Business leaders face mounting pressure to cut costs while accelerating operations. Traditional payment systems drain resources through lengthy processing times and hefty fees.

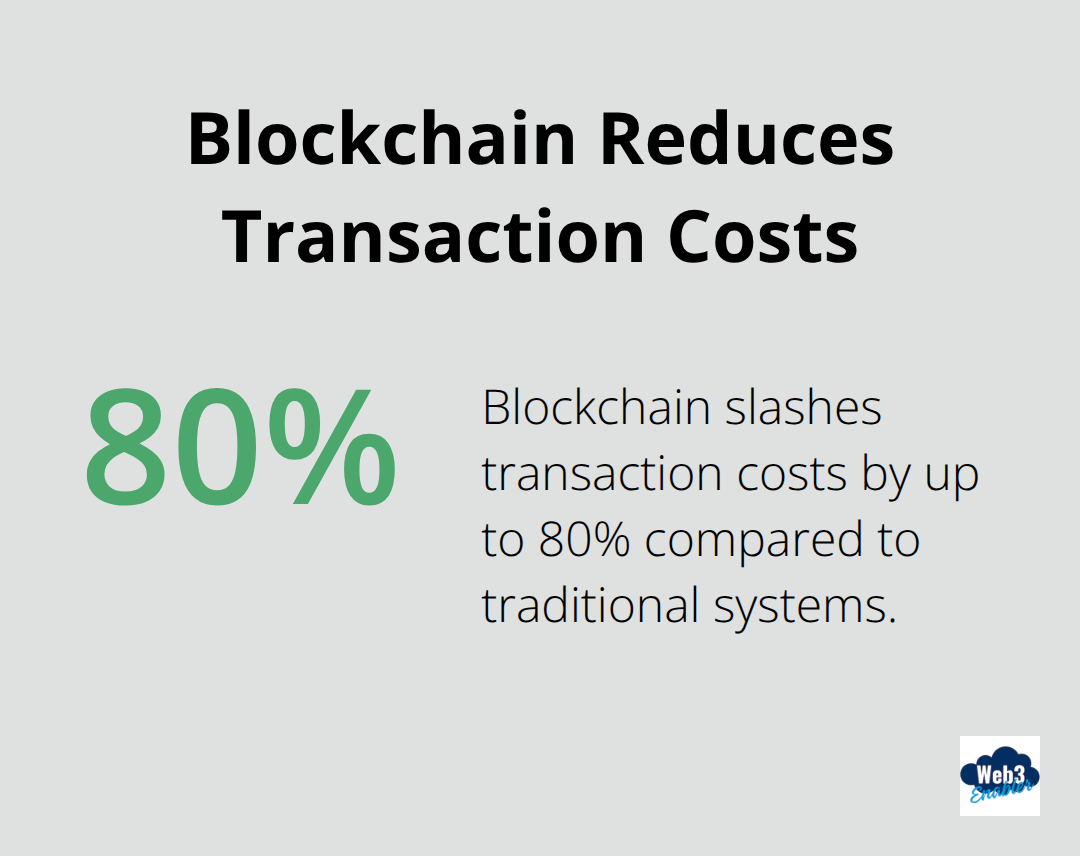

Blockchain and business integration offers a compelling solution. We at Web3 Enabler have witnessed companies reduce payment processing times from days to minutes while slashing transaction costs by up to 80%.

The technology transforms how businesses handle payments, maintain records, and build trust with partners across industries.

How Blockchain Streamlines Payment Processing

Payment processing drains business resources through outdated infrastructure built on 1970s technology. Companies waste days on cross-border transfers while they pay fees that reach 5% of transaction values. A survey of 257 North American payment service providers revealed that over 90% prioritize daily settlement efficiencies, yet traditional systems force businesses to accept multi-day delays. International wire transfers typically cost $15-50 per transaction, while blockchain payments reduce these fees to under $1 in most cases.

Speed Transforms Business Cash Flow

Blockchain payments settle within minutes regardless of geography or hours of operation. Traditional international transfers take 3-5 business days through correspondent networks, which creates cash flow gaps that hurt vendor relationships and delay critical purchases. Over 70% of merchants now consider stablecoins (like USDC and USDT) as viable payment options because settlement happens in real-time. Companies that use blockchain payments report they pay vendors faster and receive client payments within hours instead of weeks. This acceleration improves capital management and strengthens business partnerships through reliable payment schedules.

