The Clarity for Payment Stablecoins Act of 2025 just changed the game for businesses using digital payments. This new legislation brings clear rules to an industry that’s been operating in regulatory gray areas.

The Clarity for Payment Stablecoins Act of 2025 just changed the game for businesses using digital payments. This new legislation brings clear rules to an industry that’s been operating in regulatory gray areas.

We at Web3 Enabler know you’re probably wondering what this means for your company’s payment operations. The short answer? It’s time to get compliant or get left behind.

What Does the New Stablecoin Law Actually Require?

The GENIUS Act forces stablecoin issuers to back their tokens with highly liquid assets like short-term U.S. Treasury bills and cash equivalents. This requirement transforms how stablecoins operate, abandoning the previous wild west approach where reserve compositions remained opaque. Issuers must now provide monthly disclosures of their reserve assets, creating transparency that businesses can actually trust. The law also establishes reserve requirements that provide an additional and growing source of demand for Treasurys, which directly impacts stablecoin projects and their growth strategies.

Reserve Requirements Hit Different Stablecoins Differently

Tether, which controls over 60% of the $300 billion stablecoin market, already holds significant U.S. Treasury positions and ranks as the seventh-largest global buyer of Treasuries as of 2024. This positions established players like Tether and USDC favorably under the new rules. Smaller algorithmic stablecoins face extinction since they cannot meet the liquid asset requirements.

Asset-backed stablecoins tied to commodities or foreign currencies now operate under stricter oversight, with foreign currency reserves that introduce potential volatility (which regulators will monitor closely).

