Global transaction fees are a major pain point for businesses and consumers worldwide. Traditional banking systems often impose hefty charges, slowing down international commerce and eating into profits.

At Web3 Enabler, we believe blockchain technology offers a game-changing solution to this problem. By leveraging the power of decentralized networks, we can dramatically reduce transaction costs and streamline cross-border payments.

Why Are Global Transaction Fees So High?

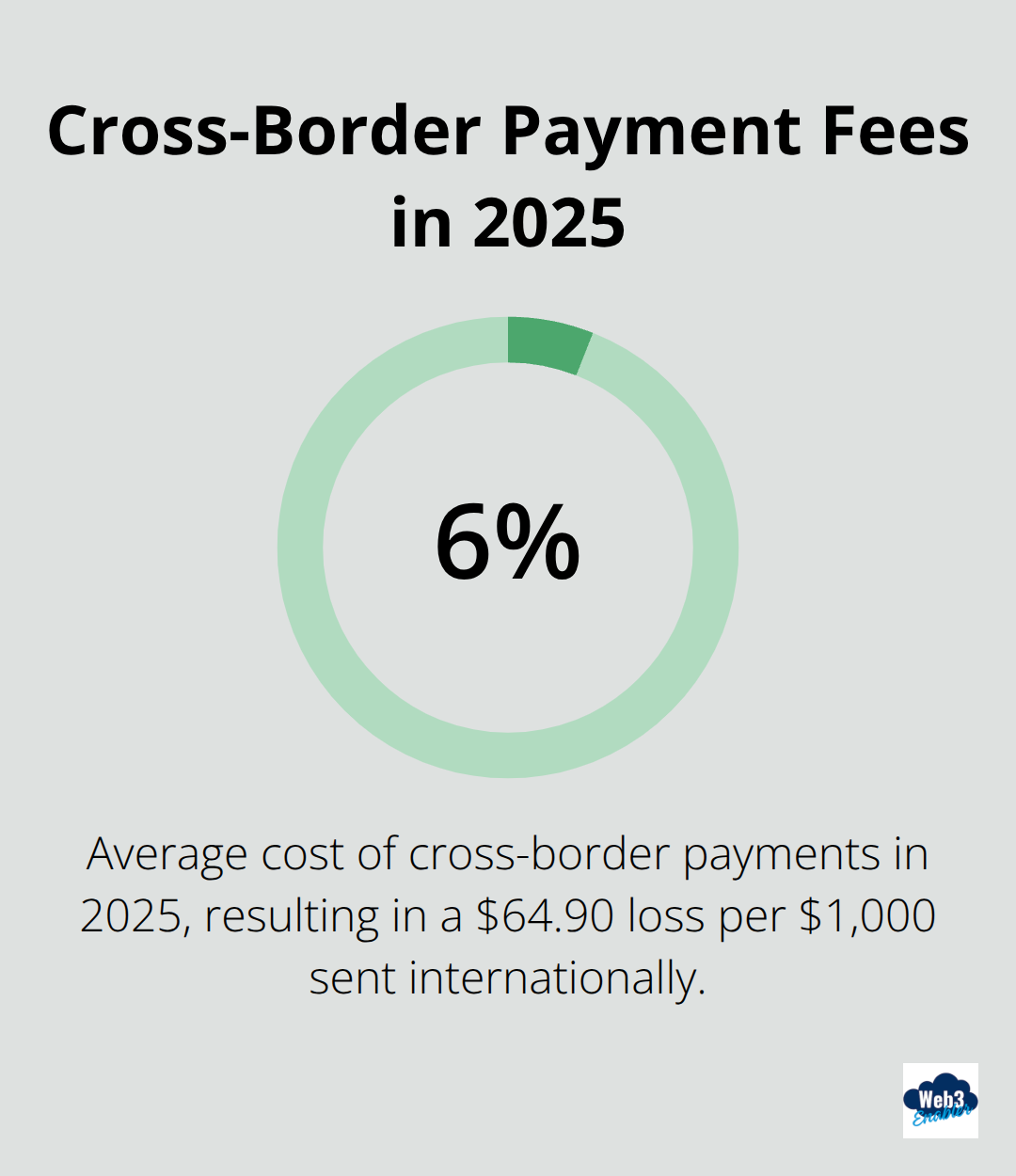

The Burden of Cross-Border Payments

Global transaction fees continue to weigh heavily on businesses and consumers. In 2025, cross-border payments still cost an average of 6.49% of the transaction value. This translates to a $64.90 loss for every $1,000 sent internationally.

The Inefficiencies of Traditional Banking

Traditional banking systems operate on a complex network of intermediaries, each claiming a portion of the transaction. SWIFT, the primary network for international transfers, involves multiple banks and requires 3-5 business days to complete a single transaction. This outdated system not only increases costs but also introduces delays and potential errors.

Small Businesses and Consumers Bear the Brunt

Small and medium-sized enterprises (SMEs) suffer disproportionately from these high fees. A Boston Consulting Group study revealed that SMEs pay between $50-$150 billion annually in transaction fees (a staggering amount that significantly impacts their profitability and global competitiveness).

