Your payment system is probably costing you more than it should. Slow transactions, hidden fees, and manual processes drain both time and money from your bottom line.

At Web3 Enabler, we’ve seen firsthand how the advantages of digital payments transform businesses. Modern payment solutions cut through the friction, slash costs, and open doors to global markets you couldn’t reach before.

Why Digital Payments Matter Right Now

Speed Transforms Cash Flow

Speed transforms everything. When McKinsey surveyed shoppers in 2024, nearly 63% of organizations using generative AI report revenue uplift within deployed business units-not because they wanted to be trendy, but because digital payments are faster and more convenient. Traditional banking moves at a glacial pace. A cross-border wire transfer takes days, involves multiple intermediaries, and charges fees at every handoff. Digital payments settle in minutes. That’s not just nice to have; it’s the difference between cash flow that funds growth and cash flow that funds frustration.

Settlement on blockchain rails happens 24/7, 365 days a year, which means your money moves while your competitors are still waiting for Monday morning. For businesses managing global operations, this speed advantage compounds fast. You don’t just save hours per transaction-you reclaim working capital that traditional systems lock away for days.

Cost Reduction Through Elimination

The cost argument is equally brutal. Merchant processing fees through traditional card networks run anywhere from 2 to 3 percent per transaction, plus gateway fees, plus settlement delays that force you to carry working capital reserves. Blockchain payments cut through that stack of intermediaries. When you remove correspondent banks and foreign-exchange corridors from the equation, costs drop measurably.

Automation amplifies the savings. Subscription billing platforms handle recurring payments without manual intervention, reducing administrative overhead and human error. Every disconnected system costs you time and money, so integration matters. Tools that connect directly to your existing infrastructure-rather than forcing you to bolt on a separate system-keep payments where your business already lives.