Lower Costs Drive Competitive Advantage

Transaction fees drop dramatically when businesses eliminate intermediaries. Traditional payment rails charge interchange fees, processing fees, and currency conversion costs that compound quickly. Blockchain payments bypass these layers, with 72% of surveyed financial institutions that express interest in stablecoin settlements specifically for cost reduction. Companies that switch to blockchain payments typically save 60-80% on international transfer costs while they gain predictable fee structures. These savings compound monthly and free capital for growth investments rather than payment overhead.

Real-Time Settlement Changes Operations

Traditional payment systems create operational bottlenecks that blockchain technology eliminates. Banks process payments during business hours only (Monday through Friday), which leaves weekend and holiday transactions in limbo. Blockchain networks operate 24/7 without interruption, so businesses can process urgent payments immediately. This constant availability transforms how companies manage supplier relationships and emergency purchases. The shift from batch processing to real-time settlement fundamentally changes cash flow management across all business operations.

These payment improvements create the foundation for broader operational benefits that extend far beyond simple transaction processing.

Enhanced Security and Transparency in Business Operations

Traditional record-keeping systems create vulnerabilities that cost businesses millions annually. Manual data entry introduces errors at a rate of 1-3% according to industry studies, while centralized databases become prime targets for cybercriminals. The average cost of data breach incidents reaches $4.44 million globally. Blockchain technology eliminates these risks through immutable ledgers that prevent data tampering after transactions are recorded. Once information enters a blockchain, it becomes permanent and verifiable by all authorized parties without trust in a single entity.

