Stablecoins are shaking up business payments faster than you can say “blockchain revolution.” These digital currencies offer the speed of crypto without the wild price swings that make your CFO break out in cold sweats.

We at Web3 Enabler see companies ditching traditional payment rails for stablecoin use cases that actually make financial sense. Ready to join the party?

What Makes Stablecoins Actually Stable?

Think your regular crypto portfolio gives you trust issues? You’re not alone. Bitcoin swings 20% on a Tuesday because someone sneezed in the wrong direction, while Ethereum treats market cap like a yo-yo competition. Stablecoins flip this script entirely and peg their value to real-world assets like the US dollar, which maintains that sweet $1.00 price point that won’t send your accounting team into therapy.

The Two Stablecoin Camps That Matter

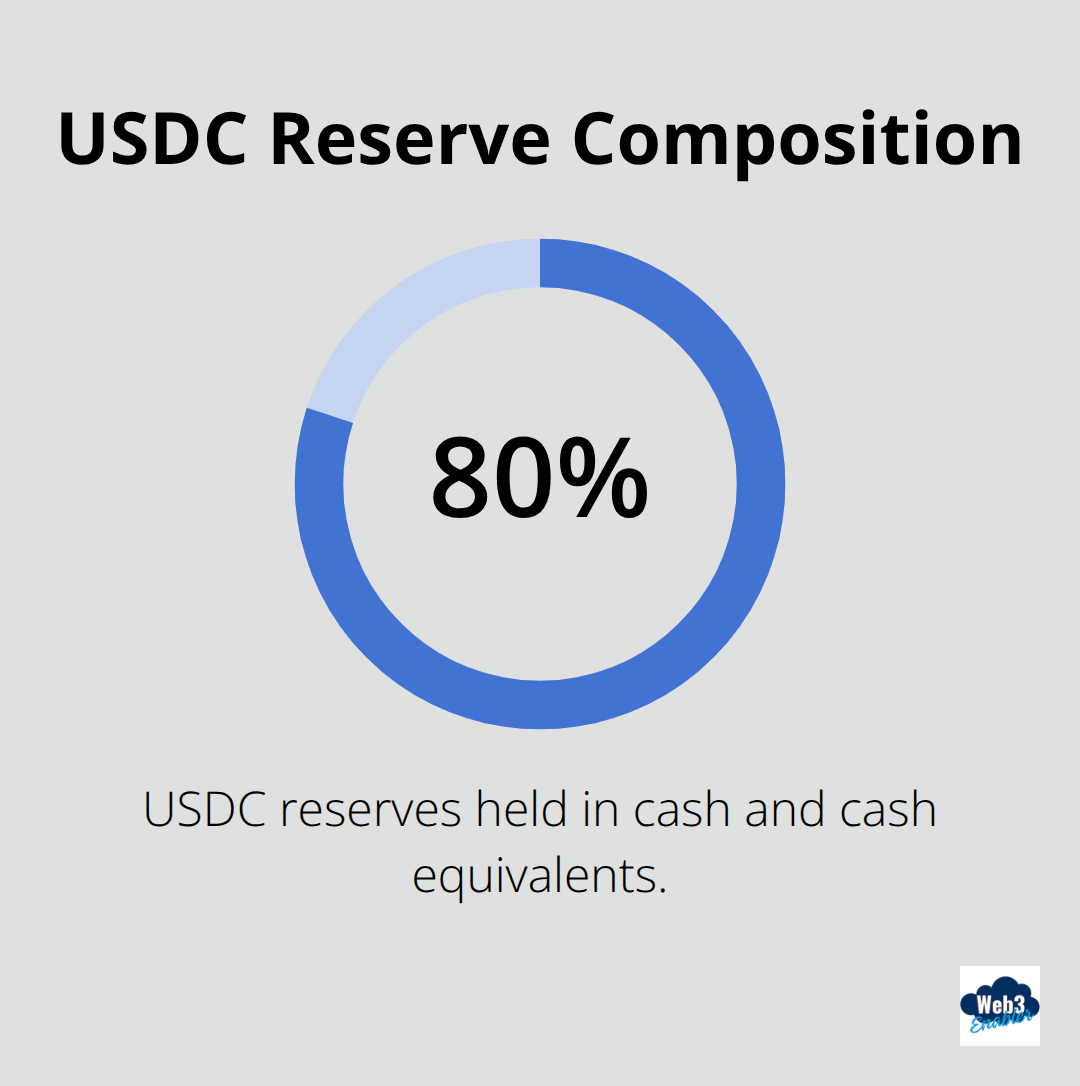

Fiat-collateralized stablecoins like USDC and USDT back every digital dollar with actual dollars that sit in bank accounts. Circle’s USDC holds roughly 80% of its reserves in cash and cash equivalents, which makes it the poster child for transparency. USDT dominates with over $120 billion in market cap but operates offshore with less regulatory oversight.