Global Reach Without Friction

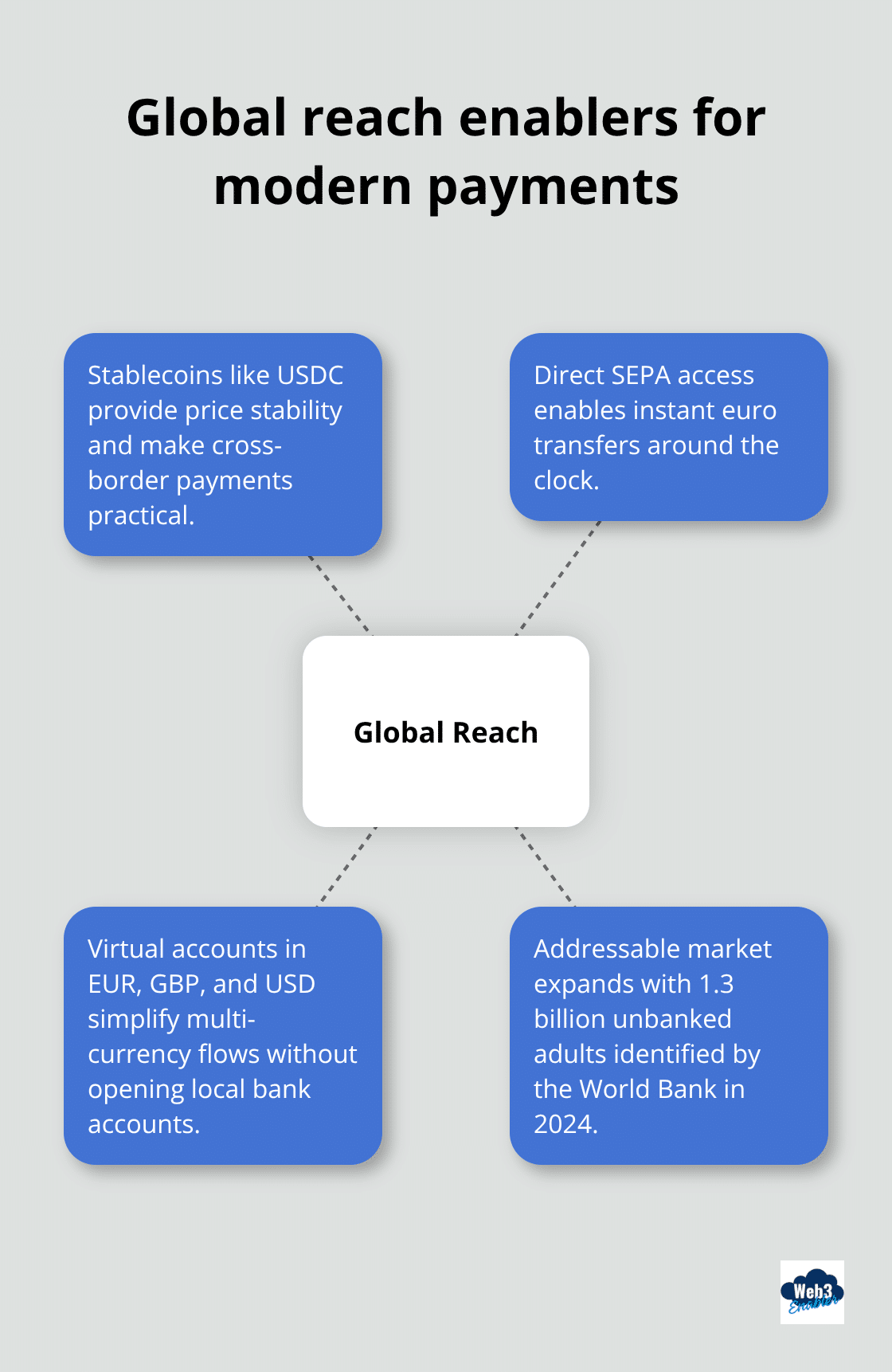

Global reach without friction is the third pillar. The World Bank identified 1.3 billion unbanked adults as of 2024. That’s not just a social issue; it’s a market you can’t access with traditional payment rails.

Stablecoins like USDC provide price stability without volatility, making cross-border payments practical. Direct SEPA access enables 24/7 instant euro payments. Virtual accounts in EUR, GBP, and USD let you manage multi-currency flows without opening accounts in every country.

These aren’t theoretical advantages-they’re operational capabilities that expand your addressable market immediately. Your next customer might live anywhere, and your payment system should reflect that reality. The infrastructure exists to make it happen, which means the real question isn’t whether you can reach global markets. It’s whether you will.

Security, Compliance, and Customer Trust

Fraud Prevention Through Immutable Records

Customers don’t care about your security measures until something goes wrong. Then they care very much. Illicit activity still represents less than 1% of all attributed crypto transaction volume, which means the problem isn’t digital payments themselves-it’s how you implement them. When you move to digital payments, you actually reduce fraud risk compared to traditional card networks. Every transaction gets timestamped, traced, and locked into an immutable record. That permanent audit trail makes tampering impossible.

Fraudsters targeting traditional systems exploit gaps between institutions and processing delays; blockchain payments eliminate those gaps entirely. The network verifies every transaction through consensus, meaning no single point of failure exists. One compromised server doesn’t tank your security. That’s not theoretical-it’s why enterprise-grade platforms exist specifically to handle this complexity for you.

Building Security Into Your Infrastructure

PCI DSS compliance becomes straightforward because the infrastructure itself is built for it. Tokenization, encryption, and two-factor authentication aren’t afterthoughts; they’re foundational. Your payment security sits inside systems your team already trusts and audits daily, not bolted onto some separate vendor’s black box.

Regulatory requirements sound terrifying until you realize that blockchain actually simplifies compliance. AML and KYC screening aren’t optional-they’re built into the platforms handling these transactions. Your transaction history becomes instantly auditable for regulators; no scrambling through bank statements or reconstructing records months later.

