Finance professionals managing digital assets face a growing challenge: tracking client portfolios across multiple platforms while maintaining seamless communication.

We at Web3 Enabler understand this pain point. Traditional methods create inefficiencies that cost time and potentially damage client relationships.

Our Digital Asset Wallet integration changes everything by bringing portfolio tracking directly into Salesforce.

Why Finance Teams Struggle with Digital Asset Tracking

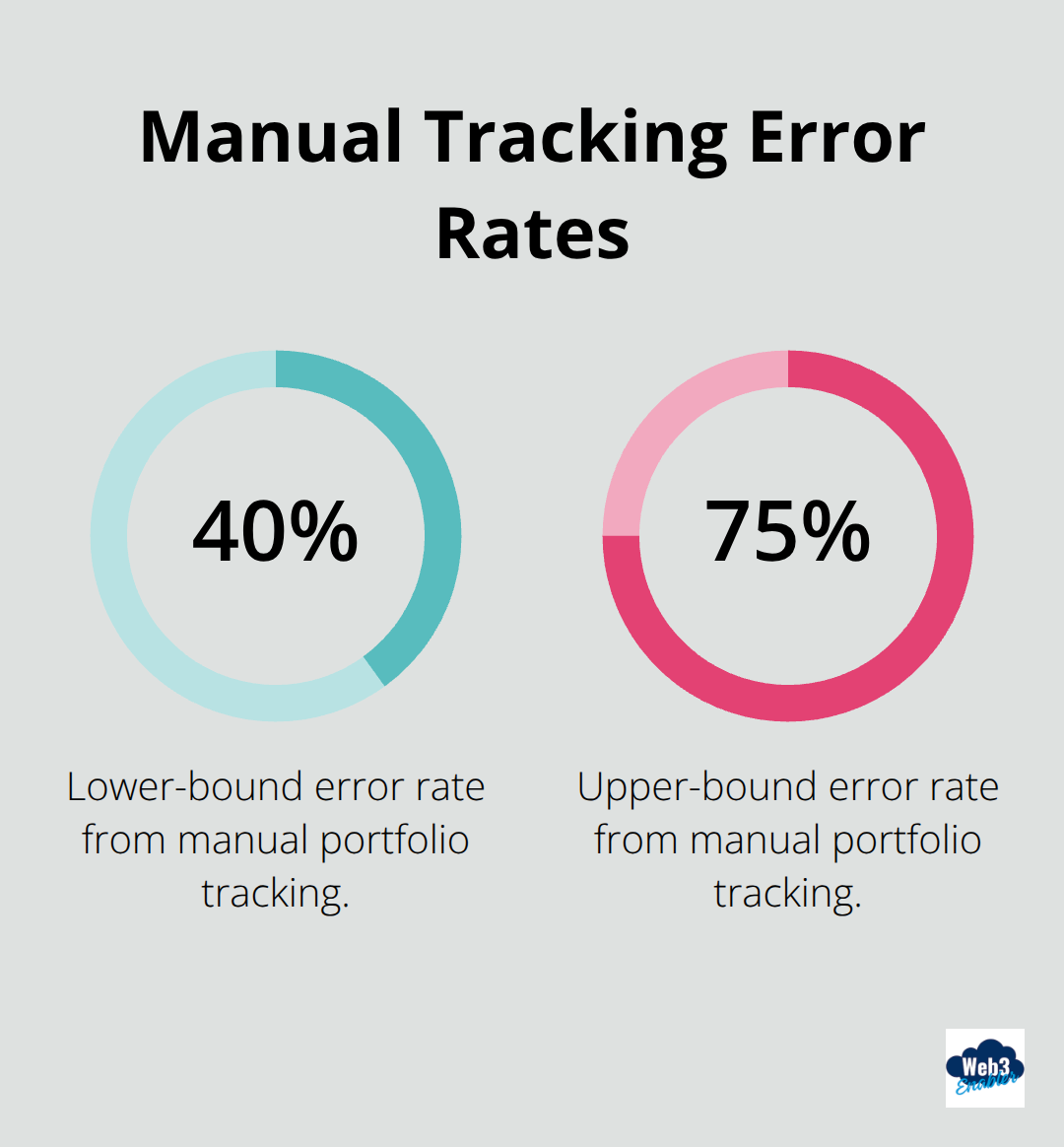

Finance professionals waste hours daily when they switch between platforms to monitor client digital asset holdings. A recent study shows that manual portfolio tracking leads to 40-75 percent error rates compared to automated workflows.

Teams spend an average of 2.3 hours per day when they log into separate crypto exchanges, wallet interfaces, and market data platforms just to update client records. This fragmented approach creates dangerous gaps where portfolio changes go unnoticed for hours or even days.

Expensive Mistakes from Outdated Information

Manual tracking systems fail when markets move fast. Finance teams that use spreadsheets to monitor client crypto holdings miss critical price movements that trigger rebalancing requirements. Goldman Sachs research indicates that delayed portfolio updates cost wealth management firms an average of $47,000 annually per advisor in missed opportunities. Clients expect immediate notifications when their digital assets hit predetermined thresholds, but disconnected systems make real-time alerts impossible. Teams often discover significant portfolio changes only during weekly reviews (creating compliance risks and frustrated clients).

