Cross-border payments with crypto are revolutionizing international transactions. At Web3 Enabler, we’ve seen businesses slash costs and speed up transfers by embracing this technology.

Say goodbye to hefty bank fees and hello to lightning-fast settlements. This guide will show you how to harness the power of cryptocurrencies for your global payment needs.

Why Crypto Beats Traditional Cross-Border Payments

Cross-border payments have long been a pain point for businesses. Traditional methods are slow, expensive, and often lack transparency. Cryptocurrencies are changing this landscape dramatically.

Speed and Cost Savings

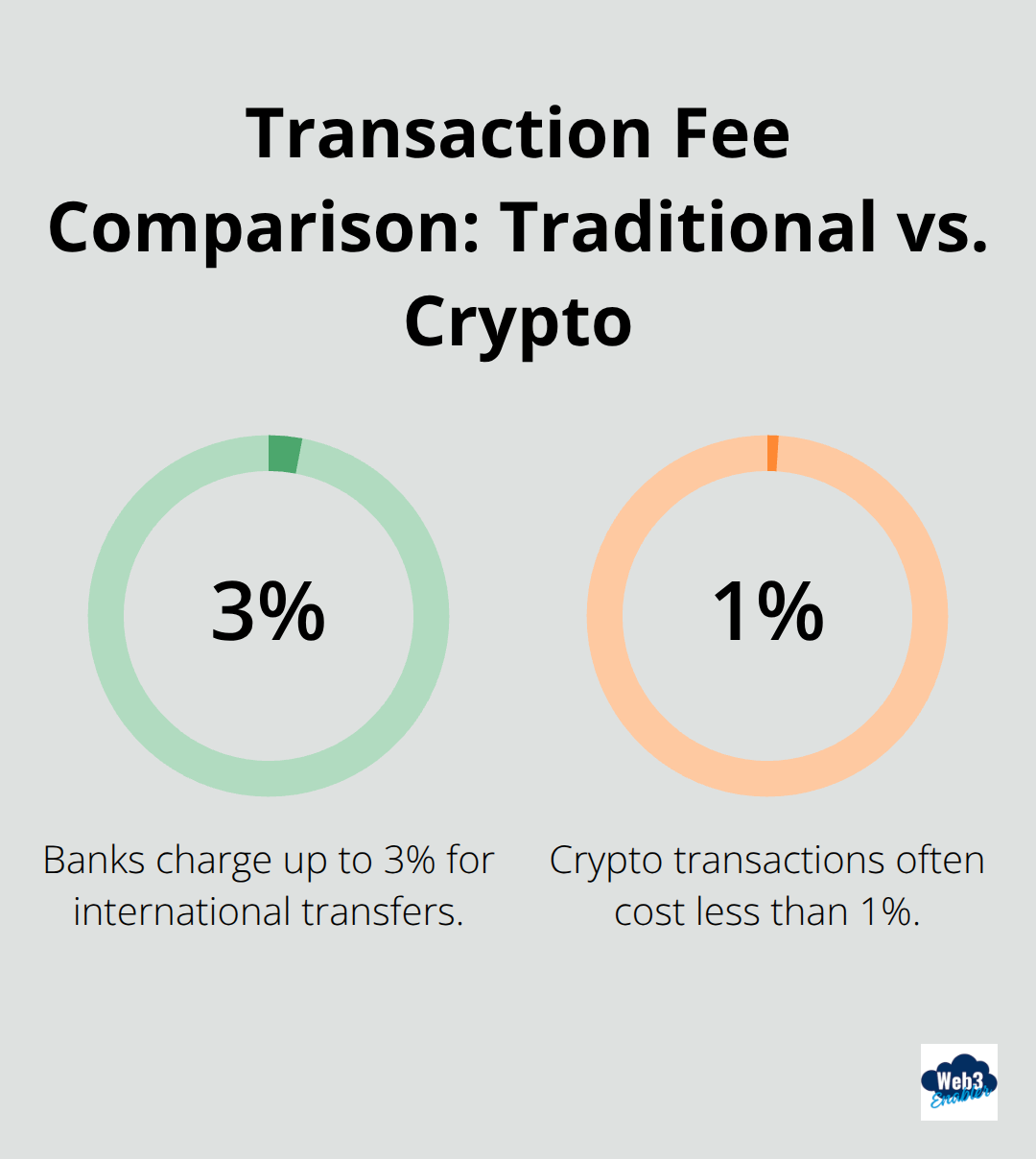

Crypto transforms international transfers from a days-long process to a matter of minutes. The cost savings are substantial too.

(Real-world example: An e-commerce company saved over $100,000 in fees in just six months after switching to crypto payments.)

Transparency and Security

Crypto transactions are recorded on a public blockchain, which makes them fully traceable. This transparency reduces the risk of fraud and errors. The decentralized nature of cryptocurrencies also enhances security by eliminating a single point of failure.

