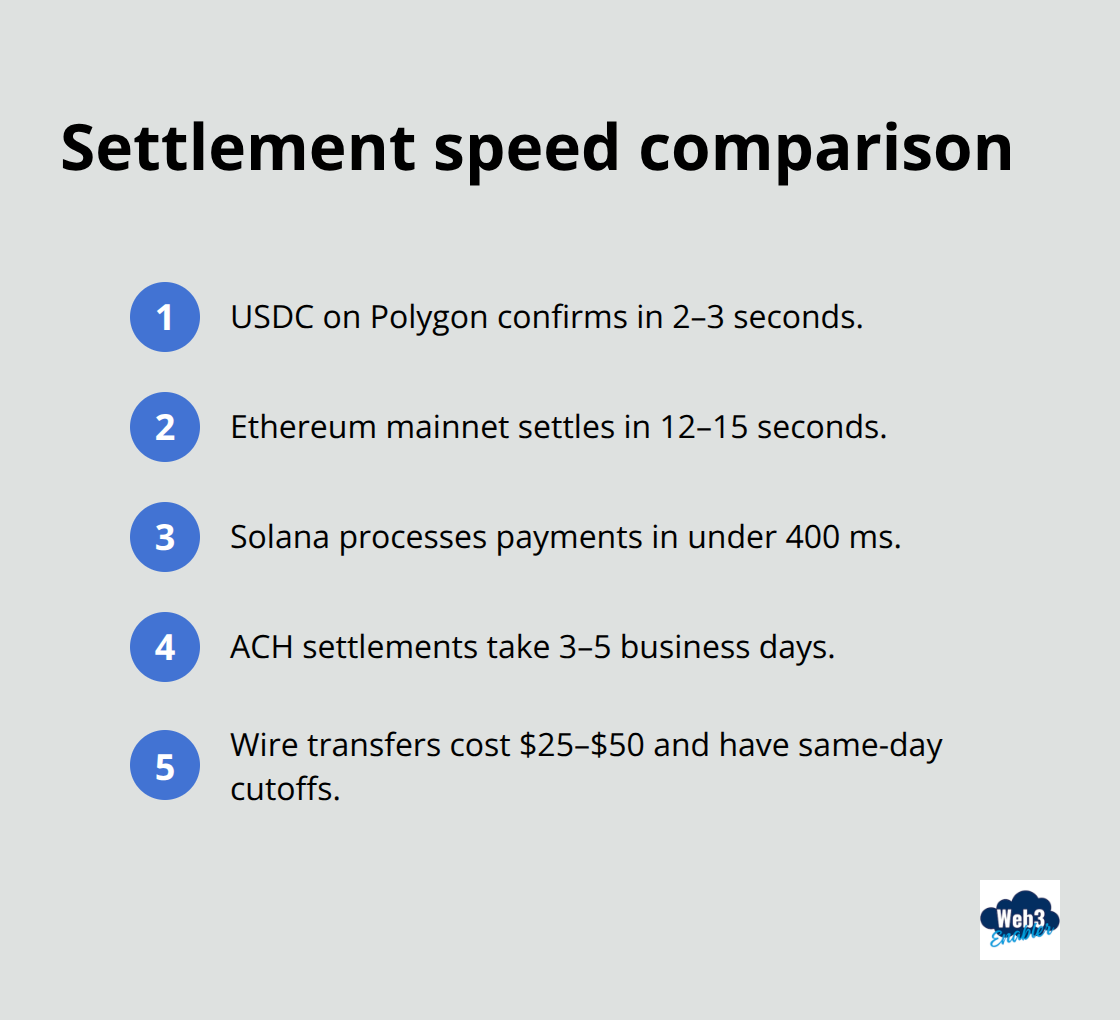

Traditional banking makes your money move like it travels through quicksand. ACH transfers take 3-5 business days to settle, while wire transfers cost $25-50 per transaction and still require same-day cutoffs that seem designed to frustrate you. Traditional payment systems create delays that keep your cash in payment purgatory instead of earning returns or covering expenses.

Stablecoin Networks Process Payments in Seconds

USDC transactions on Polygon confirm within 2-3 seconds, which gives you immediate access to funds instead of endless waiting. Ethereum mainnet settles stablecoin payments in 12-15 seconds, while Solana processes them in under 400 milliseconds according to network statistics. This speed difference transforms cash flow management from a guessing game into predictable operations.

