Stablecoins transaction fees are eating into your profits faster than you can say “blockchain efficiency.” Those sneaky costs add up quickly when you’re moving digital assets regularly.

Stablecoins transaction fees are eating into your profits faster than you can say “blockchain efficiency.” Those sneaky costs add up quickly when you’re moving digital assets regularly.

We at Web3 Enabler know exactly how frustrating it gets when network fees spike during busy periods. The good news? Smart strategies can slash those costs significantly.

Ready to keep more money in your pocket instead of feeding the fee monster?

Why Do Stablecoin Fees Keep Getting Higher?

Network congestion acts like rush hour traffic for your transactions. When Ethereum gets busy, gas prices spike from $2 to over $50 per transaction in minutes. This happens because users compete for limited block space, and miners prioritize higher-paying transactions. Peak congestion periods typically occur between 12-4 PM EST when both US and European markets overlap (making this the worst time to move stablecoins).

Gas Wars Cost You Real Money

Transaction fees consist of base fees plus priority tips that you pay to jump the queue. Ethereum’s base fee automatically adjusts based on network demand, while Layer 1 networks like Bitcoin charge flat fees regardless of transaction complexity. Users essentially bid against each other for faster processing, which drives costs through the roof during busy periods.

Network Choice Determines Your Pain Level

Polygon offers median costs around $0.02 after recent upgrades, while Arbitrum and Optimism maintain fees below $0.10 for most transfers. Solana processes USDC transfers in 400 milliseconds for under $0.01, making it the speed demon of stablecoin networks. Ethereum charges the highest fees but offers the deepest liquidity with over $70 billion in stablecoin supply.

Timing and Strategy Matter More Than You Think

Tron processes the most stablecoin volume at rock-bottom prices but faces regulatory scrutiny in some regions. Layer 2 solutions like Arbitrum reduce costs by 90% compared to mainnet Ethereum while they maintain security (though they add complexity for first-time users). Smart timing and network selection can cut your annual transaction costs from thousands to hundreds of dollars.

Now that you understand why fees fluctuate so wildly, let’s explore the specific strategies that can slash those costs dramatically.

How Can You Cut Stablecoin Fees by 90%?

Network selection makes the biggest difference in your transaction costs. Polygon processes stablecoin transfers for just $0.02 after EIP-4844 upgrades, while Solana completes USDC transfers in 400 milliseconds for under $0.01. These Layer 2 solutions and alternative networks deliver 90% cost savings compared to Ethereum mainnet without sacrificing security. Arbitrum and Optimism maintain fees below $0.10 for most transfers, making them perfect for regular business payments. Tron handles the highest stablecoin volume at rock-bottom prices, though regulatory concerns limit its appeal for compliance-focused businesses.

Pick Your Network Like Your Business Depends On It

Ethereum remains the gold standard for liquidity with $70 billion in stablecoin supply, but those premium fees only make sense for large transactions above $10,000. Avalanche C-Chain offers sub-second finality with fees under $0.05, while BNB Smart Chain processes transfers for $0.20 during peak periods. The key insight: match your network choice to transaction size and frequency rather than brand recognition.

Time Your Transactions Like a Wall Street Trader

Network activity drops 60-80% between 2-8 AM EST, when both US and European markets sleep. Gas tracker data from Etherscan shows weekend fees average 40% lower than weekday peaks. Schedule your routine payments during these quiet hours to avoid the 12-4 PM EST rush when fees spike from $2 to $50.

Smart scheduling alone can cut your monthly transaction costs in half.

Batch Everything You Can

Process 20 payments separately and you’ll pay $40 on Ethereum, while batching them into one transaction costs just $5. Payment platforms like Circle’s APIs support batch processing for up to 100 recipients per transaction. This strategy works best for payroll, vendor payments, or customer refunds where timing flexibility exists. Even Layer 2 networks benefit from batching since you pay one bridge fee instead of multiple small ones.

The right network and timing strategy can slash your fees dramatically, but the tools you choose to execute these transfers matter just as much as the blockchain itself.

Which Tools Actually Cut Your Stablecoin Fees

Layer 2 solutions transform your fee structure from painful to practical. Arbitrum One processes USDC transfers for $0.08 while it maintains Ethereum’s security, and Optimism delivers similar rates with faster withdrawal times. Polygon PoS handles transactions for $0.02 after recent network upgrades, which makes it perfect for high-frequency business payments. Base, Coinbase’s Layer 2, offers institutional-grade infrastructure with fees under $0.05 and direct fiat on-ramps that eliminate conversion hassles. These networks reduce your costs by 85-95% compared to Ethereum mainnet while they preserve the security and liquidity you need for serious business operations.