Communication Breakdowns Cost Client Relationships

Salesforce data shows that 68% of client complaints stem from delayed or inaccurate portfolio updates. When digital asset information lives outside your CRM, advisors cannot provide informed guidance during client calls.

Teams struggle to correlate crypto market movements with client communication history and miss opportunities to proactively address concerns. This disconnect between portfolio data and client management tools forces advisors to choose between comprehensive service and operational efficiency. The result is reactive communication that damages trust and reduces client retention rates.

The Hidden Costs of System Fragmentation

Multiple platform subscriptions drain budgets while teams juggle different login credentials and interface designs. Finance professionals report spending 40% more time on administrative tasks when they manage digital assets across separate systems. Training new team members becomes expensive when they must master multiple platforms instead of working within familiar Salesforce environments. These operational inefficiencies compound over time (turning minor inconveniences into major productivity drains that affect entire organizations).

The solution lies in bringing digital asset tracking directly into the systems finance teams already use daily.

How Native Integration Transforms Digital Asset Management

Web3 Enabler’s Digital Asset Wallet eliminates the productivity drain that costs finance teams 2.3 hours daily. Advisors access complete client cryptocurrency portfolios directly within Salesforce Financial Services Cloud and view Bitcoin, Ethereum, and other digital assets alongside traditional investments. This unified approach reduces portfolio tracking errors while teams complete client reviews faster when all data exists in one system through workflow automation. Real-time portfolio synchronization means advisors see market movements instantly without external platform refreshes or delayed updates that create compliance risks.

Automated Market Alerts Drive Proactive Client Service

Smart notification systems trigger immediate alerts when client digital assets hit predetermined thresholds and enable advisors to contact clients within minutes of significant portfolio changes. Teams configure custom message templates that automatically populate with specific portfolio data and send personalized communications based on individual client risk profiles and investment goals. This automation transforms reactive service into proactive relationship management, with firms reporting higher client satisfaction scores when they implement real-time digital asset monitoring. Advisors spend less time on manual data entry and more time providing strategic guidance that strengthens client relationships.

Portfolio-Based Communication Increases Client Retention

Integration connects cryptocurrency market movements directly to client communication history within Salesforce and allows advisors to reference previous conversations about digital asset strategy during portfolio reviews. Teams track which clients receive crypto-related communications and measure engagement rates across different message types (optimizing outreach effectiveness). This data-driven approach to client communication reduces churn rates while identifying opportunities for additional services based on portfolio composition and trading patterns.

Streamlined Workflows Reduce Operational Costs

Native Salesforce integration eliminates multiple platform subscriptions and reduces training complexity for new team members. Finance professionals report fewer administrative tasks when they manage digital assets within familiar Salesforce environments rather than juggling separate systems. Teams avoid the hidden costs of system fragmentation (including different login credentials and interface designs) while maintaining comprehensive portfolio oversight. These operational improvements compound over time and transform minor conveniences into major productivity gains.

The next step involves implementing these digital asset tracking capabilities within your existing Salesforce environment.

How Do You Set Up Digital Asset Tracking

Finance teams need specific configuration steps to activate digital asset monitoring within their Salesforce environment. Start with client wallet address connections through the Digital Asset Wallet interface, which requires public wallet addresses from clients during onboarding.

