Cryptocurrency visibility is becoming a critical issue for financial advisors. As more clients invest in digital assets, traditional portfolio management tools fall short.

At Web3 Enabler, we’ve seen firsthand how this lack of insight can hinder advisors’ ability to provide comprehensive financial guidance. Our solution integrates crypto data directly into Salesforce, giving advisors the full picture they need to serve their clients better.

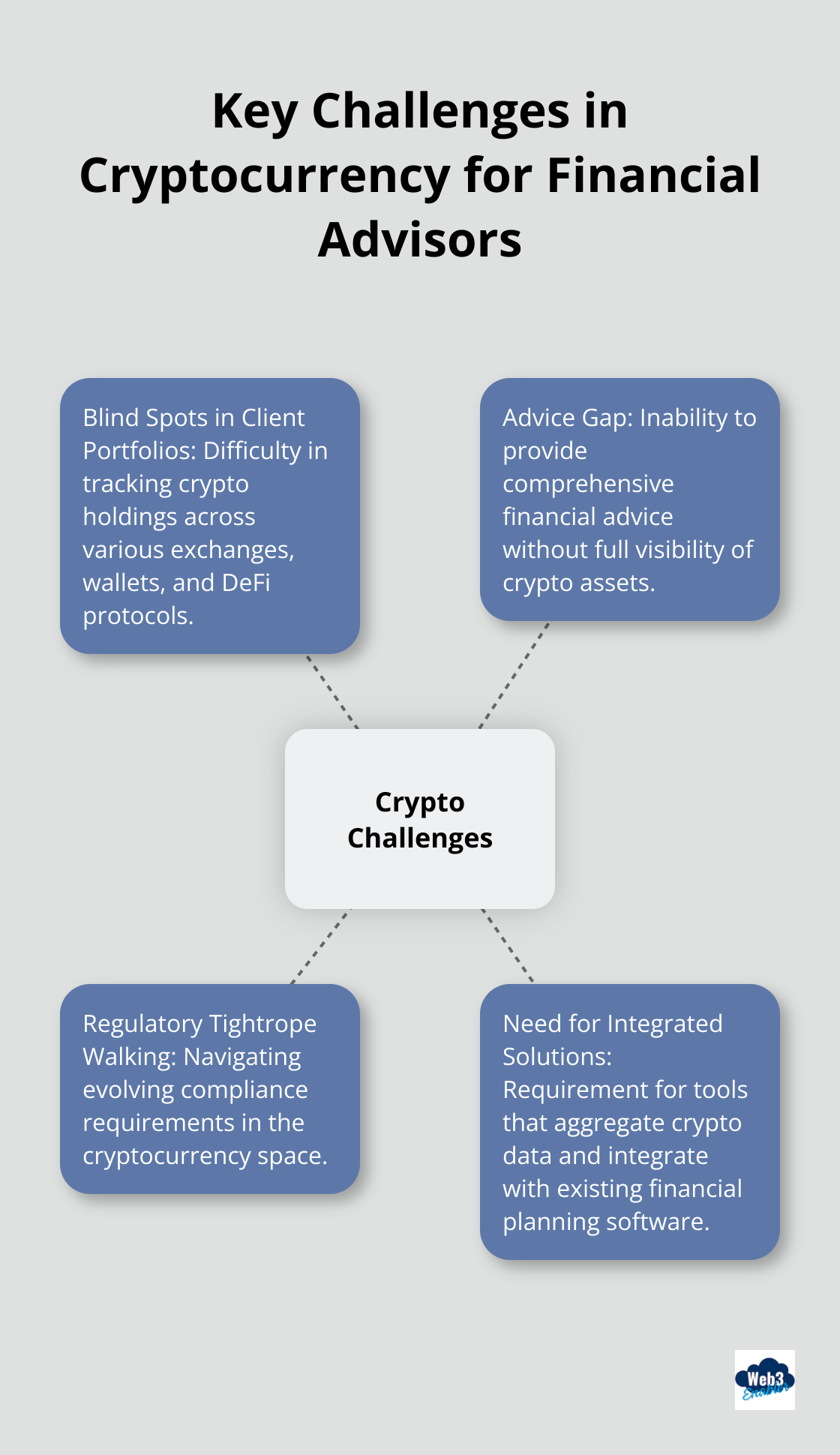

Navigating the Crypto Maze: Challenges for Financial Advisors

Blind Spots in Client Portfolios

Financial advisors face a complex landscape when it comes to cryptocurrency. The rapid growth of digital assets creates new challenges that traditional financial tools struggle to address. One of the biggest hurdles for advisors is the lack of visibility into clients’ crypto holdings. Unlike traditional assets, cryptocurrencies often exist outside the usual financial ecosystem. Clients may hold their digital assets on various exchanges, in hardware wallets, or even in decentralized finance (DeFi) protocols. This fragmentation makes it difficult for advisors to get a complete picture of their clients’ financial situation.