Then there’s the algorithmic camp, which uses smart contracts and market mechanisms to maintain stability. The spectacular collapse of TerraUSD in 2022 taught everyone that computer code can’t always outsmart market panic (wiping out $60 billion in value practically overnight).

Your Stablecoin Shortlist for Business

USDC wins the compliance game hands down. It’s regulated, audited monthly, and backed by Circle and Coinbase’s reputation. USDT moves the most volume globally at $27.6 trillion in 2024 transfers according to the World Economic Forum, making it the workhorse of international business despite regulatory concerns.

Skip the algorithmic experiments unless you enjoy explaining massive losses to stakeholders. Stick with the boring, battle-tested options that actually keep your payments predictable and your finance team happy.

The Real Business Impact

These stable digital currencies transform how companies handle international transactions. The cross border payments market was valued at $206.5 billion in 2024 and is estimated to reach $414.6 billion by 2034, while stablecoin transfers complete in minutes for under $1. The math gets even better when you factor in foreign exchange fees (which stablecoins eliminate entirely).

Now that you understand which stablecoins won’t give you nightmares, let’s explore how smart businesses actually put them to work in their payment operations.

Where Stablecoins Transform Business Operations

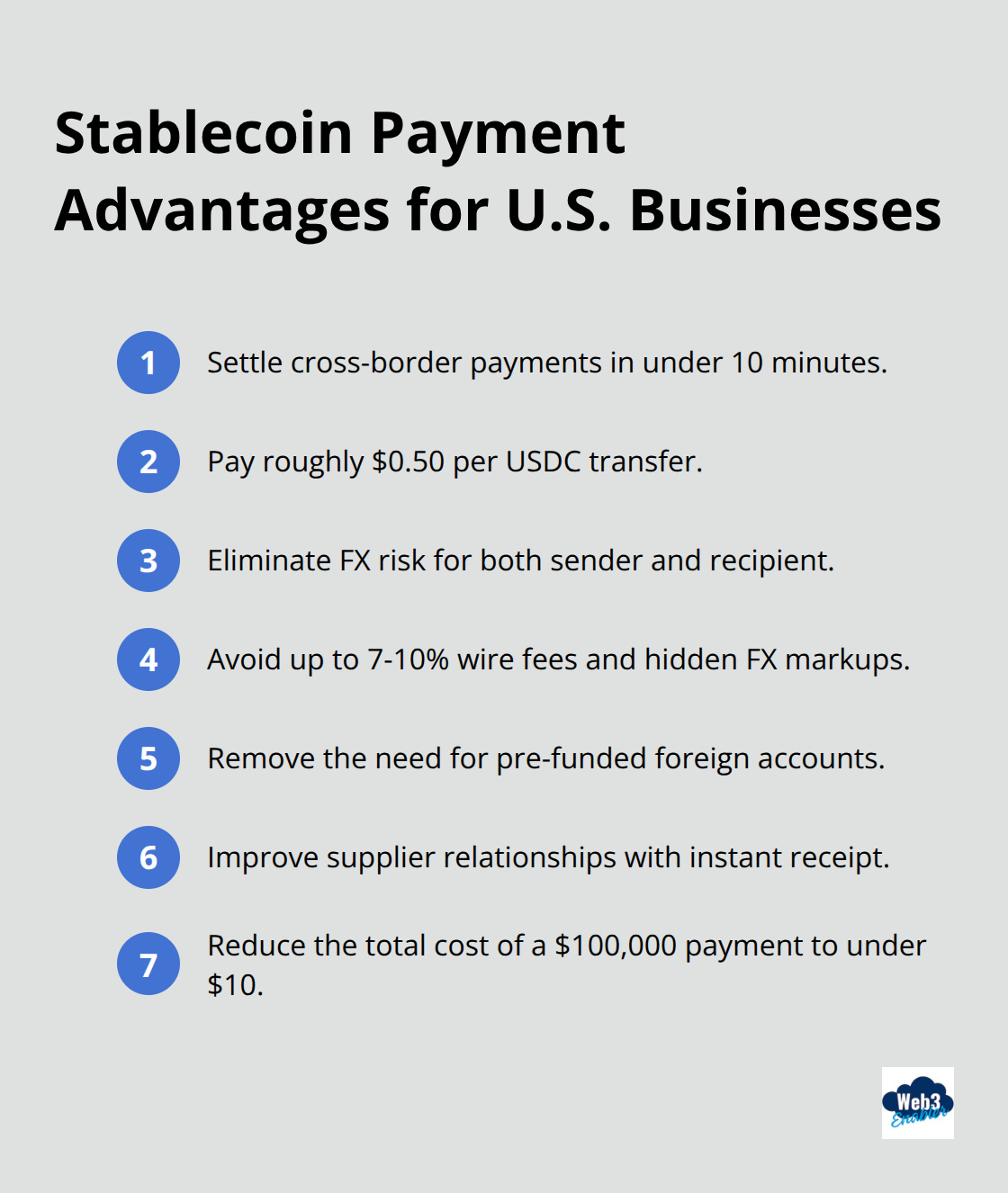

Traditional wire transfers rely on multiple intermediaries, charge up to 7-10% per transfer, and take 2-5 days for settlement. Stablecoins flip this equation completely. A USDC transfer from New York to Singapore settles in under 10 minutes for roughly $0.50 and eliminates FX risk entirely since both parties receive the exact dollar amount sent.

Cross-Border Payments Skip the Banking Maze

Companies that process high-volume international payments save massive amounts when they route transactions through stablecoin networks. A $100,000 supplier payment through traditional banks costs significantly more due to hidden FX markups that make the total cost even higher. The same transaction with USDC costs under $10 total.