Popular Cryptocurrencies for Business

While Bitcoin started the crypto revolution, it’s not always the best choice for business transactions due to its volatility. Stablecoins like USDC and USDT are gaining traction. These coins are pegged to fiat currencies, offering stability while retaining the benefits of crypto.

Ripple’s XRP is another popular option, designed specifically for cross-border payments. Major banks use it, and it can settle transactions in seconds.

Overcoming Volatility

The price swings of cryptocurrencies can be a concern for businesses. However, solutions exist:

- Use stablecoins: These maintain a steady value relative to fiat currencies.

- Instant conversion services: These tools allow you to lock in exchange rates, protecting you from market fluctuations.

(Pro tip: Always check the latest regulations in your jurisdiction before implementing crypto payment solutions.)

The Future of Cross-Border Payments

The future of cross-border payments is undoubtedly crypto-based. It offers faster, cheaper, and more secure transactions than traditional methods. As more businesses adopt this technology, those who stick to old systems risk falling behind.

Now that we’ve explored why crypto is superior for cross-border payments, let’s move on to the practical aspects. In the next section, we’ll guide you through setting up your crypto payment system, ensuring you’re ready to harness these benefits for your business.

How to Set Up Your Crypto Payment System

Choose the Right Cryptocurrency Wallet

Your crypto wallet forms the foundation of your payment system. For businesses, we recommend a combination of hot and cold wallets. Hot wallets connect to the internet and suit day-to-day transactions. Cold wallets, which remain offline, provide enhanced security for larger amounts.

For hot wallets, consider options like MetaMask or Coinbase Wallet. These user-friendly options integrate well with various payment systems. For cold storage, hardware wallets like Ledger or Trezor set the industry standard.

At Web3 Enabler, we pride ourselves in being wallet agnostic. But we do have a native Salesforce wallet built on Circle’s Programmable Wallet Technology. It’s great for easy payments.

Select a Reliable Cryptocurrency Exchange

A reputable exchange allows you to convert between cryptocurrencies and fiat money. Look for exchanges with high liquidity, strong security measures, and support for your chosen cryptocurrencies.

We use Bridge (Stripe Crypto) for easy On-ramps and Off-ramps, without leaving Salesforce. Just setup a virtual account for your Network/Coin combo, and then ACH or Wire the funds to get crypto. If you are doing high volumes, there may be ways to get slightly cheaper rates, but for low volume users, we aim for convenience.

Integrate Crypto Payments into Your Business

This step transforms your business into a crypto-ready powerhouse. Native Salesforce solutions make it easy to accept crypto payments directly through your CRM. For businesses not using Salesforce, options like BitPay or Coinbase Commerce exist.