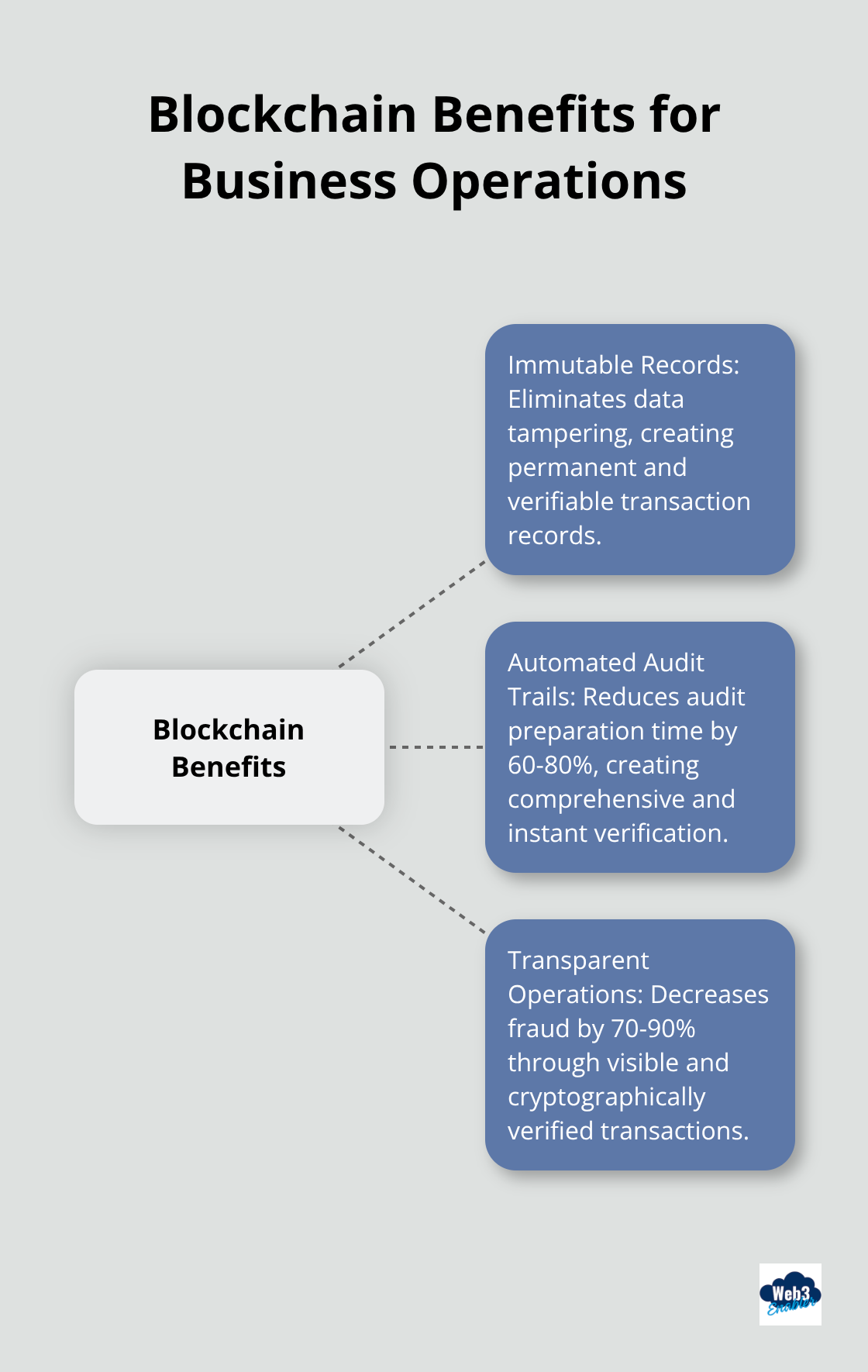

Immutable Records Eliminate Data Tampering

Blockchain creates permanent records that no single party can alter or delete. Each transaction receives a unique cryptographic signature that links to previous records, which forms an unbreakable chain of evidence. Companies that implement blockchain record-keeping report zero instances of internal data manipulation because the technology makes unauthorized changes mathematically impossible. The distributed nature of blockchain means that thousands of computers verify each record simultaneously, which eliminates the single points of failure that hackers typically exploit in traditional databases.

Automated Audit Trails Reduce Compliance Costs

Financial audits drain resources because traditional systems scatter transaction records across multiple databases and paper trails. Blockchain creates comprehensive audit trails automatically, with every transaction timestamped and linked to previous records. Chainalysis reported that illicit activities account for only 0.34% of all cryptocurrency transactions, which demonstrates blockchain’s effectiveness at clean record maintenance. Companies reduce audit preparation time by 60-80% because auditors can verify transaction histories instantly rather than request documents from various departments (eliminating weeks of preparation work).

Transparent Operations Prevent Fraud

Blockchain’s transparent nature makes fraudulent activities nearly impossible to hide or execute. Each transaction requires cryptographic verification from multiple network participants, which eliminates single points of failure that fraudsters typically exploit. The technology’s distributed consensus mechanism means that record alteration would require control over 51% of the network, which makes fraud economically unfeasible for most business applications. Companies report fraud reduction rates of 70-90% after blockchain implementation because the technology makes suspicious activities visible to all authorized participants immediately.

These security improvements create the foundation for practical applications that transform entire industries through enhanced trust and operational efficiency.

