Your payment system is probably costing you more than it should. Manual processes, fraud losses, and slow cash flow drain resources that could go elsewhere.

We at Web3 Enabler know that the benefits of digital payments go way beyond just moving money faster. They reshape how your business operates, cuts costs, and scales globally.

How Digital Payments Reduce Operational Costs

What Actually Costs You Money in Payments

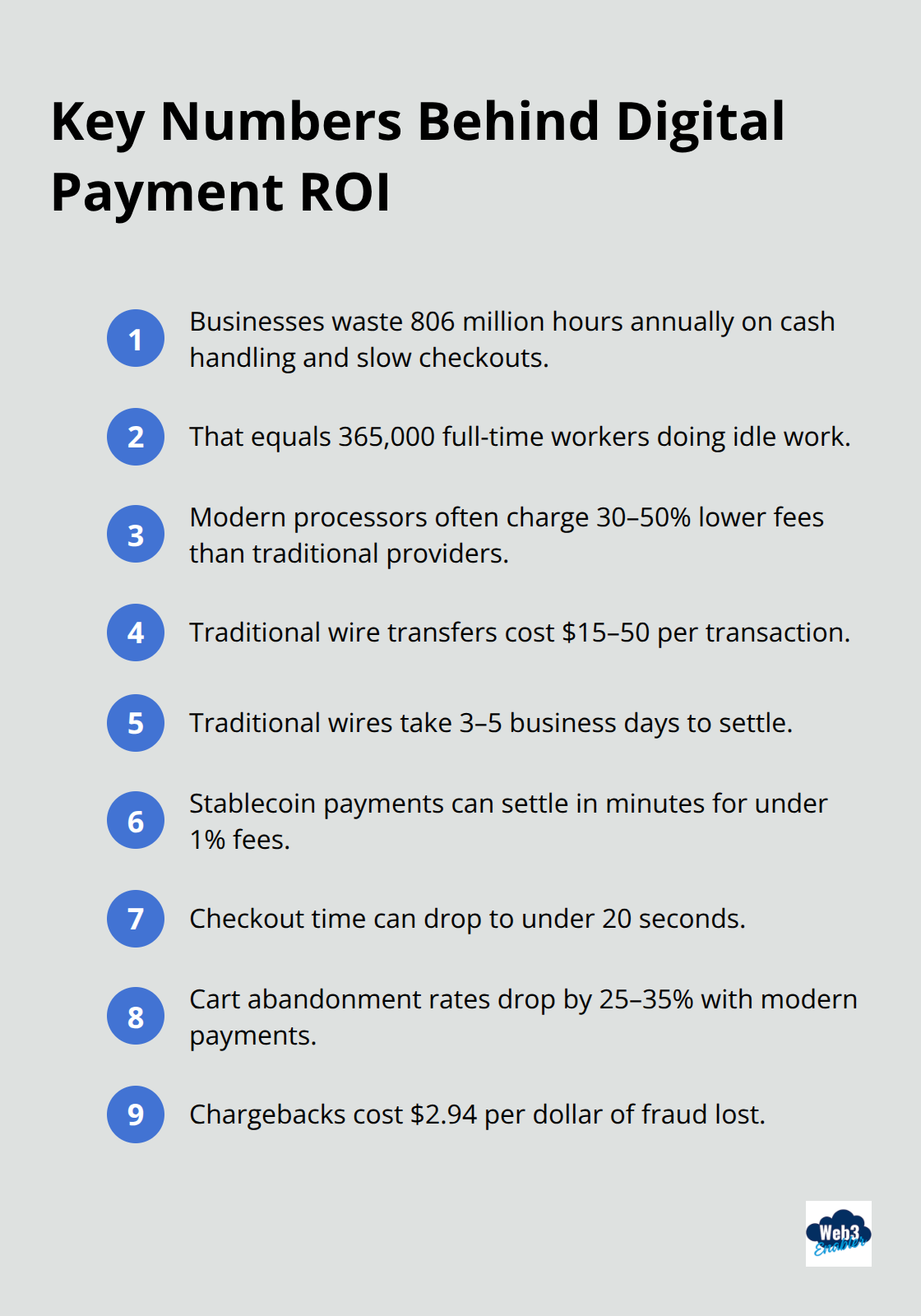

Your current payment setup is probably bleeding money in ways you haven’t noticed. Businesses waste about 806 million hours annually on cash handling and slow checkout processes-equivalent to 365,000 full-time workers doing nothing but fidgeting. That’s not just inefficient; that’s expensive.

