Your customers want to pay you faster. Cash is becoming the awkward uncle at family dinners-nobody really wants it around anymore.

At Web3 Enabler, we’ve watched businesses leave serious money on the table by clinging to outdated payment methods. Digital payments growth isn’t some distant goal-it’s happening right now, and the businesses winning are the ones making it dead simple for customers to buy.

Why Your Customers Are Ditching Traditional Payments

The Digital Wallet Revolution Is Already Here

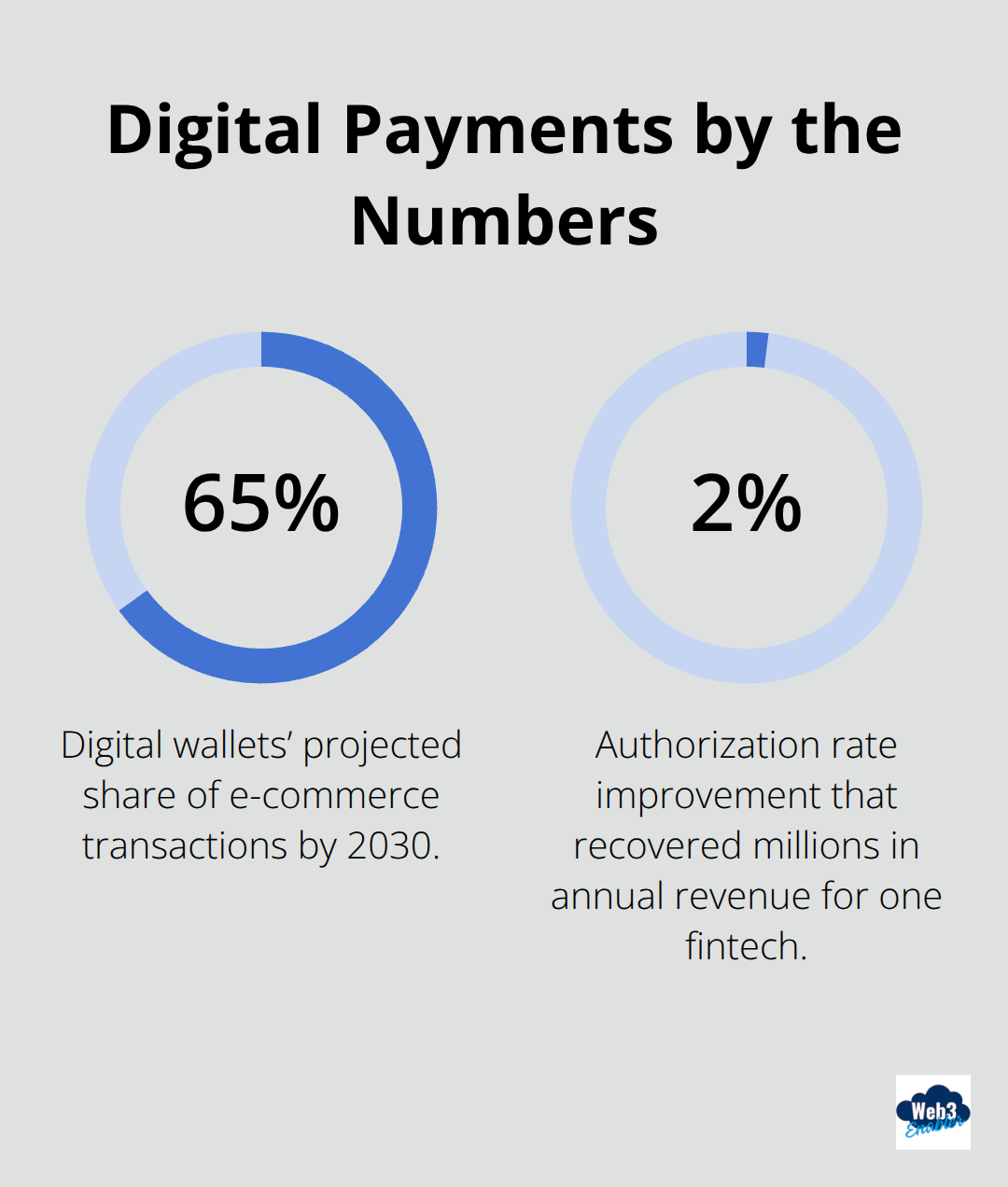

Digital wallets are projected to account for 65% of e-commerce transactions by 2030, meaning more than half of transactions happen through phones and apps rather than cards or cash. This shift stopped being a trend years ago-it’s the new normal. Businesses that haven’t adapted to this reality are already losing customers to competitors who have.

When checkout takes three clicks instead of ten, customers complete their purchases. When they can pay with their preferred method, conversion rates climb.

Speed and Friction Kill Revenue

Speed matters more than most businesses realize. Authorization rates directly impact your bottom line-even small improvements in declining fewer transactions unlock millions in annual revenue for larger businesses when issues get fixed quickly. If your checkout experience feels slow or clunky, customers abandon their carts before they even reach payment. Real-time payment data reveals exactly where friction happens and which payment methods your specific customers actually want to use.

The US embedded payments market alone reaches about 193 billion dollars by 2032, which shows exactly how much money sits at stake for companies that get this right versus those that drag their feet. Traditional payment processors drain your profits with fees that reach 3-5% per transaction, making every sale more expensive than it needs to be.

Global Expansion Demands Payment Flexibility

Global expansion becomes genuinely possible when you support multiple payment methods across different regions and currencies. Customers in Brazil expect different payment rails than customers in Europe, and payment method preferences shift constantly. Monitoring what actually works in each market-not guessing-means you adapt fast and capture revenue you’d otherwise miss.

The businesses winning right now aren’t the ones betting on one payment method. They’re the ones offering choice, removing friction, and using real transaction data to make smarter decisions about what comes next. This foundation of flexibility and data-driven decisions sets the stage for the next critical piece: actually building the systems that make these payments seamless.

