Cross-border payments through traditional banking systems cost businesses billions in fees and delays every year. Companies lose an average of 3-5 business days waiting for international transfers to clear.

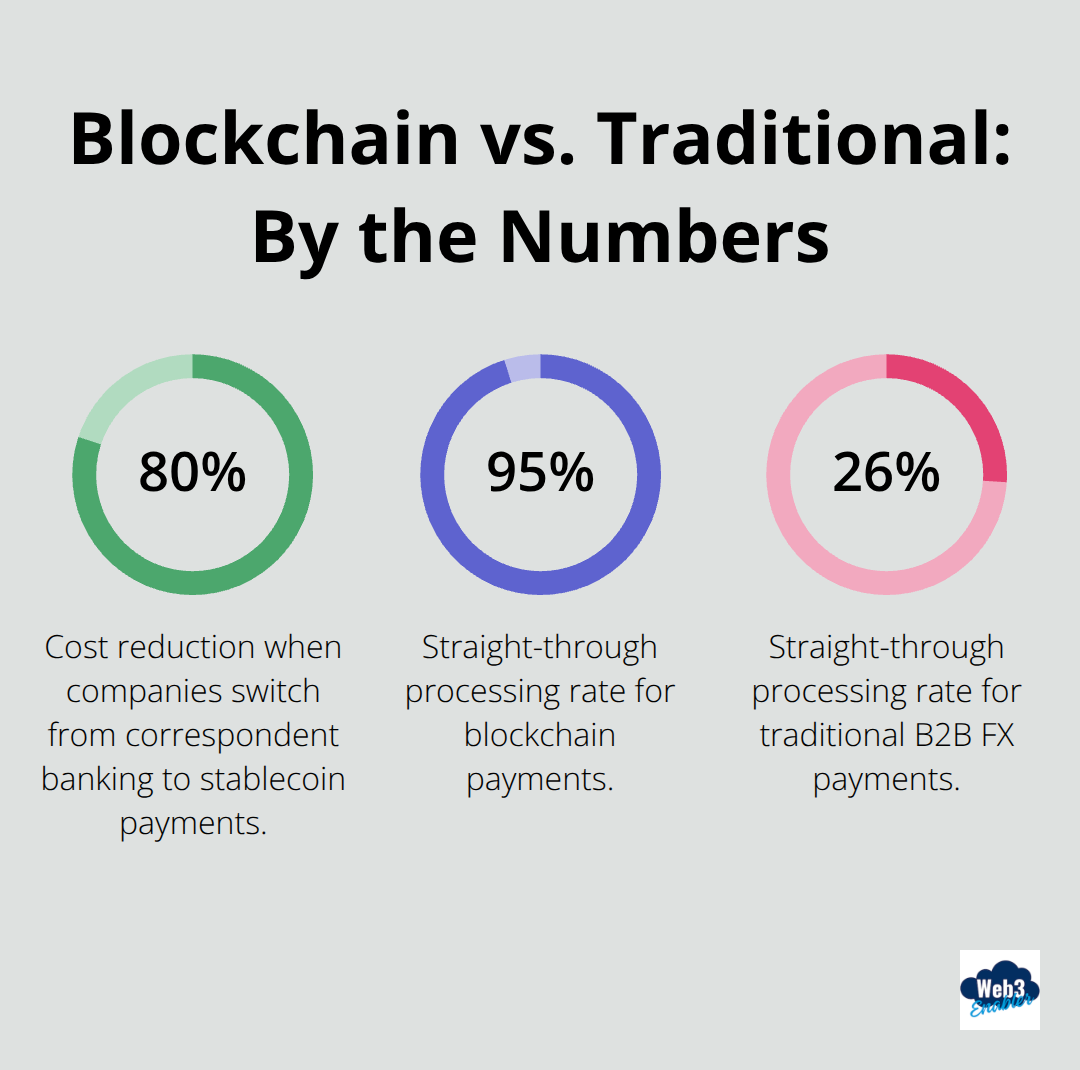

We at Web3 Enabler see how Salesforce integration changes this game completely. Modern blockchain payment solutions cut processing time from days to minutes while reducing transaction costs by up to 80%.

