Stablecoins promised to be the boring, reliable cousin of crypto. Spoiler alert: they’re not as stable as their name suggests.

We at Web3 Enabler have watched billion-dollar stablecoin projects crumble faster than a house of cards. Understanding stablecoins risk isn’t just smart-it’s survival in today’s volatile crypto landscape.

From regulatory nightmares to technical meltdowns, these “stable” coins pack more drama than a reality TV show.

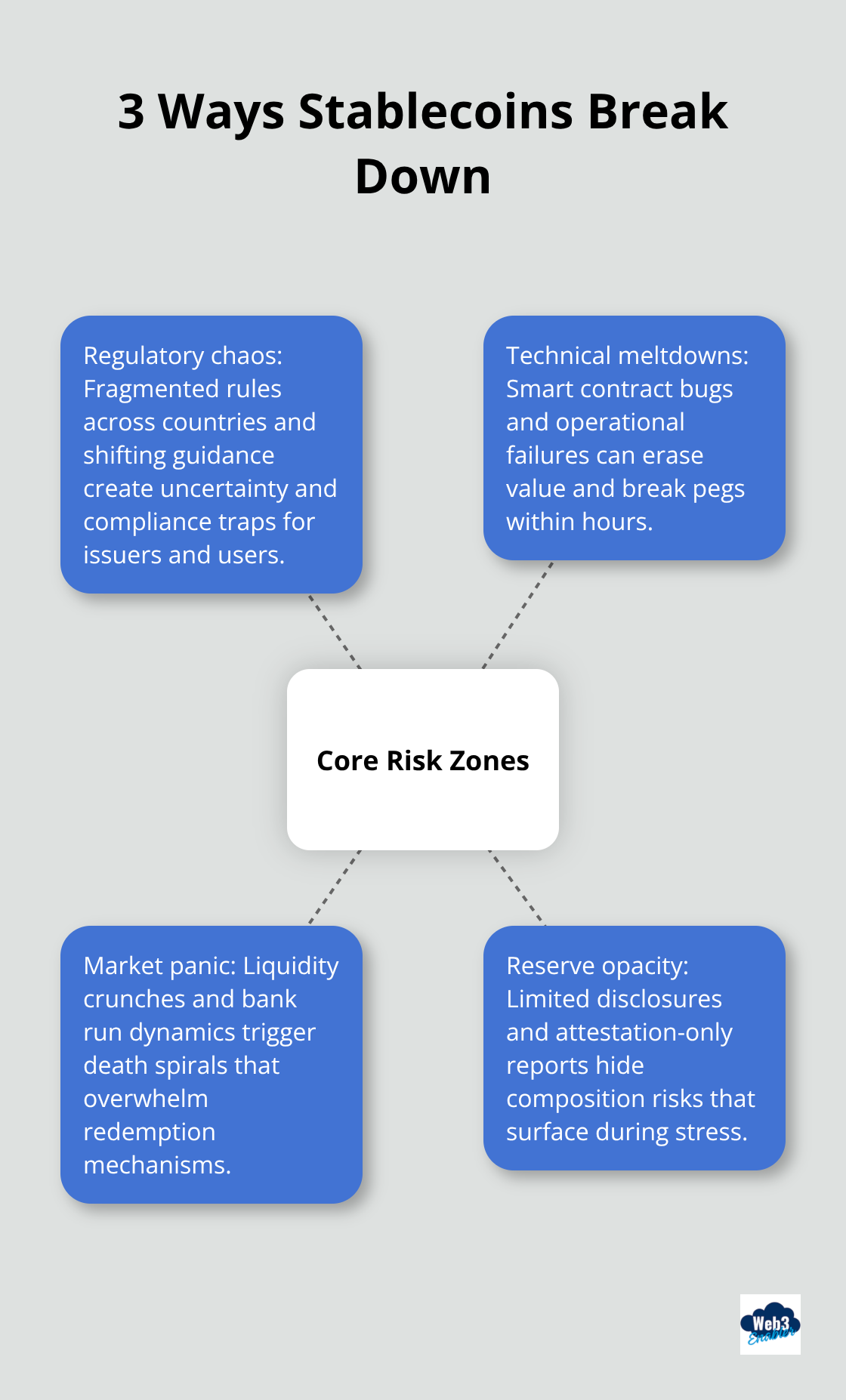

Where Do Stablecoins Break Down Most Often?

The stablecoin world operates in three danger zones that regularly destroy investor confidence and wipe out billions. These breakdown points reveal why “stable” coins often behave more like financial time bombs than reliable digital assets.

Regulatory Chaos Strikes First

Government agencies treat stablecoins like financial hot potatoes, and the regulatory landscape shifts faster than a crypto trader’s mood. Regulatory frameworks remain fragmented across jurisdictions, with different countries taking vastly different approaches to oversight and compliance.

