Your business sends payments to 47 countries, but each market demands different systems, currencies, and compliance rules. The result? Sky-high fees, week-long delays, and enough paperwork to bury your finance team.

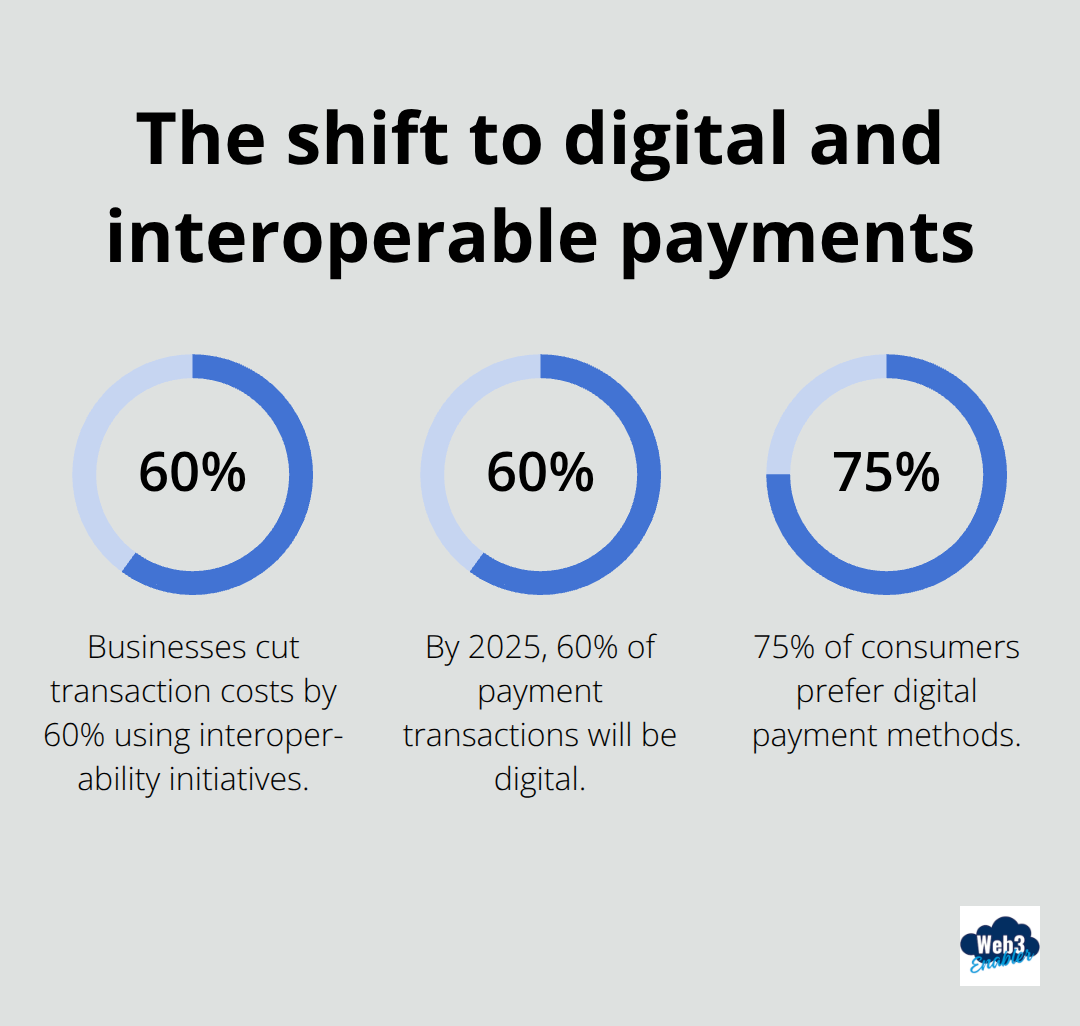

Payment interoperability changes this game completely. We at Web3 Enabler see businesses cutting transaction costs by 60% while settling payments in minutes instead of days across any border.

Why Payment Systems Fragment Global Business

Your finance team manages 12 different payment processors across Europe alone, each one demands separate contracts, compliance checks, and technical integrations. In Asia-Pacific, you need another eight systems because regional preferences favor local payment rails over international cards. The result hits your bottom line hard: businesses face significant costs on cross-border transactions, while these payments take up to five business days to settle.

