The importance of digital payments isn’t some future trend-it’s happening right now. At Web3 Enabler, we’ve watched businesses transform their operations by ditching legacy systems, and the results speak for themselves: faster transactions, happier customers, and actual visibility into what’s happening with your money.

Why Businesses Are Ditching Legacy Payment Systems

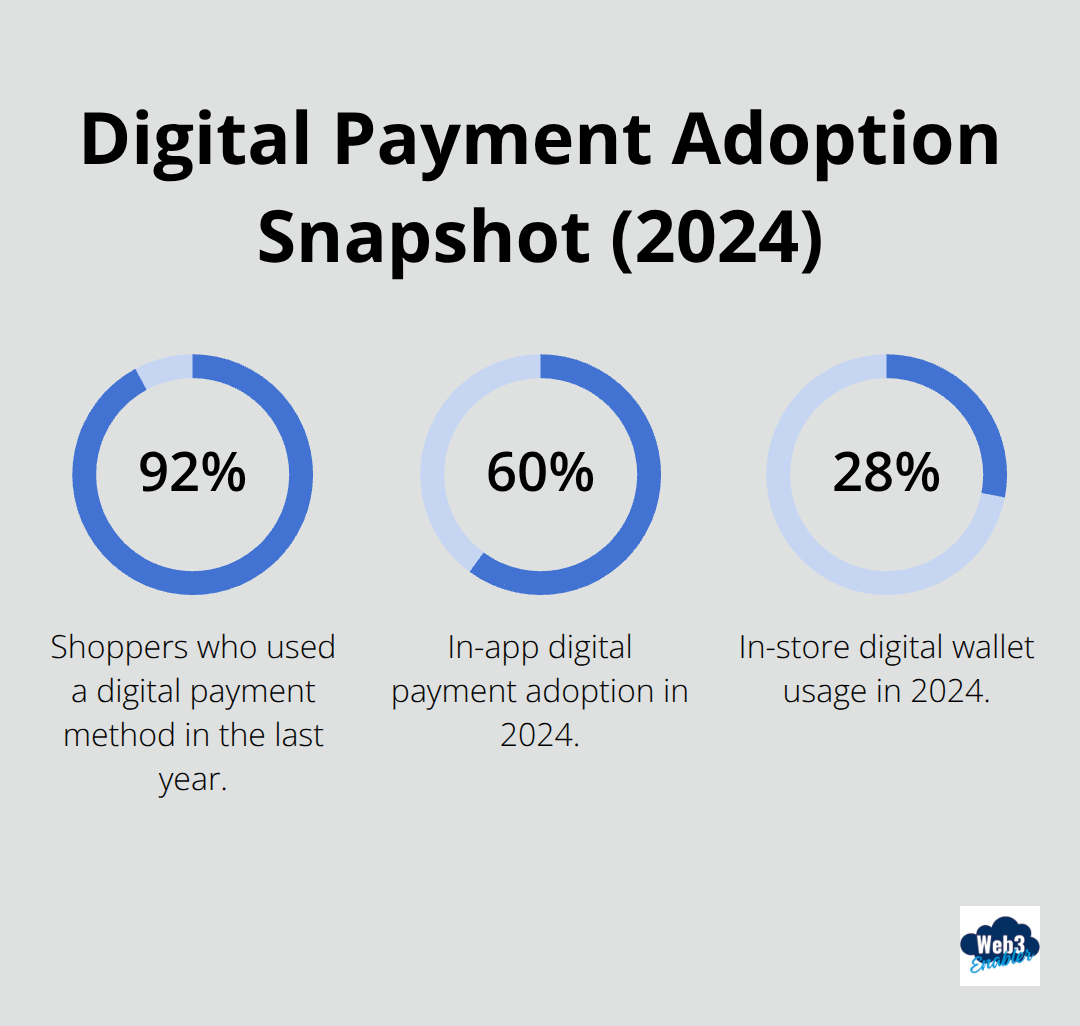

Your competitors aren’t waiting around for checks to clear. According to McKinsey research from 2024, 92% of shoppers used a digital payment method in the last year, and that number keeps climbing. Businesses that still rely heavily on cash and checks are essentially running against the current.

The speed difference alone is brutal: while a check takes 3-5 business days to clear, digital payments settle in seconds or minutes. For cash-heavy operations, you lose time and visibility into your cash flow, tying up working capital that could fund growth. Companies processing high transaction volumes have discovered that switching to digital payments frees up staff from manual reconciliation work, reduces human error, and dramatically cuts the cost per transaction. When JDS Industries moved to an integrated digital payment platform, they achieved 10% cost savings and 50% faster payment processing. That’s not theoretical-that’s money back in your pocket.

