Your business probably loses money every day to slow payments and outdated banking infrastructure. A digital payments network changes that equation entirely-faster settlements, lower fees, and zero geographic friction.

We at Web3 Enabler have watched companies transform their cash flow by moving away from traditional payment systems. This guide walks you through exactly how to make that shift work for your business.

Why Digital Payments Matter Right Now

The Speed and Cost Problem Nobody Talks About

Traditional banking moves at a glacial pace, and that costs you real money. When you send a cross-border payment through a bank, you’re looking at 3-5 business days for settlement, multiple intermediaries taking cuts, and zero visibility into where your money actually is. Global digital payment volumes hit £18.6 trillion in 2025 according to The Payments Trends Report, and that momentum exists because companies are finally fed up with this nonsense. Digital payment networks compress what used to take days into minutes or seconds, which means your cash flow improves immediately and your teams stop chasing payment statuses.

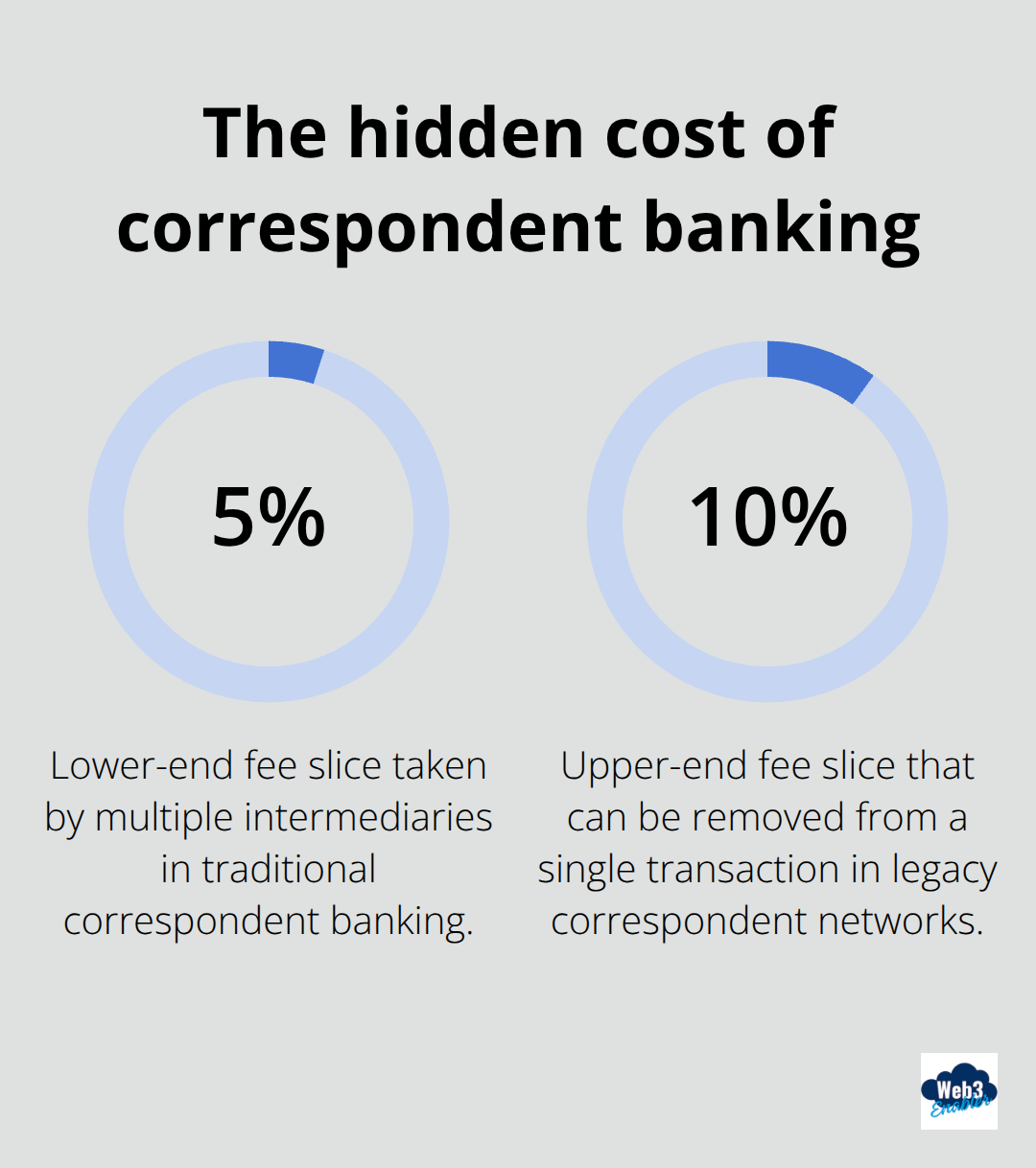

The cost difference is staggering. Traditional correspondent banking can eat 5-10% of transaction value in fees across multiple intermediaries, while blockchain-based settlement cuts that dramatically because you remove middlemen entirely. Real-time payment systems now operate in over 70 countries, and businesses aren’t adopting them out of curiosity-they’re doing it because the working capital improvement is measurable and immediate.