Digital payments eliminate the manual grind. Paper invoices, manual entry, and reconciliation spreadsheets that live in someone’s email aren’t charming legacy processes-they’re profit killers. When you automate payment flows, labor costs drop dramatically. A business processing 1,000 invoices monthly spends roughly 40–60 hours on manual entry, follow-ups, and dispute resolution. Switch to digital, and that drops to near zero. The cost savings alone justify the switch, before you even consider fraud prevention or faster cash flow.

Transaction Fees That Actually Make Sense

Traditional payment processors love opacity. They bury fees in fine print, charge differently for different card types, and make it nearly impossible to predict your monthly bill.

Modern digital payment solutions are transparent by design. You know exactly what you pay per transaction, and those rates often run 30–50% lower than traditional card processing, especially for high-volume businesses.

Cross-border payments reveal the real savings. Traditional wire transfers cost $15–50 per transaction and take 3–5 business days. Blockchain-based solutions settle in seconds for a fraction of the cost. If your business sends even five international payments monthly, digital solutions pay for themselves immediately.

Fraud Stops Before It Starts

Chargebacks cost businesses roughly $2.94 per dollar of fraud lost, according to industry data. Beyond the direct loss, there’s the administrative nightmare of disputing chargebacks, the reputational damage, and the payment processor penalties if your chargeback rate climbs too high.