The Contactless Revolution Is Already Here

Your customers have already made the choice for you. In-store digital wallet usage has grown significantly, and in-app payments reached about 60% adoption. If your business doesn’t accept mobile wallets like Apple Pay and Google Pay, you watch customers abandon their carts and head to competitors who do. The shift goes beyond convenience-contactless payments reduce friction at checkout, lower fraud risk through tokenization, and speed up transaction processing. Global payment networks have made this infrastructure accessible even to small businesses through standard payment processors. The real advantage goes to businesses that accept multiple digital payment methods (customer preferences vary by region, age group, and purchase context). Offering flexibility isn’t nice-to-have anymore; it’s the baseline expectation that separates thriving businesses from struggling ones.

What Happens When You Ignore Digital Payment Trends

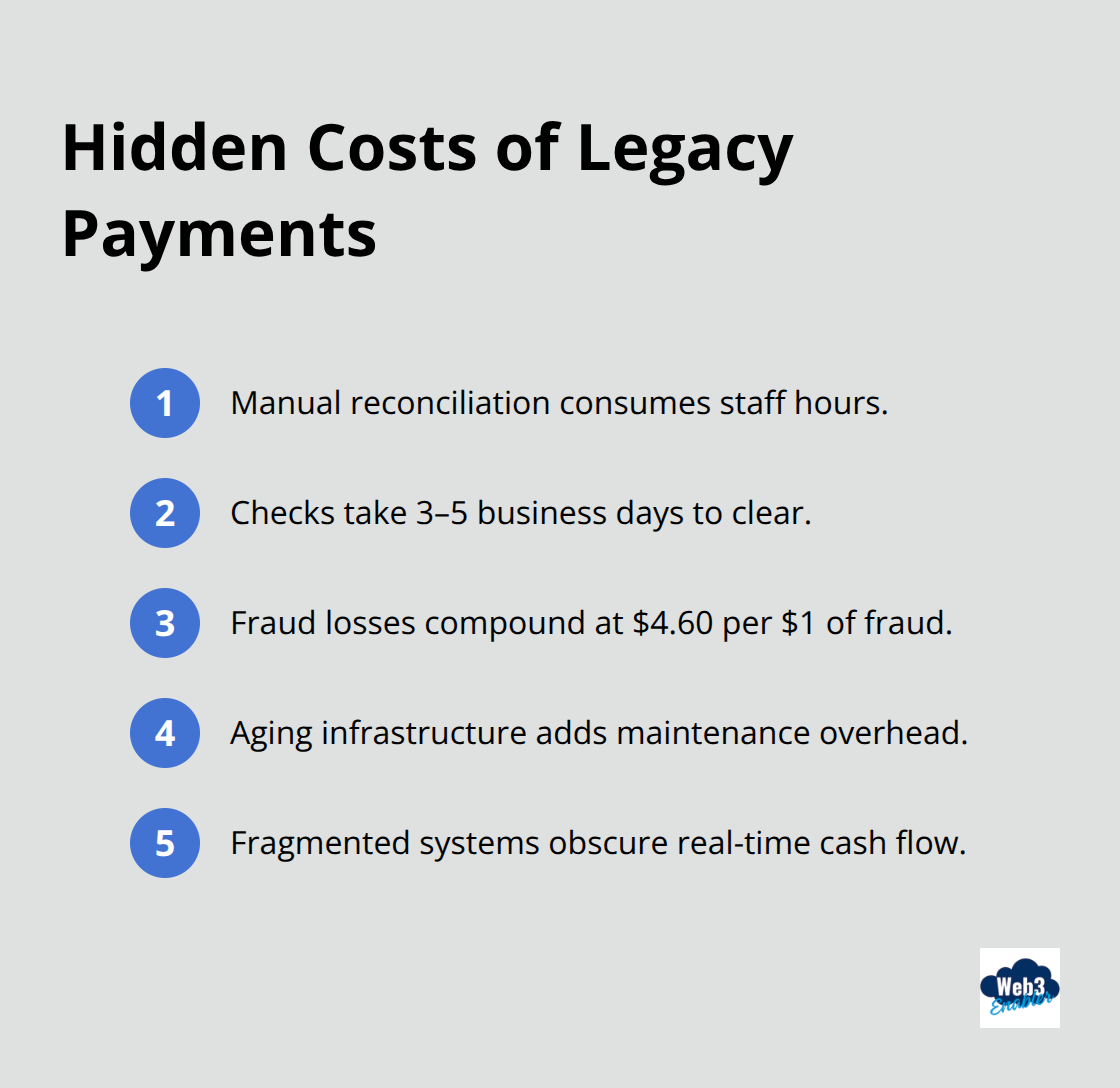

Sticking with legacy systems costs more than you think. Your staff spends hours reconciling transactions manually, your customers experience checkout friction that drives them elsewhere, and your cash flow remains opaque until days after transactions complete. Meanwhile, businesses that embraced digital payments already moved ahead-they process transactions faster, reduce operational overhead, and gain real-time visibility into their finances. The competitive gap widens every quarter. Those hidden costs of legacy systems (processing delays, manual labor, lost sales) add up quickly, which is exactly why the next section reveals what you’re actually paying to stay stuck in the past.