Real-World Impact on Your Operations

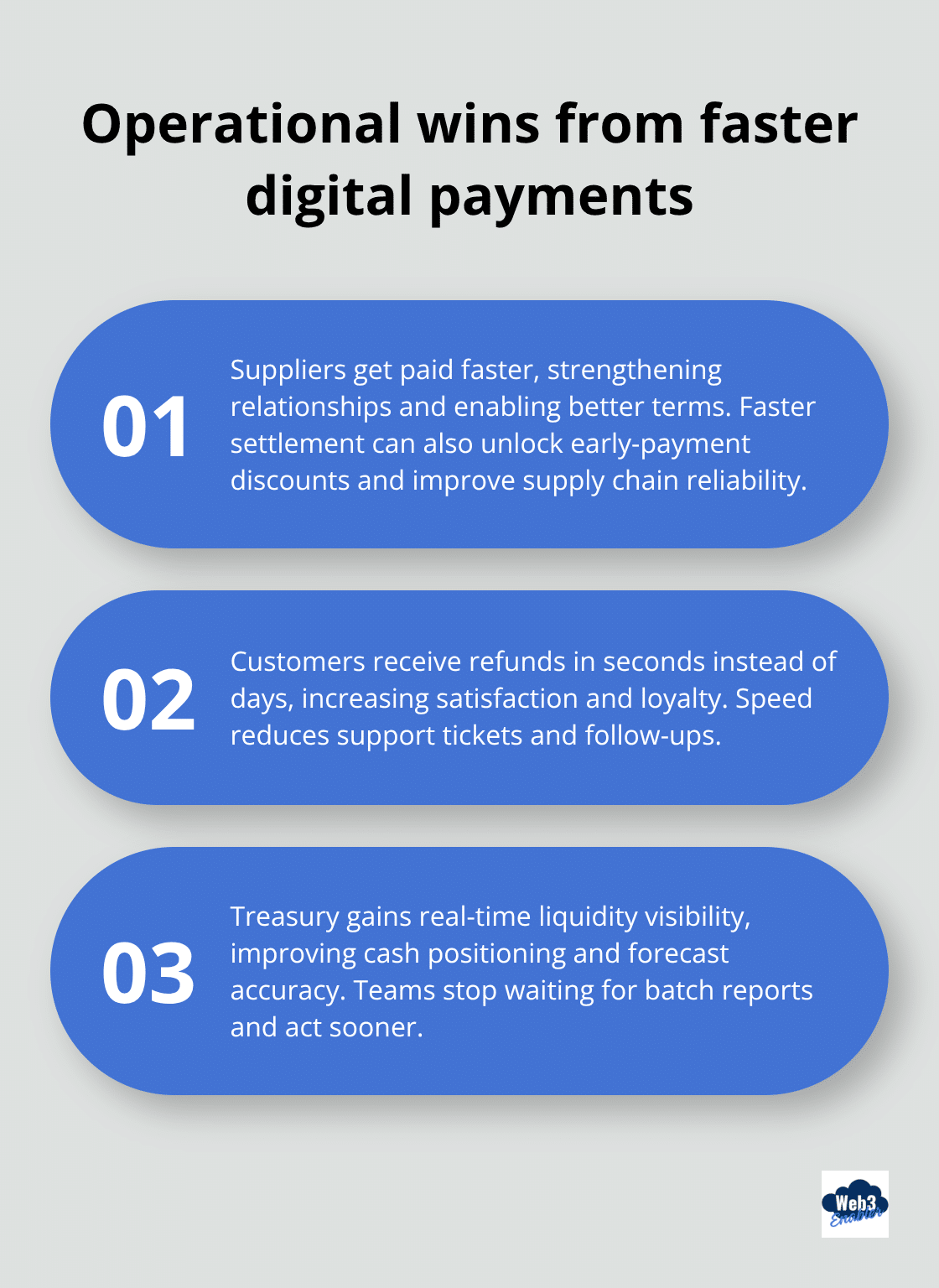

Your suppliers get paid faster, which strengthens relationships. Your customers experience refunds in seconds instead of days, which improves satisfaction. Your treasury team gains visibility into liquidity in real time rather than waiting for batch reports.

These aren’t theoretical benefits; they translate directly into operational efficiency and competitive advantage.

Fraud Prevention Through Immutability

The fraud risk reduction is equally compelling. Traditional payments are reversible, which creates incentives for fraud and chargebacks that cost merchants billions annually. Digital payment networks use cryptographic verification and immutable transaction records, which means fraud becomes exponentially harder to execute and trivial to audit.

When a transaction settles on-chain, it’s final and traceable-no disputes, no reversals, no ambiguity. Compliance becomes easier too because every transaction leaves a timestamped record that auditors can verify instantly.

Breaking Geographic Barriers

If you’re operating globally, the geographic limitations vanish entirely. A stablecoin payment settles the same way whether you’re paying someone in Singapore or São Paulo, 24/7/365, without currency conversion delays or restrictive banking hours. Cross-border payment volumes are forecast to exceed $180 trillion by 2027, and that growth reflects businesses recognizing that digital rails eliminate the friction that made international commerce painful.

Understanding how these networks actually function-and which solution fits your infrastructure-requires looking at the mechanics under the hood.

How Digital Payment Networks Actually Work

