Your customers are asking for crypto payment options, and you’re probably wondering if it’s worth the hassle. Spoiler alert: it absolutely is.

We at Web3 Enabler know that learning how to integrate crypto payments on your website might seem intimidating, but the benefits are too good to ignore. Lower fees, faster settlements, and happy customers who can finally spend their digital coins on your products.

Ready to join the crypto payment revolution?

Why Crypto Payments Are Worth Your Time

Your customers want crypto payment options more than ever, and the numbers prove it. USD stablecoin issuers’ net T-bill purchases will likely be $50 billion to $55 billion at end-2025, with 580 million digital asset owners worldwide according to Statista. That’s not a niche market anymore – that’s mainstream adoption knocking on your door.

Growing Consumer Demand Hits Different

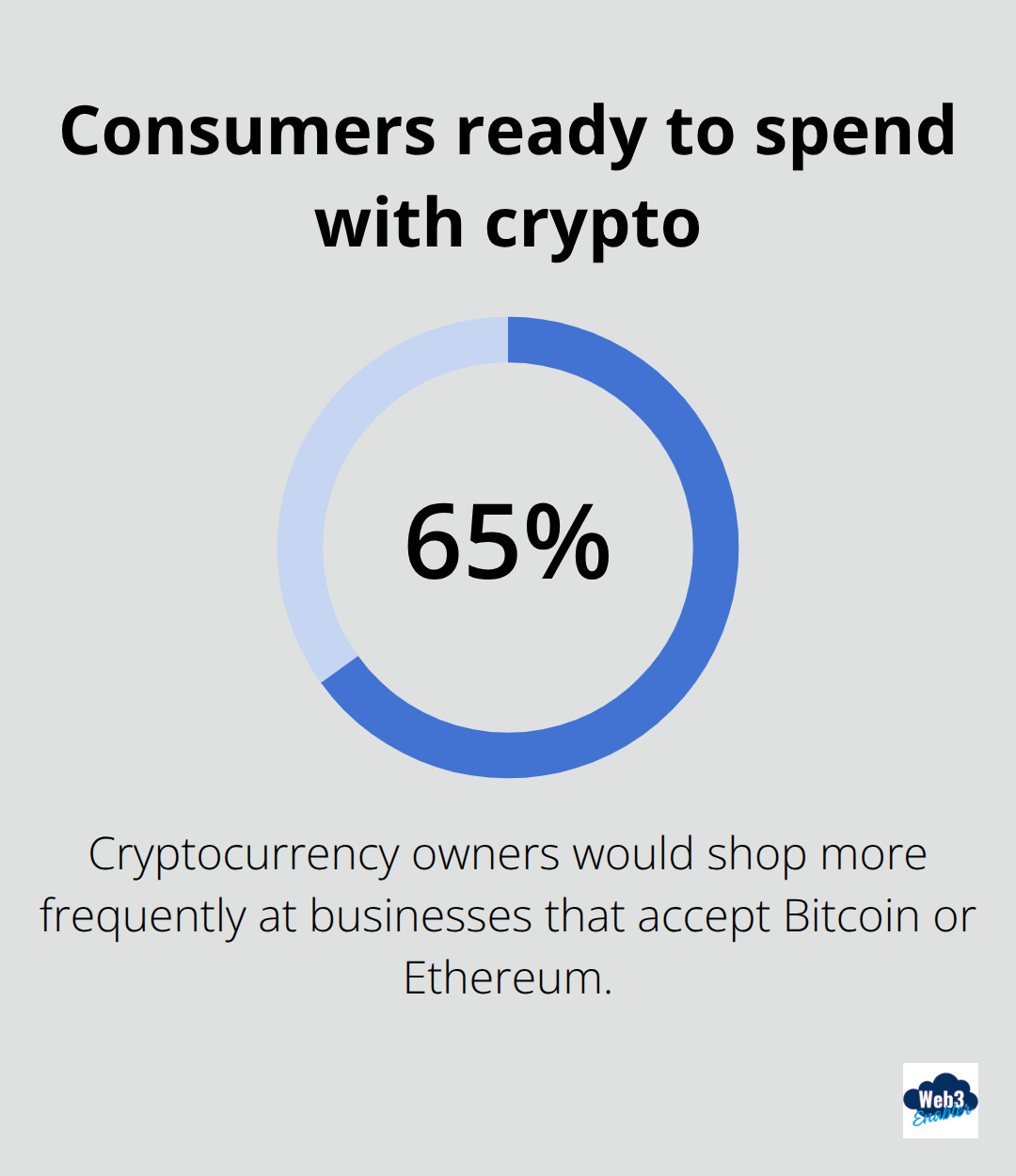

Coinbase research shows 65% of cryptocurrency owners would shop more frequently at businesses that accept Bitcoin or Ethereum. Translation: you leave money on the table every day you don’t offer crypto payments. These customers already hold digital assets and actively seek places to spend them.