Non-bank stablecoin issuers face increasing scrutiny from financial regulators worldwide. Financial institutions must navigate complex compliance requirements while dealing with transactions that prove harder to trace than traditional payments. International regulations change direction more often than a weather vane in a tornado.

Technical Meltdowns Hit Without Warning

Smart contract vulnerabilities represent the silent killers of stablecoin stability. Code bugs don’t announce themselves before they strike-they just destroy billions in value overnight. Technical failures can trigger massive liquidations across millions of accounts, as market data consistently shows.

Unlike fiat-backed stablecoins such as USDT, algorithmic stablecoins rely on complex mechanisms that can fail catastrophically during market stress. Operational and cyber risks compound these technical vulnerabilities, with technological failures capable of destroying peg stability within hours.

Market Panic Creates Death Spirals

Liquidity crises turn stable assets into volatile nightmares overnight. The stablecoin market has experienced significant contractions during periods of market stress, proving that even dollar-pegged assets face severe redemption pressures when panic sets in.

Bank run scenarios occur when investors simultaneously rush to redeem holdings, threatening the entire ecosystem’s stability. TerraUSD’s May 2022 collapse exemplified how quickly confidence evaporates-algorithmic mechanisms failed under pressure like a house of cards in a hurricane. Current stablecoin markets process trillions in transaction volume, yet this massive scale amplifies systemic risks when liquidity dries up.

These technical and market failures often trace back to fundamental problems with how stablecoins manage their reserves and maintain transparency.

What Happens When Reserve Promises Break?

