Stablecoin implementation is reshaping the business landscape. These digital assets, pegged to stable currencies, offer a bridge between traditional finance and the crypto world.

At Web3 Enabler, we’ve seen firsthand how stablecoins are revolutionizing payments, especially for cross-border transactions. This blog post will explore why your business should jump on the stablecoin bandwagon now, and how to do it effectively.

Why Stablecoins Are Revolutionizing Business Payments

The Stablecoin Market Explosion

Stablecoins represent a new frontier in digital assets, designed to maintain a stable value by pegging to fiat currencies like the US dollar. Their impact on the business world is undeniable, offering a perfect blend of cryptocurrency efficiency and fiat stability.

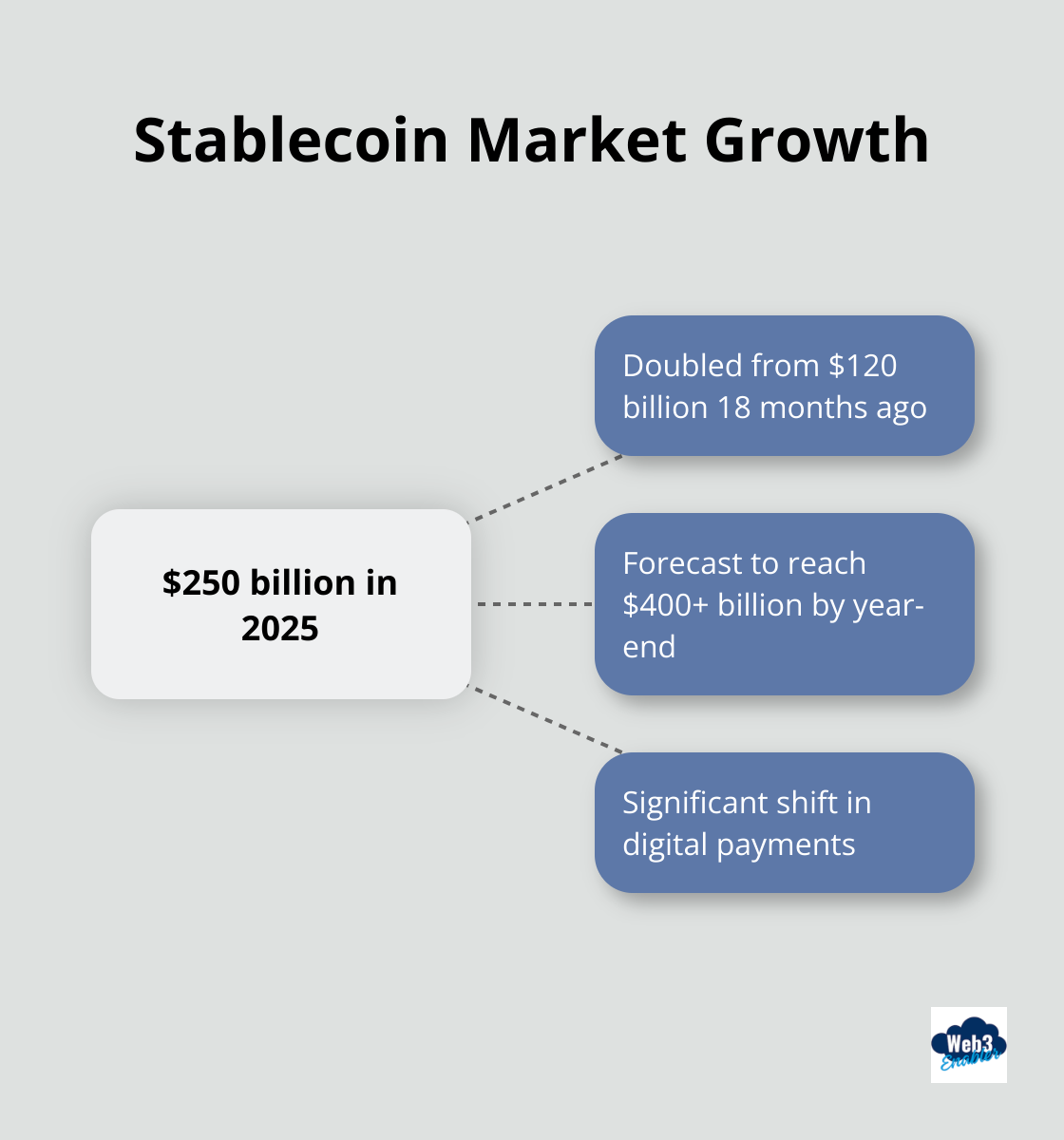

As of July 2025, the total value of issued stablecoins has doubled to $250 billion from $120 billion 18 months ago, and it is forecast to reach more than $400 billion by the end of the year. This remarkable growth trajectory signals a significant shift in how businesses and consumers perceive and use digital payments.

Industry-Wide Adoption

Major players across various sectors now embrace stablecoins. Financial giants like Bank of America and Standard Chartered explore the launch of their own stablecoins, recognizing the potential for faster and cheaper transactions. In the tech world, companies such as Meta (formerly Facebook) work on stablecoin projects to facilitate global payments.

Real-World Business Impact

Stablecoins transform business operations, particularly for companies dealing with cross-border transactions. Traditional international transfers often take 1-3 business days, while stablecoin transactions settle in minutes. This speed proves crucial for businesses operating in a global, 24/7 economy.

The cost savings are equally impressive. Traditional payment methods often involve multiple intermediary fees, but stablecoin transactions typically incur only minimal network fees. This reduction in costs can significantly impact a company’s bottom line, especially for businesses processing high volumes of transactions.

Financial Inclusion Through Stablecoins

One of the most promising aspects of stablecoins is their potential to increase financial inclusion. In regions with unstable local currencies or limited banking access, stablecoins provide a reliable alternative for transactions and value storage. This opens up new markets for businesses and allows them to serve previously unreachable customer bases.

The Future of Business Payments

As the stablecoin ecosystem continues to evolve, businesses that adopt this technology early will position themselves at the forefront of faster, cheaper, and more inclusive financial transactions. The next chapter will explore the specific benefits of implementing stablecoin payments in your business operations.