Transparency That Regulators and Customers Demand

IBM’s Food Trust demonstrated how blockchain-enabled traceability transformed supply-chain oversight, and that same principle applies to payments. Every transaction is verifiable, timestamped, and accessible to authorized parties. The immutable ledger means you can prove exactly what happened, when it happened, and who authorized it. That matters for audits, regulatory filings, and dispute resolution.

Customers increasingly expect this transparency too-92% of shoppers used digital payment methods in the last year according to McKinsey’s 2024 research, and they’re choosing businesses that demonstrate security and clarity. When you accept stablecoin payments like USDC, you’re not adding compliance burden; you’re reducing it. The same regulatory framework that governs traditional payments applies, but with better documentation built in.

Moving From Pilot to Scale

Start with a controlled pilot using reputable platforms to track processing speed, cost per transaction, and error rates. Once you’ve proven the model works in your environment, you’ll have the confidence to scale. The data from your pilot becomes your roadmap for full deployment, showing exactly where digital payments deliver the most value for your specific operations.

Digital Payments That Integrate With Your Business

Connect Payments to Systems You Already Use

Your payment system shouldn’t force a complete infrastructure rebuild. The integration question matters more than the technology itself, because a brilliant system that doesn’t connect to your existing tools becomes expensive friction. When your payment system lives where your customer data already lives, reconciliation happens automatically and visibility becomes instant. Your finance team stops chasing spreadsheets across three different vendors and starts actually knowing what’s happening in real time.

Enterprise-grade platforms recognize this reality. They speak your language-literally. Your gateway needs to support the payment methods your customers actually use, which means stablecoins like USDC for international transactions, traditional card processing for domestic ones, and whatever else your specific market demands. A native blockchain solution means your payment data flows directly into your existing systems without manual exports or data entry errors. You’re not choosing between integration and compliance; you’re getting both because the system was built for enterprise operations from the start.

Real-Time Settlement Keeps Cash Moving

Real-time settlement and visibility separate businesses that thrive from those that merely survive. When you accept stablecoin payments for cross-border transactions, settlement happens in minutes instead of days, which means your working capital stays in motion instead of trapped in processing queues. Virtual accounts in EUR, GBP, and USD let you accept payments in multiple currencies without maintaining separate banking relationships in each country-a massive operational simplification for companies with global customers.

The visibility piece is equally critical: you need to see transaction status, conversion rates, and settlement timing within your existing business systems, not buried in a separate portal you check occasionally. Most digital payment solutions fail here. They deliver the transaction but leave you blind to what actually happened. Merchants converting between crypto and fiat need price certainty during the transaction window so they’re not exposed to volatility between payment authorization and settlement. On-platform conversion tools handle this automatically, locking FX and crypto pricing the moment your customer commits to the purchase. That certainty eliminates the guesswork that makes finance teams nervous about blockchain payments.

Start Small, Scale With Data

Try one payment method first-stablecoin acceptance for your highest-value international customers makes sense because it delivers the biggest speed and cost advantage immediately. Track your processing speed, conversion rates, and settlement costs for 30 days. That data tells you whether to expand or adjust your approach.

Final Thoughts

The advantages of digital payments aren’t coming someday-they’re here now, and your competitors are already moving. Speed, cost savings, and global reach aren’t nice-to-have features anymore; they’re baseline expectations for businesses that want to stay competitive. You’ve seen the numbers: 92% of shoppers used digital payments last year, settlement happens in minutes instead of days, and fraud drops when transactions become immutable.

The real question isn’t whether digital payments work. It’s whether you’ll implement them before your market forces your hand. Start small with one use case-maybe cross-border payments for your highest-value customers-and measure what actually happens. Processing speed, conversion rates, settlement costs. Let the data guide your next move, and you’ll understand exactly where the advantages of digital payments matter most for your operation.