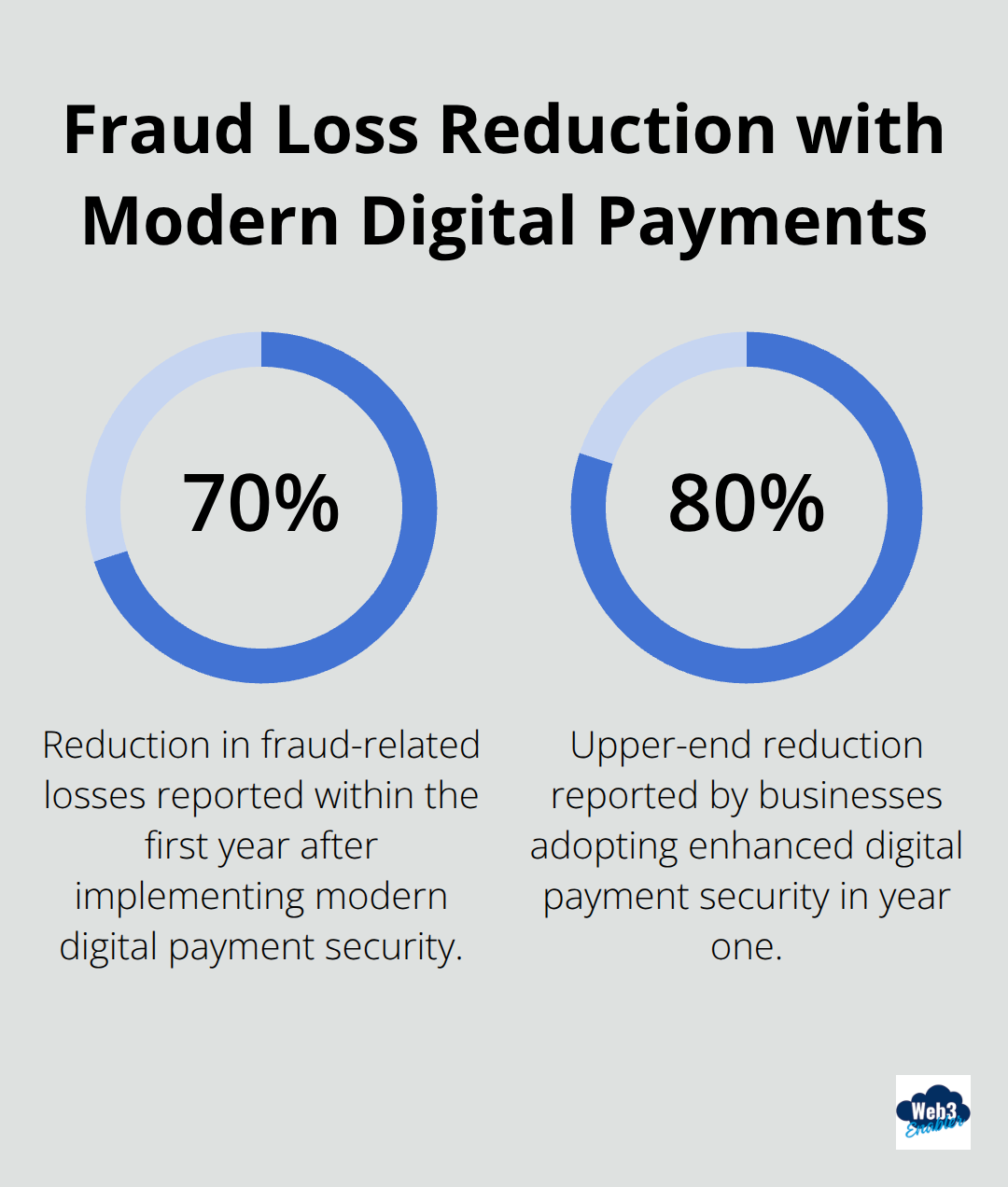

Digital payments with enhanced security reduce fraud dramatically. Real-time transaction verification, encryption, and immutable audit trails make fraudsters look elsewhere. When every transaction is recorded and verifiable, disputes vanish. You spend zero time fighting chargebacks that never happen in the first place. Businesses implementing modern digital payment security report 70–80% reductions in fraud-related losses within the first year.

These operational wins set the stage for something bigger: why companies across industries are now adopting digital payments at scale, not just for cost savings, but for competitive advantage.

Why Businesses Adopt Digital Payments Now

Speed Up Cash Flow and Improve Liquidity

Cash flow matters more than revenue. A business generating $5 million annually but waiting 30–45 days to collect payments operates on fumes compared to one collecting in 2–3 days. Digital payments compress that timeline dramatically. Eliminating manual invoicing, payment processing delays, and banking settlement windows moves money from customer accounts to yours in hours, not weeks. That acceleration alone justifies switching.

Companies implementing digital payment systems report cash conversion cycles improving through working capital management, which translates directly to working capital that funds operations, inventory, and growth without requiring external financing. Faster cash also means paying suppliers earlier to negotiate better rates, creating a compounding advantage that cash-based competitors simply cannot match.

Expand Global Reach with Cross-Border Payments

Global expansion used to mean hiring accountants to manage currency conversions, international wire fees, and compliance headaches across jurisdictions. Digital payments obliterate that friction. A business sending payments to freelancers, suppliers, or partners across ten countries no longer needs to batch payments monthly or accept 5–7 day settlement windows.

Stablecoin payments settle across borders in minutes for transaction costs under 1%, compared to traditional wire transfer fees of $15–50 and processing times measured in business days. Businesses now expand into new markets without building local banking infrastructure. The speed and cost advantage compounds as you scale internationally, making global operations accessible to companies of all sizes.

Meet Customer Expectations for Seamless Checkout

Customers now expect frictionless checkout regardless of geography or device. If your checkout process takes longer than 60 seconds, you lose conversions. Digital payment solutions reduce checkout time to under 20 seconds while supporting multiple payment methods simultaneously.

That seamless experience isn’t a luxury feature anymore-it’s table stakes. Retailers and service providers implementing modern digital payments see cart abandonment rates drop by 25–35% because friction disappears. Mobile payments, one-click options, and transparent pricing at checkout all compound to create an experience that feels effortless rather than transactional. These operational advantages set the stage for the next critical step: integrating digital payments directly into your existing business systems.

