The stablecoins vs cryptocurrency debate isn’t as black and white as most people assume. We at Web3 Enabler see businesses getting confused about which digital assets actually make sense for their operations.

Here’s the real difference that matters for your bottom line.

What Makes Stablecoins the Boring Cousin of Crypto

Stablecoins are digital currencies that maintain stable value through pegs to reserve assets, primarily the US dollar. While Bitcoin swings 20% overnight and gives you a heart attack, stablecoins stay as steady as your morning coffee routine. J.P. Morgan Global Research projects the stablecoin market could hit $500–750 billion in the coming years, with nearly 99% pegged to the US dollar. Think of them as the Swiss bank account of digital assets.

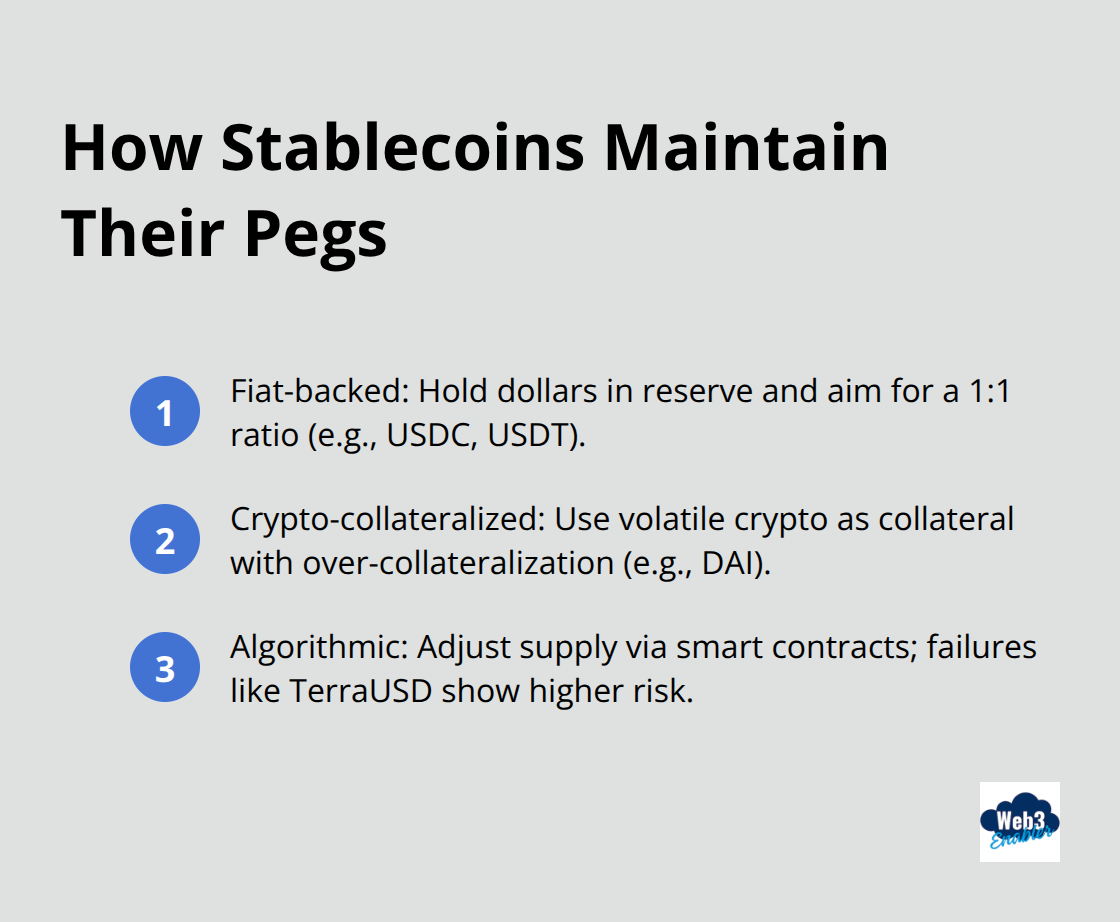

Three Ways Stablecoins Stay Steady

The magic happens through three main support mechanisms. Fiat-backed stablecoins like USDC and USDT hold actual dollars in reserve accounts and maintain a 1:1 ratio. Crypto-collateralized versions like DAI use other cryptocurrencies as collateral but require over-collateralization to handle price swings. Algorithmic stablecoins attempt to maintain their peg through smart contracts that adjust supply based on demand, though this approach has failed spectacularly before (TerraUSD’s collapse in May 2022 being the prime example).

Market Leaders Worth Your Attention

Tether and Circle dominate the space and control about 90% of the total stablecoin market value according to J.P. Morgan Global Research. USDT processes the highest transaction volumes despite scrutiny over reserve transparency, while USDC has built its reputation on regulatory compliance and frequent audits. Transaction volumes for stablecoins surged 50% year-over-year in 2025, driven by cross-border payments where traditional remittances cost an average of 6.49% globally.