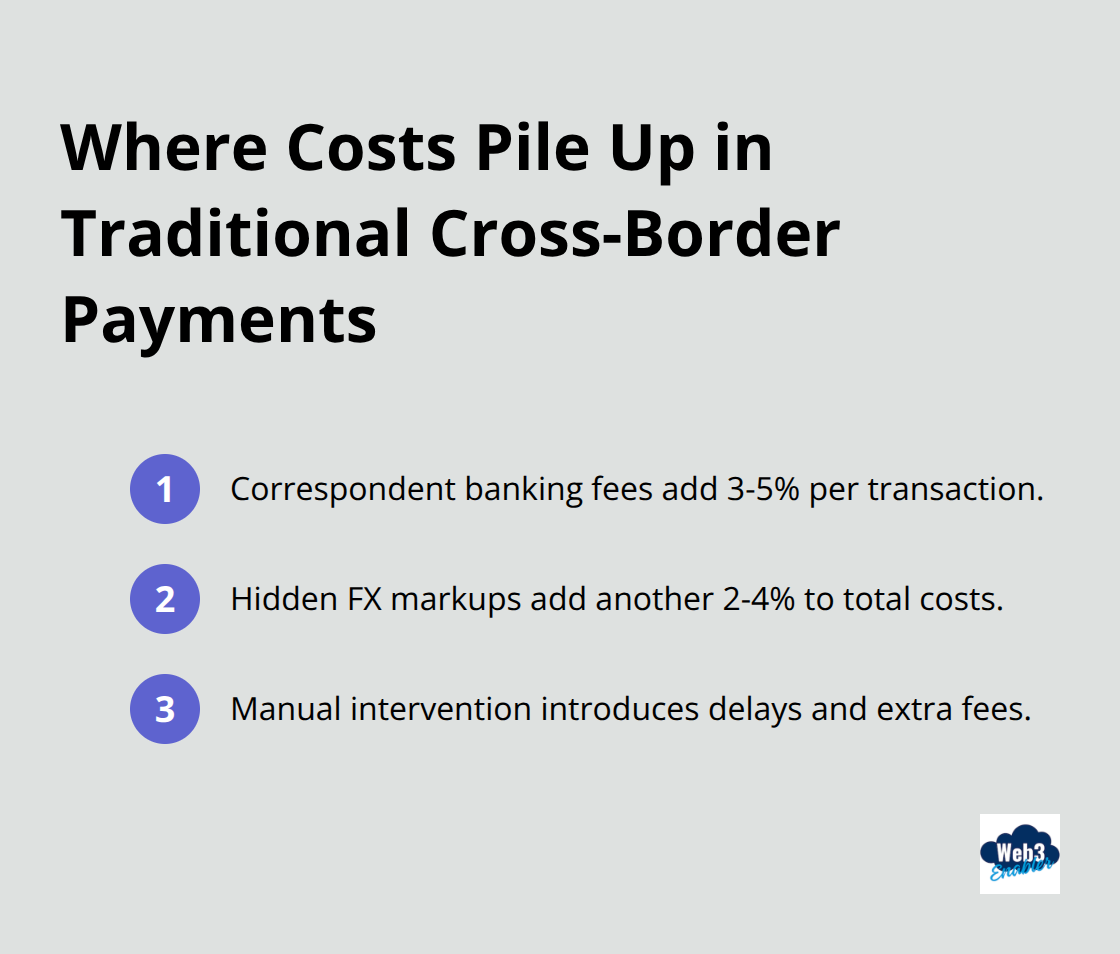

Why Cross-Border Payments Drain Business Resources

Traditional cross-border payment systems extract massive costs from businesses through layers of intermediary fees that compound with each transaction. Banks charge correspondent banking fees that range from 3-5% per transaction, while hidden FX markups add another 2-4% to the total cost. Cross-border B2B payments face significant processing challenges, with most international payments requiring manual intervention and additional fees.

Processing Delays Cost More Than Money

International wire transfers take 1-3 business days minimum, with complex transactions that stretch to a full week. This delay forces companies to maintain excess cash reserves across multiple currencies and markets. Businesses often open local bank accounts in foreign markets to speed up payments, which creates treasury inefficiencies and overhead costs that can reach thousands of dollars monthly per market.

Compliance Complexity Multiplies Operational Burden

Each jurisdiction requires different documentation, reporting standards, and regulatory approvals for cross-border transactions. Payment traceability remains a significant pain point that leaves treasury teams without visibility into transaction status or location. Manual compliance checks slow processing further while they increase the risk of errors that can trigger costly investigations or penalties.

Hidden Costs Compound Across Markets

Suppliers may inflate invoices to protect against potential currency fluctuations, which adds another layer of hidden costs. FX volatility creates uncertainty that forces businesses to negotiate unfavorable terms or accept higher prices. These operational inefficiencies compound when businesses scale internationally and create a maze of regulatory requirements that traditional banking systems handle poorly.

Modern payment platforms address these fundamental limitations through integrated solutions that work directly within existing business systems like Salesforce.