Building Payment Systems That Actually Work

Integrate Payments Into Your Existing Stack

Integrating payment solutions into your existing infrastructure sounds complicated, but it doesn’t have to be. The businesses scaling fastest aren’t ripping out their systems and starting from scratch-they’re plugging payment capabilities directly into the platforms they already use daily. API-based integration with a banking partner accelerates deployment significantly, letting you launch embedded payments in weeks rather than months. Toast, the restaurant management platform, shows exactly how this works in practice: they integrated checkout data into their system and now surface lending offers aligned with restaurant seasonality, turning transaction data into revenue opportunities. Your payment system should feed directly into your CRM, accounting software, and inventory tools so data flows seamlessly instead of living in disconnected silos.

This unified approach means your sales team sees payment status in real time, your finance team gets accurate cash flow forecasts instantly, and your customer service team understands payment issues before customers call to complain.

Match Payment Methods to What Customers Actually Use

Offering multiple payment options isn’t about making your checkout menu longer-it’s about matching what your customers actually use. Digital payments are expected to keep rising in 2025, yet most businesses still treat cards as their primary option. Monitor which payment methods your specific customers choose by region and adjust accordingly; a customer base in Southeast Asia behaves completely differently from one in North America. Reduce friction ruthlessly at checkout by supporting wallets like PayPal, Venmo, and Apple Pay alongside cards, and track authorization and decline rates obsessively because even small improvements unlock serious revenue at scale.

Use Transaction Data to Fix What Breaks

Real transaction data reveals exactly where customers abandon carts-whether they’re dropping off because payment methods don’t match their preferences, because the form takes too long, or because they don’t trust your security. Test and iterate based on that insight. One fintech company improved authorization rates by just 2% and recovered millions in annual revenue. Payment-linked retention metrics matter too: measure whether payment friction actually drives churn by comparing renewal rates between customers with smooth payment experiences and those facing repeated declines. The companies winning this game aren’t guessing about what works-they’re measuring everything and fixing what breaks, then using those insights to inform what payment infrastructure they build next.

