Cash is dying, and your business needs to know what’s replacing it.

We at Web3 Enabler have watched payment technology transform faster than ever before. As a digital payments expert, you’re probably juggling credit cards, wallets, stablecoins, and a dozen compliance headaches all at once.

This guide cuts through the noise and shows you exactly what modern businesses need to accept, how to stay secure, and what’s coming next.

Why Digital Payments Matter Right Now

The Cash Exodus Is Real

92% of shoppers used a digital payment method in the last year, according to McKinsey in 2024. That’s not a trend anymore-it’s the baseline. If your business isn’t accepting digital payments, you’re essentially telling nearly every customer to shop elsewhere. The shift away from cash isn’t coming; it’s already here. B2B check usage is down 7% in North America and Canada according to the 2025 AFP Digital Payments Survey. Your suppliers, your customers, and your competitors have all moved on. The question isn’t whether to accept digital payments-it’s which ones and how fast you implement them.

Your Bottom Line Gets Stronger

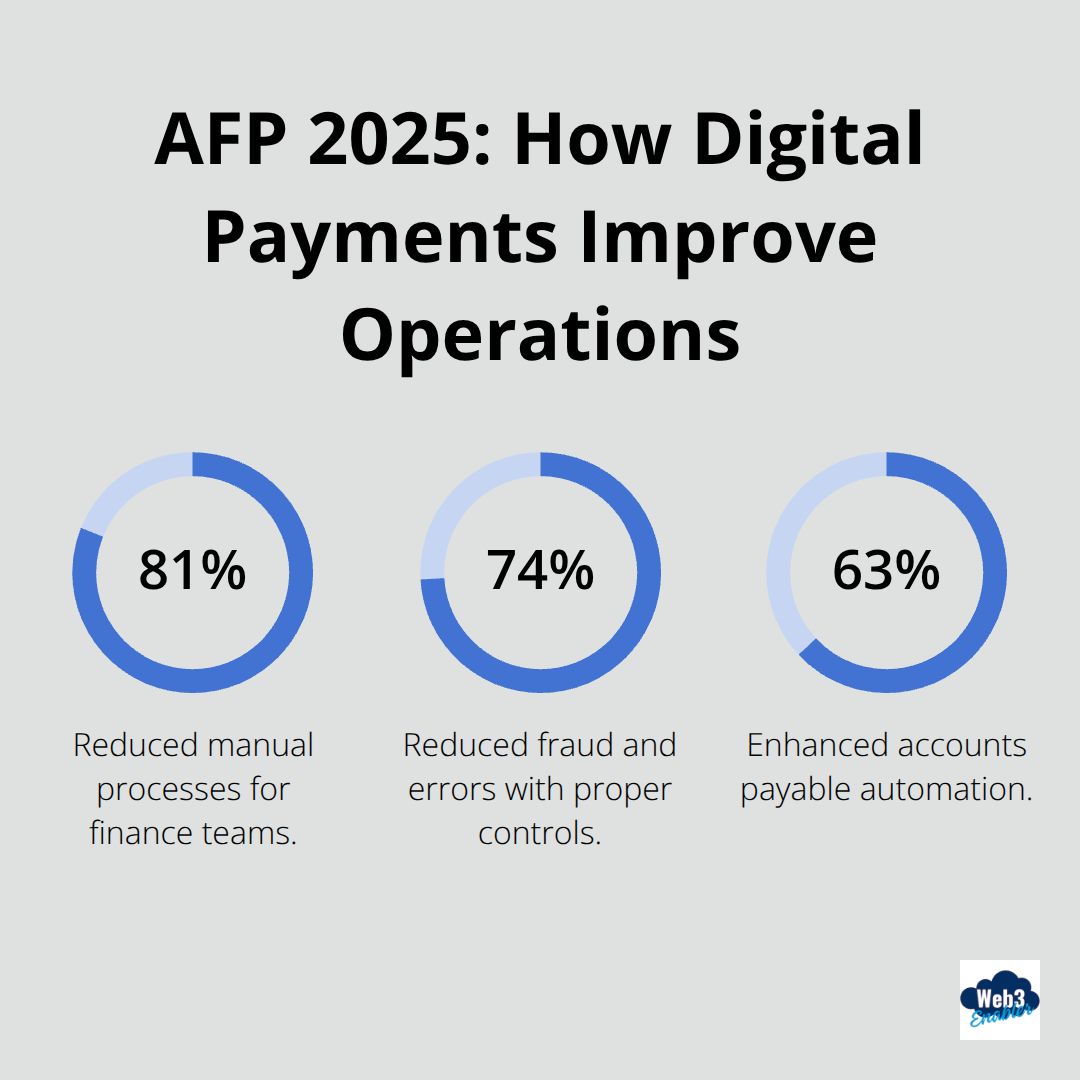

Digital payments directly improve your bottom line. According to the 2025 AFP Digital Payments Survey, 81% of financial professionals report reduced manual processes, 74% see reduced fraud and errors, and 63% gain enhanced accounts payable automation. Those aren’t nice-to-haves; they’re survival mechanics. When you eliminate cash handling, you cut operational costs immediately. Your team stops counting bills, reconciling discrepancies, and making trips to the bank.

Faster Payments in the UK handled 5.6 billion transactions in 2024, showing that real-time bank transfers are now mainstream-which means your cash flow accelerates. Money lands in your account faster, giving you working capital when you need it. In-app digital payments now account for 60% of in-app purchases, while in-store digital wallet adoption hit 28% in 2024. Your customers aren’t just willing to pay digitally; they expect it.

Customers Demand Flexibility

If you force customers back to cash or checks, they’ll take their money to a competitor who doesn’t make them jump through hoops. Businesses offering flexible payment options see faster revenue cycles and stronger customer retention. Digital wallets alone account for about 20% of UK online transactions through PayPal, and that’s just one provider. Your business needs to meet customers where they actually are-on their phones, in their apps, and through the payment methods they’ve already chosen.

