Digital payments have become the backbone of modern business, yet most companies are still wrestling with the digital payments pros and cons without a clear roadmap. The speed is intoxicating-transactions that once took days now happen in seconds. But that convenience comes with real headaches: security threats, integration nightmares, and a regulatory maze that changes by geography.

We at Web3 Enabler have watched businesses stumble through this transition, and we’re here to cut through the noise. This guide breaks down what actually works and what’ll keep you up at night.

Why Digital Payments Actually Move the Needle

The real power of digital payments isn’t just speed-it’s what speed enables. When Walmart announced its real-time pay-by-bank option for e-commerce, leveraging FedNow and the RTP network, they weren’t chasing a trend. They solved a fundamental problem: traditional payment rails take days to settle, tying up capital and creating friction at checkout. According to Statista, the average credit card transaction in the U.S. sits at $97.58, while debit transactions average $49.87. Those transactions complete instantly online, but the money doesn’t actually move for one to three business days. Digital payments collapse that gap. Real-time settlement means your cash position updates immediately, your suppliers get paid faster, and your customers see confirmations in seconds instead of waiting for bank processing queues. The financial impact compounds quickly-faster settlement directly improves working capital, reduces accounting overhead, and lets you capture early-payment discounts that traditional payment cycles make impossible.

Geography Becomes Irrelevant

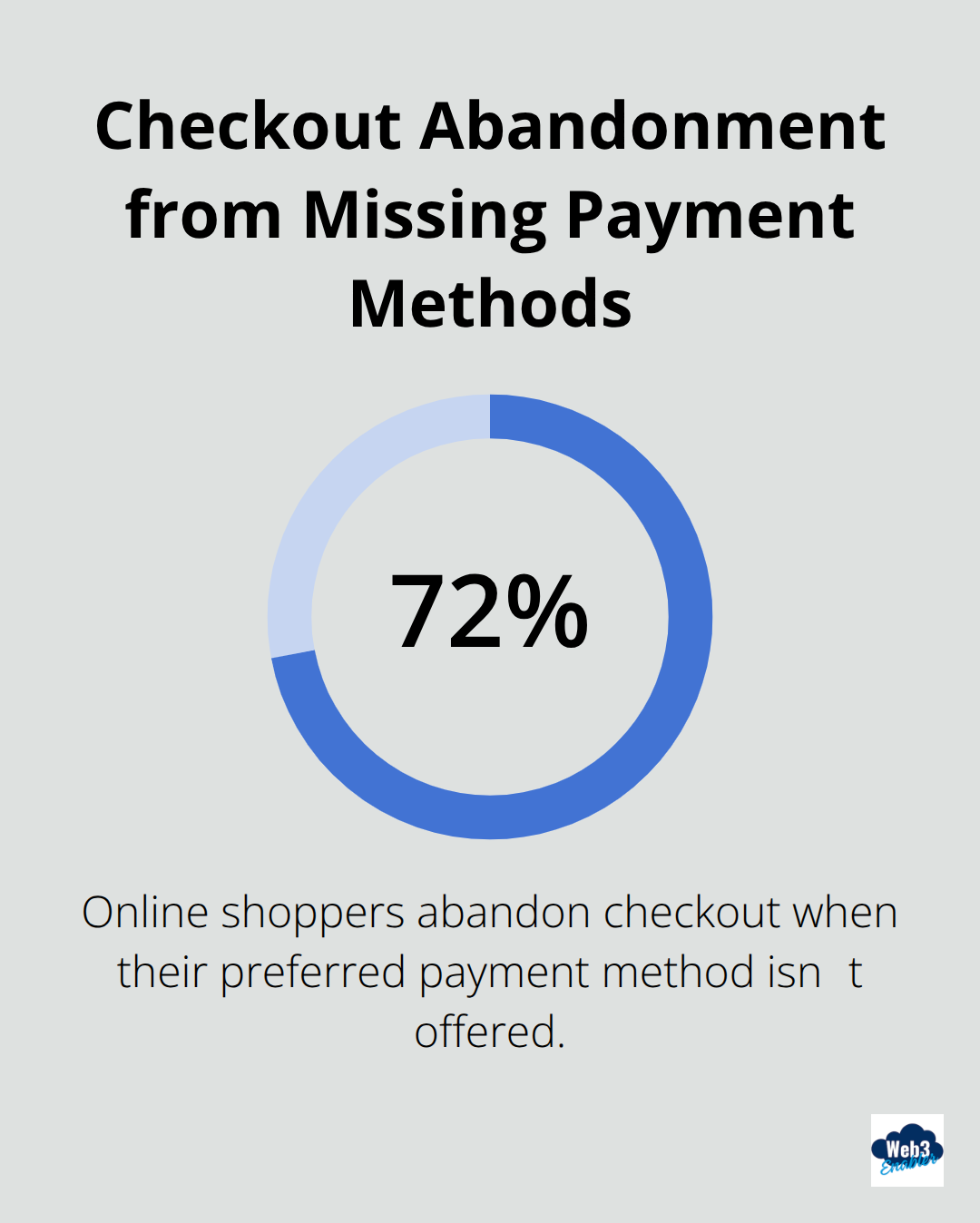

Cross-border payments are where digital payments genuinely change the game. A 2024 study found that 72% of online shoppers abandon checkout if their preferred payment method isn’t available, and that friction multiplies across borders.

Traditional correspondent banking networks require multiple intermediaries, each adding fees and delays. International transfers that should take hours take weeks. Digital payment infrastructure, particularly stablecoin rails, bypasses this entirely. Settlement happens in minutes, not days, and the cost per transaction drops dramatically because you’re not paying multiple banks to shuffle money through their systems. Walmart and Amazon aren’t exploring stablecoins casually-they’re responding to real customer demand. In China, Alipay and WeChat Pay dominate because they solved the friction problem early. In Europe, iDEAL in the Netherlands and Dankort in Denmark coexist with international cards because businesses learned that offering local preferences matters. If your business serves customers across regions, your payment infrastructure must reflect where those customers actually are, not where you want them to be.

