Traditional financial reporting shows you what happened yesterday. Blockchain analytics reveals what’s happening right now across your entire payment ecosystem.

Traditional financial reporting shows you what happened yesterday. Blockchain analytics reveals what’s happening right now across your entire payment ecosystem.

At Web3 Enabler, we’ve seen companies transform their treasury operations by leveraging real-time transaction data. This visibility changes how businesses monitor cash flows, assess risks, and optimize supplier relationships across global markets.

What Blockchain Analytics Reveals About Your Business

Blockchain analytics transforms invisible payment flows into actionable business intelligence. When your treasury team sends a USDC payment to a supplier in Lagos, traditional systems show a debit entry days later. Blockchain analytics reveals the complete journey: transaction confirmation in 15 seconds, gas fees of $2.40, wallet address verification, and immediate settlement confirmation. This granular visibility extends across every digital asset movement in your organization.

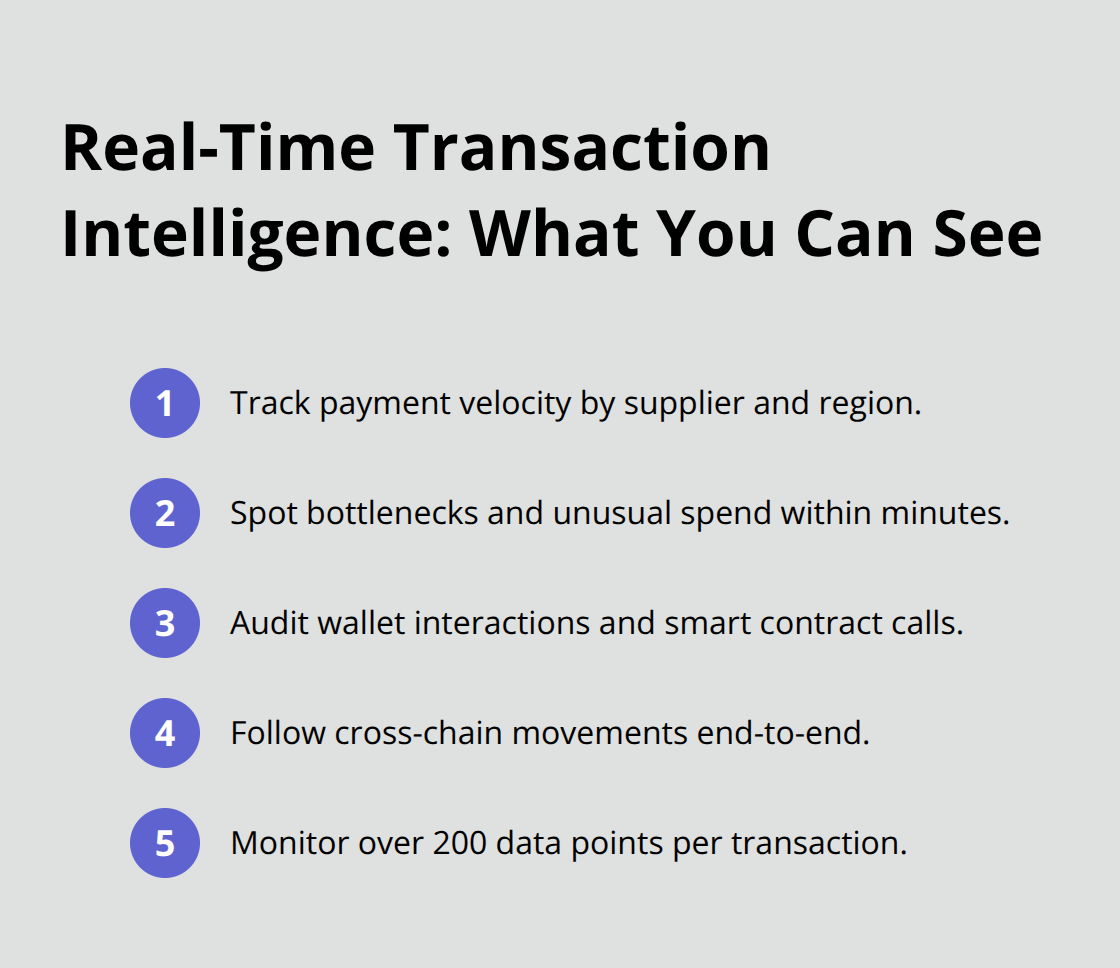

Transaction Intelligence in Real Time

Modern blockchain analytics platforms track over 200 data points per transaction. McKinsey research shows companies achieve lower costs through blockchain implementation. Your finance team can monitor payment velocity, identify bottlenecks in supplier chains, and detect unusual spending patterns within minutes. Transaction timestamps, wallet interactions, smart contract executions, and cross-chain movements create a comprehensive audit trail that traditional banking cannot match.