Compliance Infrastructure Becomes Non-Negotiable

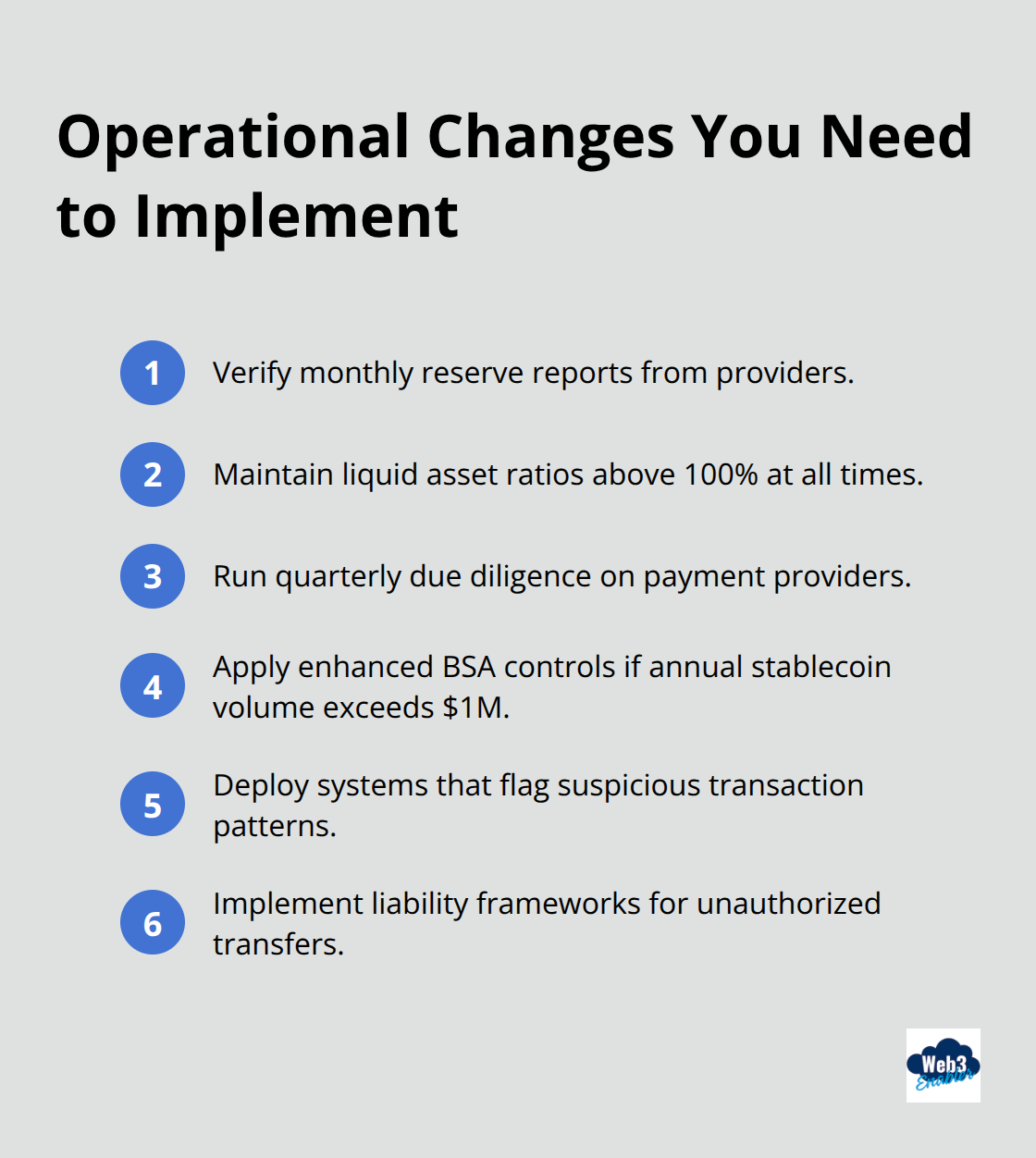

Companies that use stablecoins must now verify that their chosen providers comply with monthly reports and maintain proper reserve ratios. The law subjects new digital commodity exchanges to Bank Secrecy Act obligations, which means enhanced anti-money laundering procedures for businesses that process stablecoin payments. Payment service providers must implement stronger safeguards and liability structures, as the traditional protections consumers expect do not automatically extend to stablecoin transactions.

What This Means for Your Payment Operations

This regulatory framework eliminates the compliance uncertainty that previously made many enterprises hesitant to adopt stablecoin payment solutions. Companies can now confidently integrate stablecoins into their treasury operations (knowing their providers meet federal standards). The monthly transparency requirements also give finance teams the visibility they need to make informed decisions about which stablecoins to accept or hold.

These new compliance standards create both opportunities and challenges for businesses ready to modernize their payment infrastructure.

What Changes for Your Business Operations

The GENIUS Act transforms how companies handle stablecoin payments and treasury management. Finance teams must now verify that their stablecoin providers submit monthly reserve reports and maintain liquid asset ratios above 100%. This verification process requires new due diligence procedures where treasury departments audit their payment providers quarterly rather than annually.

Companies that process over $1 million in stablecoin transactions annually face enhanced Bank Secrecy Act obligations, which include transaction systems that flag suspicious patterns and mandatory reports to FinCEN. Payment service providers must implement liability frameworks that protect against unauthorized transfers, since stablecoin transactions lack the consumer protections that traditional payment systems offer.

Treasury Operations Require Immediate Restructure

Corporate treasury departments gain significant advantages from the new regulatory clarity, but operational changes are mandatory. Companies can now confidently hold stablecoins as cash equivalents on balance sheets, since they know their assets meet federal standards. However, finance teams must establish new processes to monitor reserve disclosures and assess counterparty risk among stablecoin issuers. The monthly transparency requirements enable real-time liquidity management across global operations, with settlement times that drop from three days via SWIFT to near-instant blockchain transfers. Risk management protocols must account for the irreversible nature of blockchain transactions and the absence of chargeback mechanisms that exist with credit cards.

