![Managing Corporate Treasury with USDC in Salesforce [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/usdc-treasury-hero-1763468077.jpeg) Corporate treasurers are ditching traditional banking headaches for something way more exciting: USDC treasury management. This digital dollar is reshaping how companies handle payments, settlements, and cash flow.

Corporate treasurers are ditching traditional banking headaches for something way more exciting: USDC treasury management. This digital dollar is reshaping how companies handle payments, settlements, and cash flow.

We at Web3 Enabler see businesses cutting transaction costs by up to 90% while speeding up international transfers from days to minutes. Your Salesforce system can become the command center for this financial revolution.

Why USDC Beats Traditional Banking

USDC represents a digital version of the US dollar that maintains 1:1 parity with traditional currency while operating on blockchain networks. Circle backs each USDC token with real dollar reserves, which makes it the most trusted stablecoin for corporate treasury operations. Companies choose USDC because it eliminates the friction that makes traditional banking feel like financial quicksand.

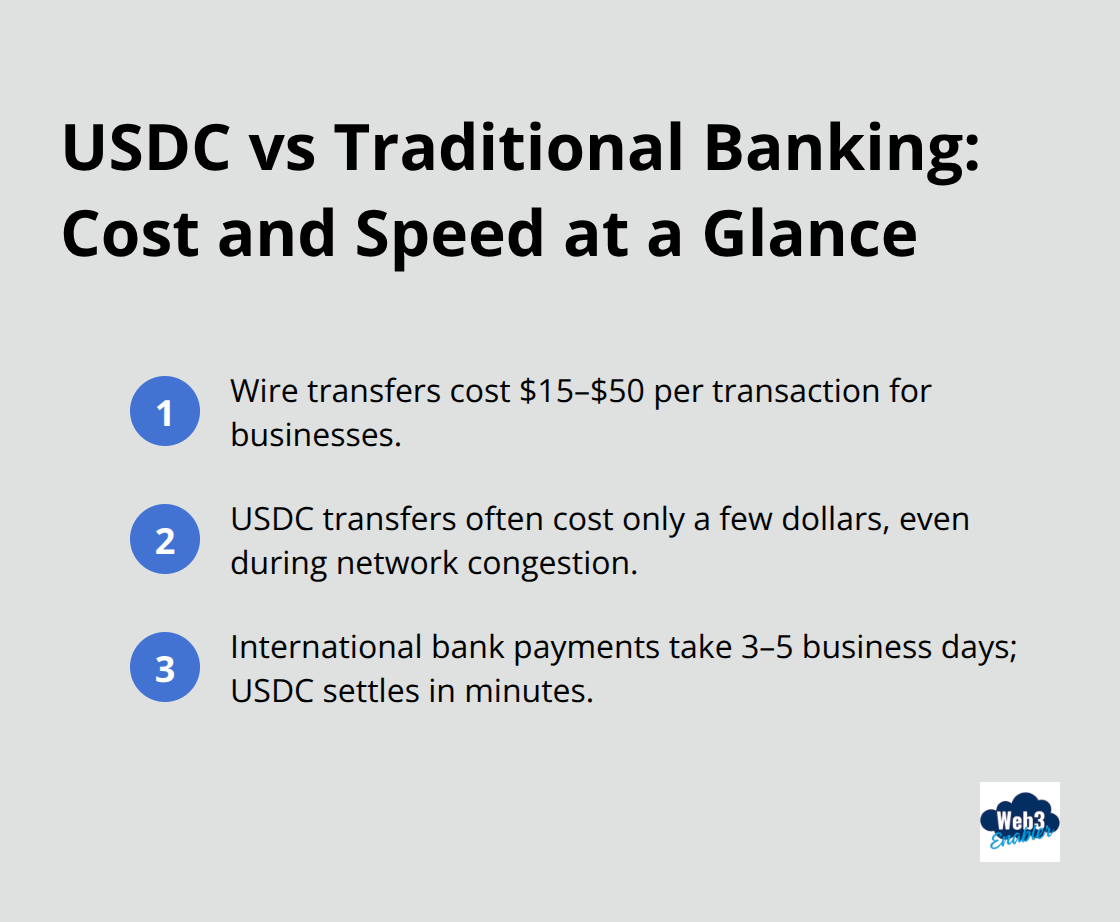

Traditional Banking Creates Expensive Bottlenecks

Wire transfers cost businesses between $15-50 per transaction according to Federal Reserve data, while USDC transfers might cost a few dollars during network congestion – still significantly cheaper than traditional methods. International payments through correspondent banking networks take 3-5 business days and involve multiple intermediary fees. USDC settlements happen in minutes, not days. MoonPay reports 112% year-over-year net revenue growth in 2025, largely driven by businesses that switch from traditional payment rails to stablecoin infrastructure.

