Ever wondered why sending money across borders feels like you’re stuck in a 90s dial-up internet nightmare? Well, buckle up buttercup, because blockchain’s about to make global remittance sexier than a cryptocurrency trader’s lambo collection.

At Web3 Enabler, we’re all about making your money move faster than gossip in a small town. Get ready to discover how blockchain is flipping the script on slow, expensive international payments and turning them into a financial fast and furious.

Why Are Global Payments Still Stuck in the Stone Age?

The Snail Mail of Money Transfers

Picture this: You try to send money abroad, and suddenly you’re transported back to the financial equivalent of the Flintstones. Yabba dabba don’t, am I right? Let’s break down why traditional cross-border payments are about as efficient as using a rock to hammer in a nail.

Traditional global payments move slower than a sloth on a coffee break. SWIFT’s current system is known for its inefficiencies, with international transfers often taking up to five days and incurring fees ranging from £20 to £40. That’s slower than my grandma’s dial-up internet! And let’s not even talk about weekends or holidays when your money decides to take an extended vacation (probably sipping piña coladas on a beach somewhere).

Fees That Make Your Wallet Weep

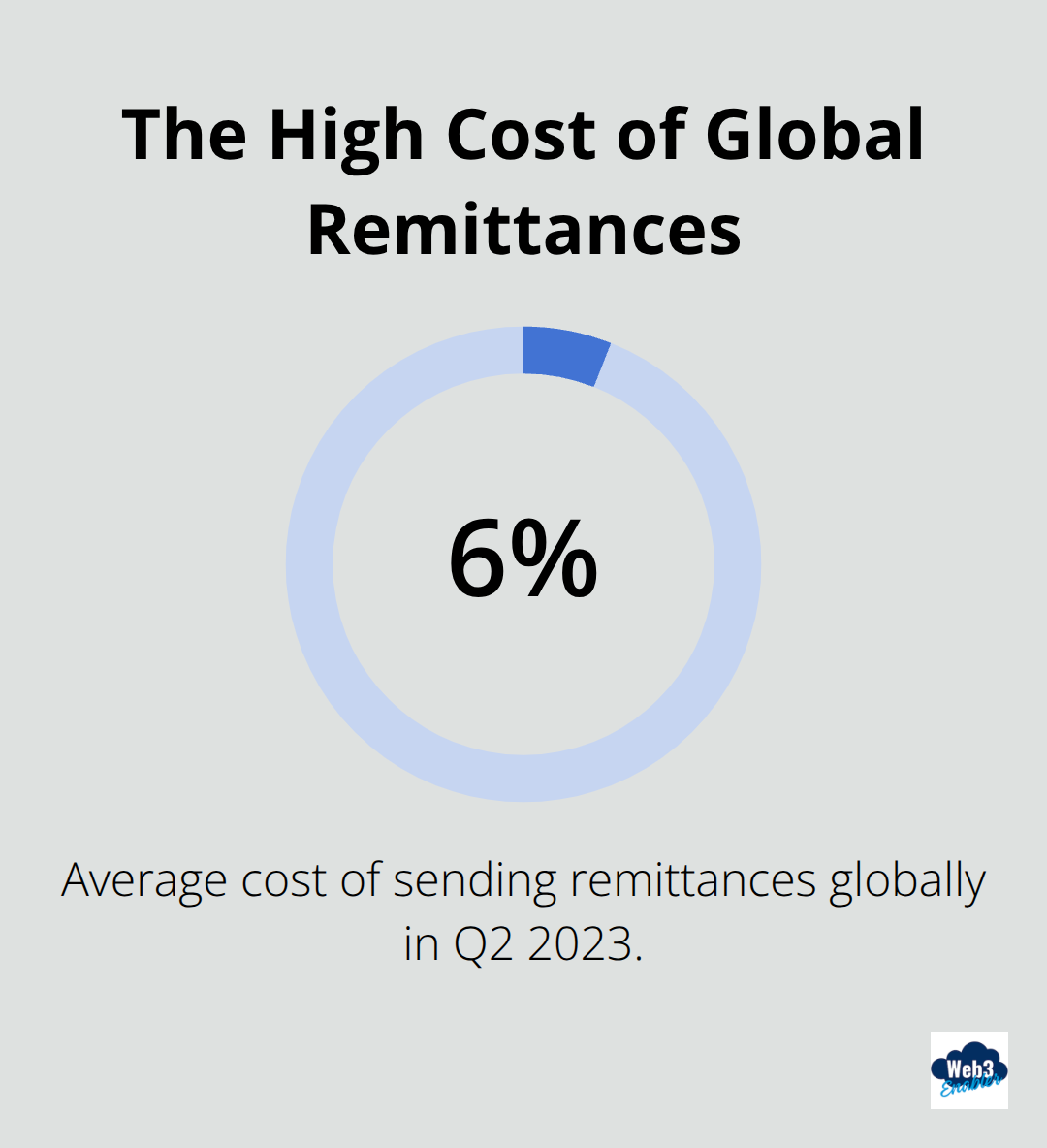

If slow speeds weren’t enough to make you pull your hair out, let’s talk about fees. The World Bank reports that the average cost of sending remittances globally stands at a jaw-dropping 6.4% as of Q2 2023. That means if you’re sending $1000 to your cousin in Timbuktu, you’re kissing goodbye to $64 just because banks said so. It’s like paying for a first-class ticket and getting squeezed into economy (with a crying baby next to you).