How Stablecoins Can Boost Your Business

Slash Transaction Costs

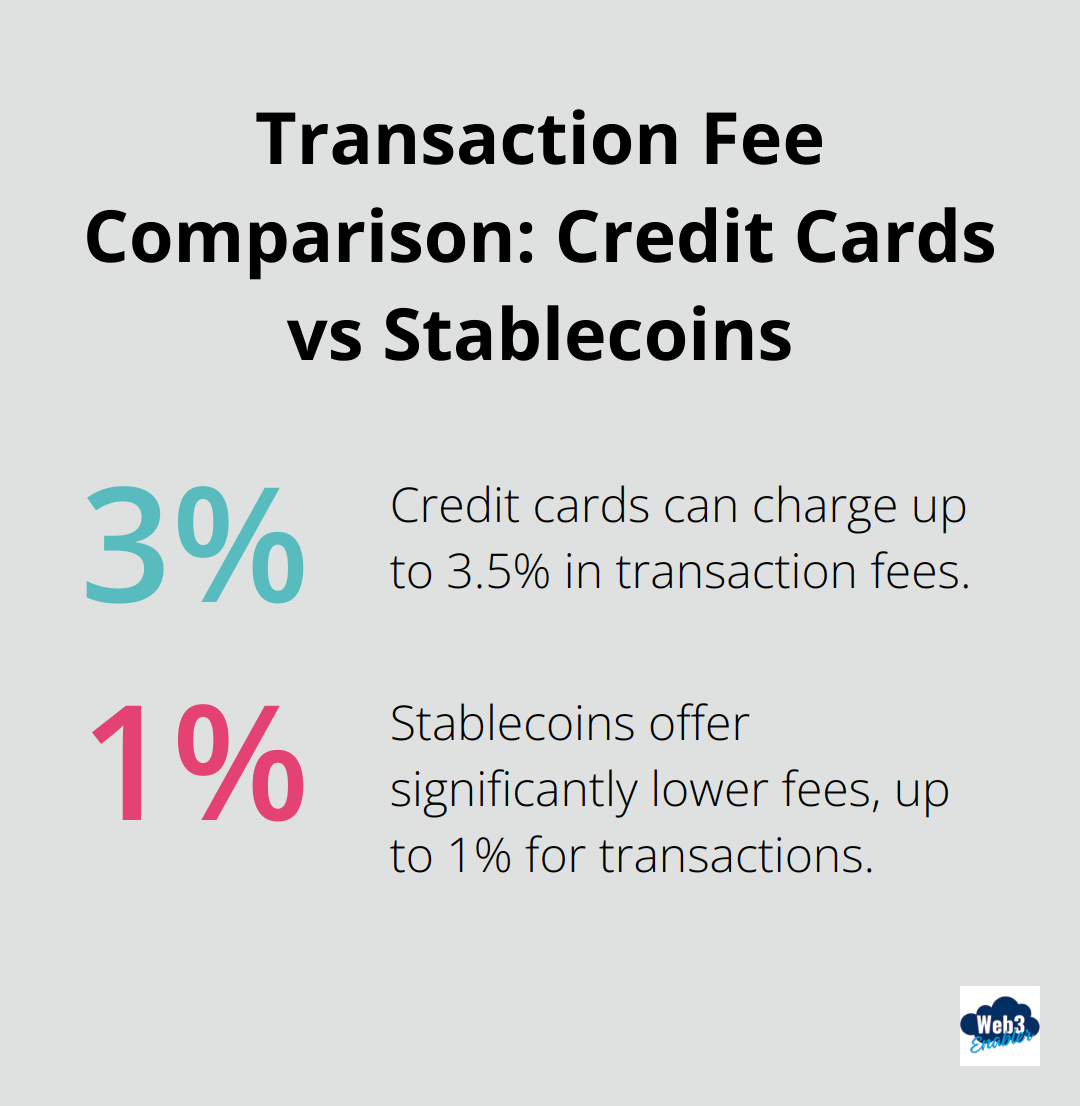

Stablecoin transactions offer lower fees compared to traditional payment methods. This preference stems from substantial cost savings.

Credit card fees often range from 1.5% to 3.5%, while stablecoin transaction fees can be as low as 0.1% to 1%. For a business processing $1 million in monthly transactions, this could translate to savings of up to $34,000 per month (a significant boost to any company’s bottom line).

Turbocharge Settlement Times

Speed matters in today’s fast-paced business environment. Stablecoins excel here, particularly for cross-border transactions. Traditional international wire transfers take 1-3 business days to settle. Stablecoin transactions, however, typically settle within minutes.

This rapid settlement time transforms cash flow management. Businesses can reinvest or utilize funds almost immediately, rather than wait days for transactions to clear. This agility benefits companies dealing with time-sensitive opportunities or operating in volatile markets.

Expand Your Customer Base

Stablecoins unlock doors to previously untapped markets. In regions with limited banking access or unstable local currencies, stablecoins provide a reliable alternative for transactions. This increased financial inclusion can significantly expand your potential customer base.

A recent report indicates that there are now 560 million crypto users worldwide. Accepting stablecoin payments caters to this growing demographic and positions your business as forward-thinking and technologically adept.

Moreover, recent data shows that 80% of crypto users now prefer stablecoins for transactions over volatile cryptocurrencies. This preference underscores the importance of integrating stablecoin payments to meet evolving consumer demands.

Enhance Transaction Transparency

Stablecoins operate on blockchain technology, which provides an immutable record of all transactions. This transparency can improve your business’s auditing processes and help build trust with customers and partners.