Corporate Treasurers See Real Cost Savings

Shopify merchants who use USDC through Coinbase’s payment integration save up to 2.9% on transaction fees compared to credit card processing. Companies that process $10 million annually in international payments can save $200,000-300,000 when they switch to USDC rails. Ramp’s corporate clients report over $2 billion in savings through their stablecoin-backed spend management platform. BitPay processes over 600,000 transactions annually, with stablecoins that represent the majority of volume because businesses prefer the predictable costs and faster settlement times.

Real Companies Choose USDC for Treasury Operations

Tesla holds USDC on its balance sheet for operational liquidity. Stripe enables millions of merchants to accept USDC payments through its platform integration. PayPal allows business accounts to hold and transact in USDC for cross-border commerce. These companies recognize that stablecoins provide the stability of traditional currency with the efficiency of digital infrastructure.

Your Salesforce system can become the control center for these same treasury operations (with the right integration strategy). The next step involves connecting your existing workflows to USDC payment rails without disrupting your current processes.

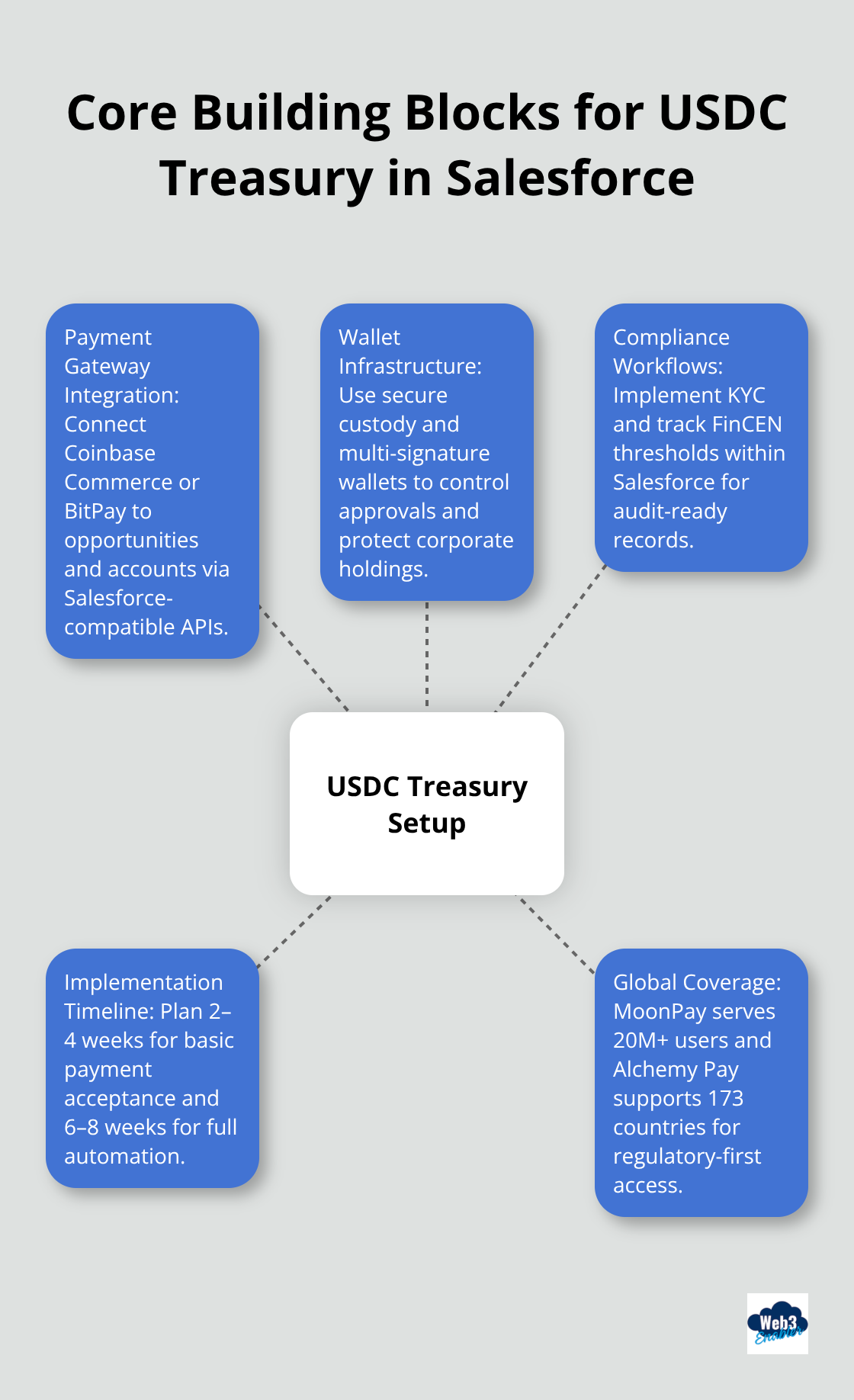

How Do You Set Up USDC Treasury in Salesforce

Your Salesforce org requires three critical components to handle USDC treasury operations: a blockchain payment gateway integration, proper wallet infrastructure, and compliance tracking workflows. Coinbase Commerce and BitPay offer Salesforce-compatible APIs that connect directly to your existing opportunity and account records. MoonPay’s enterprise solution integrates with over 20 million users’ payment flows, while Alchemy Pay supports 173 countries through its regulatory-first approach. The integration process typically takes 2-4 weeks for basic payment acceptance and 6-8 weeks for full treasury automation.

Treasury Workflow Integration Strategy

Connect your USDC payment gateway to Salesforce custom objects that track digital asset transactions alongside traditional payment records. Create automated workflows that trigger when USDC payments exceed $10,000 – this threshold requires additional compliance documentation under current FinCEN guidance. Ramp’s corporate clients save over $2 billion through automated spend management that categorizes USDC transactions directly within their existing expense reporting systems. Your accounts receivable team needs real-time visibility into USDC settlement status, which requires custom Lightning components that display blockchain transaction confirmations.

Security and Compliance Framework