Integration of Digital Payments into Existing Business Systems

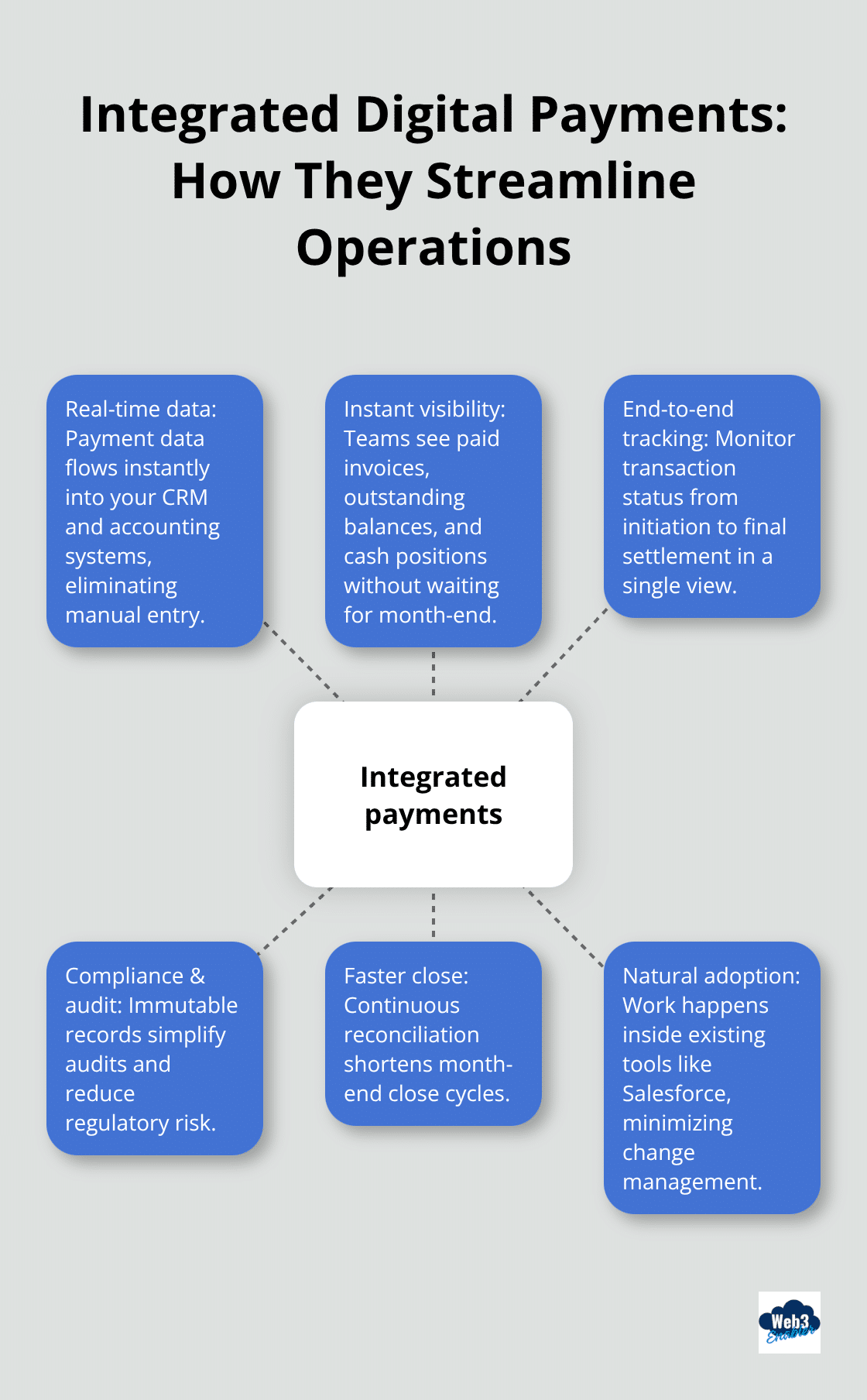

Integrating digital payments into your existing infrastructure sounds like a nightmare if you’re imagining ripping out systems and starting from scratch. It’s not. The best modern payment solutions connect directly to your current tech stack without requiring a complete overhaul. If you’re running Salesforce, your payment data should flow seamlessly into your CRM without manual intervention or custom engineering that costs six figures. Modern payment platforms built natively on Salesforce integrate cleanly with the systems your team already knows. The integration happens in weeks, not months, and your finance and sales teams access real-time payment data without switching between applications. This matters because every tool your team uses outside of their primary system creates friction, delays reconciliation, and introduces data entry errors. When payment information lives where your team already works, adoption happens naturally.

Real-Time Data Flow Eliminates Reconciliation Headaches

Manual reconciliation destroys productivity in accounting departments. Digital payment integration eliminates this entirely. When payments hit your account, the data automatically flows into your accounting system and CRM, matching transactions to invoices without human touch. Your accounts receivable team stops being a data entry operation and starts managing relationships instead.

Visibility becomes instant too. Your finance team sees exactly which customers have paid, which invoices are outstanding, and cash position updates in real time rather than discovering problems during month-end close. This speed matters for decision making. If a major client payment fails, your team knows immediately instead of discovering it three weeks later during reconciliation. Businesses implementing integrated digital payments report reducing month-end close timelines because reconciliation happens continuously rather than as a painful batch process at month end.

Tracking Every Payment From Send to Settlement

Visibility across your payment lifecycle transforms how you manage cash and customer relationships. Traditional payment methods leave you blind until money appears in your account days or weeks later. Digital payments provide complete tracking from the moment you initiate a transaction. You see confirmation codes, settlement status, and final receipt without logging into multiple systems or waiting for bank statements.