They represent a tech-savvy demographic with disposable income who will choose competitors over you if crypto payments aren’t available.

Transaction Costs That Actually Make Sense

Traditional payment processors bleed you dry with fees between 2% to 5% per transaction. Crypto processors slash that to 0.5% to 1.5%, saving you thousands monthly if you process significant volume. Cryptomus charges just 0.4% with zero withdrawal fees, while B2BinPay offers competitive rates from 0.5%. These aren’t theoretical savings – they hit your bottom line immediately. Small businesses especially benefit since every percentage point matters when margins are tight (and let’s be honest, they always are).

Speed Beats Everything

Crypto transactions complete in minutes while bank transfers crawl along for up to five business days. Stablecoin payments processed $5.8 trillion in transaction volume during 2024, proving businesses trust instant settlement. Your cash flow improves dramatically when payments arrive within hours instead of days. International customers can pay instantly without currency conversion delays or astronomical wire transfer fees that traditional banks love to charge.

Now that you understand why crypto payments make business sense, let’s explore how to actually implement them on your website.

Technical Implementation Options

You have two paths: build everything yourself or use a payment processor. Direct integration gives you complete control but requires serious technical expertise. BTCPay Server offers self-hosted solutions where you manage the entire infrastructure, from wallet generation to transaction monitoring. This route works if you have blockchain developers on staff and want zero middleman fees. Most businesses should skip this headache and choose payment processors instead.

Payment Processors That Actually Work

Coinbase Commerce leads with beginner-friendly integration and 1% transaction fees, supports major cryptocurrencies with automatic fiat conversion. Cryptomus supports over 100 cryptocurrencies with 0.4% merchant fees and zero withdrawal costs. B2BinPay offers instant stablecoin conversion with competitive 0.5% rates, while Triple-A provides licensed operations across multiple jurisdictions with near-instant settlement. OpenNode specializes in Bitcoin payments with automatic fiat conversion for merchants who want Bitcoin exposure without volatility risk. Integration takes hours, not months, through APIs that connect seamlessly with WooCommerce and Shopify platforms.