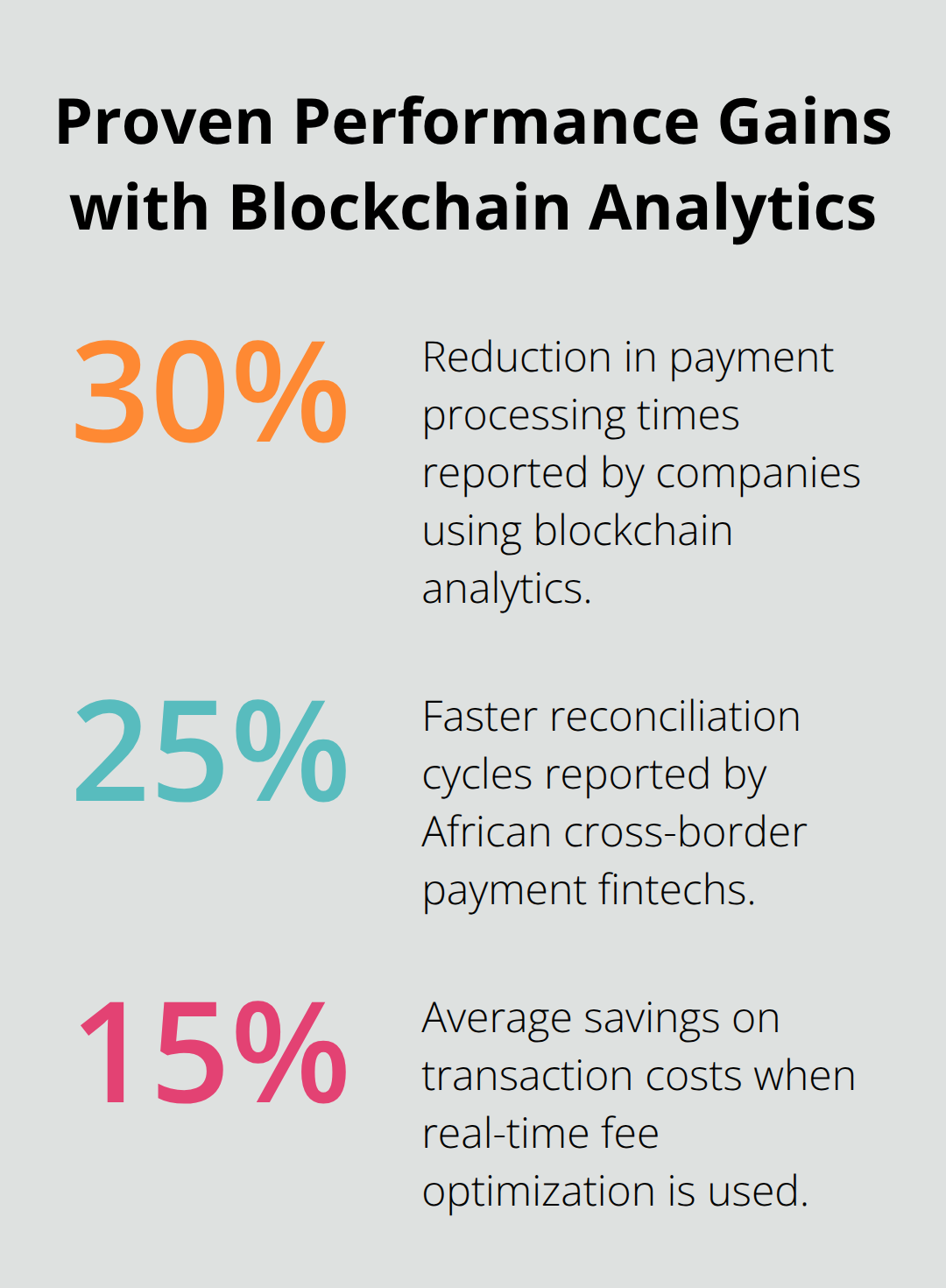

African fintech companies that process cross-border payments report 25% faster reconciliation times when they leverage real-time blockchain data versus correspondent banking reports.

How Analytics Differs from Traditional Reports

Traditional accounting systems aggregate data weekly or monthly. Blockchain analytics operates continuously and processes transaction data as it occurs on-chain. While your ERP system shows quarterly supplier payment totals, blockchain analytics reveals payment frequency patterns, optimal payment timing, and liquidity management opportunities. This difference becomes significant for companies that manage international payroll or supplier relationships across multiple currencies. PwC studies indicate 25% faster transaction processing when businesses integrate blockchain with existing financial systems (particularly for companies that operate across emerging markets where traditional banking infrastructure remains limited).

Key Metrics That Drive Business Decisions

Blockchain analytics provides metrics that traditional financial systems cannot capture. Transaction finality rates, network congestion patterns, and cross-border settlement speeds become measurable data points. Your treasury team can track average confirmation times, optimize gas fee strategies, and predict network performance during peak periods. These insights enable proactive cash flow management and help finance teams make data-driven decisions about payment timing and routing strategies across different blockchain networks.

How Blockchain Analytics Transform Daily Operations