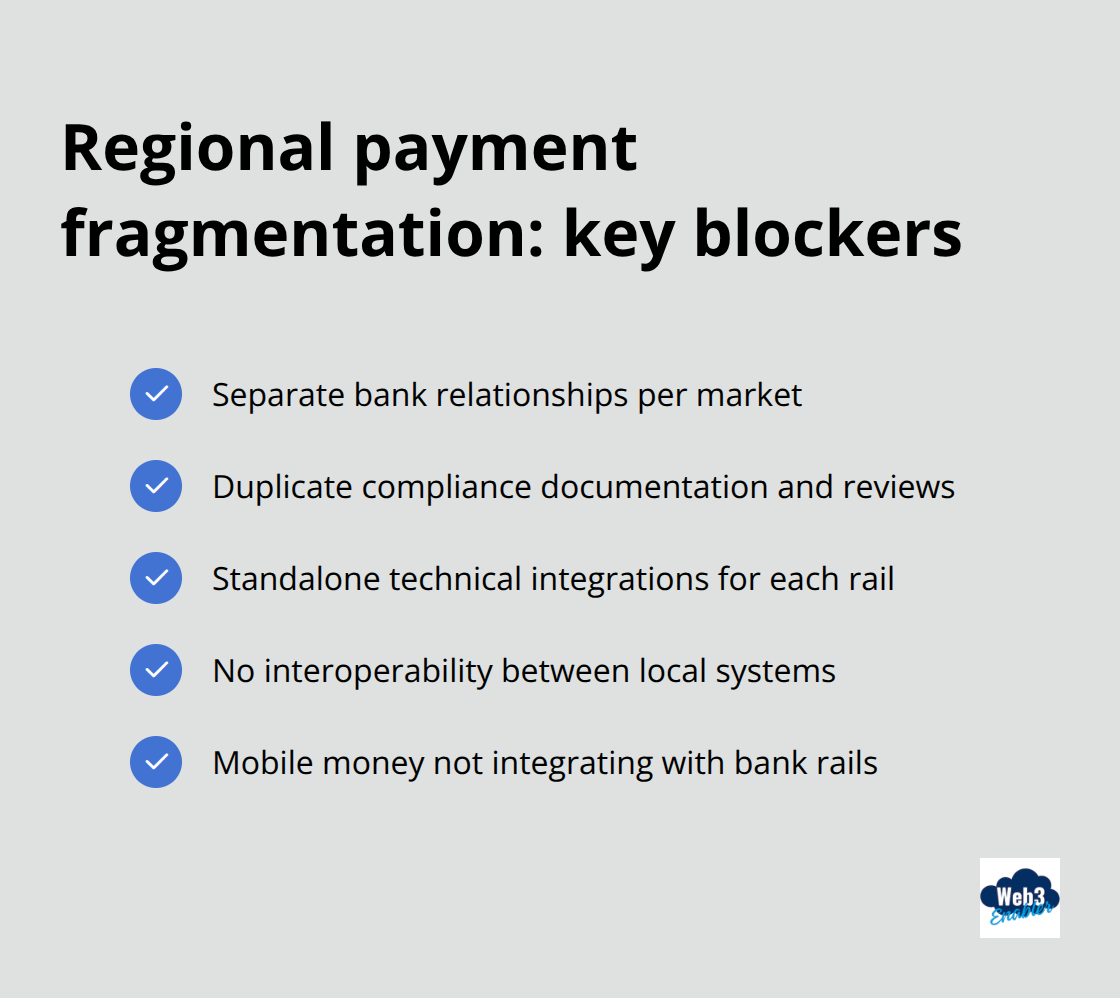

Regional Payment Monopolies Block Expansion

Europe runs on SEPA for euro transactions, but try to send payments to Southeast Asia and you hit a wall of incompatible systems. Thailand prefers PromptPay, Singapore pushes PayNow, while Indonesia relies heavily on local bank transfers. Each system operates independently with zero communication between platforms. Your business maintains separate bank relationships, compliance documentation, and technical infrastructure for every market you enter. The fragmentation gets worse in emerging markets where mobile money dominates but refuses to integrate with traditional bank rails.

Currency Conversion Eats Profit Margins

Traditional banks charge conversion spreads between 2-4% above market rates, which turns a simple payment into an expensive ordeal. Exchange rate fluctuations can swing your costs by hundreds of dollars between quote and settlement, especially when payments sit in correspondent bank queues for days. McKinsey reports that 60% of payment transactions will be digital by 2025, yet currency conversion remains stuck in analog processes that drain working capital. Your procurement team quotes suppliers in local currency, but exchange rates shift enough to impact quarterly margins before payments clear.

Compliance Complexity Multiplies Operating Costs

Every jurisdiction demands different documentation, reporting formats, and approval processes that turn simple payments into administrative nightmares. Anti-money laundering requirements vary wildly between countries, which forces your compliance team to master dozens of regulatory frameworks simultaneously. The European Union requires GDPR compliance for payment data, while Singapore demands local data residency, and the United States adds sanctions screening requirements (talk about a regulatory maze). Financial services face the highest cyber attack rates according to Accenture research, yet fragmented compliance systems create security gaps that expose your business to regulatory penalties and data breaches across multiple jurisdictions.