What Legacy Payment Systems Actually Cost You

The Hidden Price of Manual Processes

Every day your business operates on outdated payment infrastructure, you hemorrhage money in ways that don’t show up on a single line item. Your staff spends hours manually reconciling transactions across different systems because nothing talks to each other. A typical merchant loses about 4.60 dollars for every dollar of fraud that occurs, and legacy systems lack the real-time fraud detection that modern digital payment platforms provide.

Meanwhile, checks take 3-5 business days to clear while your competitors who switched to digital payments access funds in minutes.

That delay directly impacts working capital-cash you could use to pay suppliers faster, invest in inventory, or fund operations sits trapped in the clearing pipeline. Processing fees on legacy systems compound the problem. Credit card processors charge standard rates, but add in manual reconciliation labor, check printing costs, and the overhead of maintaining outdated infrastructure, and your actual cost per transaction balloons. JDS Industries discovered this firsthand and cut their costs by 10% simply consolidating onto an integrated digital payment platform. That’s not optimization theater; that’s legitimate money recaptured from inefficiency.

Security Vulnerabilities That Drain Your Bottom Line

Legacy systems create a second financial drain that most businesses underestimate. Global online payment fraud losses reached 44 to 48 billion USD in 2024, and projections suggest losses could exceed 100 billion USD by 2029. Many legacy systems lack tokenization, which replaces sensitive payment data with secure tokens, making them attractive targets for criminals. Two-factor authentication and machine-learning-based fraud detection were the most effective defenses in 2024, yet most legacy infrastructure doesn’t support either.

Your visibility into cash flow remains broken until transactions fully settle, meaning you can’t make informed decisions about inventory, payroll, or growth investments in real time. Modern digital payment systems provide instant transaction visibility, fraud scoring, and settlement confirmation. The businesses that moved forward already have cash flow transparency that legacy operators can only dream about. That information gap isn’t just inconvenient-it costs you competitive advantage every single day, which is exactly why forward-thinking companies are already exploring how digital payments can transform their operations and unlock new growth opportunities.