Security Standards You Cannot Ignore

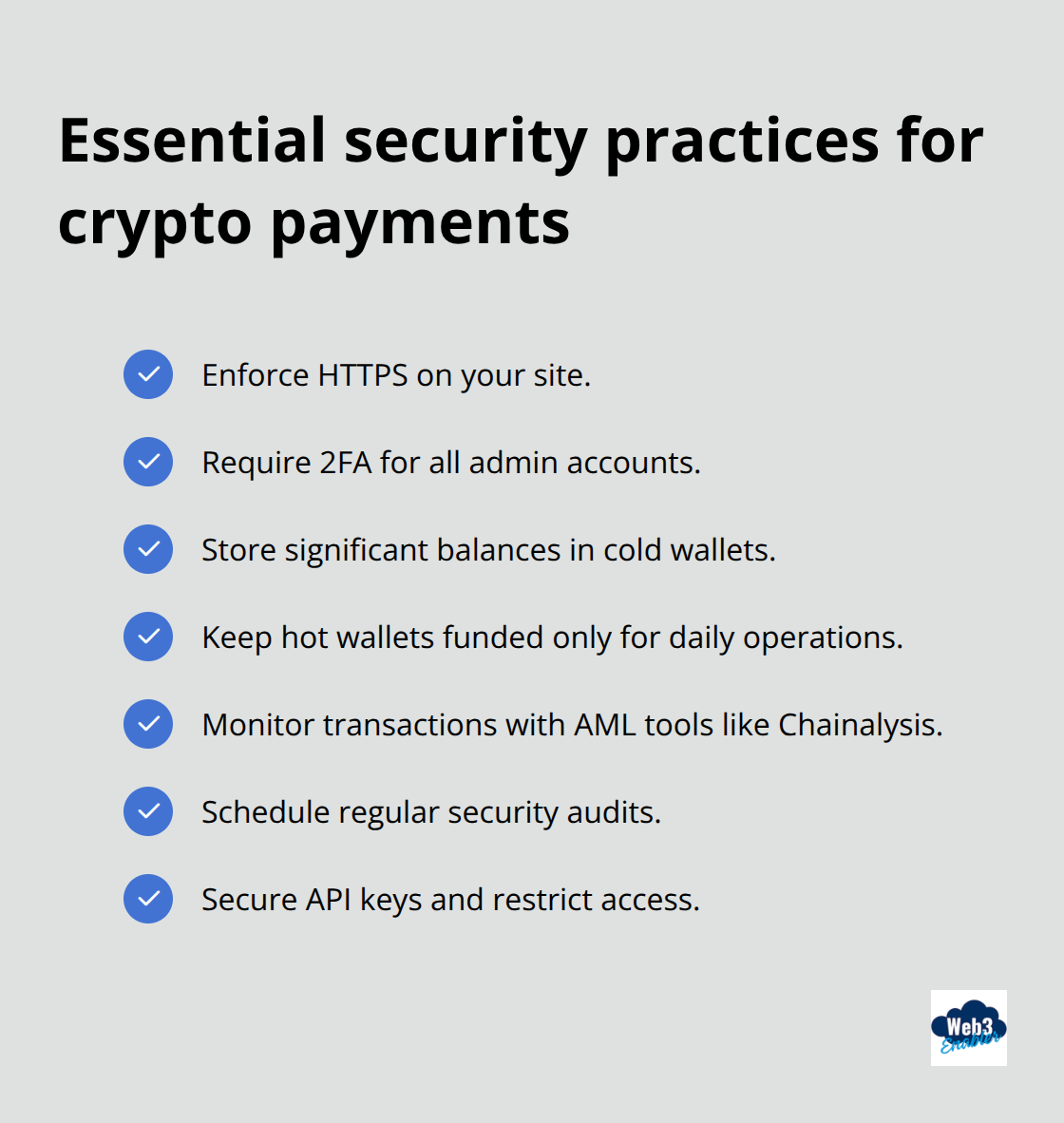

HTTPS encryption is non-negotiable for crypto transactions. Implement two-factor authentication for all admin accounts and use cold storage wallets for significant balances. Hot wallets should contain minimal amounts for daily operations only. Monitor transactions with tools like Chainalysis to identify suspicious activity and maintain compliance with anti-money laundering requirements.

Regular security audits prevent costly breaches that destroy customer trust. Payment processors handle most security requirements, but you still need secure API key management and proper access controls for your team.

API Integration Made Simple

Most payment gateways provide straightforward API documentation that developers can implement quickly. WooCommerce and Shopify plugins eliminate complex coding for popular e-commerce platforms (seriously, it’s almost plug-and-play). Test environments let you verify functionality before going live with real transactions. Webhook notifications keep your system updated on payment status changes automatically. The technical barrier is lower than you think, especially compared to traditional payment processor integrations that often require weeks of back-and-forth with banking partners. For businesses looking to implement blockchain technology more broadly, crypto payments serve as an excellent starting point.

Now that you understand the technical side, let’s tackle the business considerations that keep executives awake at night.

Business Considerations and Compliance

Tax authorities treat cryptocurrency as property, not currency, which creates immediate accounting complexities for your business. In the United States, you must record the fair market value of each crypto payment at the time of receipt, then track any gains or losses when you convert to fiat. Germany offers tax exemptions for crypto held over one year, while France imposes a flat 30% tax on gains according to current regulations.

Your accounting team needs specialized software to track these valuations automatically, since manual calculations become impossible with high transaction volumes. Coinbase Commerce and similar processors provide transaction reports, but you still need proper bookkeeping systems that integrate crypto data with existing financial records.

Compliance Requirements Hit Hard

The EU’s Markets in Crypto-Assets regulation creates unified standards across member states, but implementation varies significantly between countries. Know Your Customer and Anti-Money Laundering procedures become mandatory for businesses with substantial crypto turnover, which requires identity verification for larger transactions.

Payment processors like Triple-A handle most compliance requirements through their licensing, but you remain ultimately responsible for following local laws. Choose processors that operate with proper licenses in your jurisdiction rather than offshore entities that promise lower fees but offer zero regulatory protection.

Volatility Protection Strategies

Price swings can destroy your profit margins within hours if you hold volatile cryptocurrencies like Bitcoin or Ethereum. Automatic conversion to stablecoins or fiat eliminates this risk completely through processors that offer instant settlement.

Stablecoin circulation has grown significantly with businesses preferring price stability over speculation. Configure your payment system to convert crypto immediately upon receipt, or accept only stablecoins like USDC that maintain dollar parity (this approach eliminates most price risk). Manual conversion creates unnecessary exposure to price movements that can turn profitable sales into losses before you finish processing the order.

Final Thoughts

Crypto payments deliver measurable benefits that outweigh implementation challenges. Lower transaction fees, faster settlements, and access to 580 million digital asset owners create competitive advantages that traditional payment methods cannot match. Modern payment processors handle security and compliance requirements automatically, which reduces technical barriers significantly.

Select a reputable payment processor like Coinbase Commerce or Cryptomus that supports your target cryptocurrencies. Configure automatic conversion to stablecoins or fiat to eliminate volatility risks. Implement proper accounting systems to track fair market values for tax compliance, then test thoroughly before you launch to real customers.

The future of e-commerce includes cryptocurrency payments as stablecoin adoption accelerates and regulatory frameworks mature (businesses that master how to integrate crypto payments on website now position themselves ahead of competitors who wait). We at Web3 Enabler connect blockchain technology with existing corporate infrastructure through Salesforce Native solutions that support payments, compliance, and automation. Our tools enable businesses to accept stablecoin payments within familiar Salesforce environments.