Traditional payment systems are stuck in the stone age with their sluggish processing times and hefty fees. The advantages of stablecoins are reshaping how businesses handle digital transactions.

Traditional payment systems are stuck in the stone age with their sluggish processing times and hefty fees. The advantages of stablecoins are reshaping how businesses handle digital transactions.

We at Web3 Enabler see companies ditching outdated banking rails for faster, cheaper alternatives. Stablecoins offer the speed of crypto without the wild price swings that make CFOs break out in cold sweats.

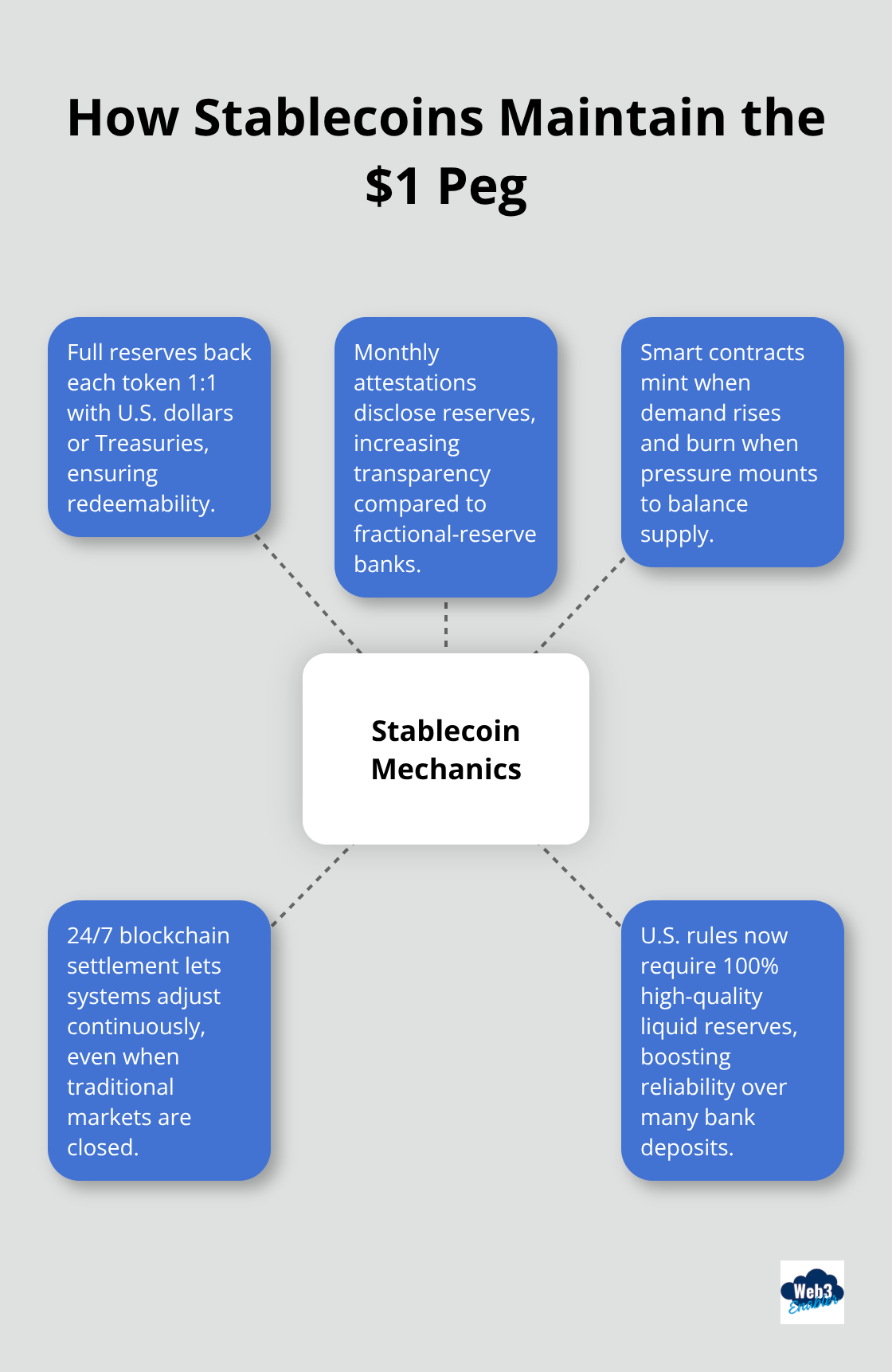

How Do Stablecoins Actually Work

Think of stablecoins as digital dollars that live on the blockchain. These cryptocurrencies maintain their value at exactly $1 through full reserve systems that back each token with real US dollars or Treasury bills. Tether USDT dominates with $183 billion in circulation, while Circle’s USDC follows at $76 billion. The magic happens when every digital token represents an actual dollar that sits in a bank account.

