USDC disputes can turn your finance team’s day upside down faster than you can say “blockchain transaction.” Traditional payment dispute processes weren’t built for digital assets, leaving many businesses scrambling when issues arise.

We at Web3 Enabler know that managing these disputes in Salesforce requires a completely different approach than your standard chargeback workflow.

The good news? With the right setup, you can streamline USDC dispute resolution and save your team countless hours of manual work.

What Makes USDC Disputes Different

USDC disputes fall into three main categories that will make your traditional payment team sweat. Transaction reversibility disputes happen when customers expect Bitcoin-style immutability but discover USDC transfers through centralized exchanges can sometimes be reversed. Smart contract interaction disputes occur when payments get stuck in automated processes, and customers blame you instead of the code. Authorization disputes emerge when multiple parties claim ownership of the same wallet or when business partners dispute transaction amounts recorded on-chain.

The Irreversibility Challenge

Traditional credit card disputes give you 120 days to respond and multiple appeal rounds. USDC disputes demand immediate action because blockchain transactions create permanent records within minutes. Web3 security challenges continue to grow, with Web3 hacks causing significant losses in recent periods, creating additional dispute scenarios around security breaches. Your dispute response window shrinks from months to hours, and documentation requirements shift from receipt copies to transaction hash verification and wallet ownership proof.