We at Web3 Enabler built tools specifically for this moment, connecting blockchain technology directly to your existing infrastructure so you don’t rebuild your entire operation. Explore how we help businesses implement digital payments without the complexity, and start moving your payment system forward today.

Frequently Asked Questions: Advantages of Digital Payments for Modern Businesses

What are digital payments?

Digital payments are any electronic payment methods that move money without cash, including card payments, ACH, digital wallets (like Apple Pay and Google Pay), bank transfers, and newer rails like real-time payments and stablecoin settlement. For businesses, the advantage is faster checkout, better reporting, and smoother reconciliation compared to manual or paper-based processes.

What are the biggest advantages of digital payments for businesses?

The biggest advantages are faster settlement (better cash flow), lower operational overhead (less manual reconciliation), improved customer experience (higher conversion), and easier global reach (accept payments across borders and currencies). Businesses also gain stronger reporting and clearer audit trails, which supports finance teams and compliance workflows.

How do digital payments improve cash flow?

Digital payments can reduce the time between “customer paid” and “funds usable.” Traditional cross-border payments often take one to five business days, while modern rails can confirm faster and provide real-time status visibility. Faster access to funds improves working capital and helps businesses reinvest sooner.

Do digital payments lower transaction costs?

They can. Traditional card processing commonly totals around 2% to 3% per transaction once interchange, network assessments, and processor markups are included. Digital payment strategies can reduce total cost by optimizing routing, adding lower-cost methods where customers will use them, and limiting expensive cross-border intermediaries for international flows.

How do digital payments reduce manual work and reconciliation?

Modern payment systems can sync payment status, settlement timing, and transaction metadata into the tools your team already uses. That reduces spreadsheet reconciliation, shortens month-end close, and helps finance teams spot errors, refunds, and fee anomalies faster.

How do digital payments help businesses expand globally?

Digital payments make it easier to sell internationally by supporting local payment preferences, multiple currencies, and faster settlement. They also help businesses reach customers who are underbanked or unbanked, which is still a large global population according to World Bank Global Findex reporting.

Are digital payments more secure than legacy systems?

They can be, especially when paired with tokenization, encryption, device-based authentication, and strong monitoring. Wallet payments often reduce exposure of raw card data, and modern platforms typically provide better fraud tooling and logging than disconnected legacy workflows. Security still depends on implementation, controls, and partner selection.

Do businesses still need PCI DSS compliance if they use digital payments?

Yes. PCI DSS applies to entities involved in payment card processing, especially those that store, process, or transmit cardholder data, or can impact the security of the cardholder data environment. The goal in many modern setups is to reduce PCI scope by outsourcing sensitive handling to compliant providers and using tokenization.

How do blockchain and stablecoin payments fit into the advantages of digital payments?

Stablecoins can add advantages for specific use cases, especially cross-border settlement speed, reduced intermediary friction, and 24/7 movement of value. They are usually best used selectively, for example for international supplier payouts or specific customer segments, rather than replacing your entire payment stack.

What does “real-time settlement” mean, and where does it exist today?

Real-time settlement means funds are made available to the recipient almost immediately, often within seconds. In Europe, SEPA Instant Credit Transfer is designed for near-instant euro transfers and runs 24/7/365 under the scheme rules, which supports always-on commerce and treasury operations.

How should a business start adopting digital payments without disrupting operations?

Start with one high-impact improvement, like adding digital wallets to reduce checkout friction or improving routing to raise authorization rates. Then pilot a second method for a specific problem, such as faster cross-border settlement for key corridors. Track metrics like conversion rate, cost per transaction, settlement time, chargebacks, and reconciliation hours, then scale what proves ROI.

What’s the difference between digital payments and “crypto payments”?

Digital payments is the broader category that includes cards, ACH, wallets, and real-time bank rails. Crypto payments usually refer to paying with cryptocurrencies or stablecoins on blockchain rails. Many businesses that add stablecoins do it for settlement efficiency while still presenting a familiar “pay with card or wallet” experience to customers.