How Digital Payments Multiply Your Revenue Streams

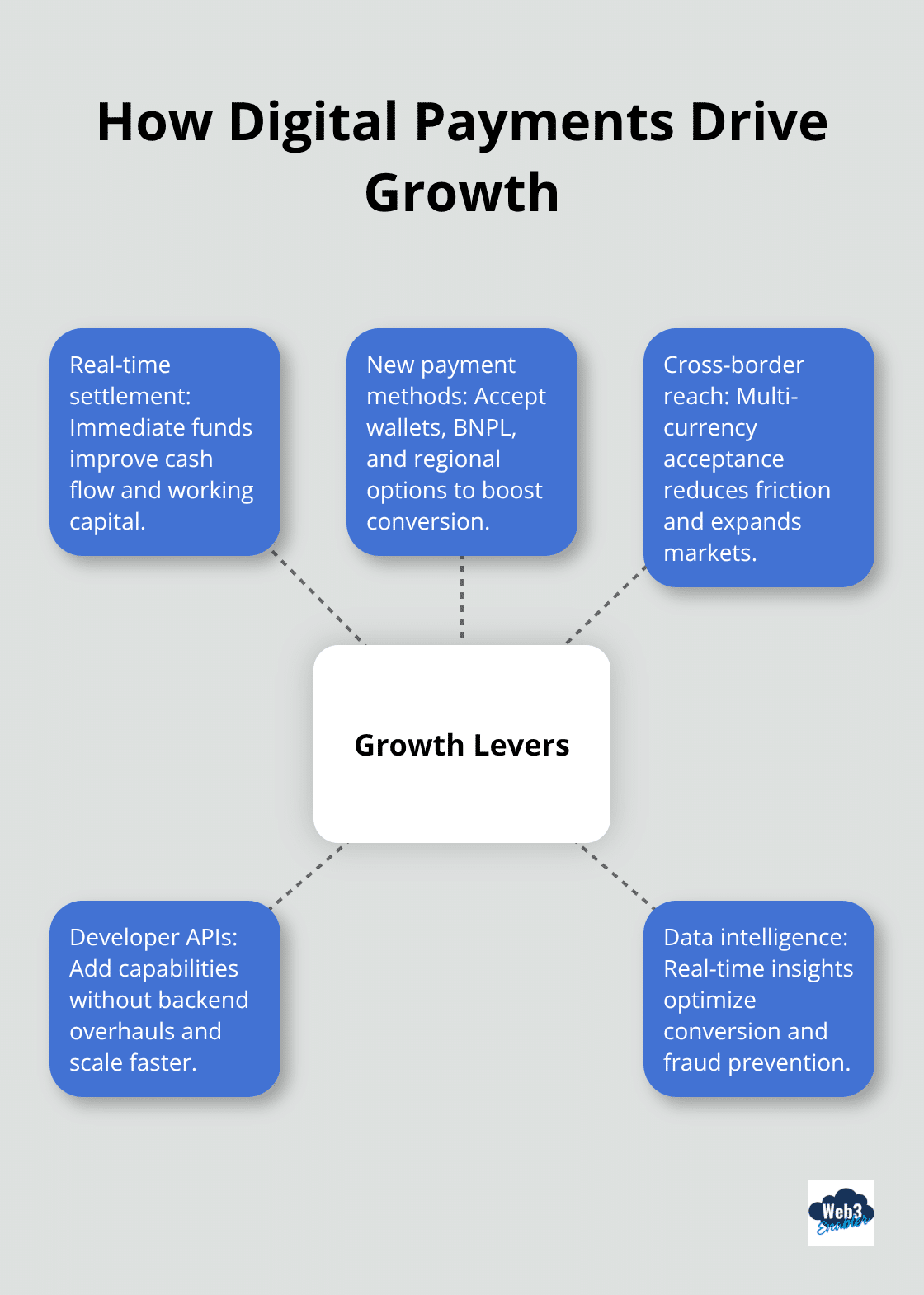

Real-Time Settlement Transforms Your Cash Flow

The moment you accept digital payments, your business stops leaving money on the table. Real-time settlement means capital hits your account immediately rather than days, fundamentally changing how you manage cash flow and working capital. Cargill and JPMorgan Payments demonstrated this advantage in Brazil’s agricultural sector, where real-time payments reduced funding delays and credit risk for suppliers and farmers. When you access capital faster, you can pay suppliers on better terms, invest in inventory immediately, or fund growth initiatives without waiting for traditional clearing cycles.

Small businesses operating on thin margins discover that faster settlement alone improves their ability to weather seasonal fluctuations or unexpected expenses. Medium-sized companies use the freed-up capital to negotiate better vendor pricing or expand operations without external financing. Large enterprises leverage real-time payment visibility to optimize working capital across global operations, reducing the cash required to run the business.

New Markets Open When You Accept What Customers Want

Expanding into new markets becomes dramatically simpler when you accept the payment methods customers in those regions actually use. McKinsey research shows in-app digital payments reached 60% adoption, while in-store digital wallet usage climbed to 28% in 2024. A retailer accepting only credit cards misses customers who prefer mobile wallets, buy-now-pay-later services like Affirm or Klarna, or regional payment methods.

Cross-border payment friction disappears when you work with platforms that handle multiple currencies and payment types seamlessly. Shopify merchants integrating services like Coinbase Commerce instantly reach customers paying with stablecoins or cryptocurrencies, opening entirely new customer segments. Developer portals and payment APIs enable merchants to add new payment acceptance capabilities without overhauling backend systems.

Data Transforms Payment Processing Into Strategic Intelligence

The data advantage compounds this opportunity significantly. Modern digital payment systems capture transaction patterns, customer preferences, and regional trends in real time. You see which payment methods drive the highest conversion rates, which customer segments prefer installment payments, and where geographic expansion opportunities exist.

This intelligence transforms payment data from a compliance checkbox into a competitive asset. Merchants using machine-learning-based fraud detection not only prevent 2024’s most common fraud types, but also identify legitimate high-value customers that rule-based systems would incorrectly flag. That distinction separates merchants who block fraud from those who block revenue.

Final Thoughts

The importance of digital payments isn’t debatable anymore-your competitors switched years ago, your customers expect it, and the financial case crushes any argument for staying put. Businesses clinging to legacy systems actively choose to pay more, move slower, and hand market share to rivals who embraced digital payment infrastructure. The gap between early adopters and laggards widens every quarter as real-time settlement, fraud prevention, and payment data intelligence compound into genuine competitive advantages.

Starting your digital payment journey doesn’t require tearing apart your entire operation. Modern payment platforms integrate seamlessly with existing systems, so you accept new payment methods, gain real-time cash flow visibility, and reduce fraud risk without massive disruption. The businesses winning right now aren’t the ones waiting for perfect conditions-they’re the ones who recognized that digital payments solve real problems: faster cash flow, lower operational costs, and access to customers and markets that legacy systems keep locked away.

We at Web3 Enabler help businesses connect blockchain technology with their existing infrastructure, making it simple to accept stablecoin payments and send global payments faster. Whether you’re processing your first digital payment or optimizing a global payment network, the time to act is now-the competitive advantage belongs to businesses that move first.