The Reserve Game Changes Everything

Fully reserved stablecoins like USDC store their assets with regulated financial institutions. Circle publishes monthly attestation reports that show exactly what backs each token. This transparency beats traditional banks, where your deposits get loaned out to other customers (goodbye, fractional reserve system). The GENIUS Act now mandates that all US stablecoins must maintain 100% reserves in high-quality liquid assets, which makes them more reliable than many bank deposits.

Smart Contracts Keep the Peg Tight

Algorithmic stablecoins use automated systems to maintain their dollar peg without human intervention. When demand increases, smart contracts mint new tokens. When pressure mounts, the system burns tokens to reduce supply. This programmable money responds to market conditions faster than any human trader could react.

The blockchain processes these adjustments 24/7 and maintains stability even when traditional markets close.

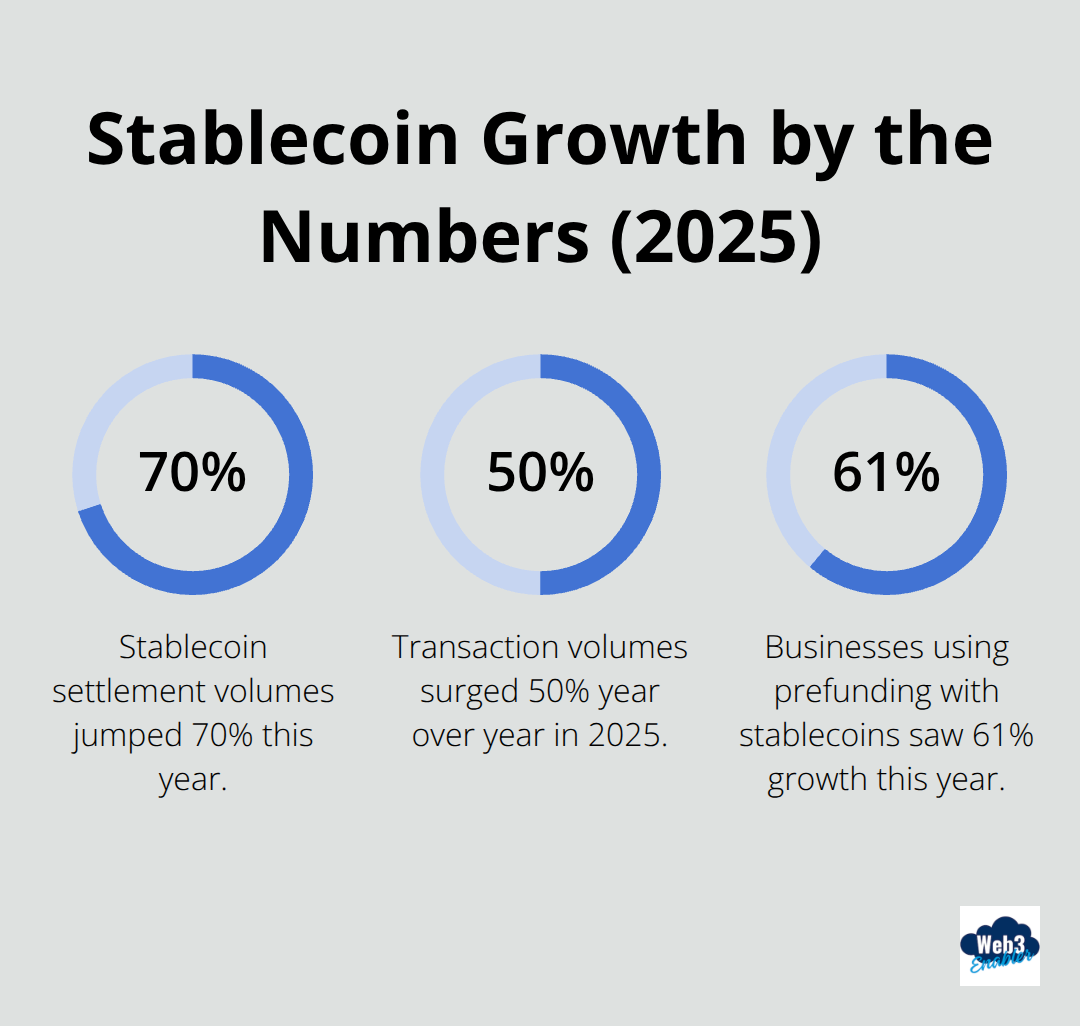

Market Growth Shows Real Adoption

J.P. Morgan Global Research projects the stablecoin market could hit $500–750 billion as more businesses adopt these automated payment rails. Transaction volumes surged 50% year over year in 2025, which reflects actual usage rather than speculation. Corporate payments now account for nearly two-thirds of total stablecoin volume, with B2B transactions more than doubling since February to $6.4 billion monthly.

