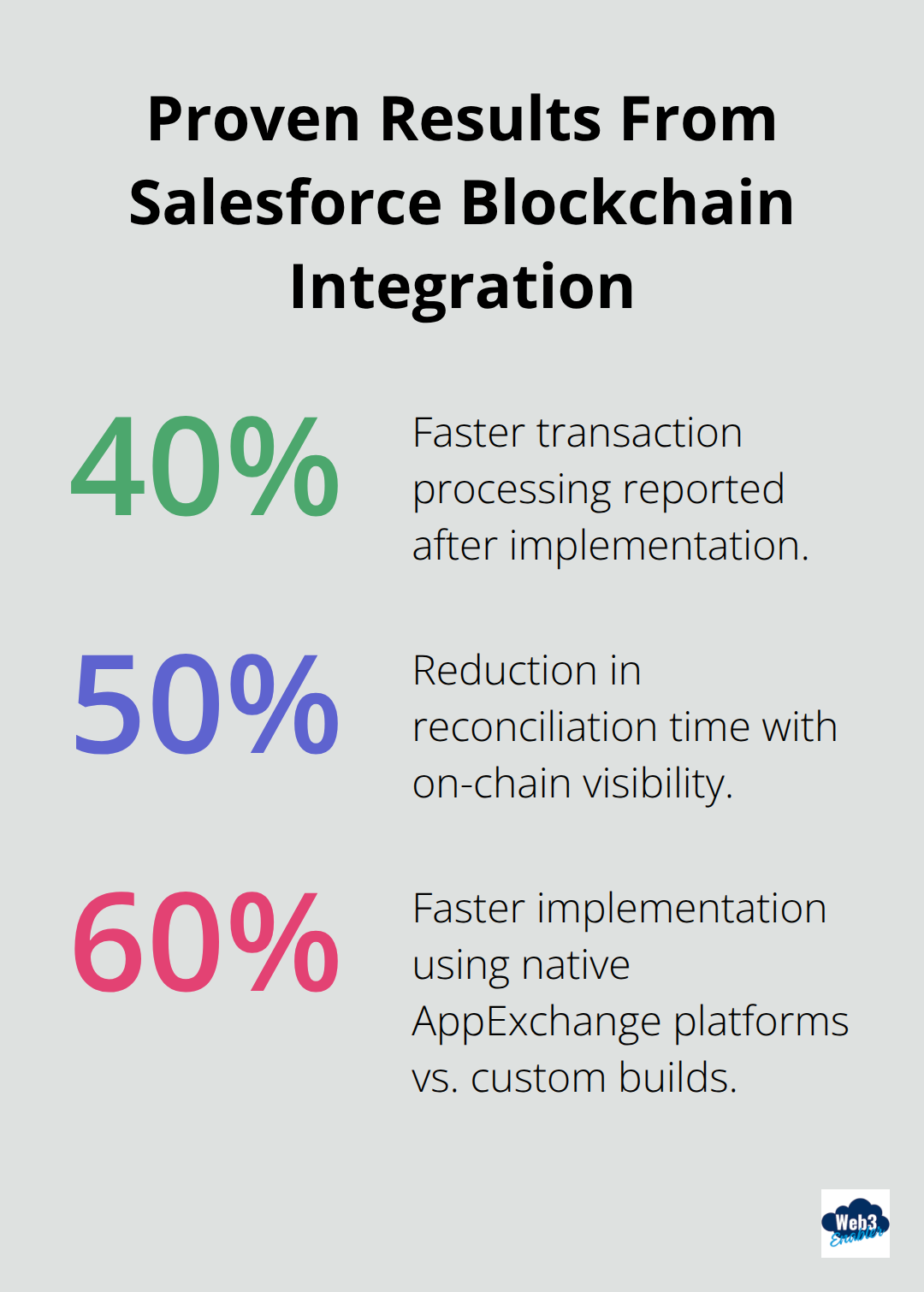

Salesforce blockchain integration transforms how businesses handle payments and financial operations. Companies using this approach report 40% faster transaction processing and significantly reduced reconciliation time.

Salesforce blockchain integration transforms how businesses handle payments and financial operations. Companies using this approach report 40% faster transaction processing and significantly reduced reconciliation time.

We at Web3 Enabler see businesses struggling with slow payment systems and complex treasury management. Blockchain technology solves these pain points by automating settlements and providing real-time transaction visibility.