The Black Box of Banking

Have you ever tried tracking your international payment? It’s like trying to find a needle in a haystack… while blindfolded… and the haystack is on fire. The lack of transparency in traditional systems means your money could be anywhere between here and Jupiter, and you’d be none the wiser. A 2022 survey by SWIFT showed that 47% of corporate treasurers cited lack of payment traceability as a major pain point. It’s no wonder people are looking for alternatives faster than you can say “blockchain.”

The Dinosaur of Financial Systems

Traditional global payment systems are the dinosaurs of the financial world. They’re big, slow, and haven’t evolved much since the Jurassic era of banking. These systems rely on a complex network of correspondent banks, each taking their sweet time (and a slice of your pie) to process transactions. It’s like playing a game of financial telephone, where your money whispers from bank to bank, losing a bit of itself with each hop.

Now, you might be thinking, “Surely there’s a better way!” Well, hold onto your crypto wallets, because the blockchain revolution is about to turn this financial fossil into a sleek, efficient money-moving machine. Get ready to see how blockchain will make your wallet do the happy dance it’s been waiting for!

How Blockchain Supercharges Global Payments

Forget the financial Stone Age – blockchain turns your cross-border transactions into a high-speed money highway. We’re not just talking about a slight improvement; we’re talking about a complete overhaul of how global payments work.

Cutting Out the Middleman (and His Fees)