These fragmented systems create the perfect storm of inefficiency, but emerging technologies offer a way out of this payment chaos.

Which Technologies Actually Fix Payment Fragmentation

Blockchain networks operate 24/7 across all time zones, which means your payments to Tokyo clear instantly while New York banks sleep. Stablecoin market capitalization hit $260 billion in 2024 with transfer values reaching $27.6 trillion according to Visa and Allium Labs research, surpassing combined Visa and Mastercard processing volumes. These networks eliminate correspondent banking delays that trap your funds for days in intermediate accounts. Plasma and similar regulatory-ready platforms handle thousands of transactions per second while maintaining compliance with anti-money laundering requirements across jurisdictions.

Stablecoins Eliminate Currency Risk

USD Tether and similar dollar-pegged tokens solve the exchange rate nightmare that destroys profit margins on international payments. Traditional banks charge 2-4% conversion spreads, but stablecoins maintain stable values without markup fees that eat your working capital. Smart contracts automate currency conversions at market rates, which removes the guesswork from international pricing. Your suppliers receive exact quoted amounts in their preferred currency while you pay predictable costs in dollars. Juniper Research projects digital wallet users will exceed 6 billion by 2030, with stablecoins becoming the preferred cross-border payment method for businesses tired of banking delays and hidden fees.

API Integration Connects Everything

Modern payment APIs connect blockchain networks directly to existing accounting systems, which eliminates manual reconciliation work that bogs down finance teams. Real-time payment networks show 400% annual growth in certain regions according to McKinsey data, driven by businesses that demand instant settlement visibility. Third-party processors simplify blockchain onboarding (they handle technical complexity while your team focuses on business operations). Direct blockchain integration gives you complete control over payment flows, though it requires stronger technical expertise than processor-managed solutions. Payment platforms that support multiple blockchain tokens reduce fragmentation by accepting various digital currencies through single integration points.