Blockchain analytics converts raw transaction data into operational advantages that finance teams can implement immediately. Companies that use blockchain analytics report up to 30% reduction in payment processing times according to McKinsey research. Your treasury team gains visibility into payment flows that traditional systems cannot provide. When you process supplier payments across African markets, analytics platforms reveal optimal timing windows, network congestion patterns, and cost-effective routing strategies.

Real-time monitoring identifies failed transactions within seconds rather than discovering issues during monthly reconciliation cycles.

Treasury Operations with Predictive Intelligence

Smart treasury management leverages blockchain analytics to predict cash flow requirements and optimize liquidity positioning. Analytics platforms track payment velocity patterns across different suppliers and regions. This enables finance teams to maintain minimal working capital while meeting payment obligations. Companies that process international payroll through stablecoins reduce foreign exchange exposure through precise timing analytics. Transaction data reveals peak processing periods, which allows treasurers to batch payments during low-fee windows. African fintech companies report 25% improvement in cash flow predictability when they implement real-time blockchain monitoring systems.

Risk Assessment Through Transaction Patterns

Compliance monitoring becomes proactive rather than reactive when blockchain analytics identify suspicious transaction patterns automatically. Analytics platforms flag unusual wallet interactions, detect potential money laundering activities, and verify counterparty legitimacy through on-chain behavior analysis. Financial institutions that process cross-border payments can identify regulatory risks before transactions complete (preventing compliance violations that cost businesses millions annually). Transaction clustering analysis reveals vendor payment patterns that indicate potential fraud or operational inefficiencies, which enables immediate corrective action.