The ability to track transactions in real-time also allows for better financial planning and risk management. You can monitor cash flows more accurately and make informed decisions based on up-to-the-minute data.

Streamline International Operations

For businesses with global operations, stablecoins offer a unified payment system that transcends borders. This can simplify accounting processes, reduce currency conversion costs, and mitigate the risks associated with volatile exchange rates.

Implementing stablecoin payments isn’t just about keeping up with trends-it’s about gaining a competitive edge in the evolving digital economy. As we move forward, let’s explore how your business can effectively implement stablecoin payments and start reaping these benefits.

How to Implement Stablecoin Payments in Your Business

Choose the Right Stablecoins

The first step involves selecting an appropriate stablecoin for your business needs. USDT and USDC are currently the two clear leaders in the stablecoin market. These fiat-backed stablecoins offer the stability and liquidity most businesses require.

Your choice should consider factors like regulatory compliance, transaction speed, and network fees. USDC, for example, is known for its strong regulatory stance and transparency (which may be essential for businesses in highly regulated industries).

While we have a clear bias towards USDC and Circle, being an inaugural member of the Circle Alliance Program – we support USDT and PYUSD equally in Blockchain Payments. Allowing you to accept USDC, USDT, and PYUSD with ease.

Integrate with Existing Systems

After selecting a stablecoin, you must integrate it into your current payment infrastructure. This process varies depending on your existing setup, but typically involves partnering with a crypto payment processor or developing an in-house solution.

For companies running Salesforce, the obvious solution is to implement Web3 Enabler’s Blockchain Payments solution. We can add stablecoins easily and naturally. You can either manage a wallet or use our liquidation wallet for automative off-ramp to fiat. You can easily push the payment URL back and forth to other parts of the Enterprise stack.

Train Staff and Educate Customers

A new payment system requires buy-in from both your team and customers. Start by providing comprehensive training to your staff, especially those in customer-facing roles. They should understand stablecoin basics, transaction processes, and how to troubleshoot common issues. But in the end, an easy solution like Blockchain Payment let’s the user manage the process with minial staff involvement.

For customers, create clear, jargon-free guides explaining stablecoin payment benefits and usage. Try offering incentives (such as discounts or rewards) for customers who opt for stablecoin transactions. This can accelerate adoption and help offset any initial hesitation.

Implement a Comprehensive Blockchain Solution

To fully harness stablecoin power, implement a comprehensive blockchain solution. Web3 Enabler’s native blockchain solution on the Salesforce AppExchange stands out as a top choice, offering seamless integration with existing Salesforce infrastructure.

This solution enables stablecoin payments and provides additional benefits like enhanced transaction tracking, automated compliance checks, and real-time financial reporting. Such a platform can future-proof your payment infrastructure and give you a competitive edge in the evolving digital economy.

Stay Informed and Adapt

The stablecoin landscape evolves rapidly. Stay informed about regulatory developments and be prepared to adapt your strategy. Regular reviews of your stablecoin implementation will ensure you continue to reap the benefits while mitigating potential risks.

Final Thoughts

Stablecoin implementation represents a present-day necessity for businesses that want to stay competitive in the evolving financial landscape. The advantages include reduced transaction fees, fast settlement times, expanded customer bases, and enhanced transparency. These benefits translate into improvements in operational efficiency and bottom-line growth.

The stablecoin market continues its explosive growth, and early adopters will gain significant advantages. Businesses that embrace this technology now will position themselves at the forefront of a financial revolution, ready to capitalize on new opportunities and serve an increasingly digital-savvy customer base.

Web3 Enabler offers a seamless path to stablecoin implementation, particularly for businesses using Salesforce. Their platform enables businesses to accept stablecoin payments, send global payments faster and cheaper, and provide financial advisors with visibility into their clients’ cryptocurrency holdings within Salesforce (all within a single, integrated solution).