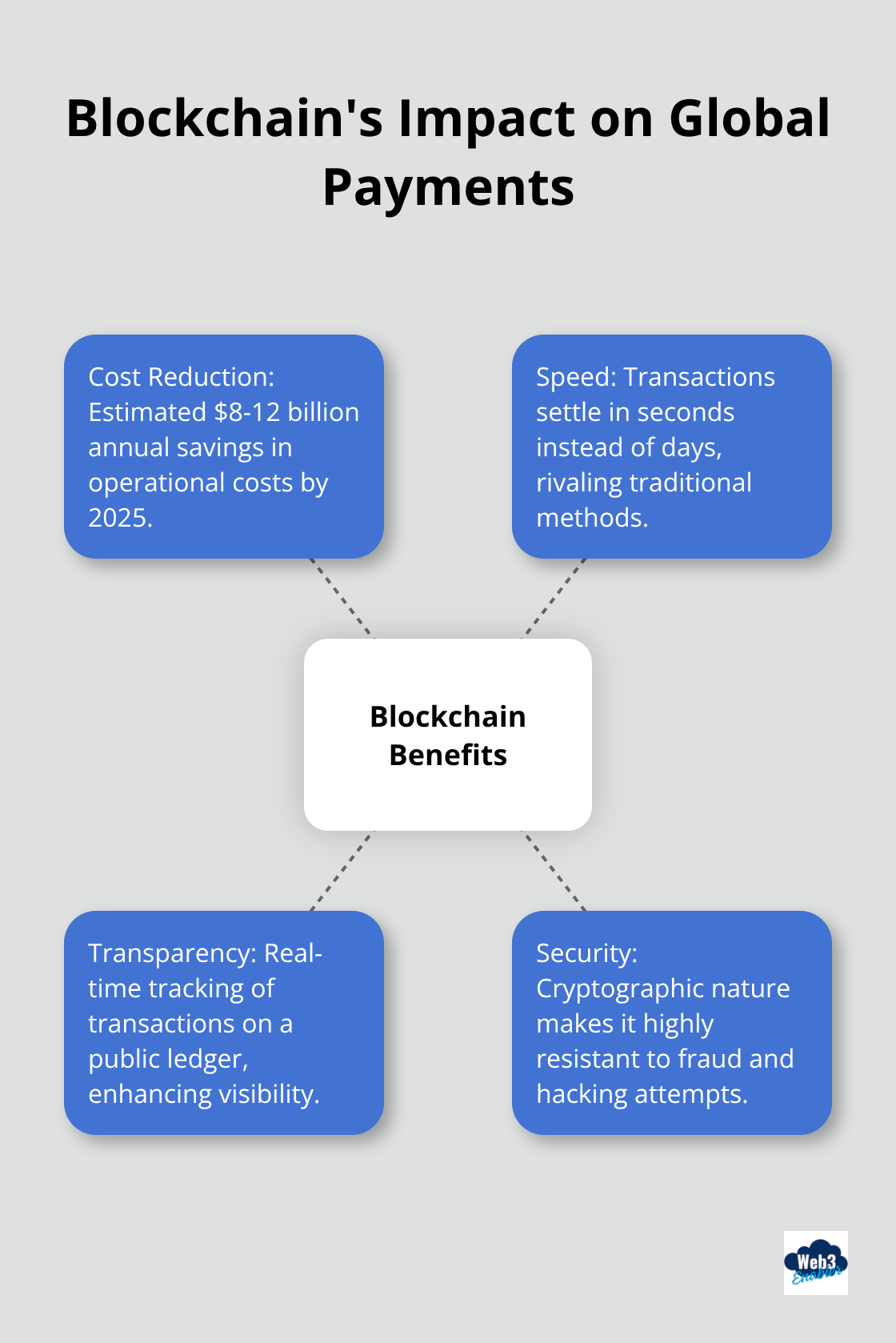

Those pesky intermediaries we mentioned earlier? Blockchain kicks them to the curb faster than you can say “decentralized ledger.” The removal of these middlemen slashes transaction costs dramatically. It’s estimated that blockchain-based transactions could save businesses between $8-12 billion annually in operational costs by 2025. (That’s a lot of lattes, folks!)

Speed That Makes Usain Bolt Look Slow

While traditional bank transfers still lace up their sneakers, blockchain transactions cross the finish line. We’re talking about settlement times measured in seconds, not days. Ripple, for instance, boasts transaction speeds of 3-5 seconds. Compare that to the 3-5 business days of traditional methods, and you’ll see why blockchain is the Usain Bolt of the financial world.

Transparency That Would Make a Glass House Jealous

Blockchain records every transaction on a public ledger. This means you can track your money’s journey from A to B in real-time. No more mysterious black holes where your cash disappears for days on end. According to a report by Deloitte, 53% of senior executives said blockchain would be a critical priority for their organizations in 2023. (Why? Because everyone loves knowing where their money is at all times.)

Security That Makes Fort Knox Look Like a Piggy Bank

Blockchain’s cryptographic nature makes it harder to hack than trying to solve a Rubik’s cube underwater. Multiple nodes in the network verify each transaction, making fraud about as likely as finding a unicorn in your backyard. A study by the World Economic Forum predicts that by 2027, 10% of global GDP could be stored on blockchain technology. That’s a whole lot of faith in blockchain’s security!

The blockchain wave isn’t just for surfing – it’s for revolutionizing how we move money globally. Whether you’re a small business owner tired of hefty international transfer fees or a large corporation looking to streamline your global operations, blockchain is your ticket to faster, cheaper, and more secure global payments.

Now that we’ve seen how blockchain turbocharges global payments, let’s look at some real-world applications that are already making waves in the financial ocean. Spoiler alert: it’s not just crypto bros getting in on the action!

Who’s Already Surfing the Blockchain Wave?

Let’s explore the real-world applications of blockchain in global payments. It’s not just crypto enthusiasts who get excited – major players jump on board faster than you can say “decentralized ledger.”

Ripple’s Tidal Force

Ripple shakes up the financial world with its RippleNet network. This blockchain-based payment system processes transactions in roughly three to five seconds, with payments costing just a fraction of a penny. That’s like the Usain Bolt of money transfers, but even faster and cheaper!

