Payment immutability is reshaping how businesses handle financial records. Traditional payment systems leave companies vulnerable to data manipulation and costly audit processes.

We at Web3 Enabler see blockchain technology changing this landscape completely. Permanent, tamper-proof transaction records are becoming the new standard for forward-thinking organizations.

How Immutable Payment Records Work

Think your current payment system is secure? Think again. Traditional databases allow alterations, deletions, or corruption without leaving a trace. Blockchain technology flips this vulnerability on its head and creates an unbreakable chain of transaction records.

Blockchain Technology Creates Permanent Transaction History

Each transaction links to the previous one through cryptographic connections that form an unalterable chain. Once the network validates a payment, it becomes part of a permanent historical record that spans back to the very first transaction. This chain structure means you cannot modify past records without breaking the entire sequence – making fraud attempts immediately visible to all network participants.

Cryptographic Hashing Prevents Data Tampering

Every transaction receives a unique digital fingerprint through cryptographic hashing that changes completely if someone modifies even one character. JPMorgan processes over $1 billion in daily transactions through their JPM Coin system, with each payment creating mathematical proof that cannot be forged. When tampering occurs, the hash breaks and immediately alerts the system to unauthorized changes (making retroactive fraud virtually impossible).

Distributed Ledger Eliminates Single Points of Failure

Multiple nodes store identical copies of all transaction records across the network, which makes system failures nearly impossible. The distributed ledger ensures transparency and consensus-based updates by functioning as a shared ledger that is duplicated across several nodes. Ripple’s network processes over 1,500 transactions per second across hundreds of validators worldwide. If one node fails, hundreds of others maintain the complete transaction history. This redundancy protects your payment records from natural disasters, cyber attacks, and hardware failures that devastate traditional centralized systems.

These technical foundations create the backbone for transformative business benefits that extend far beyond simple record-keeping.