These numbers tell us something important: businesses have found real value in stablecoin payments that goes far beyond the hype.

Why Stablecoins Beat Traditional Payment Systems

Stablecoin settlement volumes jumped 70% this year, rising from $6 billion in February to over $10 billion by August according to recent payment data. Traditional wire transfers take one to three days to clear while stablecoin transactions confirm within minutes regardless of weekends or holidays. Credit card processors charge merchants 2.9% plus fees, but stablecoin transactions cost pennies to a few dollars maximum. Stripe now processes over $1.5 billion monthly in crypto card payments, which shows businesses have moved beyond pilot programs to real adoption.

International Payments Skip the Banking Maze

Cross-border payments through banks involve multiple intermediaries that each take their cut and add processing time. Wells Fargo charges $15-50 for international wires plus correspondent bank fees that can reach $25 more per transaction. Stablecoins eliminate these middlemen entirely since transactions flow directly between wallets on the blockchain. Companies that use Circle’s payment infrastructure report savings of 40-60% on international transfer costs while they receive funds the same day instead of waiting up to five business days. Monthly B2B stablecoin payment volume more than doubled since February to $6.4 billion, which proves cost savings drive real business decisions.

Round-the-Clock Operations Change Cash Flow

Banks shut down at 5 PM and stay closed weekends, but blockchain networks process payments continuously. This 24/7 availability lets companies manage cash flow in real-time rather than wait for banking hours to move money between accounts. Businesses that use prefunding methods to maintain liquidity with stablecoins saw 61% growth this year as they gain control over when payments settle. Friday evening payments that would normally sit until Monday now clear immediately, which improves working capital efficiency and supplier relationships.

Transaction Fees Drop to Almost Nothing

Traditional payment systems drain business profits through excessive fees (credit cards alone cost merchants $187 billion annually in processing fees). Stablecoins flip this model on its head with transaction costs that rarely exceed a few dollars. International wire transfers that cost $40-75 through banks now cost under $5 with stablecoins. These savings compound quickly for businesses that process hundreds or thousands of payments monthly, freeing up capital for growth instead of banking fees.

The real question becomes whether your business can afford to ignore these advantages while competitors gain operational efficiency through modern payment rails.

