Sony, a global leader in electronics and entertainment, has announced plans to launch a new cryptocurrency exchange by revamping Whalefin, a platform it acquired last year. This move signals a major step toward corporate adoption of digital assets, as Sony integrates blockchain technology into its broader business operations. The development comes alongside other significant crypto industry updates, including Circle’s regulatory approval in France and the UAE’s controversial decision to ban crypto payments.

Sony’s Cryptocurrency Exchange: A Corporate Giant Steps In

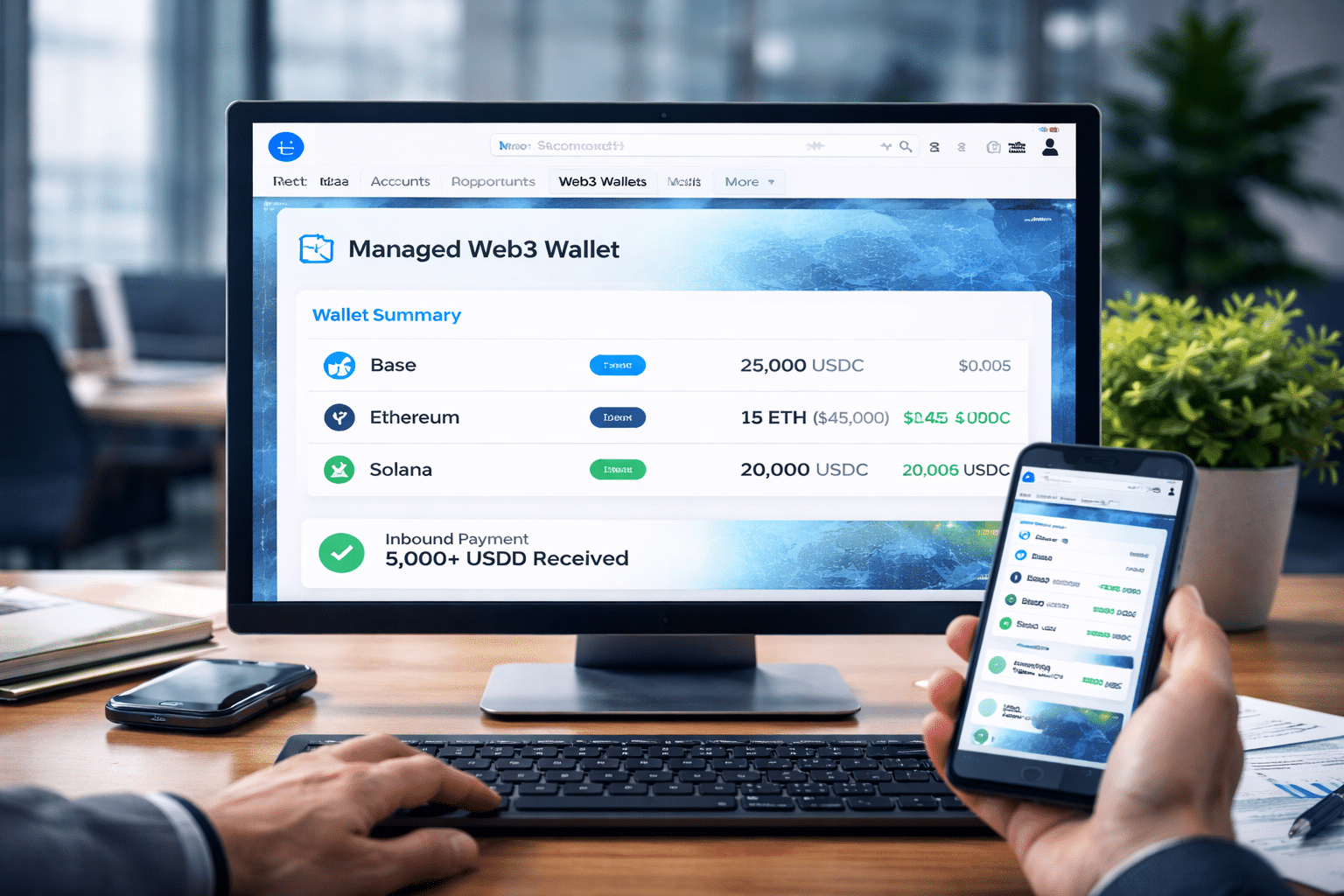

Sony’s decision to enter the cryptocurrency market is a strong indicator of blockchain’s growing role in mainstream business. Whalefin, the exchange Sony acquired, will be rebranded and improved with a focus on user-friendly interfaces, mobile applications, and security enhancements. This initiative aligns with Sony’s broader strategy of incorporating blockchain into its various ventures, reinforcing its commitment to technological innovation.

The timeline for the launch remains unknown, but Sony’s involvement in the space could encourage other multinational corporations to follow suit. The move also highlights Japan’s growing reputation as a crypto-friendly hub with strong regulatory frameworks that promote innovation while maintaining compliance.

Circle Gains E-Money License in France

Another significant development in the industry is Circle’s recent approval for an e-money license in France. This milestone makes USDC the first stablecoin to become compliant with the EU’s regulatory framework under the MiCA (Markets in Crypto-Assets) law. The MiCA law governs transparency, disclosure, and supervision of digital transactions, ensuring stability and compliance across European markets.

For Circle, this approval solidifies its position as a trusted player in the stablecoin market. France’s approval also suggests that other European nations may follow suit, accelerating stablecoin adoption across the region. This regulatory clarity contrasts with the uncertainty in the U.S. and could attract more blockchain companies to set up operations in Europe.

UAE Bans Crypto Payments—But Workarounds Emerge

In a surprising move, the United Arab Emirates (UAE) Central Bank recently outlawed cryptocurrency payments, allowing only state-approved digital assets for transactions. While this initially caused concern among businesses operating in Dubai and Abu Dhabi, industry players quickly devised solutions. Binance, which recently obtained a UAE license, has already implemented a workaround, enabling transactions through a state-sanctioned digital currency bridge.

This rapid response highlights the crypto industry’s ability to adapt to regulatory challenges. The UAE remains a significant financial hub, and despite the restrictions, digital assets will likely continue to play a role in its economy. However, the decision raises questions about the future of decentralized finance (DeFi) and cross-border crypto payments in the region.

Global Crypto Adoption: Regulation Meets Innovation

From Sony’s entry into crypto to Circle’s regulatory progress and the UAE’s evolving policies, the landscape of digital assets is undergoing rapid transformation. These developments reflect a growing intersection between traditional finance, corporate innovation, and regulatory oversight.

- Sony’s cryptocurrency exchange could introduce millions of new users to digital assets.

- Circle’s approval sets a precedent for stablecoin regulation in the EU.

- The UAE’s ban tests the limits of crypto adoption in highly regulated economies.

As companies and governments navigate these shifts, the industry’s ability to balance innovation with compliance will determine its long-term success. Sony’s involvement marks a milestone in the corporate adoption of blockchain technology, reinforcing the idea that crypto is here to stay.

Final Thoughts

Sony’s move into the cryptocurrency space is a game-changer, signaling that major corporations see value in blockchain integration. Meanwhile, Circle’s regulatory achievements and the UAE’s evolving stance on digital assets demonstrate the ever-changing nature of crypto regulations worldwide. As blockchain adoption continues to grow, businesses and investors must remain adaptable to regulatory changes and technological advancements.

See the Original Podcast: Sony launches its exchange, Circle’s USDC is MiCA compatible, Binance gets a UAE Licence