The real question now shifts: which payment methods should you actually accept, and how do you implement them without drowning in complexity?

Payment Methods That Actually Drive Revenue

Credit and debit cards remain the backbone of payment acceptance, but treating them as your only option is like showing up to a modern business battle with yesterday’s weapons. 92 percent of shoppers used a digital payment method in the last year, and that number keeps climbing. Apple Pay, Google Pay, and Samsung Pay aren’t niche anymore-they’re how your younger customers expect to pay. The contactless payment volume hit 18.9 billion transactions in 2024, proving that tap-to-pay isn’t a feature, it’s a requirement. If your physical terminals don’t support NFC technology, you’re actively frustrating a significant portion of your customer base.

Buy Now, Pay Later Drives Conversions

Buy Now, Pay Later solutions like Klarna, Afterpay, and Clearpay deserve serious attention. These aren’t just nice extras for e-commerce-they directly boost conversion rates by letting customers spread payments across weeks while you get paid upfront minus a processing fee. The mechanics matter: you receive full payment immediately while the BNPL provider handles the installment relationship with your customer. That’s working capital flowing faster without any additional risk on your side.

Stablecoins Solve Real Business Problems

Here’s where most payment guides get wishy-washy, and we’re not doing that. Stablecoins-digital currencies pegged to real assets like the US dollar-solve genuine problems for businesses willing to implement them. They’re not about speculation or cryptocurrency hype. They’re about speed and cost. Transactions settle in minutes rather than days, and fees run significantly lower than traditional wire transfers for cross-border payments. If your business handles international transactions, stablecoins cut both friction and expense.

The practical move: start by accepting stablecoins from customers in high-volume international markets where wire transfer costs genuinely hurt. You don’t need to accept them from everyone immediately. Test the waters with your most tech-forward customers first, measure the settlement speed gains, and scale from there. Web3 Enabler connects stablecoin payments directly into Salesforce, so businesses integrate blockchain solutions with their existing infrastructure rather than bolting them on as afterthoughts.