Why Blockchain Integration Changes Everything for Salesforce Users

Native blockchain integration within Salesforce eliminates friction between traditional CRM operations and modern payment infrastructure. Companies that implement this approach see transaction processing times drop from 3-5 business days to under 3 minutes, while they reduce cross-border payment costs from 2-7% to just 0.5-2%. This massive adoption signals a fundamental shift in how businesses handle financial operations.

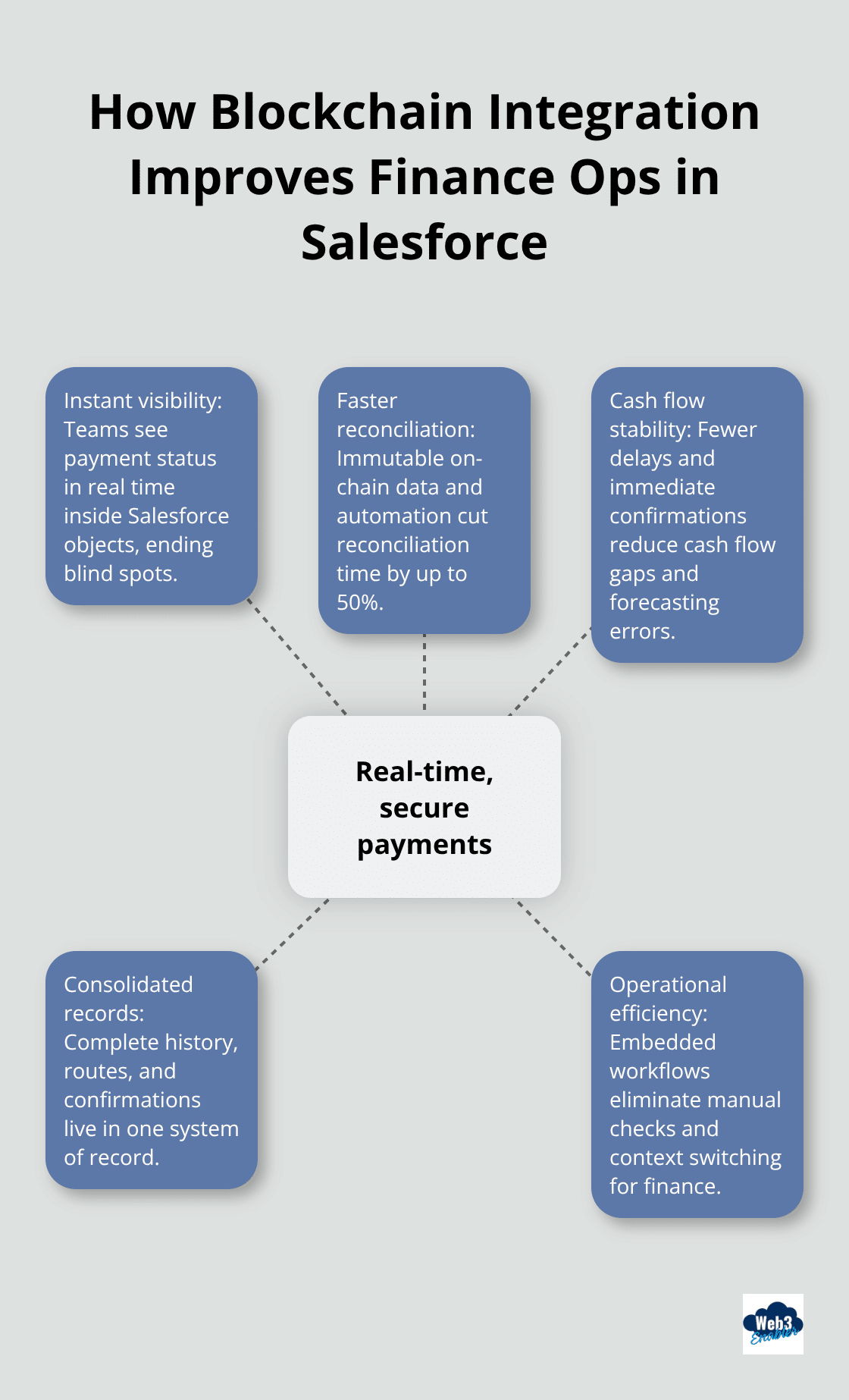

Instant Transaction Visibility Transforms Financial Operations

Traditional payment systems leave finance teams to wait days for settlement confirmations and reconciliation data. Blockchain integration provides immediate transaction visibility directly within Salesforce objects, which allows teams to track payment status in real-time. This transparency eliminates cash flow gaps that plague conventional methods and reduces reconciliation time up to 50%.

Finance teams now access complete transaction history, payment routes, and settlement confirmations without platform switches or batch processing delays.