Businesses eliminate pre-funded accounts in multiple currencies (which typically tie up millions in capital across different jurisdictions). Your suppliers receive payments instantly instead of wait for correspondent banks to clear funds, which improves relationships and creates opportunities to negotiate better terms for faster payment.

Payment Integration Without the Headaches

Modern payment processors make stablecoin adoption surprisingly painless. Businesses can accept USDC payments through existing Stripe accounts without overhaul of systems or staff crypto wallet training. The funds settle directly in USD within company accounts and maintain familiar structures while companies gain speed and cost advantages.

Hybrid Approaches That Finance Teams Love

Companies keep traditional payment methods for domestic transactions while they route international payments through stablecoin rails. This targeted approach delivers measurable cost reductions without complete system changes that finance teams resist. Stripe now processes stablecoin payments for US businesses and converts USDC directly to USD in company accounts without the typical 2-3% credit card fees that eat into margins.

Smart businesses recognize these operational advantages, but success depends on proper implementation and security measures that protect both company assets and customer trust.

How Do You Handle Stablecoins Safely?

Your stablecoin strategy needs rock-solid foundations that won’t crumble when markets get spicy. Start with provider selection that prioritizes regulatory compliance over flashy marketing promises.

Choose Providers That Pass the Audit Test

Circle’s USDC maintains full reserves with monthly attestations, while Tether operates with less oversight despite its market dominance. The GENIUS Act mandates US payment stablecoin issuers maintain 100% reserves in cash or low-risk securities, which makes compliance-first providers the smart long-term bet.

Skip any provider that can’t produce recent audit reports or operates from jurisdictions with unclear regulatory frameworks. These red flags signal potential problems that could freeze your business funds when you need them most.