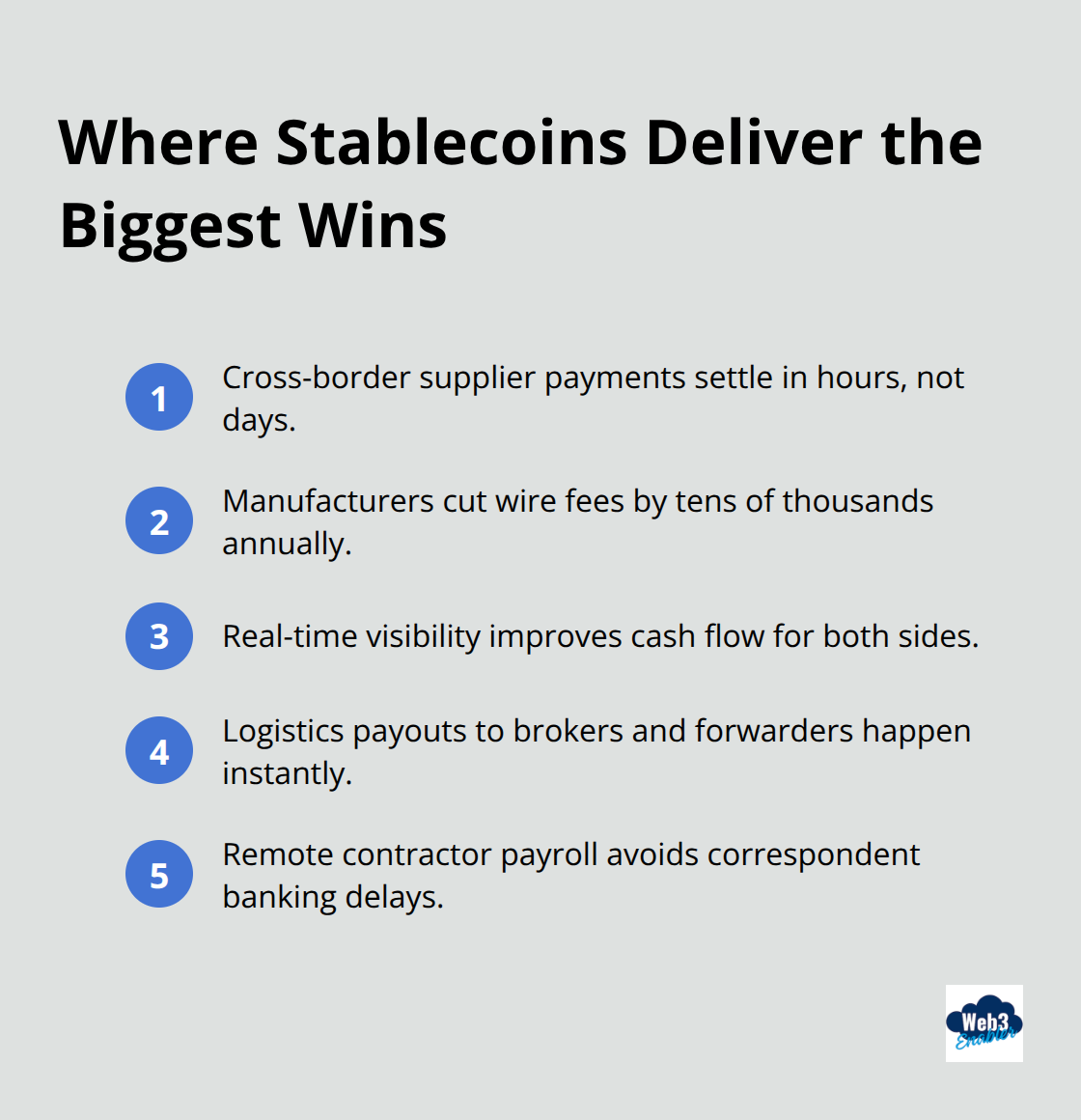

Where Stablecoins Actually Work Best

Supply chain finance through stablecoins transforms how manufacturers pay suppliers across borders without traditional bank delays. Tesla processes international supplier payments through stablecoin rails that settle within hours instead of the typical 3-5 business days that SWIFT transfers require. Manufacturing companies that source components from Asia report annual savings of $50,000-200,000 on wire transfer fees alone when they switch to USDC payments. Blockchain transaction transparency lets finance teams track every payment in real-time while suppliers receive funds immediately, which improves cash flow for both parties. Global logistics companies now use stablecoins to pay freight forwarders and customs brokers instantly, which eliminates the float time that traditionally ties up capital for weeks.

Remote Workforce Payment Revolution

Companies with distributed teams benefit from lower costs when they pay international contractors through stablecoins rather than traditional remittance services. Money transfer services usually beat conventional banks with better rates and lower fees while stablecoin payments cost under $5 regardless of amount. GitLab and other remote-first companies process contractor payments in over 50 countries through stablecoin infrastructure that bypasses correspondent banks entirely. Freelancers in Nigeria and Venezuela prefer USDC payments because they can convert to local currency immediately through peer-to-peer exchanges (this avoids the multi-day holds that traditional banks impose on foreign wire transfers).

Subscription Business Models Get Smarter

E-commerce platforms that integrate stablecoin payments eliminate chargeback fraud that costs merchants $117 billion globally each year according to Nilson Report data. Subscription businesses that use Stripe’s crypto payment processing see 23% lower payment failure rates compared to traditional card payments because stablecoin transactions cannot bounce due to insufficient funds or expired cards. SaaS companies that bill customers in USDC avoid foreign exchange volatility that typically reduces profit margins by 2-4% on international subscriptions, while customers gain predictable prices without currency conversion fees that credit cards add to cross-border transactions (this creates a win-win scenario for both parties).

Final Thoughts

The advantages of stablecoins for digital payments transform business finance faster than anyone predicted. Companies save 40-60% on international transfer costs while they gain 24/7 payment processing that traditional banks cannot match. Transaction volumes that doubled to $6.4 billion monthly in B2B payments prove this shift moves beyond experimental adoption.

Businesses that embrace stablecoin infrastructure gain competitive advantages through instant settlement, minimal fees, and elimination of chargeback fraud. The regulatory clarity from the GENIUS Act removes uncertainty while major processors like Stripe make integration seamless for existing operations. Smart companies start with pilot programs for international supplier payments or contractor payroll to test these benefits firsthand.

Web3 Enabler provides Salesforce-native blockchain solutions that connect stablecoin payments directly to existing CRM workflows without disruption to current operations. Our tools support compliance requirements while they enable faster, cheaper global transactions that improve cash flow management. The question becomes whether your business can afford to wait while competitors gain operational efficiency through modern payment rails (spoiler alert: they probably can’t).