Trust and Compliance Won’t Kill Your Growth

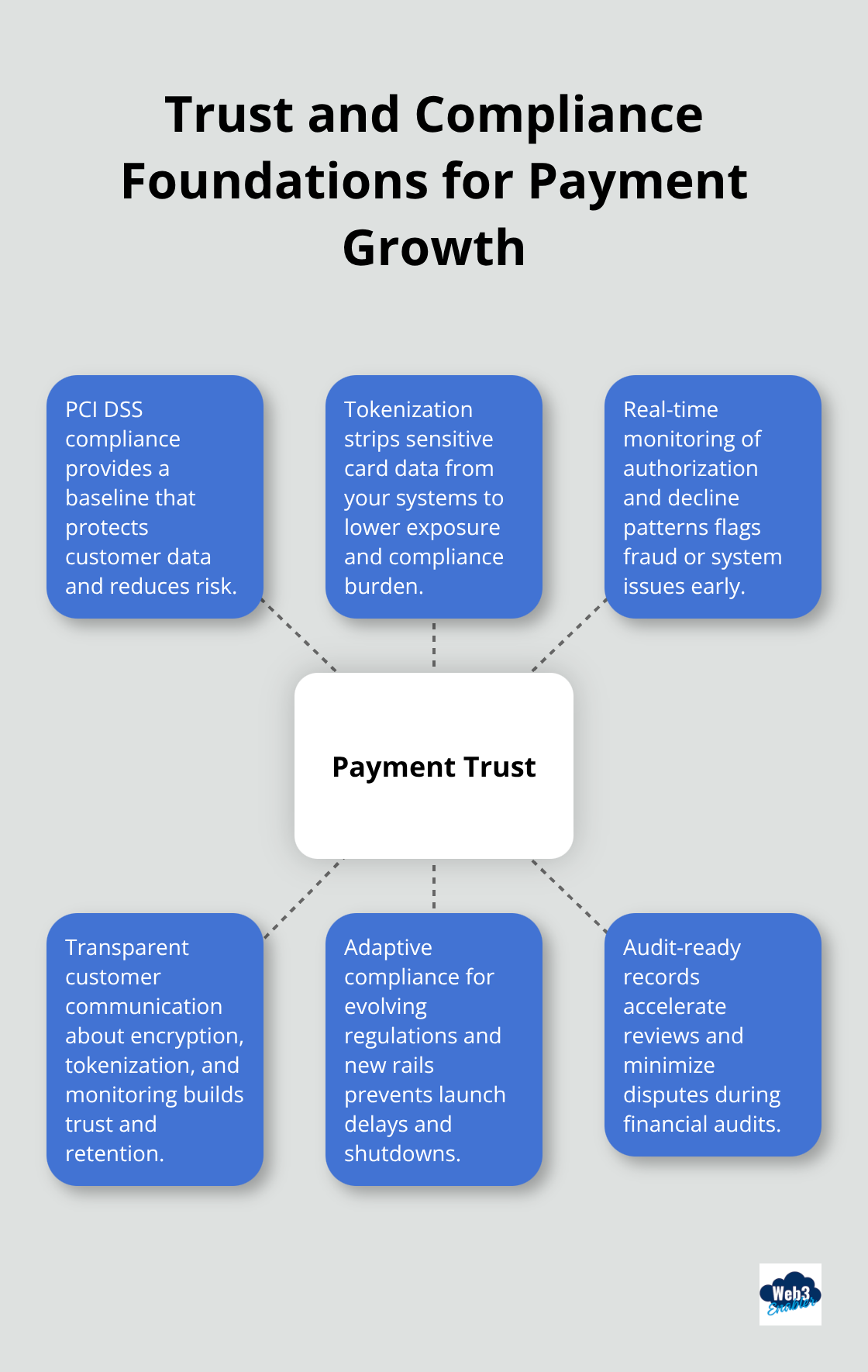

Compliance and security sound like speed bumps on the road to digital payment growth, but they actually form the foundation that lets you scale without regulatory fines or customer trust erosion. The payments industry faces real enforcement pressure: regulators have aggressively targeted BaaS providers and payment facilitators who cut corners on onboarding or know-your-customer processes. That pressure exists because bad actors damage the entire ecosystem. A strong integration partner with a rigorous onboarding process isn’t bureaucracy for its own sake-it’s the difference between launching payments confidently and launching payments that get shut down six months later.

Protect Customer Data With Layered Security

PCI DSS compliance matters not because regulators enjoy paperwork, but because your customers’ data is your most valuable asset and losing it costs far more than the investment in proper security. Advanced security measures go beyond encrypting data at rest and in transit. Real businesses implement layered defenses: tokenization removes sensitive card data from your systems entirely, reducing your attack surface and compliance burden simultaneously. Monitor authorization and decline patterns because unusual spikes in declined transactions can signal fraud attempts or system issues before they become catastrophic.

Track your chargeback and fraud rates obsessively, not as a compliance checkbox but as a business metric that directly impacts profitability. When you spot fraud patterns early-whether they originate from a specific region, a particular payment method, or a type of transaction-you can adjust your fraud tools and policies before losses compound.

Communicate Security Practices Transparently

Communicate your security practices transparently to customers-not with jargon, but with specifics about what you actually do. Tell them you use encryption, tokenization, and fraud detection. Tell them you comply with PCI DSS. Tell them you monitor transactions in real time. This transparency builds trust faster than vague promises about security. Customers feel genuinely protected when you explain exactly how you protect them, not when you tell them they should feel safe. Businesses that implement transparent security communication actually improve customer retention because trust becomes tangible rather than assumed.

Regulatory Frameworks Shift Constantly