The Integration Reality Check

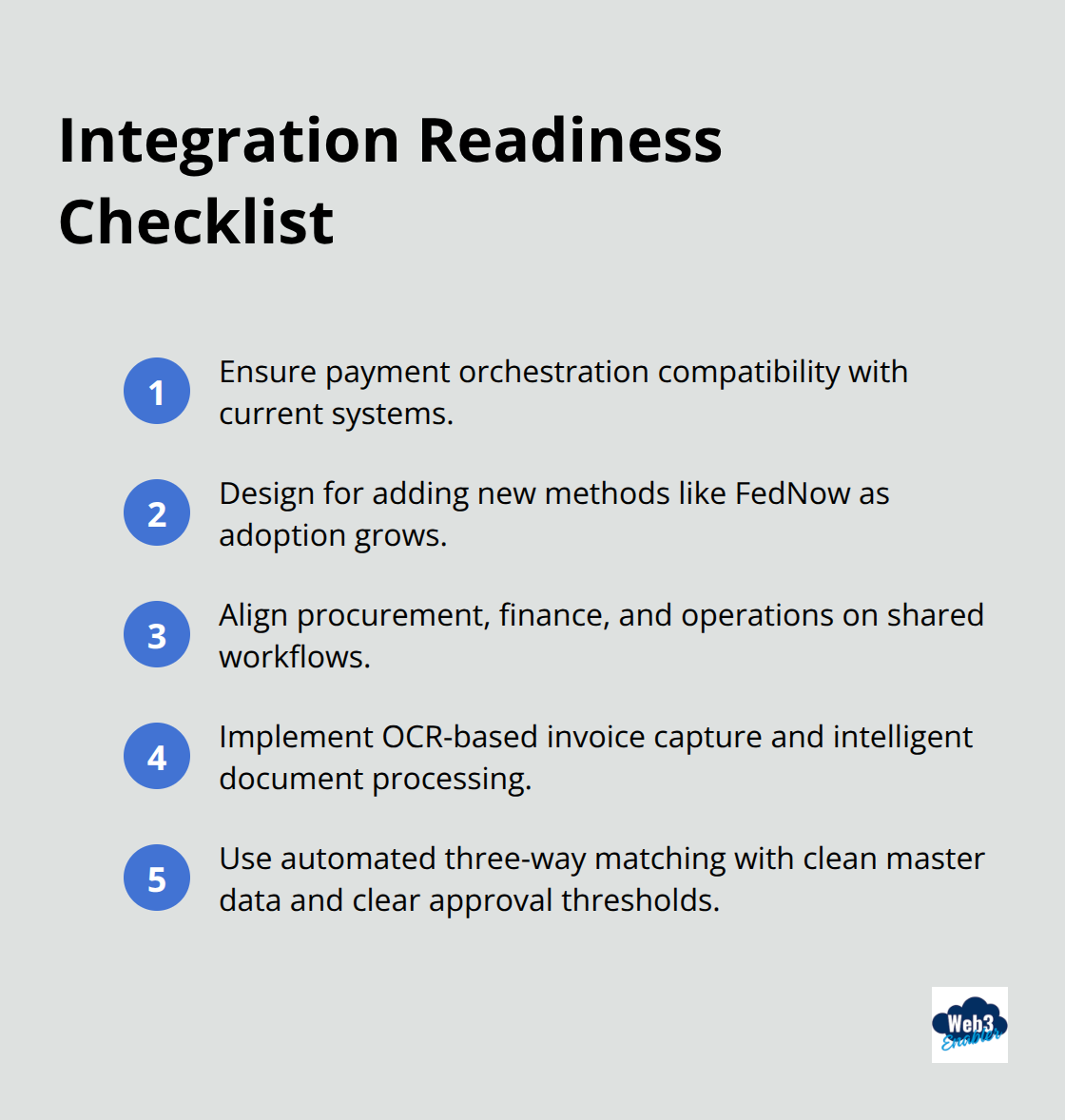

Here’s where most companies get tripped up. You don’t implement digital payments in isolation. Payment orchestration platforms unify multiple payment types, route to multiple acquirers, and improve reliability across systems, but only if your existing infrastructure can actually talk to them. The integration complexity varies wildly depending on whether you’re running modern cloud systems like Salesforce or NetSuite, or wrestling with legacy systems that treat APIs like foreign languages. Real-time payment rails like FedNow launched in 2023, and consumer adoption is still evolving-meaning you need flexibility in your payment stack to add new methods as they gain traction without ripping out your entire system.