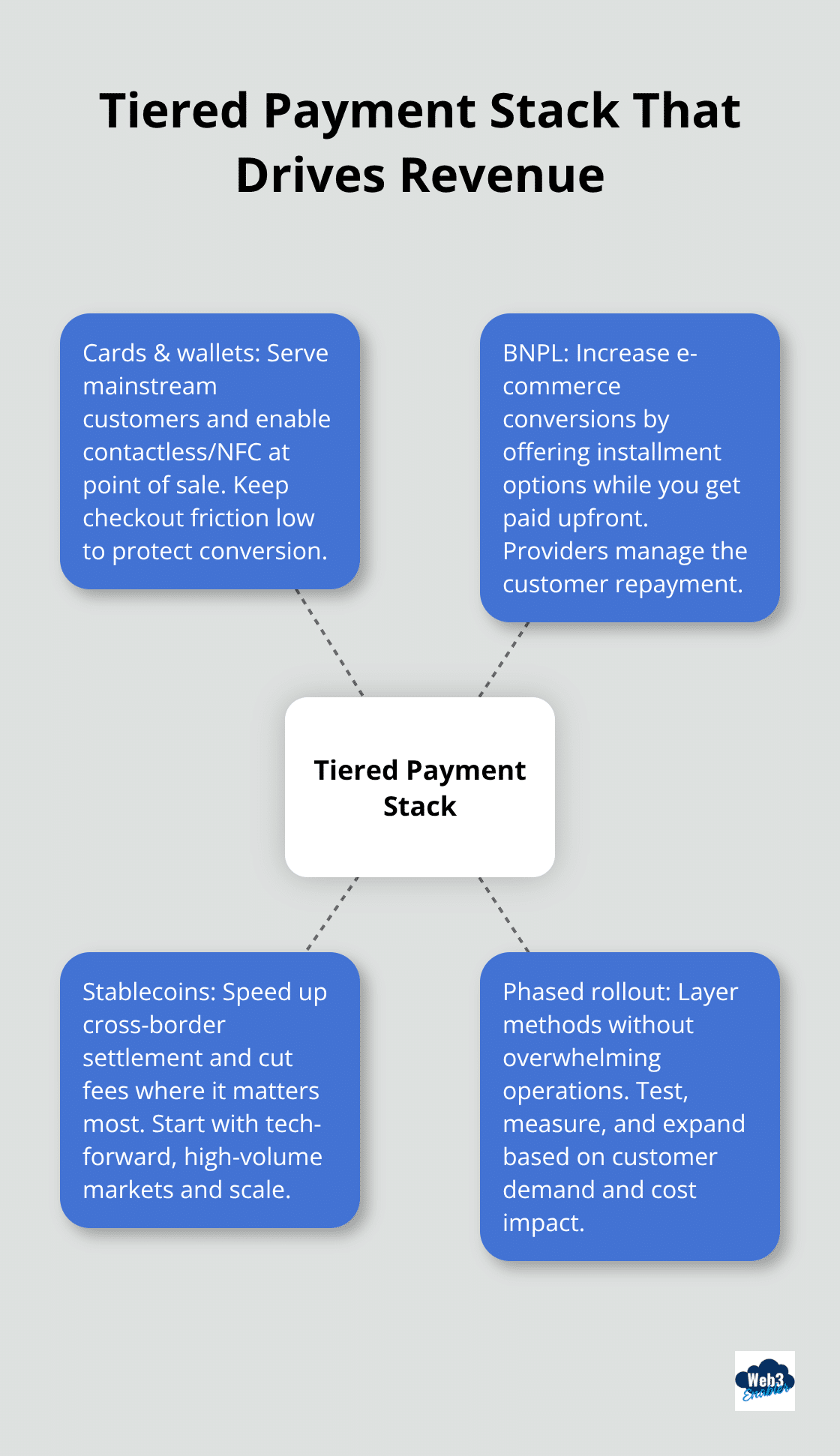

Building Your Payment Stack

Your payment strategy shouldn’t treat these methods as competing options. Instead, layer them strategically. Offer cards and wallets to your mainstream customer base. Add BNPL for e-commerce customers who want flexibility. Introduce stablecoins to international buyers where the cost savings matter most.

