Your CRM is probably treating crypto payments like that awkward cousin at family dinner – acknowledged but kept at arm’s length. Most businesses are juggling separate systems for traditional and digital transactions, creating chaos where there should be harmony.

We at Web3 Enabler see this disconnect daily. Crypto integration shouldn’t feel like performing surgery with oven mitts, yet that’s exactly what happens when your payment systems don’t talk to your customer data.

Why CRM Integration Matters for Crypto Businesses

Traditional payment systems transform your business into a data nightmare. Crypto transactions that happen outside your CRM rob you of visibility into customer behavior, payment patterns, and revenue streams. McKinsey & Company reports that 88% of sales professionals identify data integrity as their biggest challenge, and crypto-fiat disconnection makes this problem exponentially worse.

Your sales team manually updates records while finance struggles with reconciliation. Customer service operates blind to payment status. This fragmentation costs businesses an average of 40% more in operational expenses (according to Capgemini) because teams waste time hunting for information across multiple systems instead of serving customers.

Compliance Becomes Your Worst Enemy

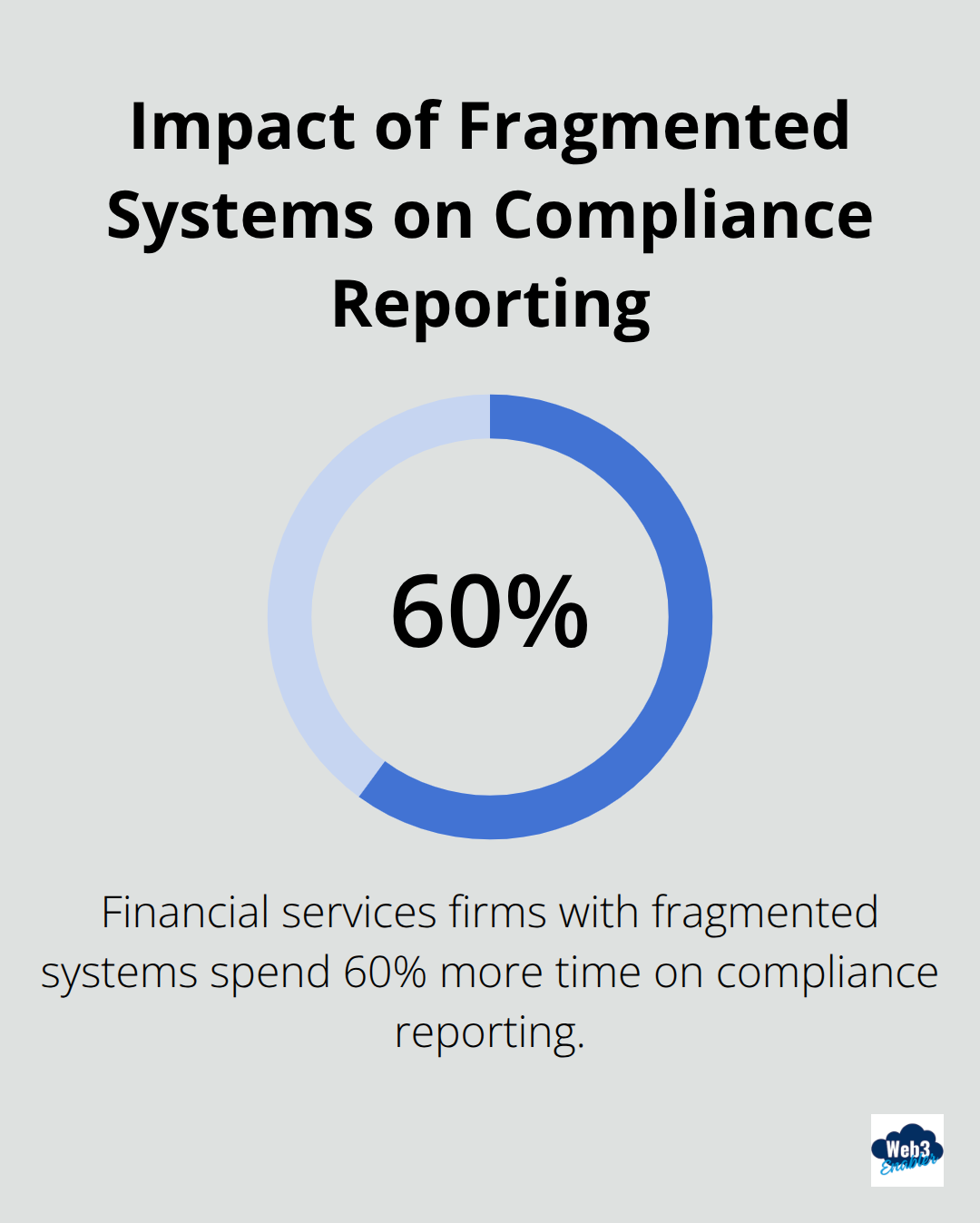

Disconnected systems create compliance chaos that regulators love to penalize. Crypto transactions that live outside your CRM turn audit trail generation into a manual nightmare.