Blockchain and distributed ledgers solve a specific problem that traditional banking creates: the need for a trusted third party to verify and record every transaction. On a digital payment network, thousands of independent computers (called nodes) each maintain an identical copy of the transaction ledger, which means no single bank or institution controls the record. When you initiate a payment, the network validators confirm it’s legitimate, add it to a block of transactions, and settle it permanently on the ledger in minutes or seconds. Ethereum has over 36 million ETH staked by validators as of December 2025, which illustrates how distributed these systems have become.

The Payment Flow: From Wallet to Settlement

The payment flow itself is remarkably straightforward. You send funds from a digital wallet, the network broadcasts your transaction to validators, those validators check that you actually own the funds and haven’t already spent them elsewhere, the transaction gets bundled into a block, and settlement finalizes on the ledger with cryptographic certainty. Stablecoins dominate this process because they peg their value to fiat currency like USD or EUR, eliminating the volatility that makes traditional cryptocurrencies impractical for business payments. Visa already pilots stablecoin settlement for U.S. banks using USDC on Solana, which demonstrates that major financial institutions recognize this infrastructure works at scale.

Cryptographic Verification Replaces Institutional Trust

Security on digital payment networks operates through cryptographic verification rather than institutional trust. Every transaction receives mathematical verification before recording, and once recorded, altering it would require recalculating every subsequent block across the majority of the network simultaneously, which is economically impossible. Immutable transaction records mean compliance becomes radically simpler because auditors verify every payment’s exact timing, amount, and parties involved with perfect accuracy. Blockchain technology removes single points of failure that traditional payment networks face and reduces system-wide risks.