This tiered approach maximizes conversion rates across different customer segments without overwhelming your operations.

The real complexity isn’t choosing which methods to accept-it’s implementing them securely and staying compliant across different regions and payment types.

Building a Secure and Compliant Payment Strategy

Accepting multiple payment methods means accepting multiple attack surfaces. Fraud isn’t theoretical anymore-it’s operational reality that directly impacts your margins. The 2025 AFP Digital Payments Survey found that 74% of financial professionals report reduced fraud and errors when they implement proper digital payment controls, which tells you that security infrastructure actually works when you build it correctly. The catch: most businesses treat security as an afterthought rather than a foundational layer. That’s backwards. Your payment security strategy needs to be bulletproof before you launch, not patched together after your first breach.

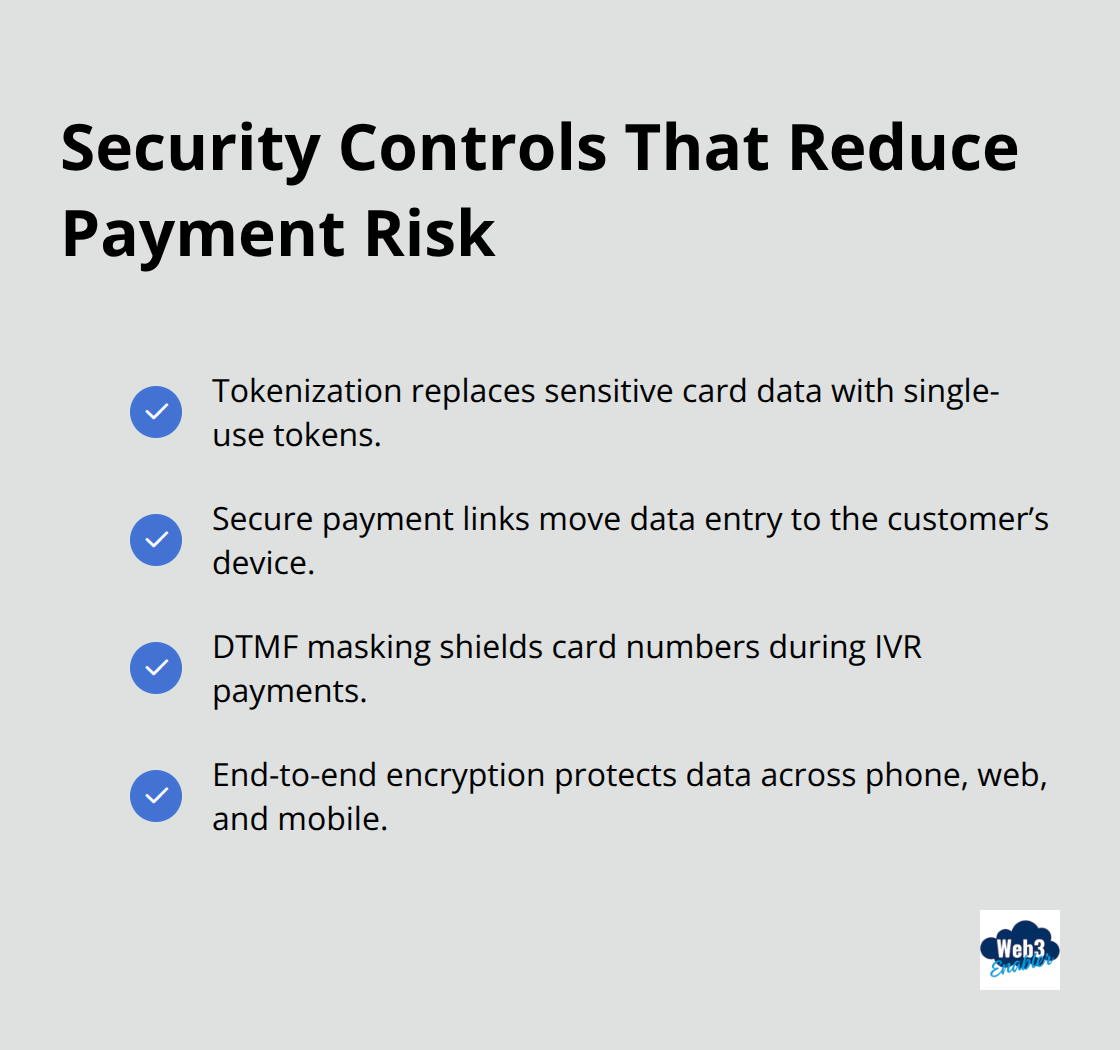

Tokenization and Encryption Stop Data Breaches Cold

Card data sitting anywhere on your systems is a liability. Tokenization replaces sensitive payment information with one-time-use tokens that become worthless if intercepted. This isn’t optional complexity-it’s the baseline. When you use tokenization properly, PCI DSS scope can shrink by up to 95% because card data never actually touches your infrastructure. That means fewer audit requirements, lower compliance costs, and dramatically reduced breach impact.

Secure payment links take this further by pushing the payment interaction entirely onto the customer’s device. Your agents send a link, customers enter their payment details on a one-time page, and sensitive data never exists in your systems or call recordings. For 24/7 automated payments through IVR systems, DTMF masking prevents card numbers from being captured in recordings while still enabling secure transactions at scale. End-to-end encryption protects data across every channel-phone, web, mobile-so payment information stays encrypted from entry point through processor.

Regulatory Requirements Shift Across Regions and Payment Types

