Bitcoin ETFs and Global Crypto Adoption

In this episode of the Real World Blockchain podcast, host Gauthier Lamothe is joined by Niles Lee-Smith, Rebecca Kaplan, and Zoe Braiterman to discuss the growing acceptance of Bitcoin ETFs (Exchange Traded Funds) and their implications for mainstream adoption of cryptocurrencies. From institutional interest to local business growth and ethical debates, the episode explores the dynamic and evolving landscape of blockchain and cryptocurrency.

Institutional Interest in Bitcoin ETFs

The podcast highlights the significant involvement of major financial institutions such as JP Morgan Chase, Goldman Sachs, and BlackRock in Bitcoin ETFs. For a detailed overview of available Bitcoin ETFs, see this list of Bitcoin ETFs. These developments signal a shift in the perception of cryptocurrencies within traditional finance. BlackRock’s initial $1 million seed fund for a Bitcoin ETF underscores this trend, while VanEck’s pledge to donate a portion of ETF profits to Bitcoin development demonstrates a commitment to the ecosystem.

Niles notes that ETFs offer a simpler investment option for newcomers, reducing the risks and technical challenges associated with direct cryptocurrency trading. This ease of access is expected to attract more investors, paving the way for broader adoption. The hosts also discuss the global perspective, pointing out that countries like Canada already have Bitcoin ETFs, raising questions about the U.S.’s position in the global crypto landscape.

Local Business Growth in Bitcoin Adoption

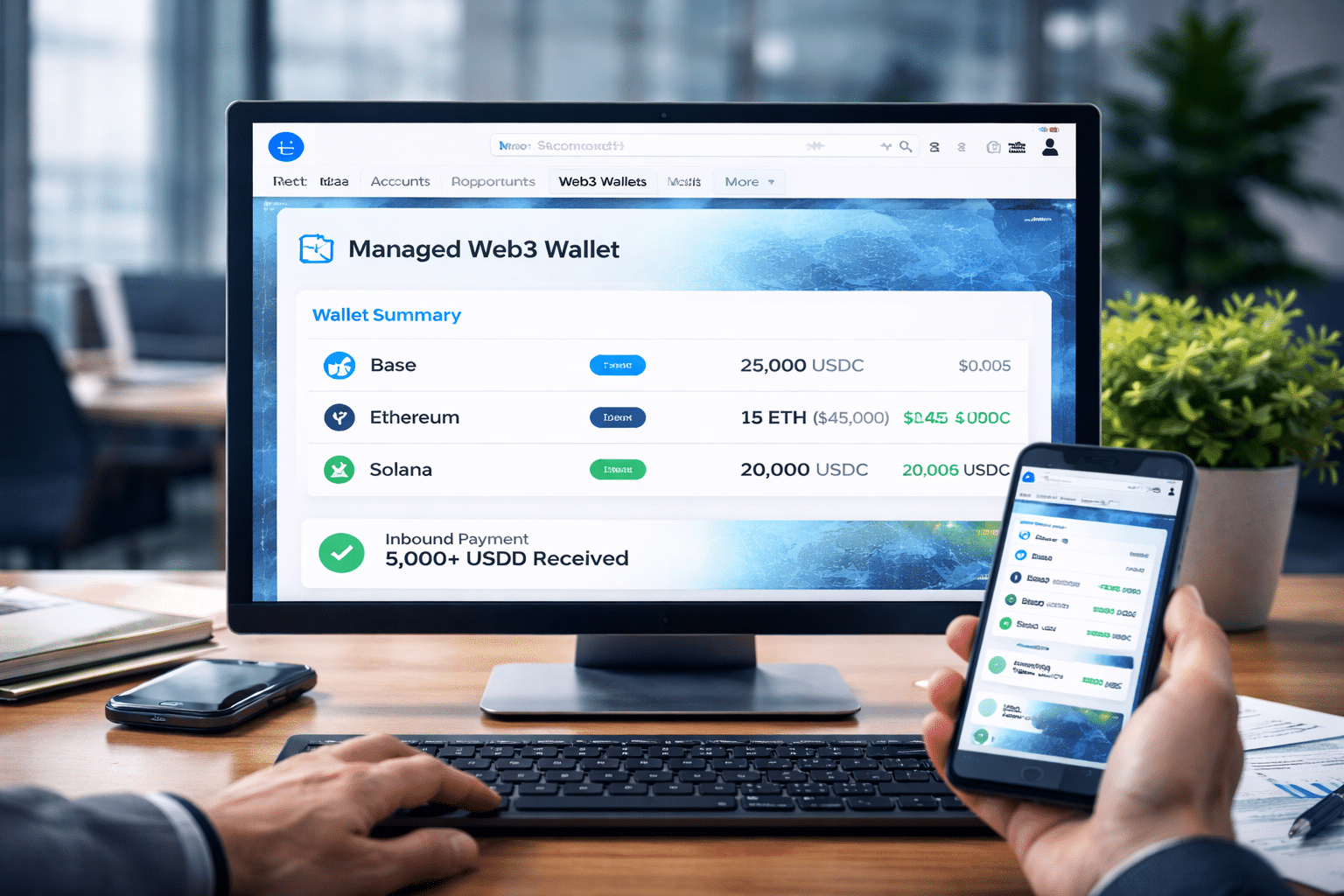

The number of in-person businesses accepting Bitcoin payments has tripled in the past year, with over 6,000 vendors now listed globally. This growth is particularly evident in regions like Latin America, where hyperinflation and currency instability have driven adoption. Rebecca shares her experiences in Venezuela, highlighting how cryptocurrency offers a viable alternative for businesses and consumers in such challenging economic environments. It is one of the reasons that Web3 Enabler supports accepting Bitcoin in Salesforce.

The BTC Map’s data reveals clusters of Bitcoin adoption in countries like Colombia, South Africa, and the Philippines, emphasizing the grassroots nature of this trend. Zoe notes that this increased acceptance indicates a growing belief in Bitcoin’s long-term value, even amidst market volatility.

Ethical Considerations in Blockchain Development Funding

The episode delves into the ethical debates surrounding funding for open-source blockchain projects. While financial contributions from private funds can sustain and advance development, they also raise concerns about potential conflicts of interest. Zoe emphasizes the importance of transparency and community-driven initiatives to maintain the integrity of blockchain ecosystems.

VanEck’s donation to Bitcoin Core development is cited as an example of how private funding can positively impact the open-source community, provided that ethical considerations are carefully managed.

E-commerce and Mainstream Integration

The podcast discusses the role of major e-commerce platforms in normalizing cryptocurrency payments. Japanese e-commerce giant Mercari’s adoption of Bitcoin payments through its Mercoin platform is a significant milestone, showcasing how large-scale retailers are integrating cryptocurrency into their ecosystems. Rebecca highlights that such developments help demystify cryptocurrency for everyday users, fostering broader acceptance. Web3 Enabler plans to bring out the ability for Salesforce Commerce Cloud.

Conclusion

This episode of the Real World Blockchain podcast underscores the transformative potential of Bitcoin ETFs and the growing adoption of cryptocurrency in various sectors. From institutional backing to grassroots business growth, the discussion highlights the multifaceted nature of blockchain’s impact. As the industry continues to evolve, the emphasis on education, transparency, and ethical practices will be critical in shaping a sustainable and inclusive future for blockchain and cryptocurrencies.

See the Original Podcast: Bitcoin ETF, Mercari accepting crypto payments.