Irreversibility and Smart Verification

Your business gains irreversible settlement finality, which eliminates the chargeback fraud that costs traditional payment processors billions annually. The tradeoff is that you need to verify recipient addresses before sending, since blockchain transactions cannot be reversed. Smart contract escrow and address verification tools handle this practically, ensuring funds move only when conditions are actually met. Compliance frameworks now separate settlement verification from transaction monitoring, which means you can settle instantly while still meeting regulatory Travel Rule requirements and anti-money laundering standards.

Fiat Connectivity Without Crypto Holdings

Platforms offering fiat on-ramp and off-ramp coverage handle the conversion between blockchain-native assets and your bank account, meaning your treasury never holds cryptocurrency on the balance sheet. This separation between settlement rails and asset custody is what makes digital payment networks practical for traditional businesses. The next step is evaluating which solution actually fits your infrastructure and operational needs.

Choosing the Right Digital Payment Solution for Your Business

Integration Without Rebuilding Your Tech Stack

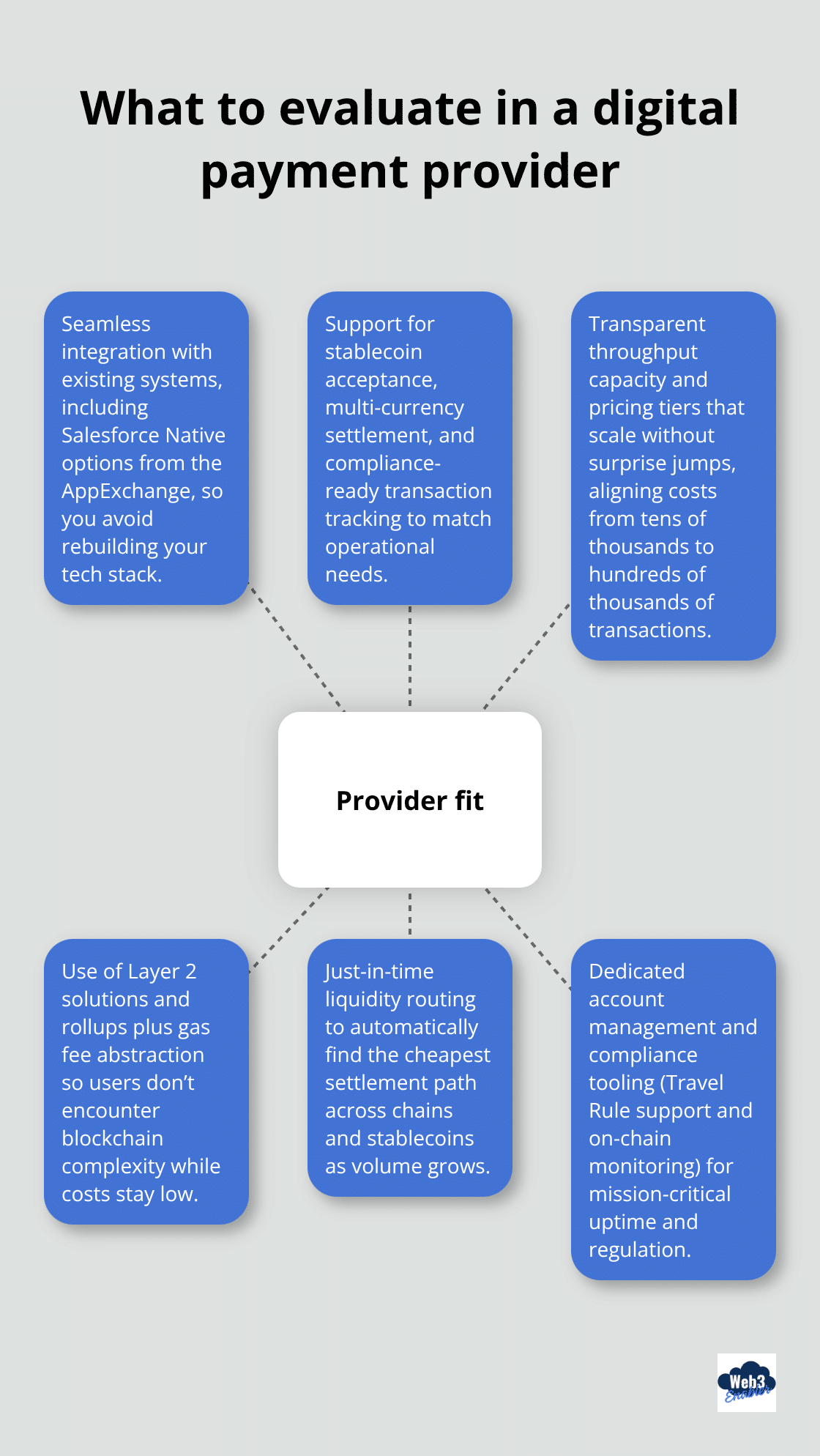

Integration complexity kills most digital payment implementations before they even start. Your existing systems-accounting software, ERP, customer databases-need to connect seamlessly to a new payment network, and most solutions force you to choose between native integration and expensive custom development. The right partner handles this friction directly. We at Web3 Enabler build 100% Salesforce Native solutions available on the Salesforce AppExchange, which means if your business runs on Salesforce, integration happens without rebuilding your entire tech stack. This matters because The Payments Trends Report 2025 found that successful payment implementations prioritize measurable ROI and operational efficiency, not just adopting the latest technology. Your payment partner should support stablecoin acceptance, multi-currency settlement, and compliance-ready transaction tracking without forcing your team to become blockchain experts. Evaluate whether the provider offers branded checkout experiences, secure wallet infrastructure, and real-time reconciliation with your existing ledgers. Ask specifically about API documentation, sandbox environments for testing, and whether they handle gas fee abstraction so your end users never see blockchain complexity. If a provider requires you to learn new systems or operate outside your current infrastructure, move on.