Consumers, particularly migrants sending money home, face similar challenges. The UN reports that remittance senders lose an average of 7% to transaction fees. This reduction diminishes the impact of the $700 billion in annual remittances that serve as a lifeline for many families in developing countries.

Transparency and Traceability Issues

The current banking infrastructure lacks real-time tracking capabilities. This deficiency prevents businesses from predicting fund arrival times accurately, which complicates cash flow management. Moreover, compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations adds further costs and delays to the process.

The Need for a Revolutionary Solution

These persistent issues highlight the urgent need for a more efficient, transparent, and cost-effective system for global transactions. Blockchain technology offers a promising solution to these challenges, with the potential to dramatically reduce fees and streamline cross-border payments.

As we explore the potential of blockchain to revolutionize global transactions, it’s important to understand how this technology addresses the shortcomings of traditional banking systems. Let’s examine the specific ways blockchain reduces transaction costs and improves efficiency in the next section.

How Blockchain Slashes Transaction Costs

Blockchain technology revolutionizes global transactions, offering a solution that dramatically reduces fees and improves efficiency. This innovative approach transforms businesses’ payment processes in several key ways.

Elimination of Intermediaries

Blockchain’s peer-to-peer nature allows direct transactions between parties, significantly lowering fees. Traditional banking systems rely on multiple intermediaries, each taking a cut. A study found that blockchain could cut investment banking costs by 30%, saving over $8B annually. This reduction stems from the streamlining of clearing and settlement processes that typically involve multiple parties and manual reconciliation.

Accelerated Settlement Times

Blockchain transactions complete much faster than traditional methods. While SWIFT transfers can take days, blockchain transactions often finalize in minutes or even seconds. This speed not only improves cash flow but also reduces the risks associated with currency fluctuations during long settlement periods. Ripple, a blockchain-based payment network, has demonstrated settlement times as low as 4 seconds for cross-border transactions (compared to the 3-5 days typically required for traditional international transfers).

Enhanced Security and Fraud Reduction

The inherent security features of blockchain, including cryptographic hashing and decentralized consensus mechanisms, significantly reduce the risk of fraud. This enhanced security translates to lower costs for fraud prevention and mitigation. A report by Juniper Research expects blockchain to reduce banks’ costs attributable to cross-border payment transactions by more than $27 billion by 2030 (with a significant portion of these savings coming from reduced fraud losses).

Real-World Cost Savings Examples

The impact of blockchain on transaction costs extends beyond theory. Many companies have already realized substantial savings:

- Santander estimated that blockchain could save the banking industry $20 billion annually in infrastructure costs.

- HSBC reported processing $250 billion worth of forex trades using blockchain in 2018, resulting in significant cost reductions and improved efficiency.

These examples demonstrate the tangible benefits of blockchain technology in reducing transaction costs. As more businesses adopt blockchain solutions, the potential for even greater cost savings and efficiency gains across various industries becomes increasingly apparent.

The next section will explore the practical steps businesses can take to implement blockchain technology and capitalize on these benefits.

How Businesses Can Implement Blockchain for Lower Fees

Implementing blockchain technology for lower transaction fees is a practical reality that businesses can achieve today. This chapter explores the concrete steps companies can take to harness the power of blockchain and significantly reduce their global transaction costs.

Assess Your Current Payment Infrastructure

The first step in adopting blockchain requires a thorough evaluation of your existing payment systems. Identify pain points such as high fees, slow settlement times, and lack of transparency. This assessment will help you pinpoint where blockchain can make the most impact.

A mid-sized e-commerce company found that international payments cost them an average of 4% per transaction and took up to 5 days to settle. By mapping out these inefficiencies, they targeted specific areas for blockchain implementation.

Choose the Right Blockchain Solution

Web3 Enabler stands out in this regard, especially for businesses using Salesforce. As the only native blockchain solution on the Salesforce AppExchange, Web3 Enabler offers a unique advantage for companies looking to integrate blockchain without overhauling their entire infrastructure.