Legal Frameworks Shift Liability and Compliance Costs

Legal departments face new compliance burdens as the act subjects stablecoin operations to federal oversight while it allows state-level regulation for certain activities. Companies must establish clear policies for private key management, as lost access means permanent fund loss without recourse mechanisms. The GENIUS Act modernizes finance with regulated stablecoins, cutting costs and enabling banks and businesses to innovate securely. However, the regulatory certainty reduces legal uncertainty that previously made stablecoin adoption risky for enterprise clients.

Payment Infrastructure Demands New Security Protocols

Payment teams must implement enhanced security measures that address the unique risks of blockchain transactions. Unlike traditional payments, lost private keys represent a significant threat since no recovery mechanisms exist. Companies need whitelisted transaction protocols and multi-signature wallet configurations to prevent unauthorized transfers. The irreversible nature of stablecoin payments requires pre-transaction verification systems that traditional payment processors don’t need.

These operational changes create the foundation for the compliance infrastructure that your business needs to build next.

How to Build Bulletproof Stablecoin Compliance

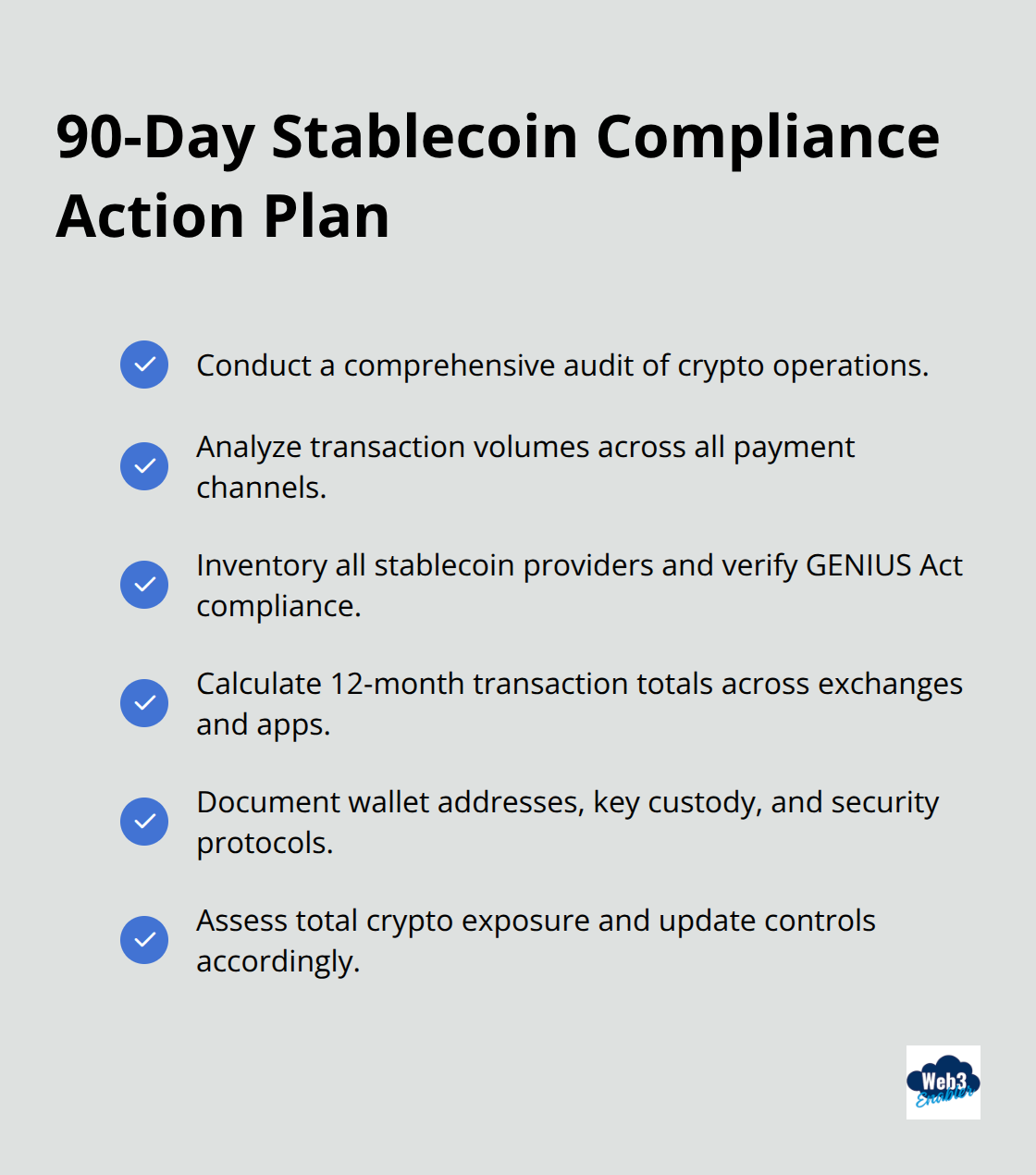

Your finance team must conduct a comprehensive audit of existing cryptocurrency operations within the next 90 days. Start with transaction volume analysis across all payment channels, then inventory every stablecoin provider your company currently uses and verify their GENIUS Act compliance status. Crypto exchanges are evolving into super apps, integrating trading, payments, and DeFi into unified ecosystems, so calculate your 12-month transaction totals immediately.

Document all wallet addresses, private key custody arrangements, and existing security protocols. Most companies discover they have three times more cryptocurrency exposure than initially estimated during these audits.

Compliance Infrastructure Demands Immediate Investment

Build proper compliance infrastructure by implementing transaction monitoring systems that flag suspicious patterns automatically and establish quarterly due diligence processes for all stablecoin providers. Your legal team must create policies for private key management, multi-signature wallet configurations, and incident response procedures for lost access scenarios. Treasury departments need real-time dashboard access to monitor reserve disclosures from stablecoin issuers monthly. The compliance burden costs approximately $250,000 annually for mid-sized companies according to recent industry surveys (but non-compliance penalties far exceed these investments).