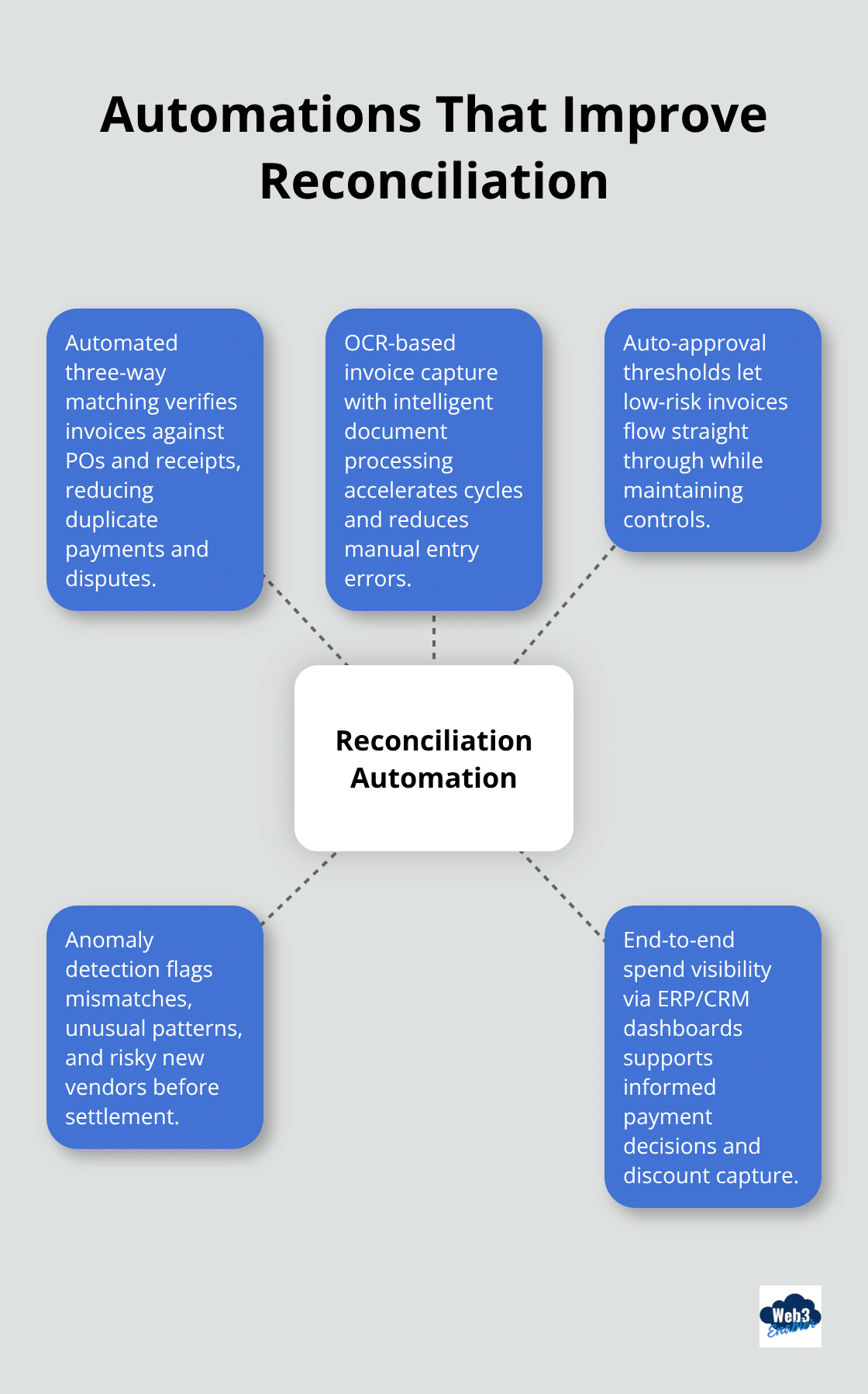

The cost isn’t just technical; it’s organizational. OCR-based invoice capture and intelligent document processing speed up your invoice-to-payment cycles, but only if your procurement, finance, and operations teams align on the new workflows. Automated three-way matching validates payments automatically and lowers duplicate payments, yet it requires clean master data and clear approval thresholds.

Pilots Prove the Path Forward

Start with pilots focusing on high-impact use cases like invoice processing and payment approvals to demonstrate ROI before broader rollout. Most organizations see ROI materialize within three to twelve months, depending on data quality and execution. These early wins build momentum across your organization and reveal integration gaps before you commit to full-scale deployment. The next challenge isn’t technical-it’s building the systems and trust that make digital payments stick.

What Actually Goes Wrong When You Go Digital

Fraud Moves Faster Than Your Defenses

Fraud isn’t theoretical anymore-firms report actual or attempted fraud in recent surveys, according to the Association for Financial Professionals, and the problem intensifies with real-time payment rails. When you move to faster settlement, you lose the buffer that traditional banking provided. A fraudster clears your account in seconds instead of days, which means your fraud detection systems must work faster than your payment processing. Crypto-related schemes are rising, and chargebacks shift from the payment processor to you when settlement becomes final. The cost compounds quickly: you pay for fraud detection tools, liability insurance, and staff time to investigate suspicious transactions. Visa pilots stablecoin settlement for U.S. banks on networks like Solana, which means you need stronger authentication and monitoring before funds move on-chain. Real-time payments also demand that your compliance team flags suspicious activity instantly, not after the fact.