Security That Actually Protects Your Assets

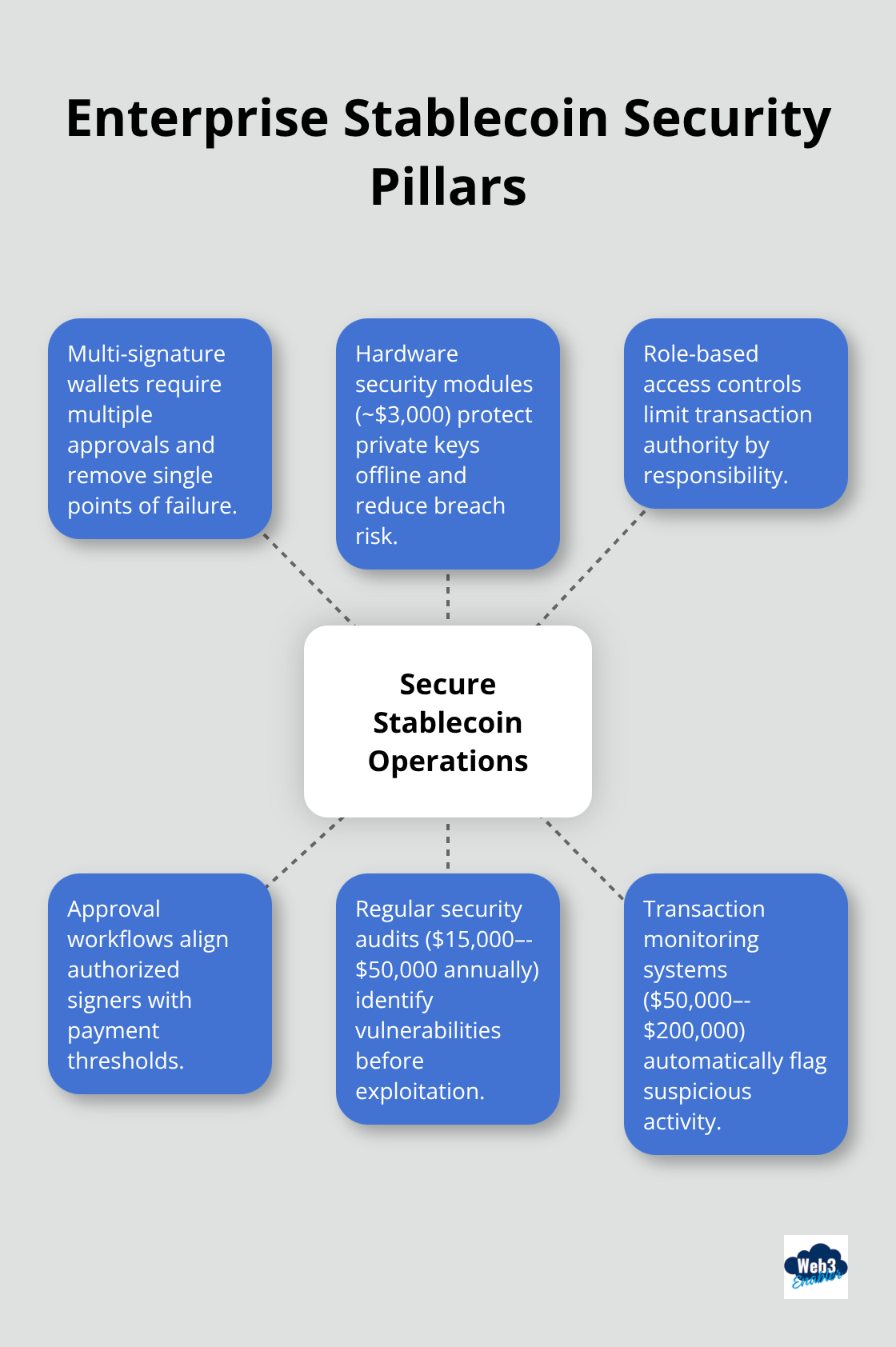

Enterprise wallet management demands institutional-grade security, not consumer apps that treat your business funds like pocket change. Multi-signature wallets require multiple approvals for transactions and prevent single points of failure that sink companies overnight.

Hardware security modules store private keys offline and cost around $3,000 upfront but prevent the million-dollar losses that make headlines. Implement role-based access controls that limit transaction authority based on employee responsibilities, and establish clear approval workflows for different payment amounts.

Regular security audits cost $15,000-$50,000 annually but catch vulnerabilities before hackers exploit them (which saves you from explaining massive losses to stakeholders).

Navigate Regulations Without Legal Nightmares

The UK’s stablecoin framework requires FCA authorization by Q1 2026, while Hong Kong mandates minimum capital requirements of $3.2 million for licensed issuers. Companies that operate internationally need compliance strategies that satisfy multiple jurisdictions simultaneously, not patchwork approaches that create regulatory gaps.

AML and KYC requirements apply to stablecoin transactions just like traditional payments, so implement customer due diligence processes that satisfy regulators without frustrating legitimate users. Transaction monitoring systems flag suspicious activity automatically and cost $50,000-$200,000 for enterprise implementations.

Document Everything Like Your Business Depends on It

Regulators love paper trails that demonstrate good faith compliance efforts, so document every transaction and policy decision meticulously. The EU’s MiCA regulation prohibits interest payments on stablecoins, while the GENIUS Act includes similar restrictions for US payment tokens (which affects how you structure treasury operations).

Keep detailed records of wallet addresses, transaction purposes, and counterparty verification. This documentation protects your business during regulatory reviews and demonstrates professional standards that build trust with partners and customers.

Final Thoughts

Stablecoins deliver measurable business advantages that traditional payment systems can’t match. Companies save thousands on international transfers while they eliminate FX risk and settlement delays that hurt supplier relationships. The $27.6 trillion in stablecoin transfers processed in 2024 proves businesses already embrace this technology for practical reasons, not crypto speculation.

Smart stablecoin use requires compliant providers like Circle’s USDC, proper security measures, and payment rails that work with existing systems. Companies don’t need complete infrastructure overhauls to benefit from faster, cheaper international payments. Major payment processors now support stablecoin integration (making adoption accessible for companies of all sizes).

The regulatory landscape continues to mature with frameworks like the GENIUS Act that create clearer guidelines for business operations. Web3 Enabler provides Salesforce-native blockchain solutions that connect stablecoin payments with existing corporate infrastructure. The future belongs to companies that embrace practical blockchain applications today, not those who wait for perfect conditions tomorrow.