Scalability That Grows With Your Volume

Scalability and cost structure determine whether a digital payment solution remains viable as your transaction volume increases. Visa processes approximately 1,700 transactions per second, which sets the speed benchmark that modern payment rails must approach. Real-time payment systems now operate in over 70 countries, and businesses adopting them report measurable improvements in working capital and supplier relationships.

When evaluating providers, request their actual transaction throughput capacity and pricing tiers at different volumes-what costs 0.5% at 10,000 monthly transactions should not jump to 2% at 100,000 transactions. Layer 2 solutions and rollups reduce per-transaction costs significantly by bundling multiple payments before settling on-chain, which becomes critical when your business scales. Ask whether the provider supports just-in-time liquidity routing, which automatically finds the cheapest settlement path across multiple blockchains and stablecoin options.

Support Quality Matters More Than You Think

Compare support quality directly: does the provider offer dedicated account management, or do you get a support ticket queue? For mission-critical payment infrastructure, dedicated support is not optional. Request references from businesses operating at your intended scale and verify they actually handle your transaction volume and geographic complexity. The provider should also offer compliance tooling, including Travel Rule support and on-chain transaction monitoring, because regulatory requirements only tighten as payment volumes increase.

Final Thoughts

Digital payment networks fundamentally transform how money moves through your business. You eliminate days of settlement delays, cut intermediary fees that drain your margins, and gain real-time visibility into cash flow across geographies. The immutable transaction records simplify compliance, fraud becomes exponentially harder to execute, and your teams stop wasting time chasing payment statuses through outdated banking channels.