The lack of unified reporting forces your compliance team to manually aggregate data from multiple sources. This approach increases error rates and audit risks. Modern regulations demand real-time visibility into all customer transactions, not just the convenient ones that fit your legacy system.

Customer Experience Takes the Hit

Customers expect seamless experiences regardless of payment method. Separate crypto and fiat operations force customers to face longer support resolution times, inconsistent communication, and fragmented account views. Deloitte research shows 70% of consumers would use crypto payments if integrated within familiar platforms, but most businesses force customers to navigate separate systems for different payment types.

Your customer success team loses context when crypto payments happen in isolation. This leads to missed upselling opportunities and frustrated customers who repeat information across multiple touchpoints. The solution lies in choosing the right integration approach that connects these fragmented pieces into a cohesive system.

Native Integration vs API Patches

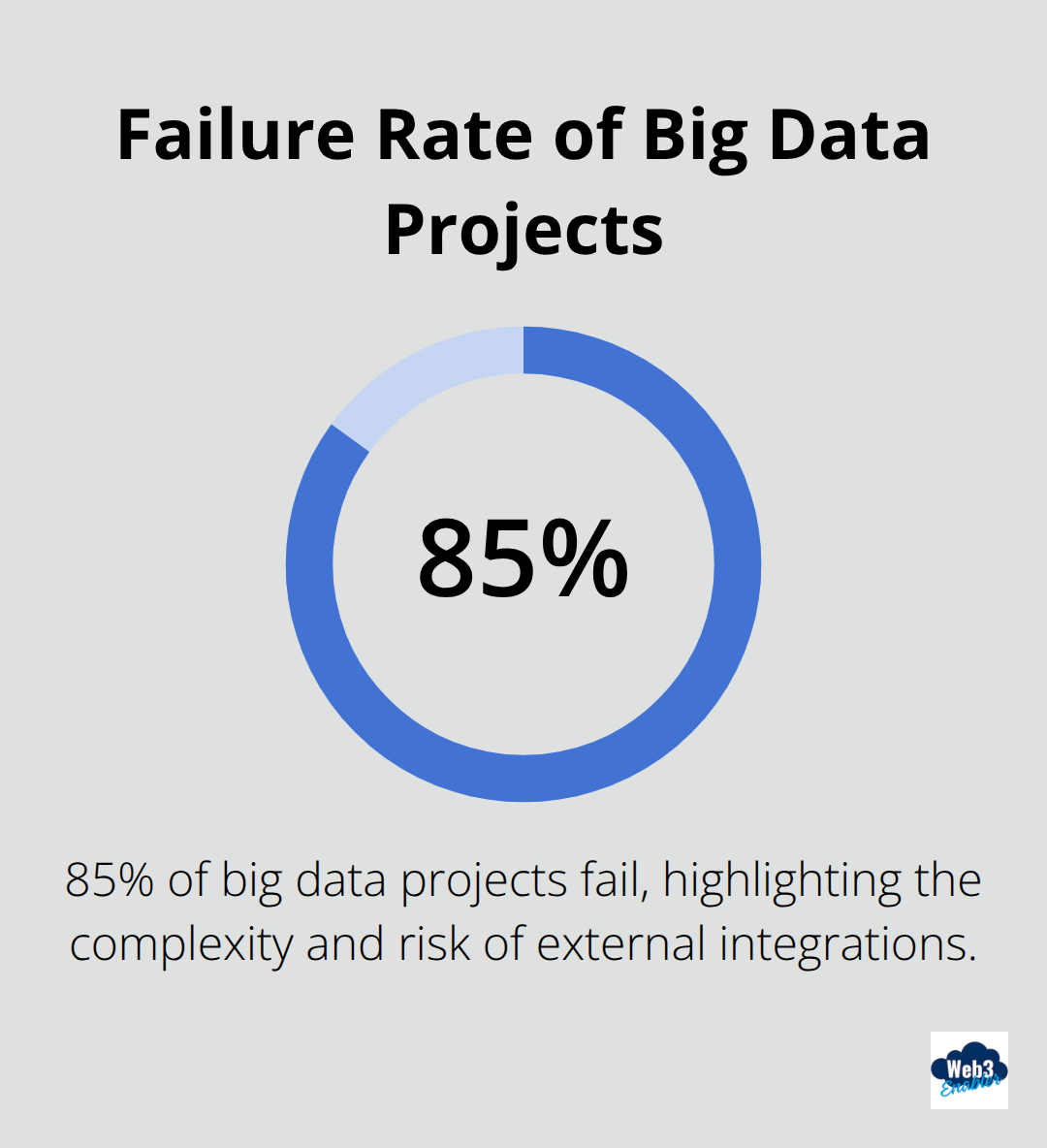

Built-in CRM solutions beat third-party patches every single time. Native crypto integrations flow data seamlessly through your existing Salesforce architecture without creating security vulnerabilities or maintenance nightmares. API-based solutions force your IT team into constant firefighting mode as endpoints break, authentication fails, and data synchronization hiccups create customer service disasters.