Security and Compliance Get Major Upgrades

Blockchain technology provides immutable transaction records that enhance audit capabilities and regulatory compliance. The decentralized ledger structure eliminates single points of failure common in centralized payment systems, while advanced encryption protects sensitive financial data. Companies report significant reductions in fraud attempts due to the transparent and traceable nature of blockchain transactions. Regulatory teams benefit from streamlined reporting as all transaction data remains permanently accessible and verifiable (supporting compliance teams with automated audit trails that traditional payment systems cannot match).

Cost Reduction Drives Adoption Across Industries

Businesses save substantial amounts when they replace traditional payment rails with blockchain infrastructure. Cross-border wire transfers typically cost 2-7% in fees, while blockchain payments operate at 0.5-2% (a reduction that adds up quickly for high-volume operations). The stablecoin market has grown from $5 billion to $305 billion in just five years, demonstrating how businesses embrace these cost advantages. Finance teams eliminate intermediary fees, reduce processing delays, and gain predictable settlement outcomes.

The next step involves choosing the right platform and implementation approach for your specific business needs.

How Do You Actually Implement Blockchain in Salesforce

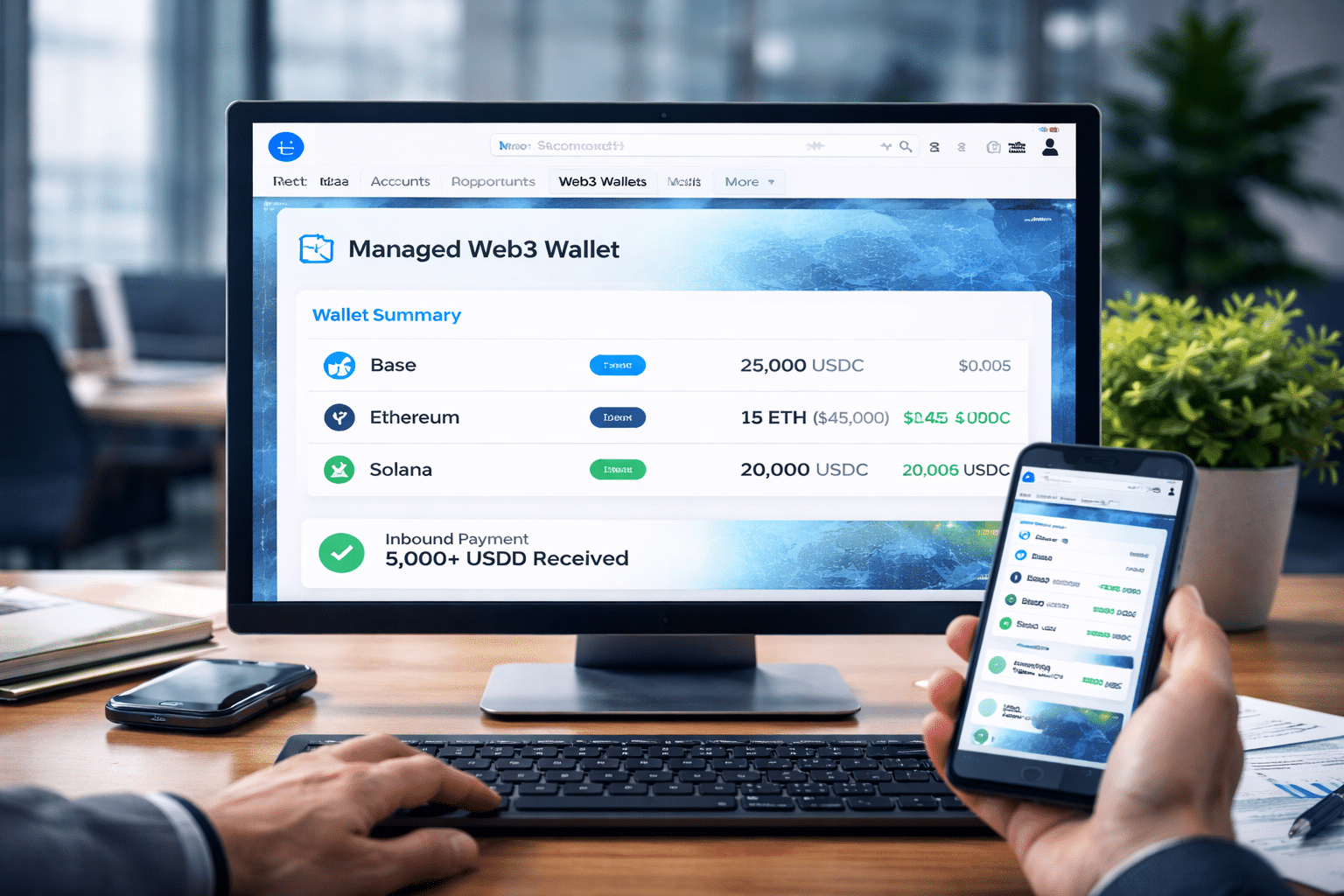

Implementation success depends on selecting a certified Salesforce ISV partner with proven blockchain expertise rather than attempting custom development. We at Web3 Enabler offer the only native blockchain platform available on the Salesforce AppExchange, which eliminates months of development work and compliance headaches that plague custom integrations. The platform connects directly to Salesforce objects and allows finance teams to process stablecoin payments within existing workflows without switching between systems.

Platform Selection Determines Long-Term Success

Choose platforms that offer pre-built Salesforce integration over custom API solutions that require extensive maintenance. Native AppExchange solutions provide automatic updates, built-in compliance features, and seamless data synchronization that custom integrations cannot match. Companies that use native blockchain platforms report 60% faster implementation times compared to custom development approaches. The integration should support major stablecoins like USDC and USDT while it provides real-time transaction monitoring through standard Salesforce reports and dashboards.

Stablecoin Processing Setup Takes Hours Not Months

Configure payment processing when you connect your existing Salesforce org to blockchain networks through certified partners rather than building direct wallet integrations. The setup process involves creating custom objects for transaction tracking, establishing automated workflows for payment confirmations, and configuring real-time data feeds from blockchain networks. Companies typically complete this configuration within 1-2 weeks using pre-built solutions (compared to 3-4 months for custom development projects).