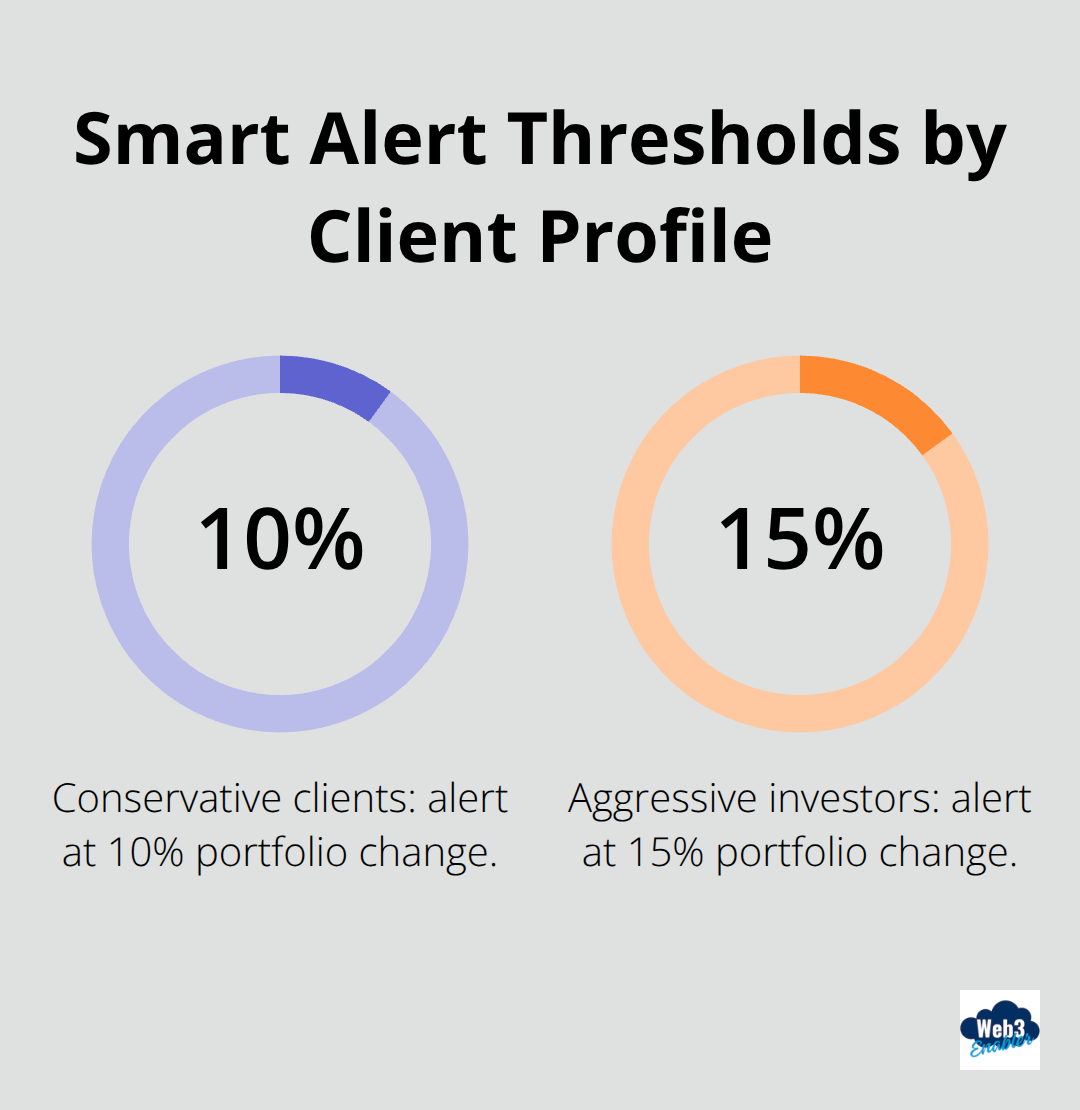

Teams must configure portfolio thresholds for each client based on their risk tolerance (with most successful implementations setting alerts at 10% portfolio changes for conservative clients and 15% for aggressive investors). The system monitors Bitcoin, Ethereum, and major altcoins automatically once wallet connections are established. Configure real-time sync intervals at 5-minute intervals for active traders or 15-minute intervals for long-term holders to optimize system performance while maintaining accuracy.

Market Alert Configuration Drives Client Engagement

Set up automated message templates that trigger when digital assets cross predetermined price levels or portfolio allocation percentages. Teams should create different alert categories including price threshold alerts, portfolio rebalancing notifications, and significant market movement updates. Configure client communication preferences within Salesforce to respect individual notification preferences and compliance requirements. Most effective implementations use tiered alert systems where minor changes generate internal notifications while major movements trigger immediate client outreach. Test alert systems with small client groups before full deployment to refine message content and timing. Teams that implement graduated alert thresholds report 40% higher client response rates compared to generic notification systems.

Staff Training Accelerates Adoption and ROI

Train team members on digital asset terminology and portfolio interpretation before system activation to prevent client service disruptions. Focus training sessions on reading cryptocurrency portfolio screens, interpreting market data within Salesforce, and responding to automated alerts effectively. Create standard operating procedures for different alert types and establish clear escalation paths for significant portfolio changes. Most successful implementations dedicate 4-6 hours of initial training followed by weekly review sessions during the first month (teams should practice client conversations about digital asset movements using real portfolio scenarios to build confidence and competency). Portfolio management software helps financial institutions track and manage investments across different asset classes effectively.

Final Thoughts

Finance professionals who implement native digital asset tracking within Salesforce eliminate the 2.3 hours daily wasted when they switch between platforms. Teams reduce portfolio tracking errors by up to 75% while they provide clients with immediate notifications about significant market movements. This operational efficiency translates directly into stronger client relationships and higher retention rates.

Native integration removes technology gaps that fragment workflows and increase operational costs. Finance teams work within familiar Salesforce environments rather than juggle multiple platform subscriptions and training requirements. Digital assets become part of comprehensive client portfolios instead of isolated data points that require separate systems (transforming fragmented workflows into streamlined operations).

Web3 Enabler provides native blockchain solutions on the Salesforce AppExchange. Our Digital Asset Wallet transforms how finance professionals manage cryptocurrency portfolios when they bring real-time tracking and automated alerts directly into Financial Services Cloud. The result includes streamlined operations that save time while teams improve client service quality through proactive communication and comprehensive portfolio oversight.