Compliance Complexity

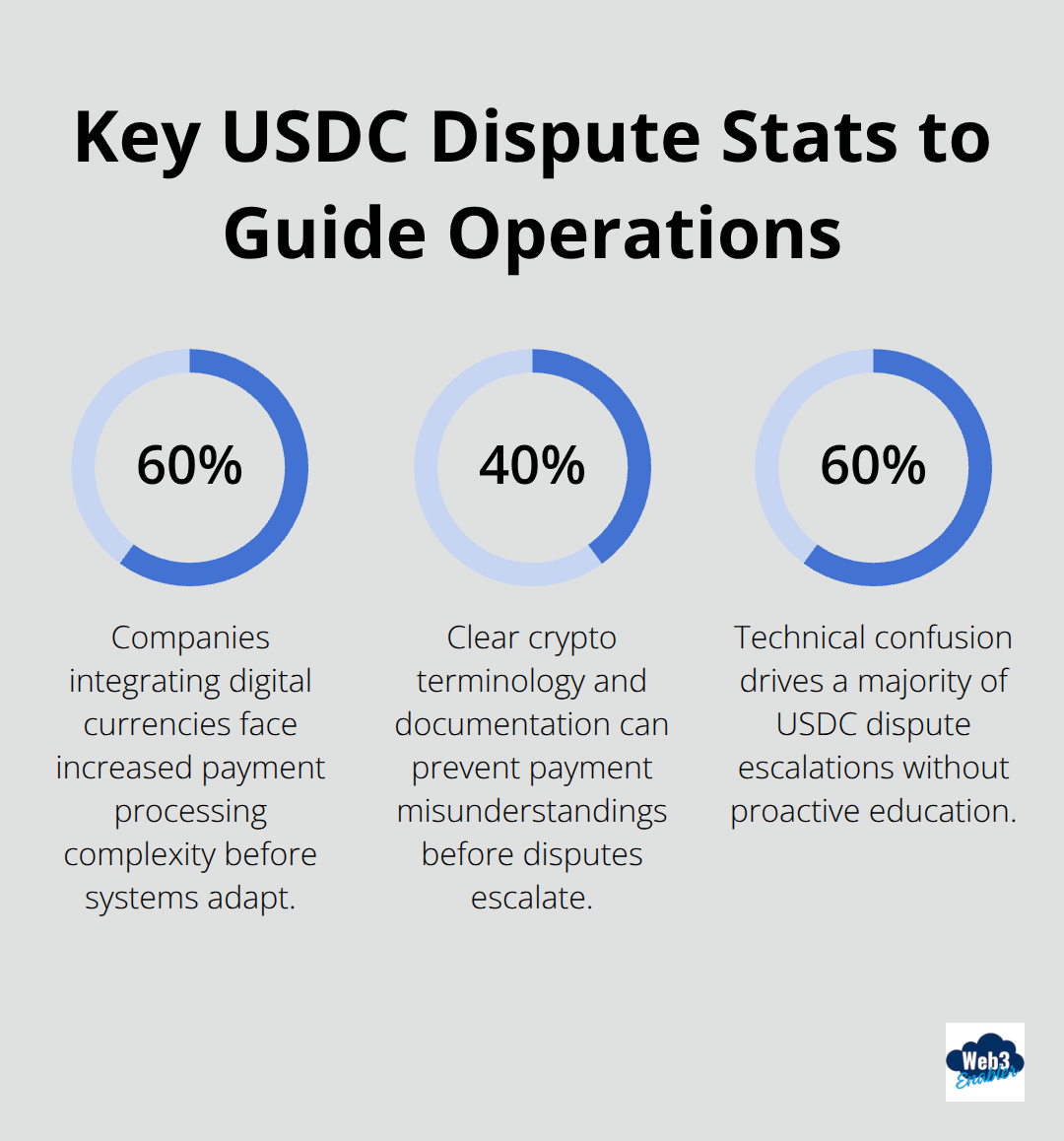

The U.S. Treasury has indicated potential regulatory guidance for digital currencies, which makes compliance a moving target for USDC dispute resolution. You need KYC documentation that traditional payment processors never required, plus transaction monitoring that goes beyond standard merchant account rules. McKinsey reports that 60% of companies that integrate digital currencies face increased complexity in payment processing, but those same companies see efficiency gains once systems adapt.

Documentation Requirements

Your Salesforce setup must track wallet addresses, transaction confirmations, and regulatory compliance simultaneously while it maintains audit trails that satisfy both traditional finance and emerging crypto regulations. This triple-layer approach creates new challenges that standard dispute workflows can’t handle, which sets the stage for specialized configuration needs within your CRM system.