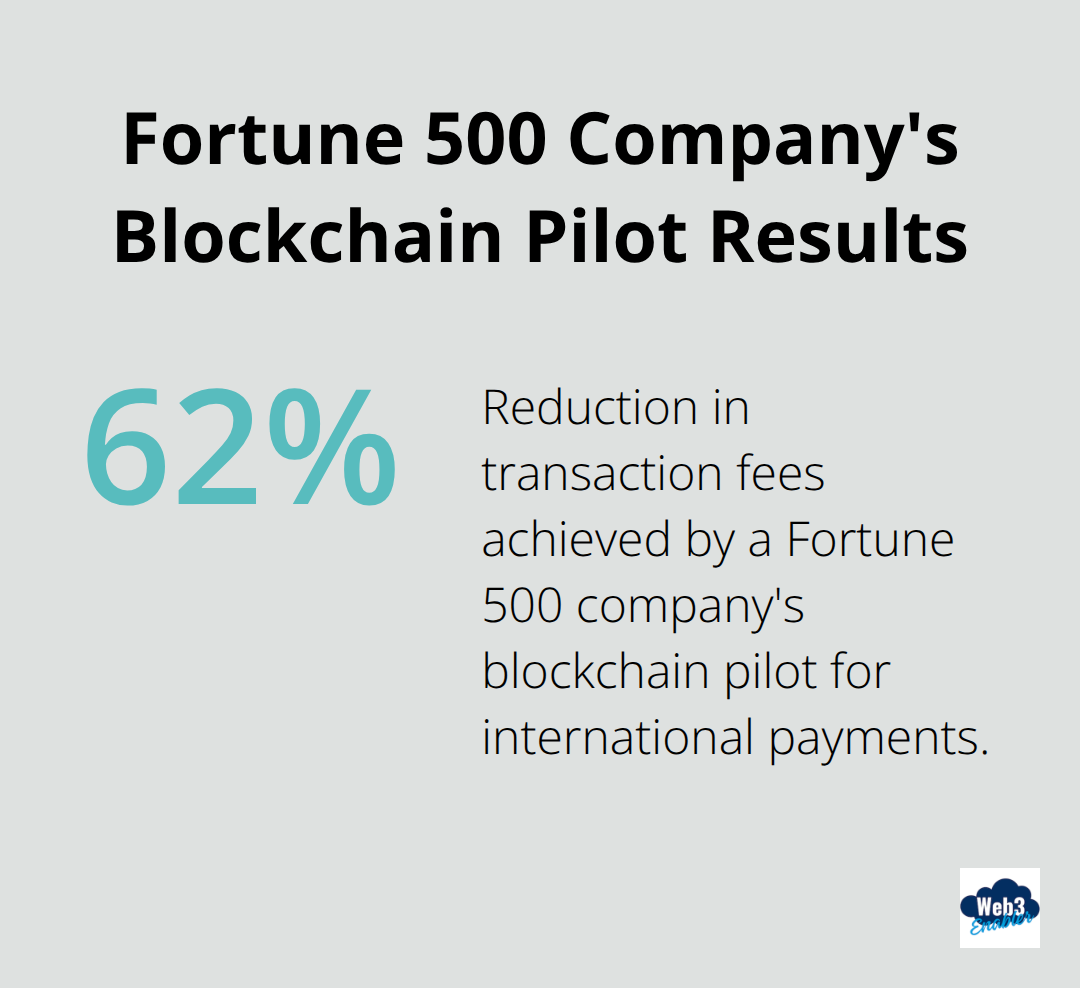

Start with a Pilot Project

Before you roll out blockchain across your entire operation, start with a small-scale pilot project. This approach allows you to test the technology in a controlled environment and gather valuable data on its performance.

A Fortune 500 company recently conducted a pilot to process international payments. The results were striking: transaction fees dropped by 62%, and settlement times decreased from days to minutes. This successful pilot paved the way for a company-wide implementation.

Train Your Team and Educate Stakeholders

Blockchain adoption requires a shift in mindset and processes. Invest in comprehensive training for your team to ensure they understand the technology and can leverage its full potential. Educate stakeholders about the benefits of blockchain to gain buy-in and support for the transition.

Companies that prioritize education see faster adoption rates and more effective use of blockchain technology. A survey found that organizations with blockchain-trained staff were 30% more likely to see significant cost savings from their blockchain initiatives.

Implement Gradually and Monitor Performance

After you successfully complete your pilot, begin implementing blockchain technology across your business operations in phases. This gradual approach allows you to fine-tune the integration and address any issues that arise without disrupting your entire payment system.

Continuously monitor key performance indicators (such as transaction costs, processing times, and error rates). Use this data to optimize your blockchain implementation and demonstrate ROI to stakeholders.

A global manufacturing firm took this approach when implementing a blockchain solution. They started with supplier payments in one region, then expanded to customer transactions, and finally integrated blockchain across their entire supply chain. This phased implementation resulted in a global transaction fees reduction, speeding up transactions, and increasing transparency.

Final Thoughts

Blockchain technology revolutionizes global transactions by slashing fees and enhancing efficiency. Companies that adopt this innovation will gain a significant competitive edge in the evolving financial landscape. The future of global transactions has arrived, powered by blockchain’s transformative potential.

Forward-thinking businesses must act now to harness blockchain’s benefits and position themselves at the forefront of this financial revolution. Web3 Enabler offers a seamless solution for companies looking to integrate blockchain without overhauling their entire infrastructure. Our native blockchain solution on the Salesforce AppExchange empowers businesses to reduce global transaction fees effectively.

Blockchain represents more than just cost savings; it heralds a shift towards a more efficient and inclusive global financial system. As businesses embrace this technology, they contribute to a fundamental change in how value moves worldwide. The reduction of global transaction fees through blockchain marks a pivotal step towards a more interconnected and frictionless global economy.