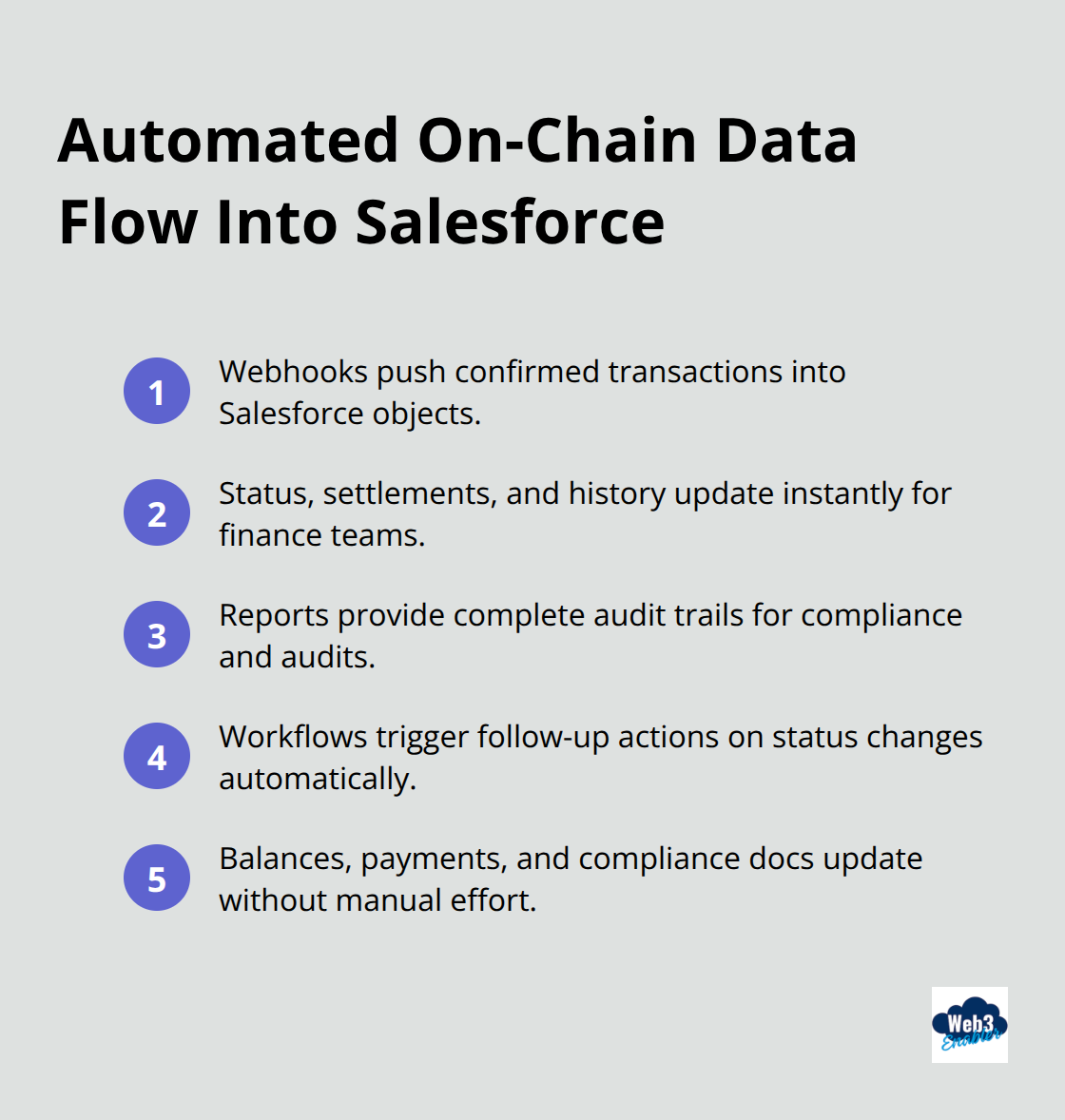

On-Chain Data Flows Into Salesforce Automatically

Synchronization happens through automated webhook systems that push transaction data directly into Salesforce objects as blockchain confirmations occur. This approach eliminates manual reconciliation processes and provides instant visibility into payment status, settlement confirmations, and transaction history. Finance teams access complete audit trails through standard Salesforce reporting tools, while automated workflows trigger follow-up actions based on transaction status changes.

The system updates account balances, payment records, and compliance documentation without manual intervention (creating a seamless flow of financial data).

These technical foundations enable powerful business applications across multiple industries and use cases.

Where Blockchain Integration Delivers Real Business Value

Financial services companies that process international wire transfers save on transaction costs when they switch from traditional SWIFT networks to stablecoin payments through Salesforce. A mid-sized investment firm that handles $50 million monthly in cross-border transfers typically pays substantial fees in wire costs, but blockchain integration reduces these expenses significantly. Settlement time drops from 3-5 business days to under 10 minutes, which improves cash flow management and client satisfaction scores. Treasury teams gain real-time visibility into payment status through Salesforce dashboards and eliminate the need for manual calls to correspondent banks.

E-Commerce Operations Scale Globally Without Payment Barriers

Online retailers that accept stablecoin payments through Commerce Cloud eliminate chargebacks entirely and reduce payment fees from 2-3% to 0.5-1%. Companies that sell digital products or services to customers in markets where traditional credit card penetration remains low particularly benefit (while crypto adoption reaches 6.8% globally). A software company that sells $10 million annually in digital subscriptions saves substantial amounts in fees while it accesses markets where traditional payment methods face restrictions. The 24/7 settlement capability means businesses receive payments instantly rather than wait for bank hours.