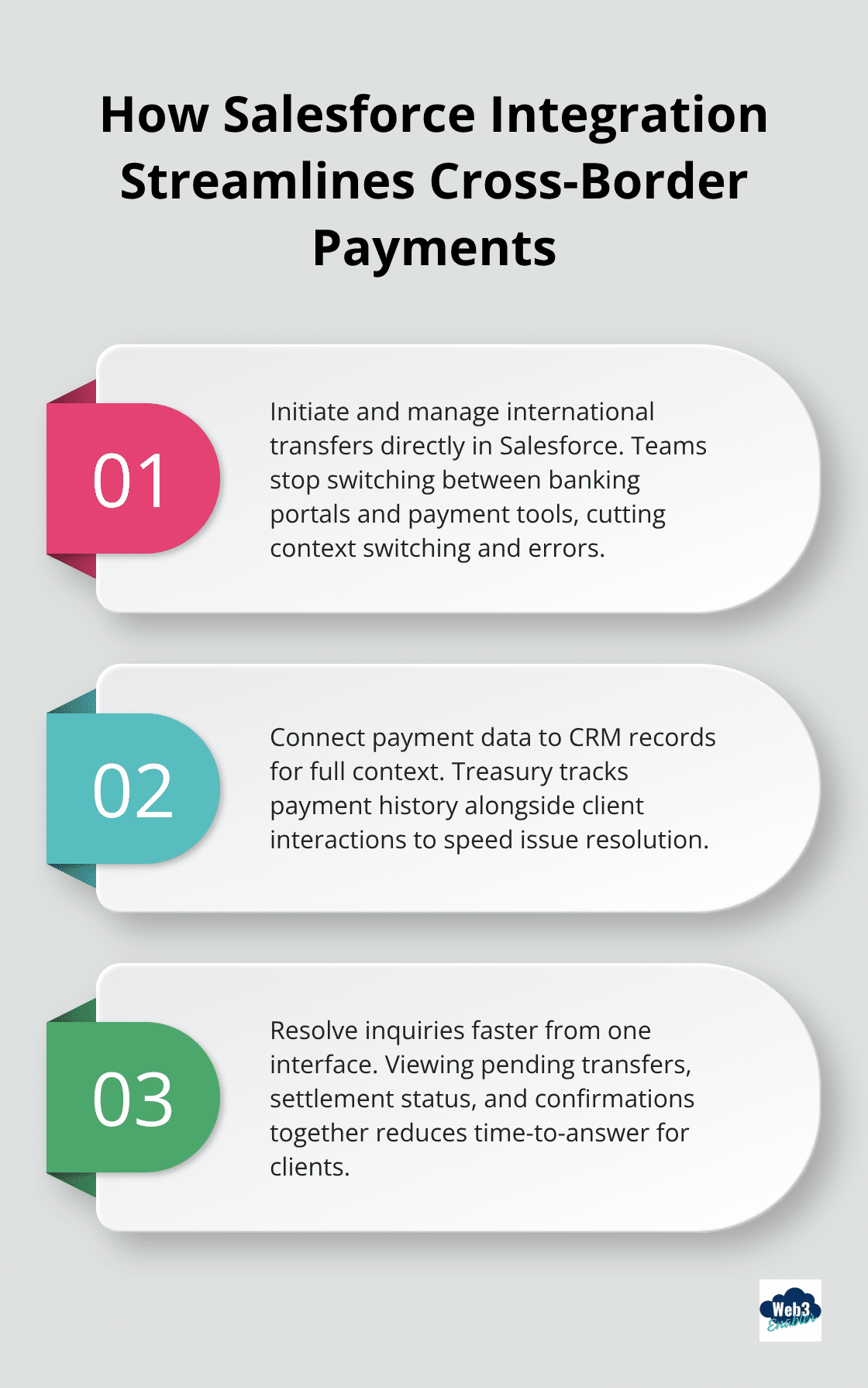

How Salesforce Integration Eliminates Payment Friction

Direct Financial Services Cloud Connection Streamlines Operations

Salesforce Financial Services Cloud transforms cross-border payments through direct integration with blockchain payment infrastructure. Treasury teams initiate international transfers directly from client records without switching between multiple banking platforms or payment systems. This native connection eliminates the need for separate payment management tools that create data silos and increase operational overhead.

Finance teams report faster payment processing when payments flow directly through Salesforce workflows compared to traditional multi-platform approaches. The integration connects payment data with customer relationship management, which enables treasury teams to track payment history alongside client interactions.

Account managers view pending international transfers, settlement status, and payment confirmations within the same interface they use for client communication. This unified approach reduces the time needed to resolve payment inquiries significantly.