How Do You Configure Salesforce for USDC Disputes

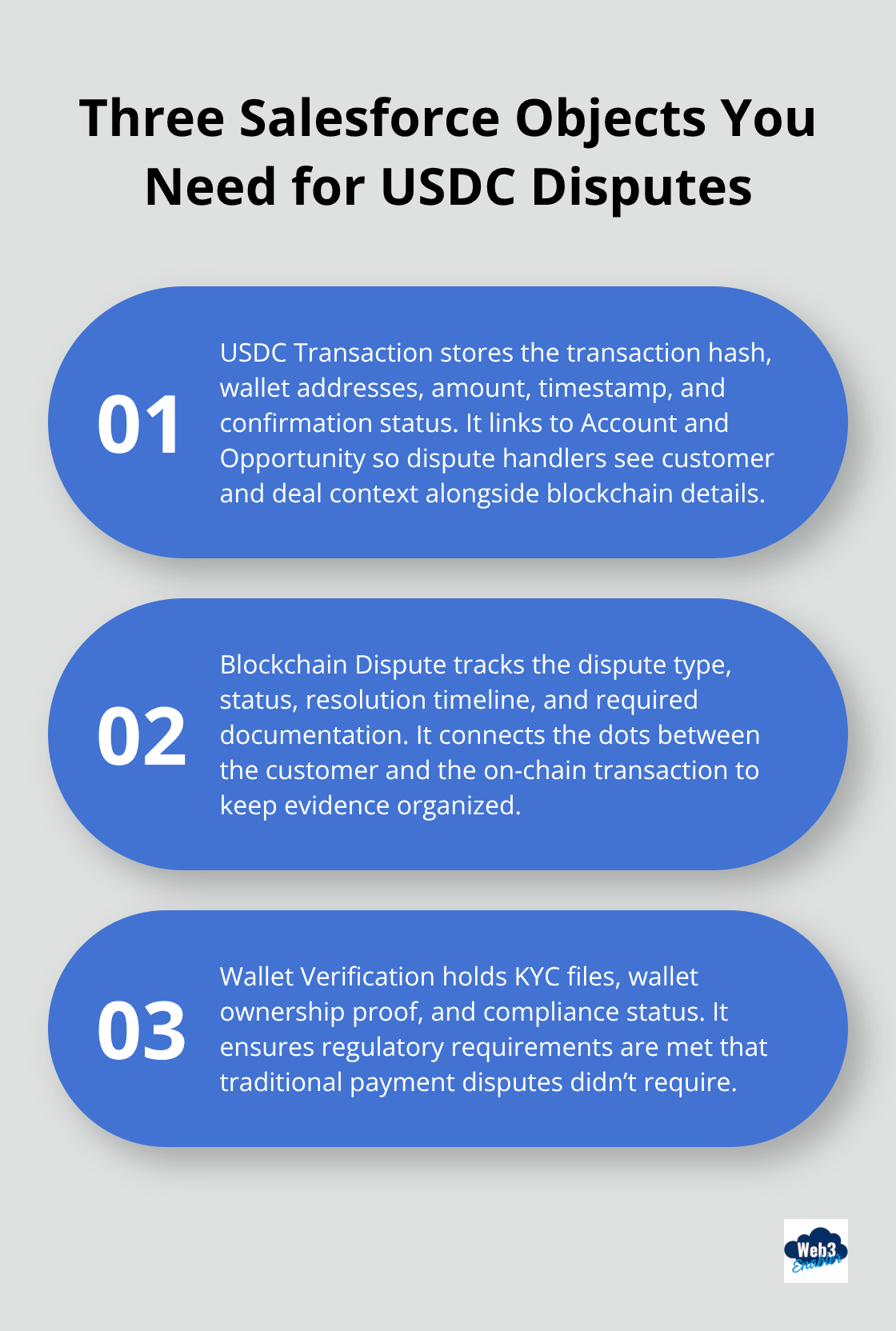

Your Salesforce org needs three custom objects to handle USDC disputes properly: USDC Transaction, Blockchain Dispute, and Wallet Verification. The USDC Transaction object captures transaction hash, wallet addresses, amount, timestamp, and confirmation status with lookup relationships to your Account and Opportunity records. The Blockchain Dispute object tracks dispute type, status, resolution timeline, and required documentation while it connects to both transaction and customer records. Your Wallet Verification object stores KYC documentation, wallet ownership proof, and compliance status to satisfy regulatory requirements that traditional payment disputes never needed.

Workflow Rules That Drive Results

Build workflow rules that trigger when dispute status changes from Open to Under Review, and these rules automatically assign cases to team members based on dispute amount and complexity. Set up email alerts that fire when blockchain confirmations exceed six blocks, and these alerts notify your finance team that transaction finality makes resolution more challenging. Configure escalation rules that bump high-value disputes over $10,000 to senior staff within two hours because USDC disputes move faster than traditional payment issues. Process Builder workflows should automatically pull blockchain data through API calls when new disputes arrive, and they populate transaction details and wallet information without manual data entry.

Real-Time Blockchain Data Integration

Connect Salesforce to blockchain APIs through custom Apex classes that pull transaction data every 15 minutes, and these classes update confirmation counts and transaction status automatically. Your integration should flag transactions stuck in pending status for over 30 minutes because these often become disputes within hours. Set up dashboard components that display wallet balances, transaction history, and network congestion levels so your team understands the full context before they respond to customers. Configure custom fields that capture gas fees, network delays, and smart contract interactions because these technical details become evidence in dispute resolution conversations.