Security Gaps Cost More Than Integration

Third-party API connections expose your customer data to unnecessary risk points. Each API call travels through external servers, which multiplies potential breach vectors.

Native solutions encrypt data within your existing Salesforce security framework. This approach eliminates the need to trust multiple vendors with sensitive financial information. Your security team maintains control over access permissions and audit trails without worrying about external API vulnerabilities.

Maintenance Headaches Drain Resources

API integrations require constant babysitting as crypto platforms update their endpoints without warning. Your development team wastes time on connection failures instead of features customers actually want. Native solutions update automatically through Salesforce releases, which reduces maintenance overhead significantly.

The Salesforce AppExchange provides vetted crypto solutions that undergo rigorous security reviews before they reach your organization. These enterprise-grade options integrate directly with your existing workflows without custom development resources or API management overhead.

Performance Advantages Stack Up

Native integrations process transactions faster because they eliminate external API calls and data transfer delays. Your sales team sees real-time payment updates without the lag that plagues third-party solutions. This speed advantage becomes critical during high-volume periods when API rate limits can throttle external connections.

The architecture differences become obvious when you examine how each approach handles data flow and system reliability.

Essential Features for Crypto CRM Integration

Your crypto CRM integration must handle three non-negotiable requirements that separate functional systems from expensive mistakes. Real-time payment tracking forms the foundation because delayed transaction updates create customer service disasters and revenue recognition problems. Salesforce-native solutions process payment confirmations within seconds of blockchain confirmation, while API-based systems often lag 15-30 minutes behind actual transaction status. This delay forces your sales team to manually check external platforms during customer calls, which destroys the seamless experience customers expect from professional organizations.

Real-Time Payment Visibility Changes Everything

Transaction status updates must appear instantly across all customer touchpoints when payments hit the blockchain. Your support team needs immediate visibility into payment confirmations without refreshing external dashboards or waiting for batch updates. Late payment notifications create confusion when customers call about transactions your system hasn’t registered yet.

Modern crypto integrations push payment confirmations directly into Salesforce records within 30 seconds of blockchain validation. This speed advantage eliminates the awkward pause when customers ask about payment status during live calls.

Multi-Currency Intelligence That Actually Works

Multi-currency support extends beyond simple conversion displays to include stablecoin rate management and automated fiat equivalent calculations. Your system must handle USDC, USDT, and DAI conversions without manual intervention because cryptocurrency markets operate 24/7 while traditional banks don’t. Hybrid payment platforms bridge fiat and stablecoin rails, letting users transact in USD or USDC interchangeably.

Your finance team needs automatic invoice updates when payment arrives in different currencies than originally quoted. Real-time balance tracking across multiple digital assets must integrate within existing Salesforce reports (not separate dashboards that nobody checks).

Compliance Automation Saves Your Business

Automated compliance reports transform regulatory nightmares into manageable workflows through built-in audit trail generation and transaction categorization. The system must automatically flag transactions that require additional documentation, generate KYC reports for regulatory submissions, and maintain immutable transaction logs that satisfy financial auditors.

Manual processes create error-prone documentation that regulators scrutinize heavily. Your compliance team gets pre-formatted reports that include transaction hashes, wallet addresses, and counterparty information without hunting through multiple systems.

Integration Architecture Determines Success

Native Salesforce solutions eliminate the security gaps and maintenance headaches that plague API-based integrations. Third-party connections expose customer data to unnecessary risk points because each API call travels through external servers (multiplying potential breach vectors). Native solutions encrypt data within your existing Salesforce security framework without trusting multiple vendors with sensitive financial information.

Final Thoughts

Crypto integration transforms customer relationship management from fragmented chaos into streamlined operations that serve your business goals. Companies with unified payment systems reduce operational costs by 40% while they improve customer satisfaction through seamless experiences across all payment methods. Native Salesforce solutions outperform third-party patches because they eliminate security vulnerabilities, maintenance headaches, and performance bottlenecks that plague API-based connections.

Your IT team stops firefighting broken connections and starts building features customers actually want. Strategic CRM integration positions your business ahead of the crypto adoption curve while competitors struggle with disconnected systems. The global blockchain technology market will reach $1.879 trillion by 2034 (making early integration a competitive advantage that becomes harder to replicate later).

Web3 Enabler provides Salesforce Native blockchain solutions that connect cryptocurrency payments with your existing corporate infrastructure. Our tools support payments, compliance, and automation within Salesforce rather than crypto speculation. The choice between integrated and fragmented systems determines whether crypto enhances or complicates your customer relationships.