Real-Time Transaction Monitoring Replaces Guesswork

Traditional cross-border payments leave treasury teams blind to transaction status once funds leave their bank account. Salesforce integration provides real-time visibility into every payment stage, from initiation through final settlement. Payment teams track transactions across multiple correspondent banks and jurisdictions without manual status checks or phone calls to banking partners.

This transparency eliminates the anxiety around international payments that forces companies to maintain excessive cash reserves. Transaction monitoring through Salesforce captures detailed routing information, FX conversion rates, and settlement confirmations in real-time (including correspondent bank fees and processing delays).

Finance teams identify bottlenecks immediately and take corrective action before payments fail or incur additional fees. Companies that use integrated payment tracking report fewer failed transactions compared to traditional banking channels that provide limited status updates.

Automated Reconciliation Cuts Manual Processing Time

Salesforce automation handles payment reconciliation that traditionally requires hours of manual work per transaction. The platform matches outgoing payments with bank confirmations, FX settlements, and vendor acknowledgments automatically. This eliminates the spreadsheet management and cross-referencing that consumes finance team resources (particularly for high-volume international operations).

Automated workflows trigger alerts when payments require attention or fail to settle within expected timeframes. These smart notifications prevent payments from falling through cracks while they reduce the need for constant manual monitoring. Treasury teams can focus on strategic decisions rather than administrative tasks that blockchain-powered automation handles more accurately.

Why Blockchain Payments Transform Salesforce Operations

Stablecoin payments, whether using USDT, USDC, or RLUSD, through Salesforce settle in under three minutes compared to the 1-3 business days that traditional wire transfers require. Treasury teams that use blockchain infrastructure facilitate real-time cross-border payments when traditional rails are closed, which eliminates the working capital constraints that force companies to maintain excess cash reserves across multiple markets. BVNK processes over $25 billion in annual payment volumes with instant settlement capabilities, which demonstrates how enterprise-scale operations benefit from immediate fund availability. Companies that convert from traditional correspondent banking to stablecoin payments reduce transaction costs by 80% while they gain 24/7 processing availability that traditional banking systems cannot match.

Stablecoin Infrastructure Cuts Processing Overhead

Blockchain payments eliminate correspondent banking fees that typically range from 3-5% per transaction while they remove FX markup costs that add another 2-4% to international transfers. Finance teams that use stablecoin payments through Salesforce avoid the manual reconciliation work that consumes hours per transaction in traditional systems. The straight-through processing rate for blockchain payments reaches 95% compared to the 26% STP rate for traditional B2B FX payments (according to LexisNexis research).

Smart contract automation handles payment execution, compliance checks, and settlement confirmation without human intervention, which reduces operational errors and processing delays significantly.

Enhanced Transaction Security and Audit Trails

Blockchain technology provides immutable transaction records that create comprehensive audit trails for compliance teams. Every payment generates cryptographic proof of execution that regulatory auditors can verify independently without reliance on banking intermediaries. Public-key cryptography protects transaction details while it maintains transparency for authorized parties, which eliminates the security vulnerabilities present in traditional correspondent banking networks.

Real-Time Visibility Replaces Traditional Delays

Salesforce captures detailed transaction data in real-time, which includes routing paths, settlement confirmations, and fee breakdowns that traditional banking systems often obscure or delay in reporting. Finance teams track every payment stage from initiation through final settlement without the blind spots that characterize traditional correspondent banking. This transparency allows treasury teams to identify bottlenecks immediately and take corrective action before payments fail or incur additional fees (particularly important for high-volume international operations).

Final Thoughts

Cross-border payments Salesforce integration through blockchain technology delivers measurable improvements that transform how global businesses manage international transactions. Companies reduce processing time from days to minutes while they cut transaction costs by up to 80% through stablecoin settlements. Real-time visibility eliminates the guesswork that plagues traditional correspondent banking, while automated reconciliation frees finance teams from manual processing overhead.

Global operations benefit from 24/7 payment availability that traditional banking systems cannot match. Treasury teams maintain better cash flow control without excess reserves across multiple markets. Enhanced security through cryptographic protection and immutable audit trails strengthens compliance frameworks while it reduces operational risk.

Implementation starts with assessment of current payment volumes and identification of high-friction international transfers that benefit most from blockchain optimization. We at Web3 Enabler provide blockchain solutions that enable organizations to modernize their payment infrastructure directly within existing Salesforce workflows. Finance teams can begin processing stablecoin payments and gain real-time transaction visibility without the need to leave their CRM environment (which streamlines operations significantly).