Real-World Applications Across Industries

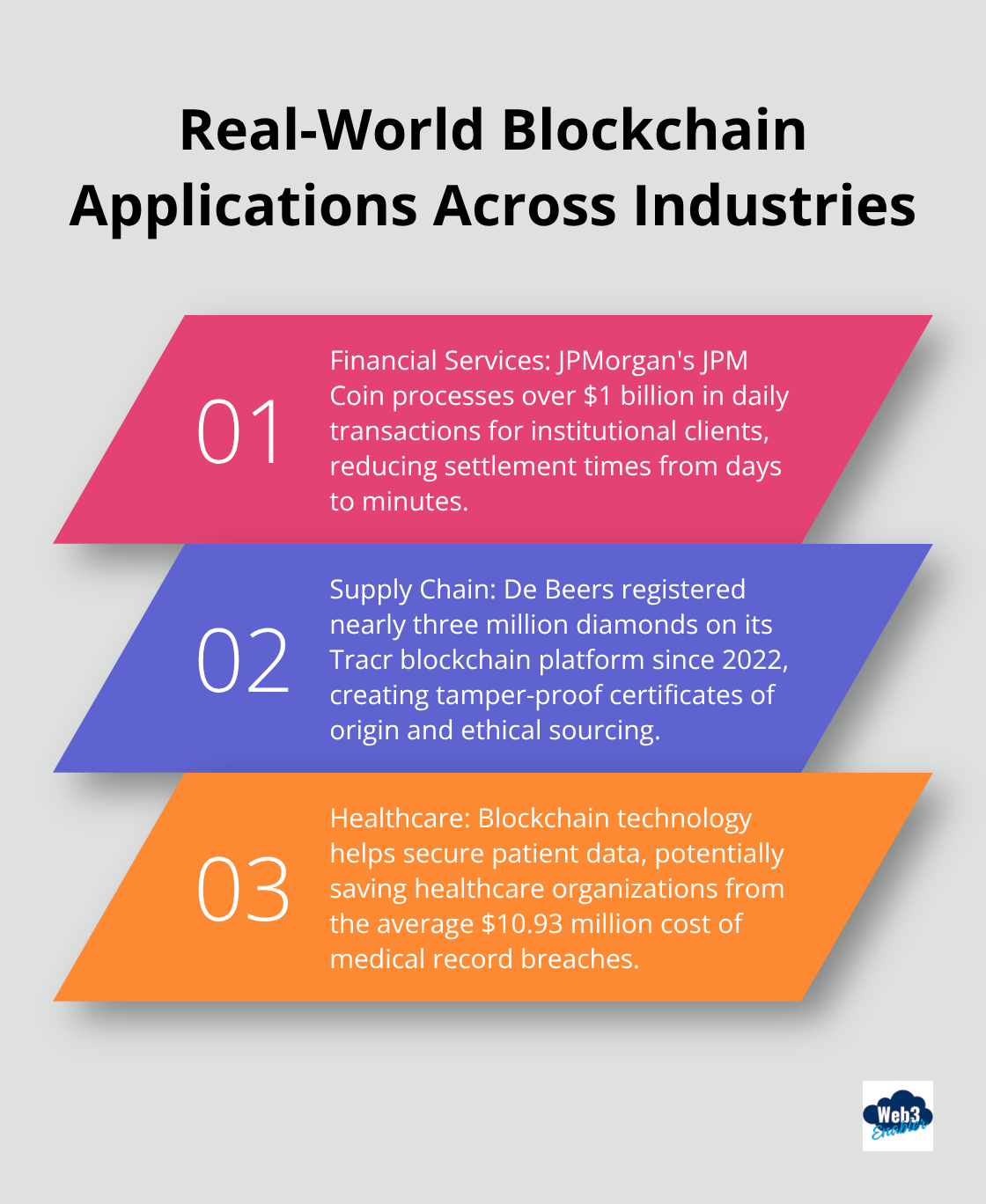

Banks process blockchain initiatives as production-ready systems or active proof-of-concepts according to research. JPMorgan’s JPM Coin processes over $1 billion in daily transactions for institutional clients, while traditional wire transfers for the same amounts take 1-3 business days. PayPal, Microsoft, and Tesla now accept Bitcoin payments, which demonstrates mainstream adoption beyond experimental phases. These financial institutions report transaction cost reductions of 40-70% compared to traditional correspondent networks.

Financial Services Transform Payment Infrastructure

Major banks replace outdated correspondent networks with blockchain rails that settle transactions instantly. Visa and Stripe actively explore blockchain solutions to create new merchant services that eliminate multi-day settlement delays. Financial institutions that adopt blockchain payments reduce operational overhead because they eliminate manual reconciliation processes that traditional systems require. The technology processes cross-border payments without currency conversion delays or correspondent bank fees (which typically add $25-75 per transaction). Banks report improved customer satisfaction because business clients receive payments within hours rather than waiting 3-5 business days for international transfers.

Supply Chains Gain Complete Traceability

De Beers registered nearly three million diamonds on its Tracr blockchain platform since 2022, which creates tamper-proof certificates of origin and ethical sourcing. Walmart tracks food products from farm to shelf through IBM’s Food Trust blockchain, which reduces foodborne illness investigation time from weeks to seconds. Companies that implement blockchain supply chain tracking report 30-50% faster response times during product recalls because they can pinpoint contamination sources immediately. Merck uses blockchain to comply with the Drug Supply Chain Security Act, which creates permanent records that prevent counterfeit medications from entering legitimate supply chains.

Healthcare Systems Secure Patient Data

Medical record breaches cost healthcare organizations $10.93 million on average, which makes blockchain’s immutable security attractive for patient data management. Blockchain allows patients to control access to their medical records while healthcare providers can verify treatment histories instantly across different facilities. The technology eliminates duplicate tests and conflicting medication prescriptions because all authorized providers access the same verified patient history. Healthcare networks that implement blockchain record-keeping reduce administrative costs by 20-30% because they eliminate manual record requests and fax-based information transfers between facilities. Patients benefit from portable medical records that follow them across different healthcare systems without paperwork delays.

Final Thoughts

Blockchain and business integration delivers measurable results that traditional systems cannot match. Companies reduce payment processing times from days to minutes while they cut transaction costs by 60-80%. The technology eliminates fraud through immutable records and automates compliance processes that previously required weeks of manual work.

Implementation requires careful planning but the benefits justify the investment. Businesses should start with pilot projects that address specific pain points like cross-border payments or audit trail management. Success depends on choosing the right technology partner who understands both blockchain capabilities and existing business workflows.

We at Web3 Enabler provide native Salesforce blockchain solutions that enable businesses to accept stablecoin payments and process global transfers faster than traditional methods. Our platform transforms payment processing without disruption to existing systems (making the transition seamless for established operations). Web3 Enabler offers the expertise and tools necessary for businesses that want to gain first-mover advantages in efficiency and cost reduction.