Treasury Automation Transforms Financial Operations

Enterprise treasury departments that manage multiple currencies and payment rails consolidate operations through automated stablecoin settlements within Revenue Cloud. Companies with international subsidiaries eliminate the complexity of correspondent bank relationships in 15-20 countries and reduce operational overhead by 40-50%. Automated reconciliation features provide finance teams with immediate transaction matches (which cuts month-end close processes from 10 days to 3 days). Liquidity management improves significantly as treasury teams access real-time balance information across all blockchain wallets and traditional accounts through unified Salesforce reports.

Final Thoughts

Salesforce blockchain integration delivers measurable results that transform financial operations across industries. Companies that implement this technology report 40% faster transaction processing, 50% reduction in reconciliation time, and significant cost savings on cross-border payments. The combination of real-time transaction visibility, enhanced security features, and automated settlement processes creates competitive advantages that traditional payment systems cannot match.

Success requires selecting a certified Salesforce ISV partner with proven blockchain expertise rather than attempting custom development. Web3 Enabler provides native blockchain solutions through the Salesforce AppExchange, which enables organizations to accept stablecoin payments and streamline global settlements directly within Financial Services Cloud, Commerce Cloud, and Revenue Cloud. Implementation typically takes 1-2 weeks compared to months for custom solutions.

Finance teams gain unified visibility into traditional and blockchain transactions through native Salesforce objects, while treasury departments automate complex multi-currency operations. As stablecoin adoption continues to grow from $5 billion to $305 billion in five years, businesses that integrate blockchain technology now position themselves ahead of competitors still relying on legacy payment infrastructure (creating sustainable competitive advantages in global markets). The technology transforms how organizations handle payments, settlements, and treasury management at scale.