The Advice Gap

Without a clear view of crypto holdings, providing comprehensive financial advice becomes a guessing game. Advisors may unknowingly overlook significant portions of their clients’ wealth, leading to suboptimal investment strategies and risk management. For example, a client with a large Bitcoin position might be overexposed to volatility, but if the advisor is unaware of this holding, they can’t properly adjust the rest of the portfolio to balance the risk.

Regulatory Tightrope Walking

Compliance concerns add another layer of complexity. The regulatory landscape for cryptocurrencies continues to evolve, with different jurisdictions taking varied approaches. Advisors must navigate this uncertain terrain while ensuring they meet their fiduciary responsibilities. Without proper tools to track and report on crypto assets, advisors risk running afoul of regulatory requirements or failing to provide accurate tax guidance to their clients.

The Need for Integrated Solutions

The challenges outlined above highlight the pressing need for integrated solutions that bridge the gap between traditional finance and the new digital asset frontier. Financial advisors require tools that can:

- Aggregate crypto holdings from multiple sources (exchanges, wallets, DeFi protocols)

- Provide real-time valuation of digital assets

- Offer compliance and tax reporting features

- Integrate seamlessly with existing financial planning software

As the crypto market continues to mature, advisors who can effectively incorporate digital assets into their practice will have a significant advantage. The next section will explore how innovative solutions (like those offered by Web3 Enabler) are addressing these challenges head-on, empowering advisors to confidently navigate the crypto landscape.

How Web3 Enabler Bridges the Crypto Gap

Unified Data Integration

Web3 Enabler’s solution aggregates data from multiple crypto sources (exchanges, wallets, and DeFi protocols). This integration provides advisors with a single dashboard within Salesforce to view all client assets. Advisors no longer need to juggle between different platforms or rely on client self-reporting. They can see the full picture of a client’s portfolio, including both traditional and digital assets, in one place.

Real-Time Asset Tracking

The crypto market moves fast, and advisors need up-to-date information to make informed decisions. Digital Asset Wallets provides real time data into Financial Services Cloud, focusing on regulatory compliance. This feature allows advisors to react quickly to market shifts and adjust strategies accordingly. For instance, if a client’s Bitcoin holdings suddenly spike in value, an advisor can immediately see this change and recommend rebalancing the portfolio to maintain the desired risk profile.

Streamlined Compliance and Reporting

Regulatory compliance presents a major concern for financial advisors dealing with crypto. Web3 Enabler addresses this issue by automating compliance reporting. The system generates detailed reports that meet regulatory requirements, which saves advisors time and reduces the risk of errors. These reports include transaction histories, capital gains calculations, and other essential data points that regulators often request.

Enhanced Client Communication

With comprehensive crypto data at their fingertips, advisors can improve their client communications. They can provide more accurate and timely updates on portfolio performance, including both traditional and digital assets. This transparency builds trust and allows for more informed discussions about investment strategies and risk management.

Seamless Integration with Existing Workflows

Web3 Enabler’s solution integrates smoothly with Salesforce, a platform many financial advisors already use. This seamless integration means advisors don’t need to learn a completely new system or disrupt their existing workflows. They can incorporate crypto asset management into their daily operations with minimal friction, allowing them to focus on what matters most: serving their clients.

The ability to confidently navigate the crypto landscape empowers financial advisors to provide more comprehensive and accurate advice to their clients. As we explore the benefits of this enhanced visibility in the next section, it becomes clear how this technology transforms the advisor-client relationship in the digital asset era.

Unlocking Advisor Potential with Crypto Integration

Holistic Portfolio Management

Financial advisors who embrace comprehensive crypto visibility gain a significant edge in today’s evolving financial landscape. The integration of cryptocurrency data into existing workflows transforms advisory practices and delivers superior value to clients.

A complete view of client assets, including cryptocurrencies, allows advisors to make more accurate assessments of portfolio allocation and risk. A client with a 20% allocation to Bitcoin (for example) might require a different approach to their traditional investments. This holistic view enables advisors to fine-tune strategies, ensuring optimal diversification and risk management across all asset classes.

Data-Driven Decision Making

Access to real-time cryptocurrency data empowers advisors to make informed decisions quickly. During the 2022 crypto market downturn, advisors who used integrated crypto tracking tools could promptly identify overexposed clients and recommend appropriate hedging strategies. This proactive approach can significantly mitigate potential losses and capitalize on market opportunities.