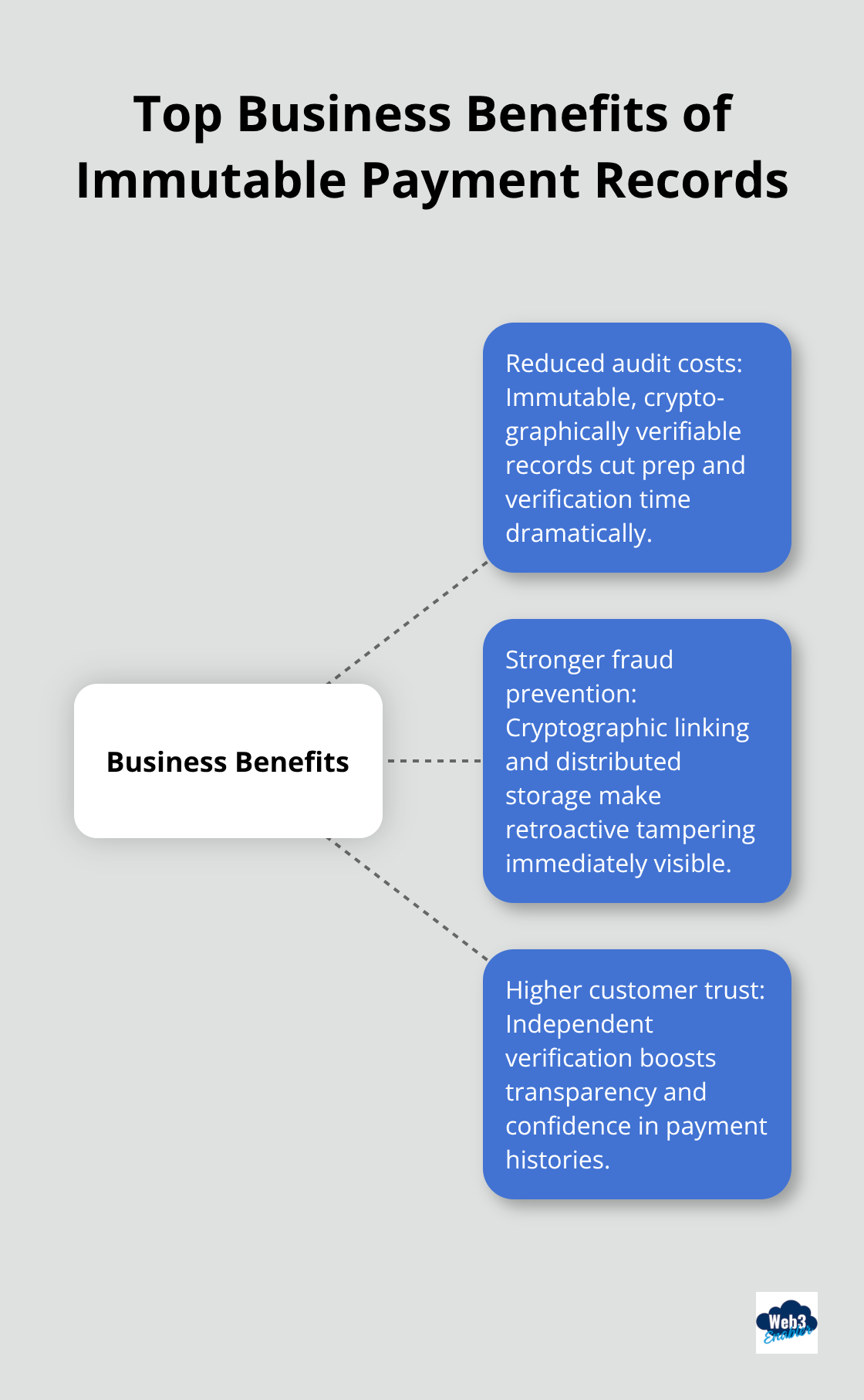

Business Benefits of Immutable Payment Records

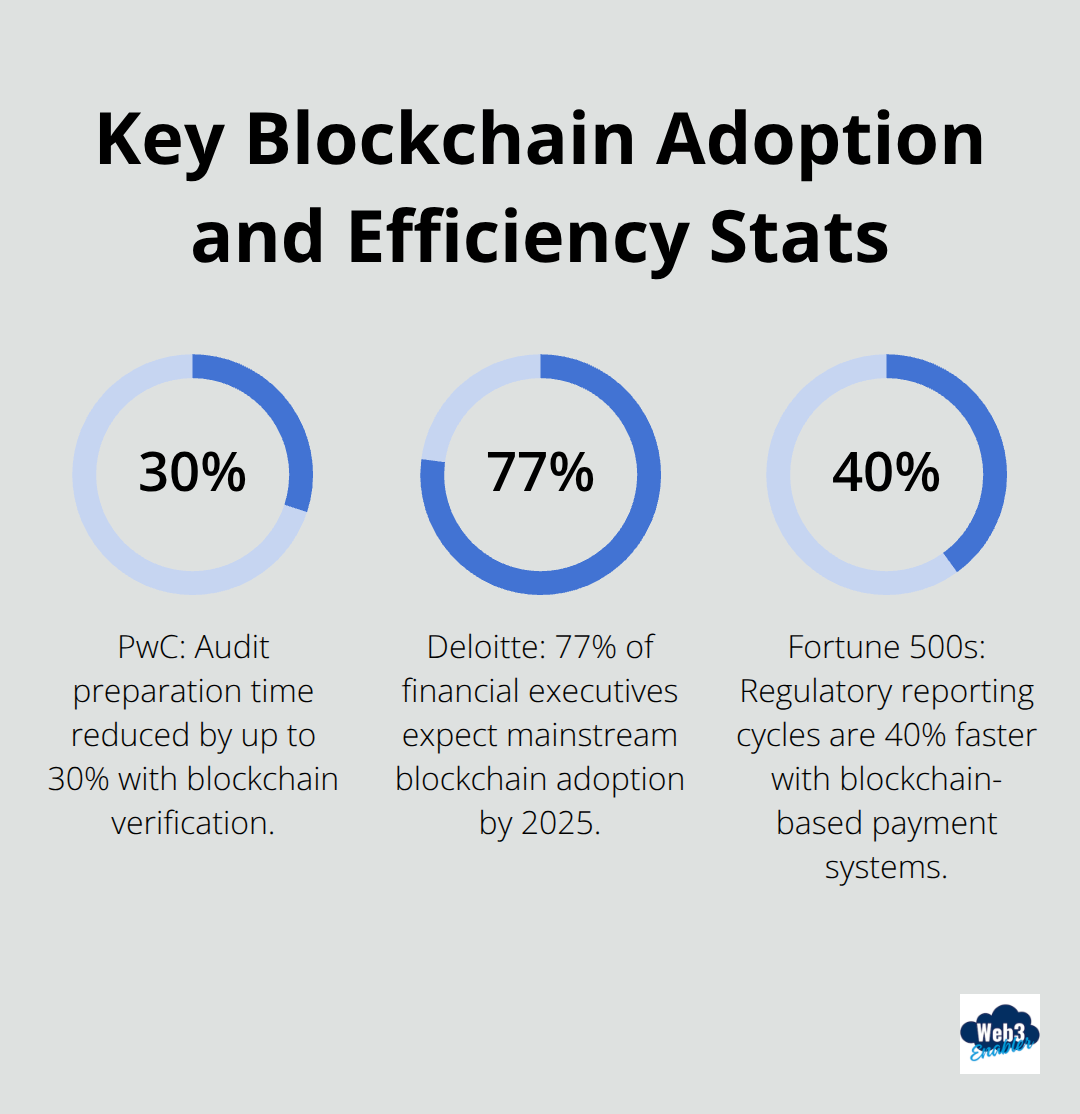

Your audit costs will plummet while your fraud detection capabilities skyrocket. PwC reports that companies implementing blockchain for financial records reduce audit preparation time by up to 30% because auditors verify transactions instantly rather than sift through months of documentation. Deloitte found that 77% of financial executives believe blockchain technology will gain mainstream adoption by 2025, primarily due to these operational cost savings.