Implementation requires three practical steps: audit your current payment infrastructure and identify where delays or costs hurt most (cross-border payments, supplier settlements, or customer refunds typically show the fastest ROI), select a provider that integrates seamlessly with your existing systems rather than forcing a complete rebuild, and start with a pilot program on lower-volume transactions to validate the workflow before scaling to mission-critical payments. We at Web3 Enabler build Salesforce Native solutions that connect blockchain infrastructure directly to your current tech stack without disruption. The payment landscape accelerates in 2026 as stablecoins move from experimental to operational, regulatory frameworks clarify how digital assets settle within compliance requirements, and AI-driven fraud detection becomes standard rather than optional.

Your competitive advantage depends on moving faster than competitors still trapped in traditional banking timelines. The infrastructure exists now, and the regulatory clarity improves monthly. Web3 Enabler specializes in connecting blockchain technology with your existing corporate infrastructure, handling the integration complexity so your team focuses on business outcomes rather than technical implementation details.

Frequently Asked Questions

Digital Payments Network: Complete Guide

What is a digital payments network?

A digital payments network is a system that moves money electronically using modern payment rails such as real-time payment networks and blockchain-based settlement. These networks reduce delays, lower fees, and improve visibility compared to traditional banking methods.

Why do businesses switch from traditional banking to digital payment networks?

Businesses switch because traditional payments can take 3 to 5 business days, include multiple intermediaries, and provide limited tracking. Digital payment networks can settle in minutes or seconds, reduce intermediary costs, and provide real-time visibility into payment status.

How do digital payment networks reduce payment costs?

Traditional correspondent banking can consume meaningful fees across intermediaries. Digital payment networks reduce these costs by cutting out middlemen and using more direct settlement rails, including blockchain-based settlement and real-time payment systems.

How do digital payment networks improve cash flow?

Faster settlement means money reaches suppliers, customers, and internal accounts sooner. This improves working capital, reduces time spent waiting on funds, and gives finance teams better control over liquidity.

Do digital payment networks help reduce fraud and chargebacks?

Yes. Many digital payment networks use cryptographic verification and immutable transaction records. When a transaction settles on-chain, it becomes final and traceable, reducing chargeback risk and making fraud easier to detect and audit.

How do blockchain-based payment networks actually work?

Blockchain payment networks use distributed ledgers maintained by independent nodes. Validators confirm transactions, record them in blocks, and settle them permanently on the ledger. This removes the need for a single institution to control and verify payments.

What is the payment flow from a wallet to settlement?

The sender initiates a payment from a digital wallet, the network broadcasts the transaction to validators, validators confirm ownership and validity, the transaction is included in a block, and settlement finalizes with cryptographic certainty once confirmed.

Why are stablecoins commonly used on digital payment networks?

Stablecoins are pegged to fiat currencies like USD or EUR, which makes them practical for business payments. They provide the speed of blockchain settlement without the price volatility of traditional cryptocurrencies.

Are blockchain transactions reversible?

No. Once confirmed, blockchain transactions are typically final. This reduces disputes and chargebacks, but it also means recipient addresses must be verified before sending. Many solutions use address verification tools or smart contract escrow to reduce error risk.

Do businesses need to hold cryptocurrency on their balance sheet to use blockchain payments?

Not necessarily. Many solutions support fiat on-ramps and off-ramps so businesses can settle on blockchain rails while converting to and from bank accounts. This allows treasury teams to avoid holding crypto directly.

How do businesses choose the right digital payment solution?

Businesses should look for solutions that integrate with existing systems, support compliance requirements, provide real-time reconciliation, and scale cost-effectively with transaction volume. Strong documentation, testing environments, and reliable support also matter.

Can digital payment networks integrate with Salesforce?

Yes. Web3 Enabler builds 100% Salesforce-native solutions available on the Salesforce AppExchange, helping businesses integrate stablecoin payments, multi-currency settlement, and compliance-ready tracking without rebuilding their tech stack.

What should businesses prioritize when implementing a digital payment network?

Start by identifying where delays and fees hurt most, such as cross-border payments, supplier settlements, or refunds. Then pilot a solution that integrates with your existing infrastructure and expand once workflows are validated.