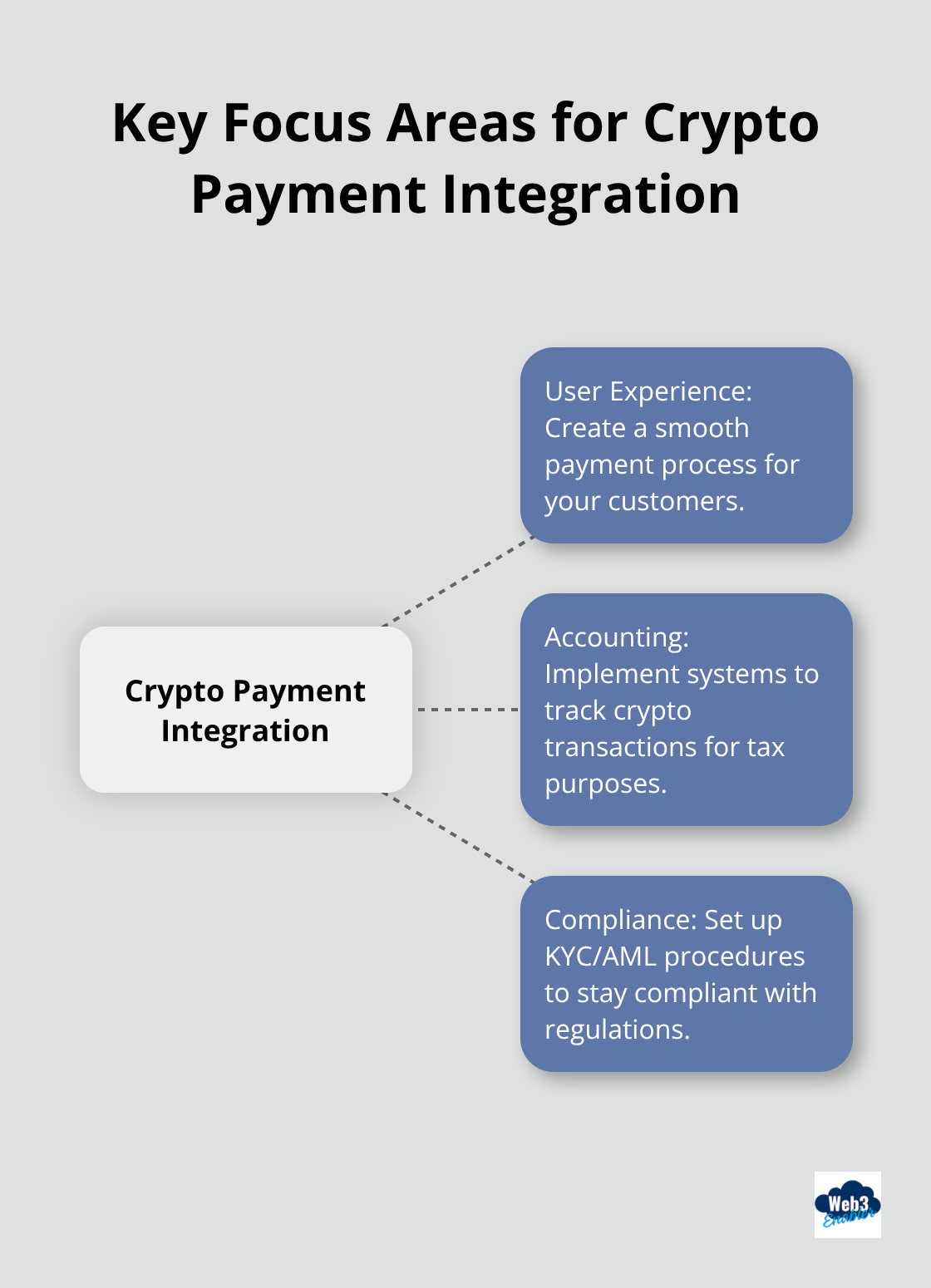

When you integrate, focus on these key areas:

The key to successful implementation? Choose solutions that mesh seamlessly with your existing business processes. (Don’t hesitate to seek expert help – it can save time and prevent costly mistakes.)

Test and Refine Your System

Before full deployment, conduct thorough testing of your crypto payment system. Start with small, internal transactions to identify any issues. Gradually increase the volume and complexity of transactions to ensure your system can handle real-world scenarios.

Collect feedback from both your team and a select group of trusted customers. Use this information to refine and optimize your payment process. This iterative approach helps you create a robust, user-friendly system that meets the needs of your business and customers.

Train Your Team

The success of your crypto payment system depends on your team’s ability to use and manage it effectively. Provide comprehensive training to all relevant staff members. Cover topics such as:

- Basic cryptocurrency concepts

- How to use your chosen wallet and exchange

- Security best practices

- Troubleshooting common issues

Regular training sessions keep your team up-to-date with the latest developments in crypto payments and ensure they can provide excellent support to your customers.

Now that you’ve set up your crypto payment system, it’s time to explore best practices for managing cross-border transactions effectively. Let’s move on to the next chapter, where we’ll discuss strategies for handling exchange rate volatility, ensuring regulatory compliance, and implementing robust security measures.