This transparency prevents costly mistakes. If a payment fails, your team catches it immediately and resends rather than assuming it went through and discovering the problem when the vendor complains. For businesses sending payments globally, this becomes critical. A wire transfer that disappears into a bank’s system for five days creates anxiety and operational uncertainty. Digital payment solutions show exact status at every step, from initiation through final settlement, so your team and customers both have confidence that transactions are progressing.

Compliance and Audit Trails That Actually Work

This tracking capability strengthens compliance significantly. Every payment creates an immutable record showing who initiated it, when, for what amount, and confirmation of delivery. If regulators or auditors ask questions, you pull data directly from your integrated system rather than hunting through email chains and bank statements. That immutable record becomes your defense against disputes and regulatory scrutiny.

Final Thoughts

Digital payments transform how businesses operate across every function-lower costs through automation, faster cash flow that funds growth, and customer experiences that feel effortless rather than transactional. The benefits of digital payments compound when you integrate them directly into your existing systems, so reconciliation happens automatically, compliance strengthens through immutable records, and your team stops wasting time on manual processes. Companies implementing integrated digital payment solutions report measurable improvements in cash conversion cycles, fraud reduction, and operational efficiency within the first quarter.

Start by auditing your current payment costs, including hidden labor expenses and fraud losses. Identify which payment methods your customers actually use and which geographic markets matter most to your business. Then evaluate solutions that integrate natively with your existing infrastructure rather than forcing you to build custom connections or maintain separate systems.

We at Web3 Enabler help businesses accept stablecoin payments, send global payments faster and more securely, and maintain full visibility into payment operations within Salesforce through native Salesforce solutions. Whether you process domestic transactions or expand internationally, the right digital payment partner accelerates your timeline and reduces implementation complexity.

Frequently Asked Questions

Benefits of Digital Payments for Modern Businesses

What are the biggest benefits of digital payments for businesses?

Digital payments reduce operational costs, improve cash flow, lower fraud risk, and support global scaling. They also improve customer experience by enabling faster, more flexible checkout and payment options.

How do digital payments reduce operational costs?

Digital payments reduce or eliminate manual work such as cash handling, paper invoicing, payment follow-ups, and spreadsheet-based reconciliation. Automated workflows reduce labor hours and human error while improving efficiency across finance and operations.

Why is cash handling expensive for businesses?

Cash handling requires employee time for counting, reconciling, depositing, and managing discrepancies. It also creates slower checkout experiences and increases the risk of loss or theft, which adds hidden operational cost.

Do digital payments reduce transaction fees?

In many cases, yes. Modern digital payment solutions offer more transparent pricing and can reduce costs compared to traditional methods, especially for high-volume processing and cross-border transactions where wire and intermediary fees add up.

How do digital payments help with cross-border transactions?

Digital payment methods, including stablecoin-based settlement, can reduce international transfer delays and costs. Cross-border payments can settle faster and with fewer intermediaries than traditional wire transfers.

How do digital payments reduce fraud and chargebacks?

Digital payment platforms use encryption, real-time verification, and stronger audit trails to reduce fraud. Some blockchain-based settlements also provide transaction finality, which can lower chargeback exposure and reduce dispute overhead.

How do digital payments improve cash flow?

Digital payments shorten the time between invoicing and settlement by reducing processing delays and banking windows. Faster settlement improves liquidity, helps fund operations, and can improve working capital cycles.

Why is faster cash flow more important than higher revenue?

A business can generate strong revenue but still struggle if payments take weeks to arrive. Faster collection improves liquidity, reduces financing needs, and enables better operational decisions such as restocking inventory or paying suppliers earlier.

How do digital payments improve customer checkout experience?

Digital payments reduce checkout friction by enabling faster payment methods such as mobile wallets, one-click options, and streamlined payment links. Businesses often see fewer abandoned carts when checkout is simple and fast.

Can digital payments help businesses expand globally?

Yes. Digital payment options make it easier to accept payments across geographies and currencies, reduce settlement delays, and support customers in markets where traditional banking infrastructure is limited.

How do digital payments integrate with existing business systems?

Modern solutions connect directly with ERP, CRM, and accounting platforms, allowing payment status and settlement data to flow automatically into the systems your team already uses. This reduces reconciliation work and improves visibility.

How does integration reduce reconciliation headaches?

When payment data flows directly into your CRM and accounting systems, transactions can be matched to invoices automatically. This reduces manual entry, speeds month-end close, and helps teams spot failed payments faster.

How does Web3 Enabler support digital payments in Salesforce?

Web3 Enabler provides Salesforce-native solutions that help businesses accept stablecoin payments, send global payments faster, and maintain real-time visibility and compliance-ready audit trails inside Salesforce.