Compliance varies dramatically, and treating it as one-size-fits-all costs money. PCI DSS compliance is mandatory for anyone handling payment cards, but the scope and intensity depend on your transaction volume and how you process payments. If you’re using Open Banking-direct bank transfers that bypass card networks entirely-you reduce PCI requirements significantly because card data isn’t involved. Open Banking adoption in the UK surpassed 15 million active users by July 2025, showing that regulators and customers both view this as a legitimate, secure path.

For stablecoin payments, regulatory treatment varies wildly by jurisdiction. The UK and EU are moving toward clearer frameworks, while other regions remain uncertain. This means your stablecoin strategy needs geographic boundaries initially. Test acceptance in markets with established regulatory clarity first, then expand cautiously as frameworks solidify. Cross-border payments add another layer-faster payment networks like the UK’s Faster Payments system handled 5.6 billion transactions in 2024, but settlement rules and compliance obligations differ between countries. Your processor needs to handle these variations transparently, not bury them in fine print.

Select Processors That Handle Complexity for You

Not all payment processors are equal, and picking the wrong one creates ongoing headaches. Your processor should handle tokenization automatically, maintain PCI DSS compliance on your behalf, and provide clear documentation about what security measures they’ve implemented. Look for processors that offer API integrations connecting directly to your CRM or ERP-this gives you real-time visibility into payment status and automates reconciliation. They should also support multiple payment methods through a single integration rather than forcing you to build separate connections for cards, wallets, stablecoins, and bank transfers.

Security certifications matter, but verify them directly rather than trusting marketing claims. Ask your processor specifically how they handle data encryption, what their breach response process looks like, and whether they conduct regular third-party audits. Processors with strong compliance records publish their security practices openly. If a processor gets cagey about security details, that’s a red flag. The cost difference between a mediocre processor and a solid one is usually small compared to the operational friction and risk you’ll face with inadequate infrastructure.