Your suppliers receive payment instantly, customers get immediate payment confirmations, and your accounting team sees real-time transaction data instead of pending status updates. No more phone calls asking “Did the payment go through?” because everyone can verify transactions on the blockchain immediately.

Working Capital Optimization Happens Automatically

Faster settlements reduce the cash conversion cycle that ties up working capital in payment delays. Standard payment systems create artificial cash gaps where businesses need credit lines to bridge timing differences between sales and available funds. JP Morgan research indicates companies spend 1.2% annually on credit facility fees to manage cash flow gaps that slow payment systems create.

Instant stablecoin settlements eliminate these costs by making revenue immediately accessible (goodbye expensive credit lines). This improvement reduces dependency on external financing and boosts return on working capital. Your money works for you instead of sitting idle in payment limbo.

These speed improvements create measurable cash flow benefits, but the real magic happens when you automate the entire payment operation from start to finish.

Streamlined Payment Operations and Automation

Reconciliation Takes Minutes Instead of Days

Traditional payment reconciliation forces accounting teams to match bank statements with invoices across multiple systems, which creates hours of manual work that nobody enjoys. Banks provide transaction data in different formats, payment processors use separate systems, and international transfers require additional currency conversion tracking. Hotels lose 1–2% of revenue annually due to reconciliation errors.

Blockchain transactions create permanent, transparent records that eliminate reconciliation guesswork. Every stablecoin payment includes sender, receiver, amount, and timestamp data that syncs automatically with your systems. Transaction hashes provide instant verification that payments completed successfully, while smart contract addresses show exactly where funds originated and landed. This transparency reduces reconciliation time from days to minutes because all payment data lives on the same immutable ledger.

Payment Workflows Run Without Human Intervention

Manual payment processes cost businesses $18.50 per invoice according to APQC data, while automated systems reduce this cost to $3.50 per transaction. Traditional payment systems require manual approval workflows, bank portal logins, and separate confirmation processes that create bottlenecks and errors. Staff members spend time to check payment statuses, call banks about delayed transfers, and manually update payment records across systems.

Stablecoin payment workflows integrate directly with existing business systems through APIs that trigger automatic payments based on predefined conditions. Invoice approval automatically initiates payment execution, supplier payments process without manual intervention, and payment confirmations update records in real-time. We at Web3 Enabler provide Salesforce Native solutions that connect blockchain payments directly with CRM data (creating seamless workflows that operate without constant human oversight). This automation eliminates manual costs while reducing payment errors that traditional systems create through multiple handoffs and data entry requirements.

Integration Connects Blockchain with Existing Systems

Most businesses worry that blockchain payments require complete system overhauls that disrupt operations for months. Traditional payment processors often demand proprietary software installations, custom integrations that cost thousands, and training programs that pull staff away from productive work. These implementation barriers make payment innovation feel like a risky gamble rather than a strategic advantage.

Modern blockchain payment solutions integrate with existing business infrastructure through standard APIs and native applications. Salesforce users can process stablecoin payments directly within their CRM without switching platforms or learning new interfaces (because who has time for that?). These integrations maintain existing approval workflows while adding blockchain settlement capabilities that improve speed and reduce costs.

Final Thoughts

The numbers paint a clear picture: stablecoin payments reduce transaction costs from 2-4% to under 0.01%, eliminate currency conversion fees entirely, and provide instant settlements that improve working capital management. These improvements translate directly to better stablecoin margins and measurable profit increases. Early adopters gain competitive advantages while traditional payment systems continue to charge premium fees for slower service.

Businesses that implement stablecoin payments now position themselves ahead of competitors still paying excessive processing costs and waiting days for settlements. The technology exists today to transform payment operations from cost centers into profit drivers. Smart companies recognize this shift and act before their competitors catch up (because waiting rarely pays off in business).

We at Web3 Enabler make implementation straightforward through Salesforce Native blockchain solutions that integrate with existing business systems. Our tools connect directly with your CRM and maintain familiar workflows while adding blockchain payment capabilities. This approach eliminates the complexity typically associated with payment innovation while delivering immediate cost savings and operational improvements that boost your bottom line.