Major financial institutions including Visa, Mastercard, and PayPal now explore stablecoin integration (signaling mainstream adoption ahead). But here’s where things get interesting – traditional cryptocurrencies operate on completely different principles.

Why Regular Crypto Makes CFOs Nervous

Cryptocurrencies are decentralized digital assets that derive value from market speculation, network effects, and adoption rather than stable backing mechanisms. Traditional cryptocurrencies operate on pure market dynamics where sentiment drives everything from regulatory headlines to celebrity tweets.

The Volatility Reality Check

Bitcoin and Ethereum experience price fluctuations that would make seasoned traders sweat. The crypto market saw over 600 instances of significant price movements in 2023 alone, with some altcoins that lost 90% of their value within months. Execution risk stems directly from this volatility – a $100,000 Bitcoin payment could be worth $80,000 by the time it settles. Companies that use Bitcoin for payroll through platforms like Bitwage must hedge constantly or accept massive currency risk that no traditional business would tolerate.

Business Applications That Actually Work

Despite the volatility chaos, cryptocurrencies excel in specific scenarios where censorship resistance matters more than price stability. Bitcoin’s Lightning Network achieves 99.7% transaction success rates with near-instant settlement, which makes it viable for international transfers where traditional banks fail. Ethereum powers most decentralized finance protocols, though EIP-4844 reduced median transaction costs on major Layer 2 solutions to just $0.02.

When Speed Trumps Stability

Smart businesses use cryptocurrencies for treasury diversification or cross-border payments where speed trumps stability, but never for daily operations where predictable accounting matters. The decentralized structure allows for resilience against censorship (making it preferable in adversarial situations), but this same feature creates accounting nightmares for finance teams.

The real question isn’t whether crypto or stablecoins are better – it’s about understanding which tool fits your specific business needs and risk tolerance.

Which Digital Asset Fits Your Business Model

Price stability separates stablecoins from traditional cryptocurrencies in ways that directly impact your business operations. Stablecoins maintain their dollar peg within 1-2% deviation during normal market conditions, while Bitcoin experiences daily price swings that average 3-5% according to recent market data. This difference means a $50,000 stablecoin payment stays predictable for accounting purposes, but the same Bitcoin payment could vary by $2,500 overnight. Standard Chartered’s research warns that stablecoins could drain up to $1 trillion from emerging market banks over the next three years, driven by this stability advantage.

Payment Applications That Make Financial Sense

Cross-border payments reveal the clearest differences between these digital assets. Stablecoins like USDC on Solana settle in approximately 400 milliseconds with fees under $0.02, while traditional remittances cost 6.49% globally according to World Bank data. Bitcoin’s Lightning Network achieves 99.7% success rates but introduces execution risk from price volatility during settlement windows.

Companies that use platforms like Bitwage for crypto payroll must hedge Bitcoin positions constantly, while stablecoin payments require no hedging strategies. The GENIUS Act passage in July 2025 provides regulatory clarity for stablecoin business use, while cryptocurrency regulations remain fragmented across jurisdictions.

Risk Management for Finance Teams

Investment risk profiles show stark contrasts between these asset classes. Stablecoins face counterparty risk from reserve management and potential de-pegging events, but 2023 data shows over 600 de-pegging instances were temporary and resolved quickly. Cryptocurrencies carry market risk that can destroy 90% of value within months (making them unsuitable for operational cash management).

Circle’s USDC temporarily de-pegged during the March 2023 banking crisis but recovered within days, while many altcoins never recovered from similar periods. Finance teams should treat stablecoins as enhanced payment rails and cryptocurrencies as speculative treasury assets that require separate risk management protocols.

Operational Cash Flow Considerations

Daily business operations demand predictable value transfers that stablecoins provide better than volatile cryptocurrencies. A company that pays suppliers $100,000 in USDC knows the exact dollar amount will arrive, while the same Bitcoin payment could fluctuate thousands of dollars during transit. This predictability matters for cash flow forecasts and budget planning that finance teams depend on for quarterly reporting.

Final Thoughts

The stablecoins vs cryptocurrency debate centers on one fundamental question: do you need predictable value or speculative potential? Stablecoins deliver payment stability with 1-2% price deviation, while cryptocurrencies swing 3-5% daily and can lose 90% of their value during market downturns. For business operations, stablecoins win hands down because they settle cross-border payments in 400 milliseconds at $0.02 fees without hedging requirements.

Cryptocurrencies work for treasury diversification and censorship-resistant transfers, but create accounting nightmares for finance teams who manage daily operations. The regulatory landscape favors stablecoins with the GENIUS Act providing clear frameworks, while cryptocurrency regulations remain fragmented across jurisdictions. J.P. Morgan projects stablecoin markets reaching $500-750 billion, driven by businesses that seek payment efficiency over speculation.

Smart companies adopt both assets for different purposes and use stablecoins for operational payments where predictability matters most. They reserve cryptocurrencies for strategic treasury positions where volatility risk aligns with investment goals (though this requires separate risk management protocols). Web3 Enabler helps businesses navigate this landscape with practical blockchain solutions that prioritize business applications over crypto speculation.