Treat fraud prevention as infrastructure, not an afterthought. Implement multi-signature verification for large transactions, set spending limits by customer type, and use AI-driven anomaly detection to catch patterns humans miss. Your payment platform should flag mismatches between invoice amounts and payment requests automatically-automated three-way matching catches duplicate payments and suspicious activity before settlement happens.

Legacy Systems Block Your Path Forward

Legacy systems are your actual nemesis, not digital payments themselves. Integration complexity varies wildly depending on whether you run modern cloud systems or wrestle with databases designed before APIs existed. The Federal Reserve’s real-time payment infrastructure and stablecoin rails require your finance, procurement, and operations teams to align on workflows that your fifteen-year-old ERP system doesn’t support natively. Regulatory compliance across different markets demands you track payment data, identity information, and transaction history in standardized formats-ISO 20022 migration is underway across payment networks, which means your systems must handle both legacy formats and new standards simultaneously during transition.

Seven state attorney generals have sought BNPL provider data, signaling that state-level regulation is intensifying for earned wage access, wallets, and payment methods beyond traditional cards. The CFPB’s future remains uncertain under shifting federal priorities, which means states will likely fill regulatory gaps, forcing you to maintain compliance frameworks that vary by jurisdiction. Your integration strategy should prioritize modern platforms like Salesforce and NetSuite that handle real-time data synchronization, audit logging, and role-based access controls natively.