Payment Platforms Beat DIY Every Time

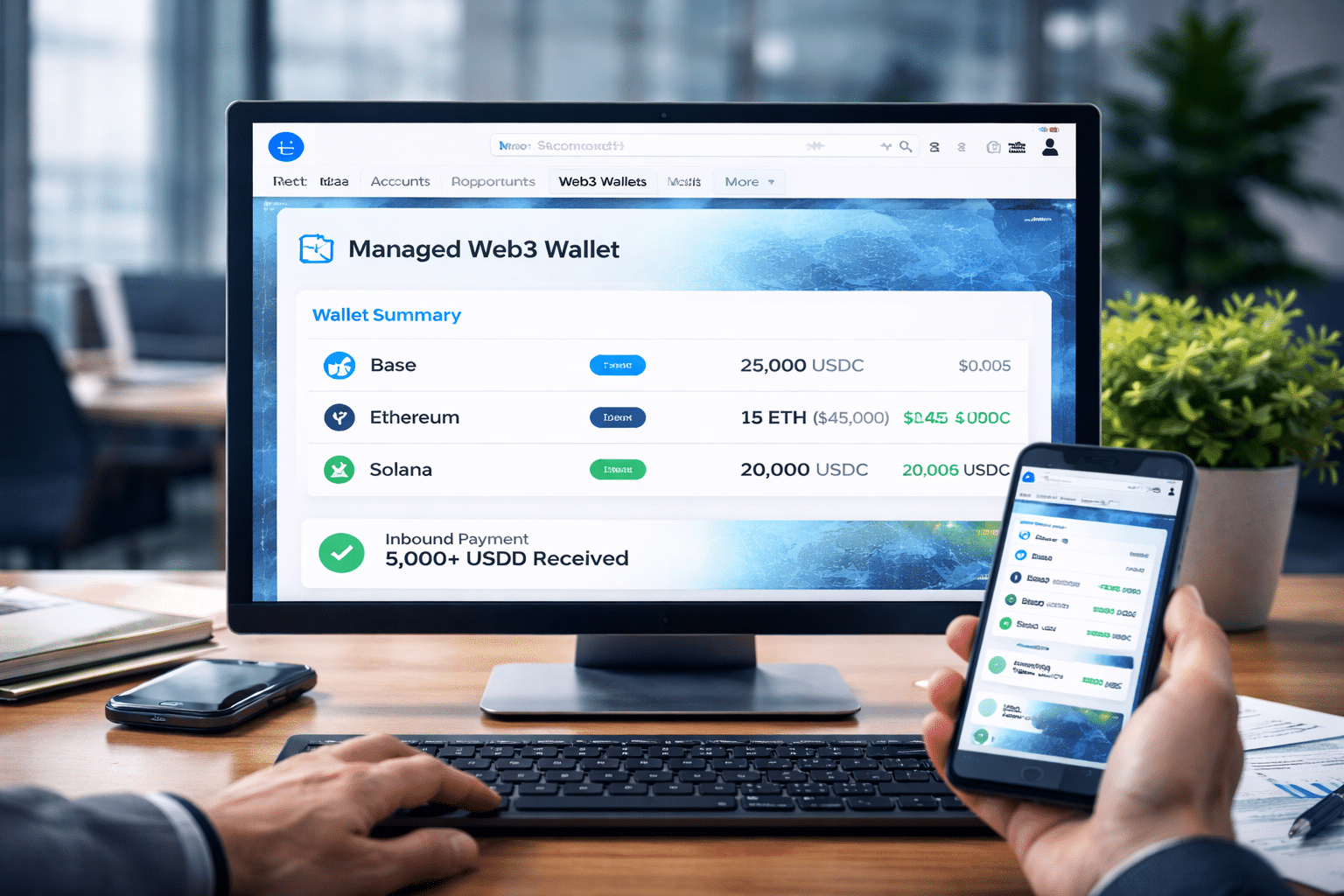

Circle’s programmable wallets handle batch payments with built-in fee optimization across multiple networks. This saves businesses up to 70% on transaction costs according to Visa’s blockchain payment analysis. BVNK processes stablecoin payments with automatic network selection that routes transactions through the cheapest available option, while their compliance features handle KYC requirements automatically. Specialized platforms like these eliminate the complexity of multiple wallet management and network bridges while they deliver better rates than manual transfers.

FlowBridge and Zodia Markets offer institutional-grade settlement with sub-1% fees for cross-border payments (compared to traditional banking’s 2-7% range). The automation alone saves finance teams 30 hours per month on payment processing, which makes the platform fees worthwhile even before you consider the direct cost savings.

Fee Comparison Reveals Clear Winners

Solana dominates speed with 400-millisecond USDC transfers that cost under $0.01, while Tron processes the highest stablecoin volume at similarly low rates but faces regulatory scrutiny in compliance-focused markets. Avalanche C-Chain delivers sub-second finality for $0.05 per transaction, which positions it between premium Ethereum security and budget-friendly alternatives.

Traditional wire transfers cost $15-50 plus 2-4% FX margins, which makes any blockchain option a massive improvement for international payments. The math becomes clear when you process $100,000 monthly: Ethereum costs $2,000 in fees, Arbitrum costs $200, and Solana costs just $20 while it delivers faster settlement than traditional banks.

Network Selection Strategy

Match your network choice to transaction size and frequency rather than brand recognition. Ethereum remains the gold standard for liquidity with $70 billion in stablecoin supply, but those premium fees only make sense for large transactions above $10,000. Avalanche C-Chain offers sub-second finality with fees under $0.05, while BNB Smart Chain processes transfers for $0.20 during peak periods (making it suitable for mid-range transactions).

Final Thoughts

Smart stablecoin transaction fee management transforms your payment operations from cost center to competitive advantage. Network selection delivers the biggest impact – Solana and Polygon cut fees by 95% compared to Ethereum while they maintain security and speed. Proper network choice and transaction batches eliminate redundant fees entirely.

The long-term benefits extend beyond immediate savings. Businesses that process $100,000 monthly save $20,000 annually when they switch from traditional banks to optimized stablecoin rails. These savings compound as transaction volumes grow, which creates sustainable cost advantages that improve profit margins year over year.

High-frequency payments benefit from Polygon or Solana, while large transfers justify Ethereum’s premium fees for maximum liquidity. Payment platforms automate network selection and batch processes, which eliminates manual optimization work while they deliver consistent savings. Web3 Enabler provides blockchain solutions that integrate stablecoin payments directly into your existing corporate infrastructure without crypto expertise requirements.