How to Optimize Crypto Cross-Border Payments

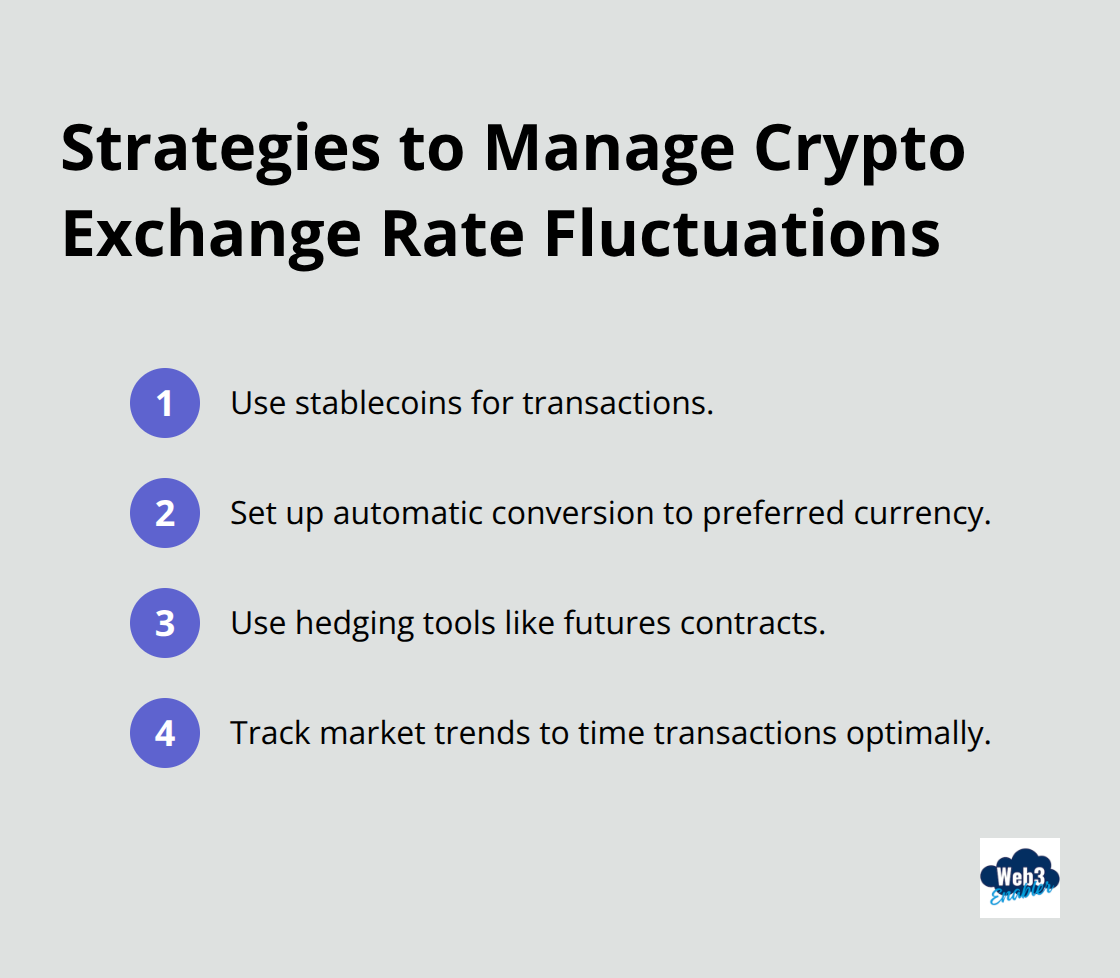

Manage Exchange Rate Fluctuations

Crypto markets often experience volatility. Protect your business with these strategies:

Use stablecoins for transactions. USDC and USDT provide crypto benefits without price swings.

Navigate the Regulatory Landscape

Compliance plays a key role in crypto payments. Follow these steps to adhere to regulations:

- Understand your jurisdiction’s rules. Crypto regulations differ widely. Research local laws thoroughly or consult legal experts.

- Establish robust KYC/AML procedures. Use tools to verify customer identities and flag suspicious transactions.

- Maintain detailed records. Keep comprehensive transaction logs. This supports audits and demonstrates compliance efforts.

- Monitor regulatory changes. The crypto landscape evolves rapidly. Provide regular training for your team to ensure ongoing compliance.

Strengthen Security Measures

Security breaches can devastate your business. Protect your crypto assets with these measures:

- Use multi-signature wallets. These require multiple approvals for transactions, which reduces the risk of unauthorized transfers.

- Implement cold storage. Store the majority of your crypto in offline wallets, safe from online threats.

- Update your software regularly. Ensure all wallets and related tools run the latest, most secure versions.

- Train your team. Human error poses a significant security risk. Provide regular training on best practices.

- Partner with reputable service providers. Choose established names in the crypto industry. Their security measures can enhance your own.

Streamline Payment Processes

Efficient processes maximize the benefits of crypto payments:

- Integrate with existing systems. (Web3 Enabler offers seamless integration with Salesforce, streamlining your payment workflows.)

- Automate where possible. Set up automatic payments for recurring transactions to save time and reduce errors.

- Provide clear instructions. Create easy-to-follow guides for your clients on how to make crypto payments.

- Offer multiple crypto options. Support various cryptocurrencies to cater to different client preferences.

Monitor and Analyze Performance

Regular assessment helps optimize your crypto payment strategy:

- Track key metrics. Monitor transaction speeds, fees, and conversion rates.

- Gather feedback. Ask your clients and team about their experiences with the crypto payment system.

- Compare with traditional methods. Regularly assess the benefits of crypto payments against conventional options.

- Stay informed about new developments. The crypto world evolves rapidly. Keep an eye on emerging technologies and trends that could benefit your business.

Final Thoughts

Cross-border payments with crypto revolutionize international transactions. Businesses save money and time with faster settlements, lower costs, and increased transparency. The future of global commerce will rely on crypto-based payments as more companies recognize these advantages.

Implementing a crypto payment system requires careful planning and execution. Choosing the right wallet, ensuring compliance, and integrating with existing systems are critical steps. Expert guidance can make a significant difference in this process.

We at Web3 Enabler help businesses leverage blockchain technology for cross-border payments crypto solutions. Our platform enables companies to accept stablecoin payments and send global payments faster and cheaper. (We partner with industry leaders to provide advanced and reliable blockchain solutions.) Don’t let your business fall behind in the evolving landscape of international payments.