Final Thoughts

Digital payments aren’t a future consideration anymore-they’re your competitive baseline. The data proves it: 92% of shoppers expect digital payment options, contactless transactions hit 18.9 billion in 2024, and businesses implementing proper payment infrastructure report 81% reduction in manual processes. Your customers have already decided, and as a digital payments expert, you know the only question is whether your business moves fast enough to meet them there.

Start with cards and wallets for your core customer base, add BNPL for e-commerce conversion boosts, then introduce stablecoins where cross-border costs genuinely hurt your margins. Prioritize security from day one-tokenization, encryption, and proper processor selection protect both your revenue and your reputation. We at Web3 Enabler help businesses integrate modern payment methods directly into their existing infrastructure through Salesforce-native solutions that accept stablecoin payments and process global transactions faster while maintaining full compliance.

The payments landscape will keep evolving as real-time settlement networks expand globally and regulatory frameworks around blockchain payments solidify. Your payment strategy determines your growth trajectory, so build it right and watch your business accelerate.

Frequently Asked Questions

Digital Payments and the Future of Cash

Why are digital payments replacing cash?

Digital payments are replacing cash because consumers and businesses demand speed, convenience, and flexibility. The majority of shoppers now use digital payment methods, and businesses that fail to support them risk losing customers to competitors that do.

Are digital payments now the standard for businesses?

Yes. Digital payments are no longer a trend but the baseline. With most consumers using cards, wallets, and other digital methods, accepting digital payments is essential for remaining competitive.

How do digital payments improve a business’s bottom line?

Digital payments reduce manual processes, lower fraud and error rates, and improve cash flow through faster settlement. Eliminating cash handling cuts operational costs and gives businesses quicker access to working capital.

What payment methods should modern businesses accept?

Modern businesses should accept a combination of credit and debit cards, digital wallets, Buy Now Pay Later options, and stablecoins. Each method serves a different customer need and helps maximize conversion rates.

Why are digital wallets important for customer experience?

Digital wallets allow customers to pay quickly using methods they already trust and use daily. Supporting wallets improves convenience and helps meet customer expectations, especially for mobile and in-app payments.

How does Buy Now, Pay Later increase conversions?

Buy Now, Pay Later options allow customers to spread payments over time while businesses receive funds upfront. This flexibility often leads to higher conversion rates and larger average order values.

What role do stablecoins play in digital payments?

Stablecoins are digital currencies pegged to real-world assets like the U.S. dollar. They provide fast settlement and lower fees, especially for cross-border payments, without the volatility associated with other cryptocurrencies.

When should businesses consider accepting stablecoins?

Stablecoins are especially useful for businesses with international customers or high cross-border transaction costs. Many companies start by accepting stablecoins in specific markets before expanding more broadly.

How can businesses manage multiple payment methods securely?

Security starts with tokenization, encryption, and secure payment links. These tools prevent sensitive payment data from being stored on business systems and reduce exposure to fraud and data breaches.

Why is tokenization important for payment security?

Tokenization replaces sensitive payment data with one-time-use tokens, reducing the risk of data breaches and significantly lowering compliance requirements such as PCI DSS scope.

How do regulatory requirements vary for digital payments?

Regulations vary by region and payment type. Card payments require PCI DSS compliance, while open banking and stablecoin payments follow different frameworks depending on jurisdiction. Businesses should tailor payment strategies to regulatory clarity in each market.

What should businesses look for in a payment processor?

A strong payment processor should handle compliance, tokenization, and encryption automatically. It should support multiple payment methods through a single integration and provide transparent security and audit practices.

How does Web3 Enabler help businesses modernize payments?

Web3 Enabler helps businesses integrate modern payment methods directly into their existing systems, including Salesforce-native solutions for stablecoins, wallets, and global transactions, while maintaining security and compliance.