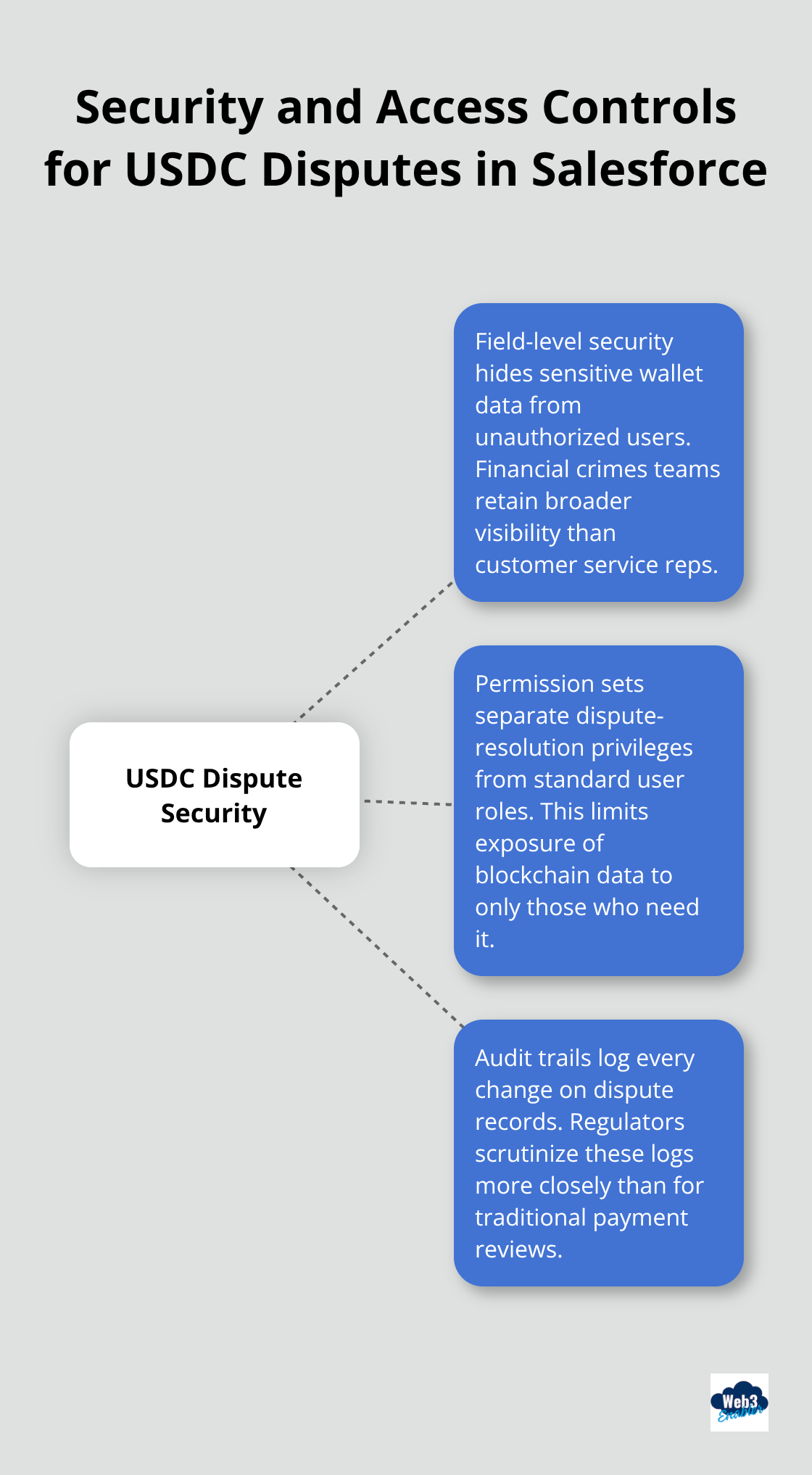

Security and Access Controls

Implement field-level security that restricts wallet address visibility to authorized personnel only (financial crimes teams need broader access than customer service reps). Create permission sets that separate dispute resolution access from standard Salesforce user privileges, and these controls protect sensitive blockchain data from unauthorized viewing. Set up audit trails that track every field change on dispute records because regulatory bodies scrutinize digital asset dispute handling more intensely than traditional payment reviews.

With your Salesforce configuration locked down and blockchain data flowing automatically, your team needs proven strategies to resolve disputes before they escalate into regulatory headaches.

How Do You Resolve USDC Disputes Fast

Your documentation strategy determines whether disputes resolve in hours or drag on for weeks. Capture transaction hashes within your Salesforce dispute record immediately when customers report issues, then pull confirmation data through blockchain APIs to verify transaction status and network fees. Store wallet ownership verification documents directly in Salesforce Files, and include signed messages from the wallet address plus government-issued ID that matches KYC records. Harvard Business Review research shows that clear documentation around cryptocurrency terms prevents 40% of payment misunderstandings before they escalate into formal disputes.

Response Speed Wins Cases

Customer communication must acknowledge USDC disputes within two hours because blockchain transactions create urgency that traditional payment disputes never faced. Send automated responses through Salesforce email templates that explain the immutable nature of blockchain transactions while you gather evidence, then follow up with personalized messages that address specific technical concerns customers raise. The Blockchain Association found that 40% of consumers prefer cryptocurrency transaction security, but they expect the same customer service speed they get with credit cards.

Train your team to explain gas fees, network congestion, and confirmation delays in plain language because technical confusion drives 60% of USDC dispute escalations. Create Salesforce knowledge base articles that customers can access through your community portal (these self-service resources should cover common scenarios like delayed confirmations and wallet connectivity issues).

Escalation Protocols That Protect Revenue

High-value disputes over $5,000 need senior finance team review within four hours because regulatory scrutiny intensifies with transaction amounts, and your response quality affects future compliance audits. Build Process Builder workflows that automatically create tasks for legal review when disputes involve potential fraud indicators like multiple wallet addresses or unusual transaction patterns.

Configure Salesforce case escalation rules that bump disputes to management when initial resolution attempts fail within 24 hours (USDC dispute resolution windows close faster than traditional payment processing allows). Document every customer interaction through Salesforce Activities because regulators examine communication patterns when they investigate digital asset dispute handling practices.

Evidence Collection Standards

Gather blockchain evidence systematically to build airtight cases that satisfy both customers and compliance teams. Screenshot transaction confirmations from multiple blockchain explorers to prove transaction completion, then save these images directly to Salesforce Files with timestamps that match your dispute timeline. Collect wallet signature verification through standardized message formats that prove customer ownership without compromising security protocols.

Final Thoughts

USDC disputes become manageable when your Salesforce system handles blockchain complexity automatically. Companies that implement these specialized workflows report 30-50% cost reductions in dispute resolution according to McKinsey research, while response times drop from days to hours. Your finance team stops scrambling with manual processes and starts resolving issues before they escalate into regulatory problems.

The efficiency gains compound quickly once you establish proper workflows. Automated blockchain data integration eliminates manual transaction verification, while standardized documentation workflows reduce evidence collection time by 60%. Your customer service team handles technical questions confidently through knowledge base resources, and escalation protocols protect high-value transactions without overwhelming senior staff.

Web3 Enabler provides Salesforce Native blockchain solutions that connect seamlessly with your existing infrastructure. Our tools support payments, compliance, and automation rather than crypto speculation (with backing from trusted partners like Circle, Ripple, and Cardano Catalyst). Stop letting USDC disputes disrupt your operations and start building competitive advantages through streamlined blockchain integration.