Stablecoins: The Steady Eddies of Crypto

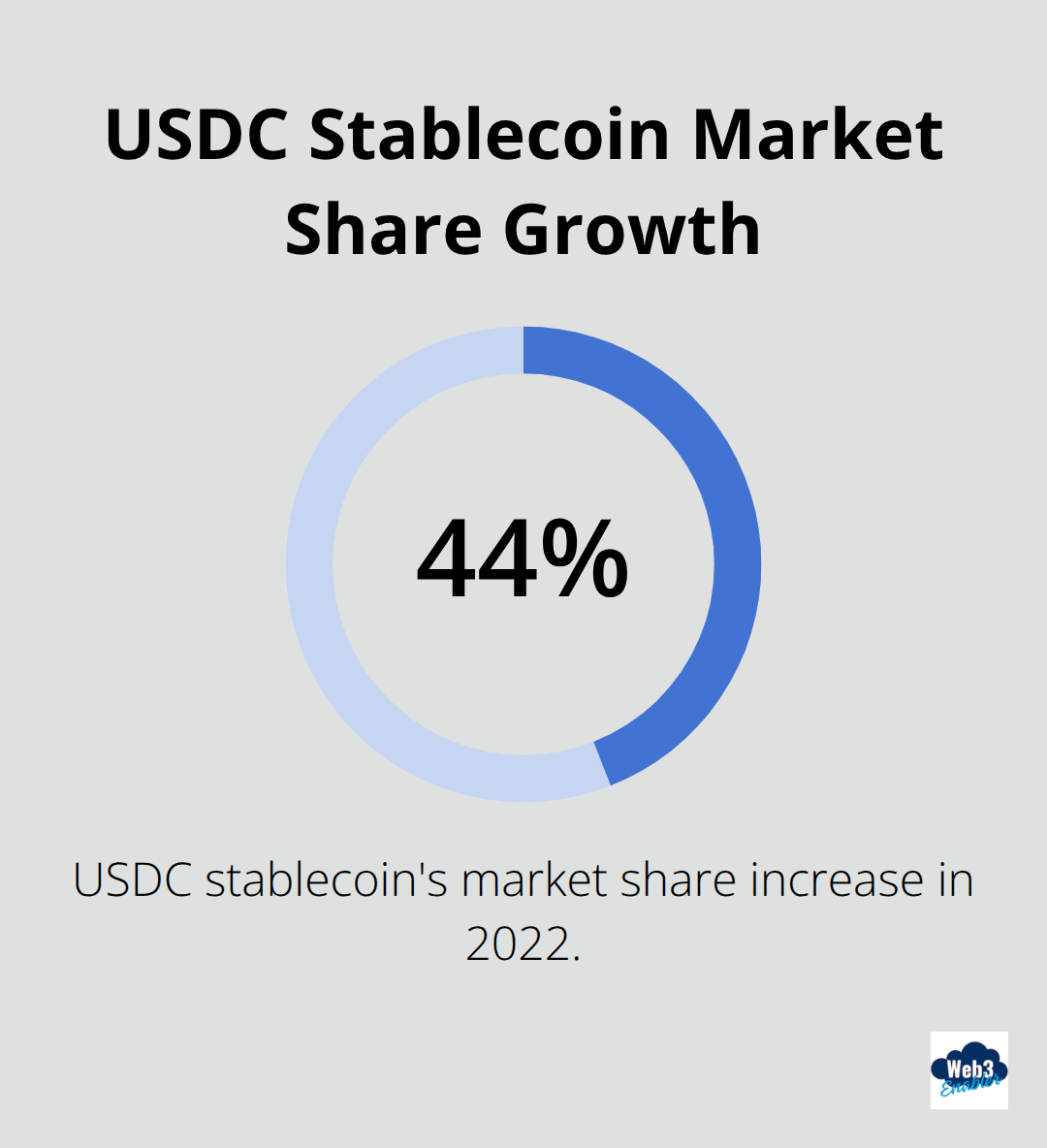

Stablecoins act as the level-headed cousins in the crypto family, and they make a splash in international trade. These digital currencies, pegged to stable assets like the US dollar, become the go-to for businesses looking to avoid volatile exchange rates. Circle’s USDC stablecoin, for instance, saw its circulation grow to $55 billion in 2022 (a 44% market share increase). Stability proves sexy in the world of digital finance!

Big Banks Join the Party

Even the financial bigwigs get in on the action. JPMorgan Chase, not exactly known for being a trendsetter, launched its own digital coin for instant payments. Their blockchain network, Liink, has over 400 financial institutions signed up. When the dinosaurs of banking start to evolve, you know something big happens.

Blockchain Solutions for Real Businesses

Companies like Web3 Enabler don’t just watch from the sidelines – they’re in the game, helping businesses leverage blockchain for faster, cheaper global payments. Salesforce-native solutions make it easier for companies to accept stablecoin payments and send global payments with the speed of a caffeinated cheetah. We’re talking real-world solutions for real-world businesses, not just crypto pipe dreams.

The blockchain revolution in global payments isn’t some far-off future – it happens right now. From Ripple’s lightning-fast transactions to stablecoins smoothing out international trade, the financial landscape changes faster than you can refresh your crypto wallet. And with players bridging the gap between blockchain and traditional business infrastructure, it’s never been easier to hop on this high-speed money train.

Wrapping Up

Blockchain revolutionizes global payments with lightning-fast speeds, minimal fees, and unparalleled transparency. This technology transforms cross-border transactions from a slow, expensive process into a seamless experience. As more businesses and financial institutions adopt blockchain, we anticipate even faster innovation in the realm of global remittance.

The future of international money transfers is here, and it’s powered by blockchain. Sending funds across borders will soon become as simple as sending a text message (minus the embarrassing autocorrect fails). This shift promises to reshape how businesses and individuals manage their global financial interactions.

Don’t let your business get left behind in the financial Stone Age. Web3 Enabler offers Salesforce-native blockchain tools to help you navigate this new landscape. Our solutions enable you to accept stablecoin payments, send global payments faster, and gain visibility into crypto holdings – all within your existing Salesforce infrastructure.