Moving From Pilots to Production

Start with pilots on high-impact use cases-invoice processing and payment approvals-to demonstrate ROI within three to twelve months before broader rollout. This reveals integration gaps and builds organizational alignment before full-scale deployment costs escalate. These early wins expose which legacy systems actually block your progress and which teams need retraining on new workflows. Once you identify your biggest friction points, you can tackle them systematically rather than attempting a company-wide overhaul that stalls halfway through. The real challenge ahead isn’t just technical-it’s ensuring your payment infrastructure can adapt as regulations tighten and new settlement methods emerge.

Making Digital Payments Work

Your payment infrastructure isn’t just about moving money faster-it’s about building a system that scales with your business without breaking your existing operations. The right setup means your finance team stops manually reconciling transactions, your customers see instant confirmations, and your compliance department actually sleeps at night.

Map Your Customer Payment Preferences

Start by mapping where your customers are and what they actually use. In North America, cards still dominate, but Apple Pay and ACH transfers are gaining real traction. Europe shows a mosaic of local payment methods-iDEAL in the Netherlands, Dankort in Denmark-alongside international cards. Asia runs on mobile wallets like Alipay and WeChat Pay. Your payment mix should reflect this reality, not some theoretical ideal. Most businesses fail here by assuming one solution works everywhere. Instead, assess your current methods, identify regional gaps, and plan a phased rollout focused on reducing friction.

Choose Infrastructure That Scales

Payment orchestration platforms unify multiple payment types and route transactions to different acquirers, which improves reliability across systems, but only if your infrastructure can actually support them. Salesforce and NetSuite handle real-time data synchronization, audit logging, and role-based access controls natively, making them far superior to legacy systems during integration. If you’re running ancient databases, the integration complexity multiplies because you’ll juggle both legacy formats and new standards simultaneously. ISO 20022 migration is underway across payment networks, which means your systems must handle this transition smoothly or you’ll create compliance gaps.

Build Trust Through Transparency

Transparency directly impacts customer trust and payment completion rates. A 2024 study found that 72% of online shoppers abandon checkout if their preferred payment method isn’t available-that’s not a preference, that’s a dealbreaker. Show customers exactly which payment options you support, display settlement timelines clearly, and explain any fees upfront. When Walmart launched its real-time pay-by-bank option, they didn’t hide it-they advertised it as a faster alternative. Your dashboard should give customers visibility into transaction status in real time, not vague pending messages that vanish after three days.

Automate Reconciliation and Error Detection

Automation transforms reconciliation from a tedious manual process into something that actually catches errors before they become problems. Automated three-way matching validates that invoices match purchase orders and receipts, automatically lowering duplicate payments and disputes. OCR-based invoice capture with intelligent document processing speeds up your invoice-to-payment cycle while reducing manual data-entry errors. Auto-approval thresholds let low-risk suppliers’ invoices pass for payment automatically, maintaining controls while accelerating cycles. Set up anomaly detection to flag suspicious activity before settlement happens-mismatches between invoice amounts and payment requests, unusual transaction patterns, or transactions from new vendors all get caught automatically. Your finance team should spend time on strategy and vendor relationships, not hunting for spreadsheet errors.

End-to-end spend visibility through dashboards tied to your ERP or CRM provides transparency for payment decisions and helps you spot early-payment discount opportunities. Most organizations see ROI materialize within three to twelve months, depending on data quality and execution. The real win isn’t just speed or cost reduction-it’s freeing your team to focus on what actually drives business value instead of chasing transaction receipts.

What’s Next for Digital Payments

Stablecoins move from experimental pilots into real infrastructure right now. Fiserv plans to issue a stablecoin, and major retailers like Walmart and Amazon explore their own stablecoins-this isn’t speculation anymore, it’s happening. The Genius Act gives financial institutions regulatory legitimacy to move stablecoins to fiat and use them for cross-border transfers, which means your payment infrastructure must support this shift sooner than you think.

Compliance tools grow smarter as ISO 20022 migration standardizes how transaction data flows across payment networks, strengthening fraud controls and making real-time risk analytics actually work. Seven state attorney generals already seek BNPL provider data, signaling that state-level oversight will intensify across earned wage access, wallets, and payment methods beyond traditional cards. Your compliance team needs systems that flag suspicious activity instantly, not after settlement happens, because the digital payments pros and cons you face today shift dramatically as real-time payment rails like FedNow expand and adoption accelerates.