Regulated Providers Become Your Competitive Advantage

Choose stablecoin providers that already submit monthly reserve reports and maintain liquid asset ratios above regulatory minimums. Tether and USDC lead in compliance readiness, while smaller issuers struggle with new requirements. Establish direct relationships with regulated digital commodity exchanges rather than using intermediary services that add compliance layers. Payment service providers must demonstrate liability frameworks that protect against unauthorized transfers and provide transaction verification systems.

Security Protocols Must Address Blockchain-Specific Risks

Implement enhanced security measures that address the unique risks of blockchain transactions. Lost private keys represent a significant threat since no recovery mechanisms exist (unlike traditional banking systems). Companies need whitelisted transaction protocols and multi-signature wallet configurations to prevent unauthorized transfers. The irreversible nature of stablecoin payments requires pre-transaction verification systems that traditional payment processors don’t need. Multi-factor authentication becomes mandatory for all wallet access, with hardware security modules recommended for high-value transactions.

Final Thoughts

The Clarity for Payment Stablecoins Act of 2025 removes regulatory uncertainty that previously blocked enterprise adoption. Companies now operate with clear compliance standards, monthly transparency requirements, and federal oversight that creates trust in digital payment systems. Your business must act quickly to audit existing cryptocurrency operations, verify provider compliance, and implement proper security protocols.

The companies that build robust compliance infrastructure today will dominate tomorrow’s digital payment landscape. Those that delay face higher costs and competitive disadvantages. Stablecoin adoption will accelerate rapidly as regulatory clarity removes enterprise barriers (the $300 billion market could exceed $2 trillion by 2028).

We at Web3 Enabler help businesses navigate this transition with Salesforce-native blockchain solutions that handle payments, compliance, and automation within existing corporate infrastructure. The regulatory foundation is set. Smart businesses will leverage this clarity to modernize their payment operations before competitors catch up.