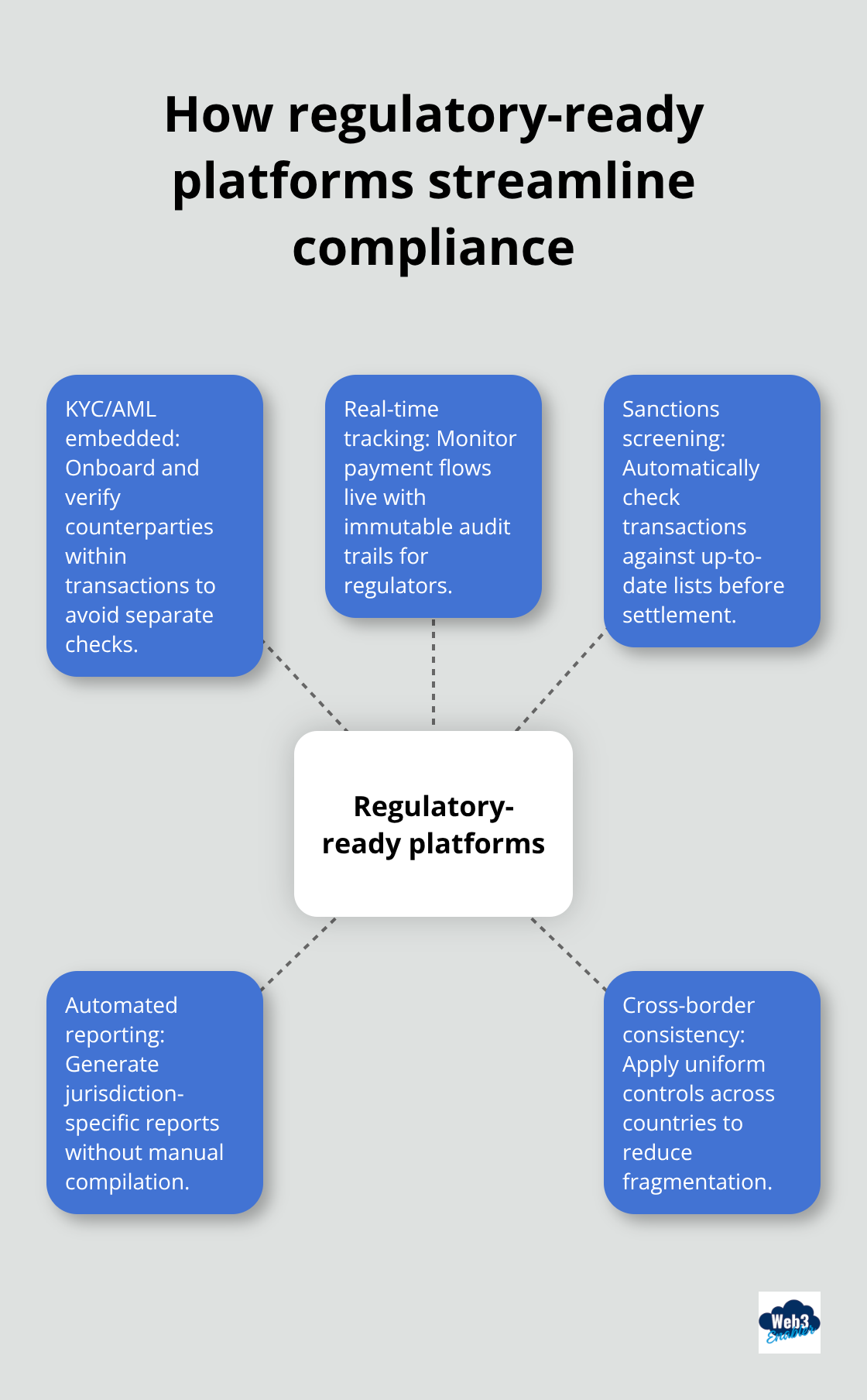

Regulatory-Ready Platforms Bridge Traditional Finance

Compliance-focused blockchain platforms address the regulatory maze that fragments global payments. These platforms integrate know-your-customer and anti-money laundering processes directly into transaction flows, which eliminates separate compliance checks for each jurisdiction. Financial institutions can track payment flows in real-time while maintaining audit trails that satisfy regulators across multiple countries (goodbye to compliance headaches). The platforms automatically screen transactions against sanctions lists and generate required reports for each jurisdiction without manual intervention.

These technological foundations create the infrastructure for unified global payments, but the real question becomes how these solutions translate into measurable business advantages.

How Much Money Does Unified Payment Infrastructure Save

Your finance team currently manages payment processors across 15 countries, each charges 3-5% transaction fees plus currency conversion spreads that eat another 2-4% of every cross-border payment. Unified blockchain payment systems cut these costs to under 1% total while they settle transactions in minutes instead of the 3-7 business days your current bank relationships require.

Real numbers from businesses that use stablecoin infrastructure show transaction cost reductions compared to traditional correspondent networks, which translates to hundreds of thousands in annual savings for companies that process $10 million in international payments.

Transaction Speed Creates Cash Flow Advantages

Traditional international wire transfers lock up capital for up to a week while payments crawl through correspondent bank networks, but blockchain settlements happen within minutes regardless of destination country or hours. Your suppliers in Southeast Asia receive payments instantly instead of they wait five business days, which improves your power to negotiate early payment discounts that can save 2-3% on invoice amounts. McKinsey research shows real-time payment networks achieve 400% annual growth because businesses demand immediate settlement visibility that eliminates the guesswork from cash flow management.

Customer Experience Improves Revenue Retention

Customers abandon purchases when payment methods fail or take too long to process, but unified payment systems accept multiple currencies and digital wallets through single integration points that reduce checkout friction. Juniper Research data shows digital wallet users will exceed 6 billion by 2030, with 75% of consumers who prefer digital payment methods over traditional cards according to industry studies. Your international customers pay in their preferred local currency while you receive stable dollar amounts, which eliminates the exchange rate disputes that damage customer relationships and create costly chargebacks.

Financial Reports Become Automatic

Blockchain transactions create immutable audit trails that automatically populate accounts without manual reconciliation work that currently consumes 20-30 hours per week for finance teams that manage multiple payment processors. Smart contracts generate real-time financial reports across all markets simultaneously, which gives executives accurate cash flow visibility instead of they wait for month-end bank statements from dozen different institutions (no more spreadsheet nightmares). Compliance reports happen automatically because blockchain platforms track all required data points for anti-money laundering and tax reports across jurisdictions, which eliminates the administrative overhead that grows exponentially with each new market you enter.

Final Thoughts

Payment interoperability transforms how businesses operate across borders by eliminating the fragmented systems that currently drain resources and slow growth. Companies that implement unified blockchain payment infrastructure see transaction costs drop from 5-9% to under 1% while settlement times shrink from days to minutes. These improvements directly impact cash flow, customer satisfaction, and operational efficiency in ways that traditional banking simply cannot match.

Implementation requires careful platform selection and technical integration plans. Businesses must evaluate whether to use third-party processors for simplified onboarding or direct blockchain integration for maximum control. Regulatory compliance varies by jurisdiction, but platforms from established providers handle anti-money laundering and know-your-customer requirements automatically across multiple countries (goodbye to compliance headaches).

The trajectory points toward universal adoption as digital wallet users approach 6 billion by 2030 and stablecoin transaction volumes continue to grow. Early adopters gain competitive advantages through lower costs and faster payments while late adopters face pressure from customers who expect instant, low-cost international transactions. Web3 Enabler provides Salesforce-native blockchain solutions that connect existing corporate infrastructure with modern payment rails.