Multi-signature wallet configurations provide the strongest security for corporate USDC holdings. These setups require 2-of-3 or 3-of-5 signature approvals for transactions above predetermined thresholds. Circle’s institutional custody solutions integrate with Salesforce through secure API connections that maintain audit trails for regulatory reporting. Your compliance team must implement Know Your Customer verification for all USDC counterparties (which adds 24-48 hours to the initial transaction setup but reduces ongoing regulatory risk). Treasury teams should maintain separate hot and cold wallet addresses – hot wallets for daily operations under $50,000 and cold storage for larger reserves that require board-level approval for access.

Payment Processing Configuration

Configure your Salesforce payment objects to handle both traditional and USDC transaction records within the same customer account view. Set up automated reconciliation workflows that match blockchain transaction hashes with your internal payment records. Your finance team can track settlement times that average 2-3 minutes for USDC compared to 3-5 business days for wire transfers. Payment processing fees drop to under $5 per transaction regardless of amount, which creates significant cost advantages for high-volume operations.

Once your basic USDC infrastructure operates smoothly within Salesforce, the next step focuses on advanced automation that transforms how your treasury team handles daily payment operations.

How Do You Automate USDC Treasury Operations

Your Salesforce org needs automated workflows that handle USDC payment reconciliation without manual intervention. Configure Process Builder flows that trigger when blockchain transaction confirmations reach your webhook endpoints – this eliminates the 2-3 hour delays that treasury teams face with manual verification processes. Ramp processes over $2 billion in automated transactions through their platform, while BitPay handles 600,000 annual transactions with automated matches between blockchain records and internal payment systems.

Your finance team should set up custom Lightning components that display real-time USDC balances alongside traditional cash positions within the same dashboard view. Treasury automation creates significant labor savings for teams that handle over 100 monthly payments.

Exchange Rate Stability Transforms Multi-Currency Operations

USDC eliminates foreign exchange volatility that costs businesses 2-4% on international transactions through traditional banks. Circle maintains USDC at exactly $1.00 parity, which means your Salesforce currency conversion workflows can use fixed rates instead of fluctuating FX spreads. Companies that operate in multiple countries save $50,000-150,000 annually when they avoid currency hedges and switch to USDC for cross-border payments.

Configure your Salesforce org to track USDC transactions in the recipient’s local currency equivalent while you maintain the actual settlement in stable digital dollars. MoonPay’s 112% revenue growth stems largely from businesses that prefer predictable exchange rates over traditional banks’ variable FX fees.