Regulatory requirements around digital payments, cross-border transactions, and emerging technologies like stablecoins shift constantly. Central Bank Digital Currencies are reshaping monetary policy and payment rails globally, which means the compliance landscape your business operates in today won’t look identical in two years. Partner with service providers who invest in staying current with these changes rather than those who treat compliance as a one-time implementation. Real-time auditing capabilities and transparent payment records make compliance reviews faster and reduce disputes during financial audits. The businesses winning long-term aren’t the ones who barely meet minimum compliance standards-they build compliance into their payment infrastructure from day one, then use that foundation to expand into new markets and payment methods confidently.

Final Thoughts

Digital payments growth isn’t a future problem to solve later-it’s a competitive advantage you build right now or lose to someone else. Your customers want to pay in ways that feel natural to them, your team needs real-time visibility into transaction data to make smarter decisions, and your compliance framework needs to be solid enough that you expand confidently into new markets without regulatory surprises. Start by auditing your current payment setup honestly and identifying where customers abandon carts, which payment methods actually drive conversions in your specific markets, and what your transaction data reveals about customer behavior that you’re currently ignoring.

The long-term winners treat payment infrastructure as a strategic asset that connects directly to customer retention, cash flow forecasting, and revenue growth. They monitor authorization rates obsessively because small improvements compound into millions, use transaction data to inform product decisions, and build compliance into their systems from day one so expansion becomes easier rather than harder. You don’t need to overhaul everything simultaneously-pick one friction point, fix it with real data, measure the impact, then move to the next one.

If you’re ready to move beyond traditional payment limitations and connect blockchain technology with your existing infrastructure, Web3 Enabler specializes in exactly this. We help businesses accept stablecoin payments, send global payments faster and more securely, and maintain full visibility into payment operations within your existing systems. Your digital payments growth starts with one decision: commit to measuring what matters, fixing what breaks, and building payment infrastructure that scales with your ambitions.

![Ensuring Regulatory Compliance in Crypto Transactions [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/crypto-compliance-hero-1758197377.jpeg)