Vendor Performance and Payment Optimization

Blockchain analytics transforms vendor relationships through detailed payment tracking and performance measurement. Analytics platforms monitor payment confirmation times, identify vendors that consistently delay invoice processing, and reveal optimal payment schedules that maximize early payment discounts. Companies that manage supplier networks across multiple African markets use transaction analytics to evaluate vendor reliability and negotiate better payment terms based on historical performance data. Payment routing optimization reduces transaction costs while maintaining supplier satisfaction through predictable payment timing.

These operational improvements create the foundation for selecting the right analytics tools and platforms that can integrate seamlessly with your existing business intelligence infrastructure.

Which Analytics Platform Fits Your Business

Enterprise blockchain analytics platforms differ dramatically in their capabilities and integration depth. Chainalysis and Elliptic lead the market for compliance-focused analytics, while Nansen and Dune Analytics excel at transaction pattern analysis. Companies that process significant cross-border payments need platforms that handle multiple blockchain networks simultaneously. Chainalysis provides comprehensive compliance databases, which makes it essential for financial institutions that operate across African markets where regulatory requirements change frequently. However, these platforms often require dedicated data teams to extract actionable insights from raw blockchain data.

Integration Requirements That Actually Work

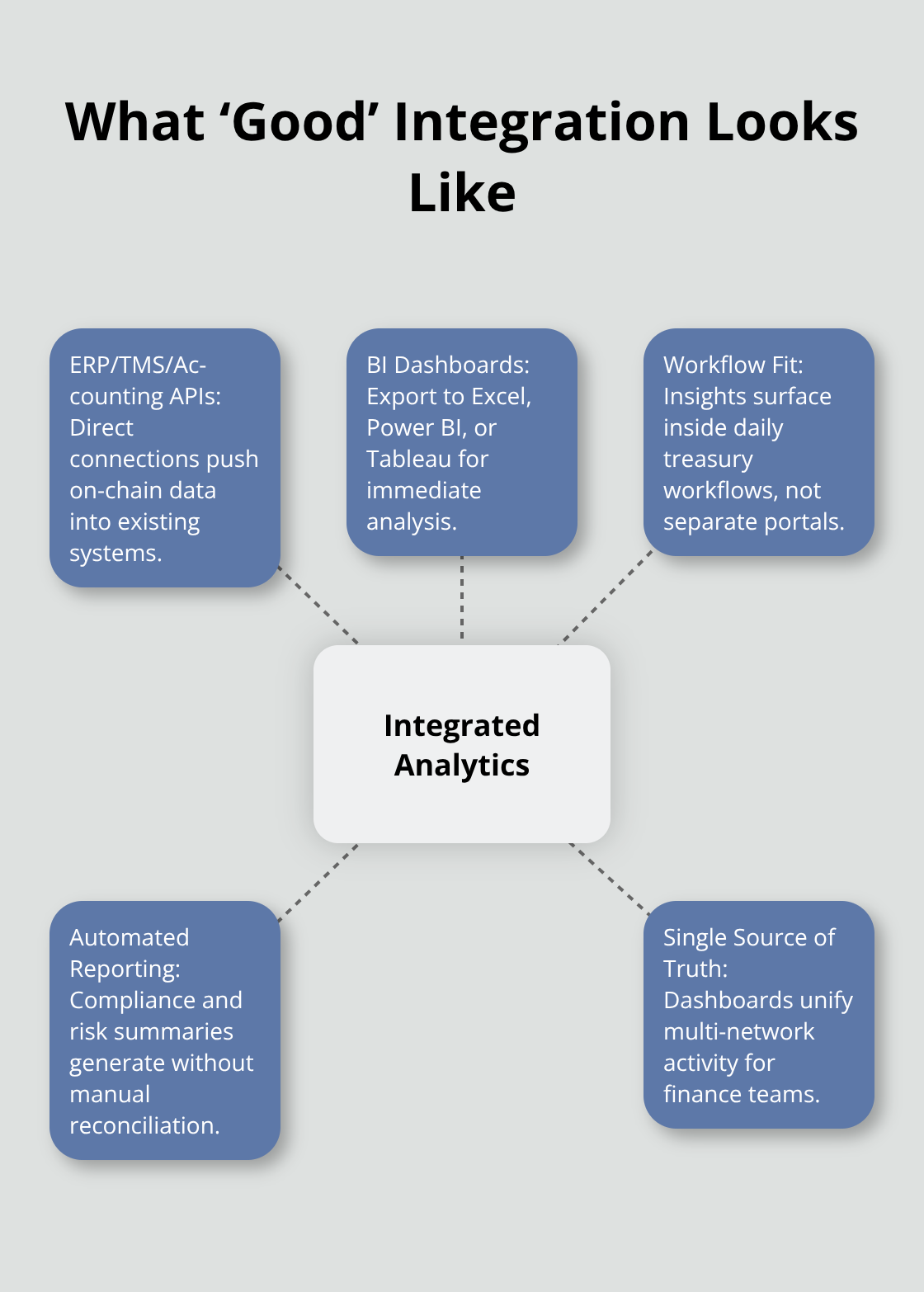

Modern businesses cannot afford analytics platforms that operate in isolation from existing financial systems. Successful blockchain analytics integration requires direct API connections to your ERP, treasury management systems, and accounting software.

Companies that achieve the best results use platforms that export data directly into Excel, PowerBI, or Tableau for immediate analysis by existing finance teams. Real-time monitoring becomes meaningless if your treasury team cannot access insights within their daily workflow. Platforms like TRM Labs provide automated compliance reports that integrate with existing risk management systems (reducing manual reconciliation work by up to 60%). The most effective implementations connect blockchain analytics directly to existing business intelligence dashboards rather than create separate monitoring systems that finance teams ignore.

Real-Time Monitoring That Drives Action