Agentic commerce emerges as the next frontier, with AI-powered shopping bots from Amazon, Visa, Google, PayPal, and Stripe publishing protocols for automated buying that could reshape how transactions happen. We at Web3 Enabler help businesses connect blockchain technology with existing corporate infrastructure through Salesforce Native solutions, letting you accept stablecoin payments, send global payments faster and more securely, and maintain compliance visibility without ripping out your existing systems. The businesses winning right now build flexible payment infrastructure today that adapts as settlement methods and regulations evolve.

Digital Payments Pros and Cons: FAQs for Businesses

What are digital payments?

Digital payments are electronic ways to pay and get paid without cash, including cards, ACH, digital wallets, pay-by-bank, real-time payments, and (in some use cases) stablecoins. For businesses, the goal is faster checkout, faster settlement visibility, and cleaner reconciliation than manual or paper-based workflows.

What are the biggest digital payments pros and cons for modern businesses?

The biggest pros are speed, convenience, better cash flow visibility, automation, and easier global reach. The biggest cons are fraud moving faster on real-time rails, integration complexity with legacy systems, and a compliance and reporting landscape that varies by region.

How do digital payments improve settlement speed and cash flow?

Digital payments can shorten the gap between customer confirmation and funds availability, especially when you add real-time rails and better payment routing. In the U.S., networks like FedNow support instant payments and operate outside traditional banking cutoffs, which helps working capital move faster.

What are real-time payments, and how are they different from cards and ACH?

Real-time payments are bank-to-bank transfers that settle within seconds or minutes with immediate confirmation, instead of waiting for batch windows. Cards can confirm instantly for the customer, but merchant funding and settlement can still take longer, and ACH is often batch-based depending on the method used.

How does “pay-by-bank” help reduce fees and checkout friction?

Pay-by-bank lets customers pay directly from their bank accounts, often lowering processing costs compared to card rails and improving approval reliability for certain customers. Large merchants are investing in pay-by-bank options that connect into real-time networks like RTP and FedNow to make bank payments feel instant at checkout.

What goes wrong most often when companies adopt digital payments?

The most common issues are fraud exposure increasing as money moves faster, operational teams not aligning on new workflows, and integrations breaking when systems cannot share clean data. Many rollouts fail because the payment layer is implemented without updating reconciliation, approvals, and reporting processes.

Is fraud worse with real-time payments?

Fraud risk changes because real-time settlement removes the delay buffer that sometimes helped catch suspicious activity before funds moved. That is why businesses typically add stronger authentication, tighter limits, and real-time monitoring when they expand into instant payment methods.

How do you reduce fraud without hurting approval rates?

Use layered controls: risk-based authentication, device and behavior signals, velocity limits, and step-up verification for higher-risk transactions. Also track false declines and tune rules by customer segment, because overly aggressive fraud filters can reduce authorization rates and lower revenue.

Why is integration the hardest part of digital payments?

Digital payments touch everything: checkout, billing, ERP, accounting, refunds, disputes, and reporting. If your stack is fragmented, you end up reconciling across portals and spreadsheets, which increases cost and errors instead of reducing them.

What is payment orchestration, and when does it make sense?

Payment orchestration is a layer that routes transactions across multiple providers, adds redundancy, and helps you optimize approvals and costs by geography or method. It makes sense when you sell across regions, need multiple payment methods, or want failover so one processor outage does not break revenue.

How does ISO 20022 affect digital payments and compliance?

ISO 20022 is a global messaging standard that upgrades payment data quality, which improves reconciliation and compliance reporting. As networks migrate, businesses and financial institutions need systems that can handle richer data fields and avoid data loss during format conversions.

What are the pros and cons of adding stablecoin payments?

The pros are faster cross-border settlement, 24/7 movement of value, and fewer intermediary steps for specific corridors. The cons include added operational complexity, partner and custody risk, and the need to design compliance, reporting, and treasury controls appropriately for your jurisdiction.

What is the best way to roll out digital payments without disruption?

Start with a pilot tied to a measurable problem, like reducing checkout abandonment, cutting reconciliation hours, or speeding up cross-border vendor payouts. Track metrics for 30 to 90 days, document results, then scale to additional payment flows once you have proven ROI and resolved integration gaps.

What is next for digital payments in 2026?

Real-time bank payments are expanding, stablecoin infrastructure is becoming more enterprise-friendly, and “agentic commerce” is emerging where AI agents can complete purchases with controlled permissions. Businesses that win will build flexible payment infrastructure now so they can add new rails and standards without rebuilding everything.