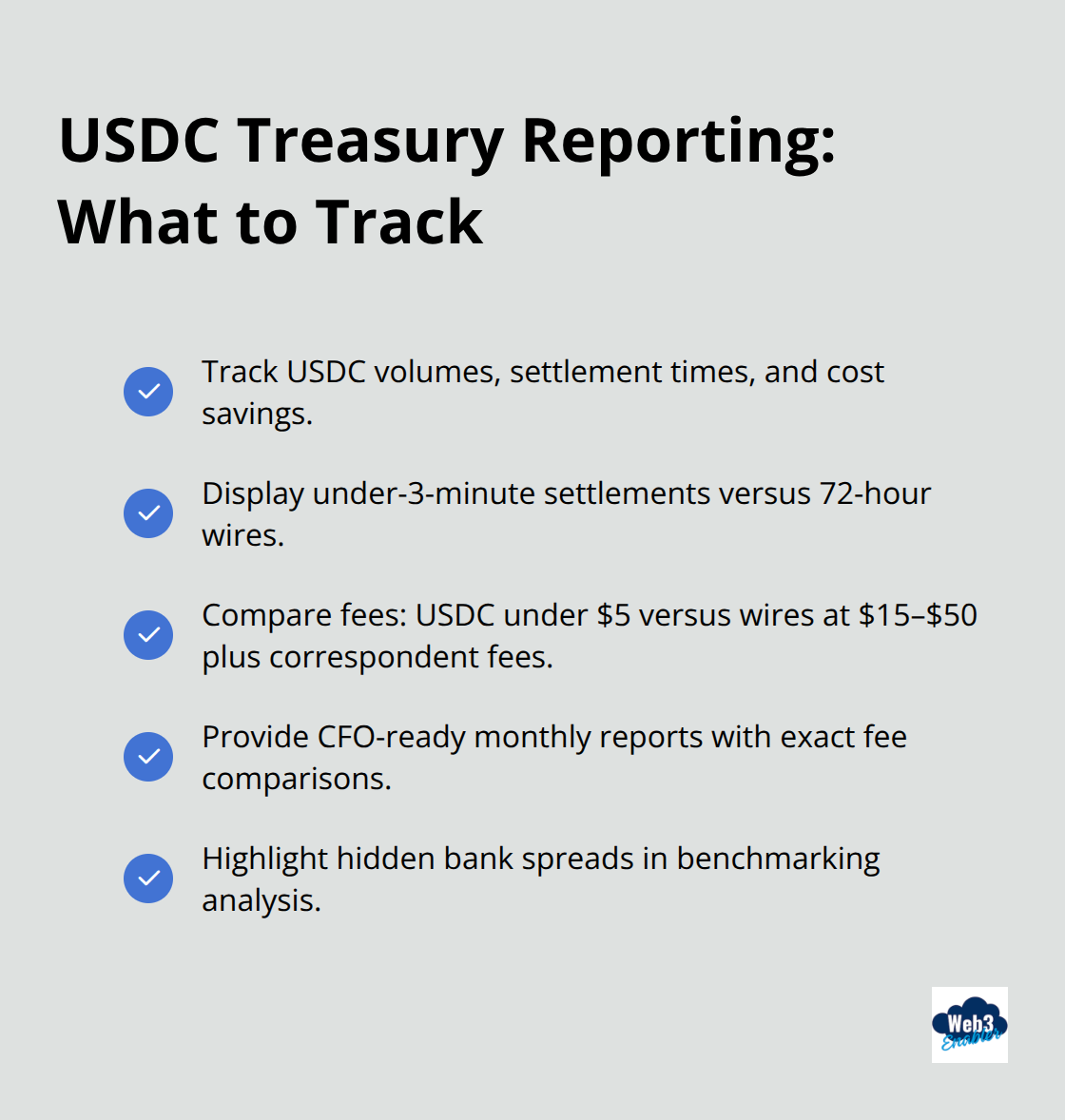

Financial Reports Provide Real-Time Visibility

Custom Salesforce reports should track USDC transaction volumes, settlement times, and cost savings compared to traditional payment methods. Create dashboards that display average settlement times under 3 minutes versus 72-hour wire transfer delays. Your CFO needs monthly reports that show exact fee comparisons – USDC transactions typically cost under $5 regardless of amount while wire transfers range from $15-50 plus correspondent fees (not to mention the hidden spreads banks love to sneak in).

Treasury teams can configure automated alerts when USDC wallet balances drop below operational thresholds or when large transactions exceed board-approved limits. Financial visibility improves dramatically when blockchain transaction data flows directly into your existing Salesforce reports without separate reconciliation processes.

Final Thoughts

USDC treasury management in Salesforce delivers measurable results that traditional banks cannot match. Your finance team gains access to sub-$5 transaction fees, 2-3 minute settlement times, and eliminates foreign exchange volatility that typically costs businesses 2-4% on international payments. Companies that process $10 million annually save $200,000-300,000 when they switch from wire transfers to USDC rails.

Implementation requires careful attention to compliance workflows, multi-signature wallet security, and automated reconciliation processes. Your treasury operations need 2-4 weeks for basic payment setup and 6-8 weeks for full automation deployment. The technical complexity drops significantly when you work with experienced blockchain partners (who understand both Salesforce architecture and digital asset infrastructure).

We at Web3 Enabler provide Salesforce Native blockchain solutions available on the AppExchange. Our tools support payments, compliance, and automation workflows that connect blockchain technology with existing corporate systems. Web3 Enabler specializes in USDC treasury solutions that transform expensive, slow traditional processes into efficient digital asset management that saves money and improves cash flow visibility.

![Accepting Crypto Payments in Salesforce [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/salesforce-crypto-payments-hero-1763468205.jpeg)