Building Trust Through Transparency

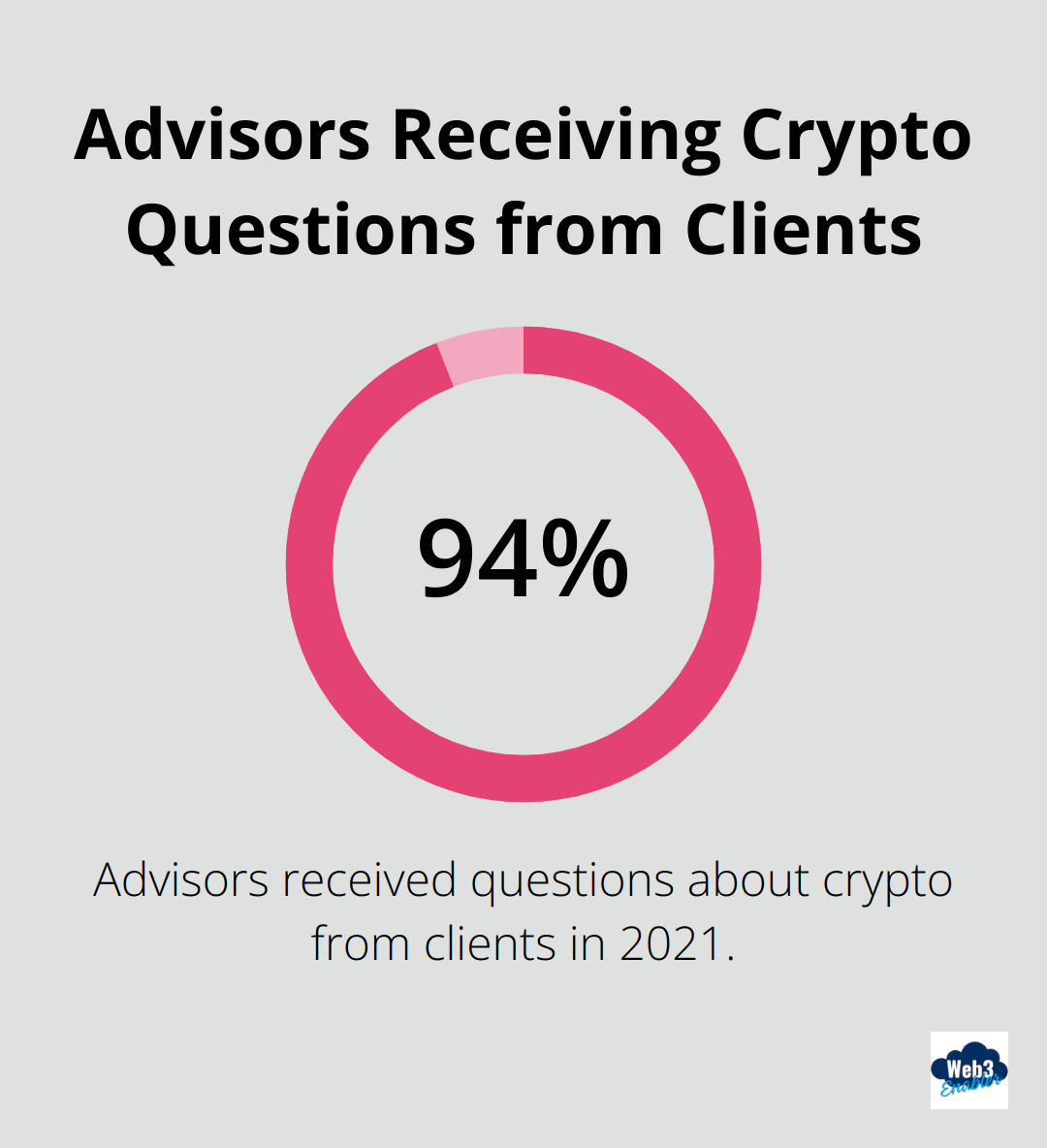

Clients increasingly expect their advisors to understand and incorporate digital assets into their financial planning. A survey by Bitwise Asset Management and ETF Trends found that 94% of advisors received questions about crypto from clients in 2021. Advisors who demonstrate expertise in this area strengthen client relationships and attract new business. Transparent reporting on crypto holdings alongside traditional assets fosters trust and positions the advisor as a forward-thinking professional equipped to handle the complexities of modern wealth management.

Competitive Advantage in a Digital Age

The integration of cryptocurrency visibility into financial advisory practices isn’t just about keeping up with trends-it’s about staying ahead of the curve. Advisors who master this integration position themselves to thrive in an increasingly competitive landscape. They offer a unique value proposition that sets them apart from peers who may still struggle with incorporating digital assets into their advisory services.

Enhanced Risk Management

Real-time tracking of crypto assets allows advisors to implement more sophisticated risk management strategies. They can set up alerts for significant price movements, rebalance portfolios more effectively, and provide timely advice on when to take profits or cut losses. This level of oversight (previously difficult to achieve with crypto assets) now becomes a standard part of the advisory toolkit.

Final Thoughts

Cryptocurrency visibility revolutionizes financial advisory services in today’s digital asset landscape. Web3 Enabler’s Salesforce integration tackles fragmented data and compliance challenges head-on. Our solution provides real-time crypto asset tracking and automated reporting, empowering advisors to offer more comprehensive financial guidance.

Enhanced cryptocurrency visibility enables data-driven decisions and sophisticated risk management strategies. Advisors who embrace these tools gain a significant advantage in modern wealth management. They attract new clients and provide superior value to existing ones by demonstrating expertise in digital assets.

Financial advisors must integrate cryptocurrency visibility into their practice to stay competitive. Web3 Enabler offers the necessary tools and expertise for a smooth transition. Take the first step towards comprehensive cryptocurrency visibility today and transform your client services in the digital age.