Effective blockchain analytics platforms provide instant alerts when transaction patterns deviate from established baselines. Your treasury team needs platforms that identify failed transactions within 30 seconds, not during monthly reconciliation cycles. Advanced monitoring systems track network congestion and automatically recommend optimal transaction timing to minimize gas fees. Companies that process payroll through stablecoins save an average of 15% on transaction costs when they use platforms that provide real-time fee optimization. The best analytics platforms integrate directly with payment systems to automatically adjust transaction parameters based on network conditions (eliminating manual intervention for routine optimization decisions).

Platform Selection Criteria for African Markets

African fintech companies require analytics platforms that handle multiple currencies and regulatory frameworks simultaneously. Platforms must support local compliance requirements while providing insights into cross-border payment flows. Companies that operate across Kenya, Ghana, and Nigeria need analytics tools that track regulatory changes and automatically flag potential compliance issues. The most effective platforms provide customizable dashboards that display metrics relevant to African market conditions, including local currency volatility patterns and regional payment network performance data.

Final Thoughts

Blockchain analytics represents a fundamental shift from reactive financial reports to proactive business intelligence. Companies that implement comprehensive analytics platforms achieve measurable improvements in treasury efficiency, compliance oversight, and vendor relationship management. The data shows clear advantages: 30% reduction in payment processing times, 25% faster reconciliation cycles, and significant cost savings through optimized transaction timing.

Implementation success depends on platforms that integrate seamlessly with existing business systems rather than create isolated environments. Finance teams need analytics tools that connect directly to their daily workflows through ERP systems, accounting software, and business intelligence dashboards. The most effective deployments focus on actionable insights rather than raw data collection.

African markets present unique opportunities for blockchain analytics adoption. Companies that process cross-border payments across these markets benefit from real-time transaction tracking and automated risk assessment capabilities (particularly as regulatory frameworks in Kenya and Ghana create demand for compliance-focused systems). Web3 Enabler connects blockchain transactions directly to Salesforce environments, which enables businesses to leverage blockchain analytics within their existing corporate infrastructure while maintaining the security and efficiency that modern treasury operations require.