The math is simple: when your payment records cannot be altered retroactively, compliance teams spend less time investigating discrepancies and more time on strategic initiatives.

Reduced Audit Costs and Faster Compliance Reporting

Traditional audit processes require weeks of document gathering and verification because auditors must trace payment histories through multiple systems and intermediaries. Immutable records eliminate this tedious verification process entirely. Ernst & Young reduced client audit times by 25% using blockchain verification methods because every transaction includes cryptographic proof of authenticity (no more endless paper trails). Your accounting team can generate compliance reports in hours instead of weeks, and regulatory bodies gain instant access to verifiable payment histories. Fortune 500 companies using blockchain-based payment systems report 40% faster regulatory reporting cycles compared to legacy database systems.

Enhanced Fraud Prevention and Detection

Fraudulent payment modifications become impossible when transaction records are cryptographically locked and distributed across multiple nodes. The Association of Certified Fraud Examiners found that organizations lose 5% of annual revenue to fraud, but blockchain implementation reduces payment fraud by up to 90% according to IBM research. Real-time fraud detection improves dramatically because any attempt to modify payment data breaks the cryptographic chain and triggers immediate alerts. Your finance team gains unprecedented visibility into payment flows (making suspicious patterns obvious within minutes rather than months after the damage occurs).

Improved Customer Trust and Transparency

Customers demand transparency in financial transactions, and immutable records deliver exactly that. When clients can verify payment histories independently through blockchain explorers, trust levels increase significantly. A study by Capgemini found that 73% of consumers would switch to a company that provides complete transparency in financial transactions.

Your customers no longer need to take your word for payment processing – they can verify every transaction themselves. This transparency creates competitive advantages that traditional payment processors simply cannot match, setting the stage for widespread industry adoption across multiple sectors.

Industries Leading the Adoption

Financial institutions move fastest because they face the highest regulatory pressure and fraud losses. JPMorgan processes over $6 trillion in daily payments and now uses blockchain technology for institutional transfers through JPM Coin, which reduces settlement times from days to hours while cutting operational costs by 30%. Bank of America has filed over 50 blockchain patents specifically for payment processing because executives recognize that immutable records solve their biggest compliance headaches.

Wells Fargo partnered with HSBC and Standard Chartered to process $300 billion in trade finance transactions through blockchain systems, which eliminates the paper-heavy processes that previously took weeks to complete.

Supply Chain Finance Gets Real-Time Visibility

Walmart tracks over 25 products through blockchain systems and extends this transparency to payment processing for suppliers, which reduces invoice disputes by 90% because every payment links directly to verified delivery records. Maersk processes $4 billion in annual payments through TradeLens blockchain platform and gives all stakeholders instant access to payment status while reducing administrative costs by 15%. The combination of supply chain tracking with immutable payment records creates unprecedented accountability (suppliers cannot claim non-payment when blockchain records show exact payment timestamps, and buyers cannot dispute deliveries when cryptographic proof exists).

Healthcare Payments Cut Administrative Waste

Healthcare organizations waste $200 billion annually on administrative costs, but Change Healthcare processes medical payments through blockchain systems that automatically verify insurance claims and provider payments. Anthem uses blockchain technology to process member payments and provider reimbursements, which reduces claim processing time from 30 days to 3 days while eliminating payment disputes that previously required manual investigation. Medical providers gain instant payment verification and patients can track their insurance claims in real-time through immutable records that prevent billing fraud and duplicate charges (making healthcare finance finally transparent for everyone involved).

Final Thoughts

Payment immutability represents the biggest shift in financial operations since digital banking emerged. Companies that implement blockchain-based payment systems report 30% faster audit cycles, 90% reduction in payment fraud, and 40% improvement in regulatory reporting speed. These operational transformations create competitive advantages that traditional payment processors cannot match.

The global blockchain market will reach $163.24 billion by 2029, driven primarily by demand for secure transaction systems. Financial institutions, supply chain operators, and healthcare organizations already capture these benefits while their competitors struggle with legacy payment infrastructure. The question is not whether immutable payment records will become standard – it is whether your organization will lead this transformation or follow behind competitors who moved first.

Your business can start this transformation today without replacement of current systems. We at Web3 Enabler provide Salesforce Native blockchain solutions that integrate seamlessly with your current operations (backed by trusted partners like Circle, Ripple, and Cardano Catalyst). Our tools enable stablecoin payments, global transfers, and crypto visibility within Salesforce.