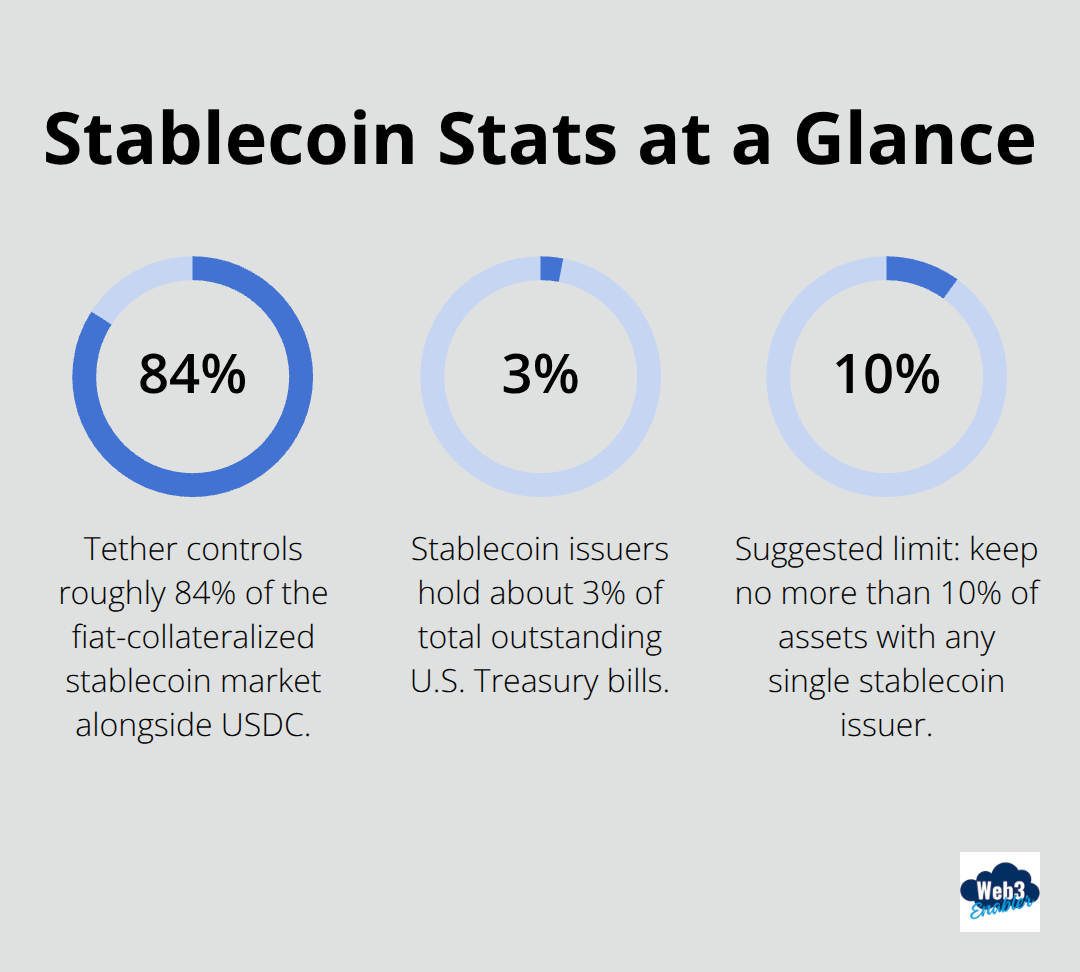

Stablecoin issuers love to make bold claims about their assets, but the reality often looks messier than a teenager’s bedroom. Tether has increased its holdings of short-term U.S. Treasury securities, yet transparency around its complete reserve composition remains limited compared to competitors like USD Coin. Circle provides monthly attestations from Deloitte that show USDC reserves held with regulated U.S. banks, while Tether operates with significantly less oversight despite the fact that it controls roughly 84% of the fiat-collateralized stablecoin market alongside USDC.

Reserve Composition Creates Hidden Vulnerabilities

Most stablecoin issuers park their reserves in short-term U.S. Treasury securities and cash equivalents, but duration exposure in fixed-income securities poses serious profitability challenges when interest rates rise. Financial institutions that back stablecoins face conflicts of interest when they seek higher returns on assets, which potentially undermines peg stability. The GENIUS Act mandates 1:1 asset ratios in cash or U.S. Treasuries, yet enforcement mechanisms remain untested when major market stress events occur.

Audit Gaps Leave Investors Blind

Monthly public disclosures sound impressive until you realize what they don’t reveal. USDT faced regulatory penalties for transparency issues, while algorithmic stablecoins like the failed TerraUSD operated without traditional assets altogether. Third-party firms provide attestations rather than full audits, which creates verification gaps that become obvious only after disasters strike. Stablecoin issuers collectively own just below $200 billion in U.S. Treasury securities as of mid-2025 (representing about 3% of total outstanding Treasury bills), yet individual reserve breakdowns often lack granular detail.

Centralized Control Points Spell Trouble

Single points of failure plague even the largest stablecoin operations. Custodial arrangements concentrate enormous risk with limited institutions, while administrative challenges around unregulated issuers raise fundamental questions about investor protection. When confidence erodes, these centralized structures amplify redemption pressures rather than provide stability buffers. The rapid growth to $250 billion in total stablecoin supply by August 2025 occurred without proportional improvements in decentralized risk management systems.

These reserve management failures pale in comparison to the spectacular public meltdowns that have rocked the stablecoin world.

Which Stablecoin Disasters Should Terrify Every Business?

TerraUSD’s $60 Billion Algorithmic Nightmare

TerraUSD collapsed in May 2022 and wiped out $60 billion in market value within days. This disaster proved that algorithmic mechanisms fail spectacularly under pressure. The stablecoin maintained its dollar peg through a complex relationship with LUNA tokens, but this system created a death spiral when redemption pressure mounted.

Over 1.6 million accounts faced liquidations as close to $19 billion worth of long positions got destroyed (according to CoinGlass data). The collapse revealed that algorithmic stablecoins without traditional asset backing represent existential risks. No business should accept these instruments for treasury management or payment processes.

Tether’s Opacity Problem Persists Despite Market Dominance

Tether now dominates the fiat-collateralized stablecoin market, yet its transparency remains questionable compared to Circle’s monthly Deloitte attestations. USDT has experienced major price fluctuations due to confidence issues, with previous regulatory penalties that highlight administrative challenges around reserve disclosure.

While Tether has increased its short-term U.S. Treasury securities, the complete reserve composition lacks the granular detail that businesses need for risk assessment. Companies that consider USDT for payments should recognize that opacity creates unnecessary counterparty risk when alternatives like USDC provide clearer reserve documentation through regulated U.S. banks.

USDe’s Recent De-Peg Exposes Synthetic Risks

USDe, the third-largest stablecoin with over $12 billion in market capitalization, recently dropped to $0.65 during a liquidation event that highlighted vulnerabilities in its hedge mechanisms. Unlike traditional stablecoins backed by fiat currency, USDe relies on crypto assets and derivatives for stability. This creates exposure to market fluctuations that businesses cannot control.

The incident prompted social media debates that question whether USDe deserves classification as a stablecoin. Ethena Labs emphasized that the asset remains over-collateralized despite the de-peg. Businesses that use synthetic stablecoins face risks that extend far beyond simple price volatility into complex derivative exposure that can amplify losses during market stress.

Iron Finance Bank Run Scenario

Iron Finance’s TITAN token collapse in June 2021 demonstrated how quickly confidence can evaporate in partially-collateralized stablecoins. The protocol’s IRON stablecoin lost its peg when investors rushed to redeem their holdings simultaneously. This bank run scenario destroyed the entire ecosystem within hours and left investors with worthless tokens.

Final Thoughts

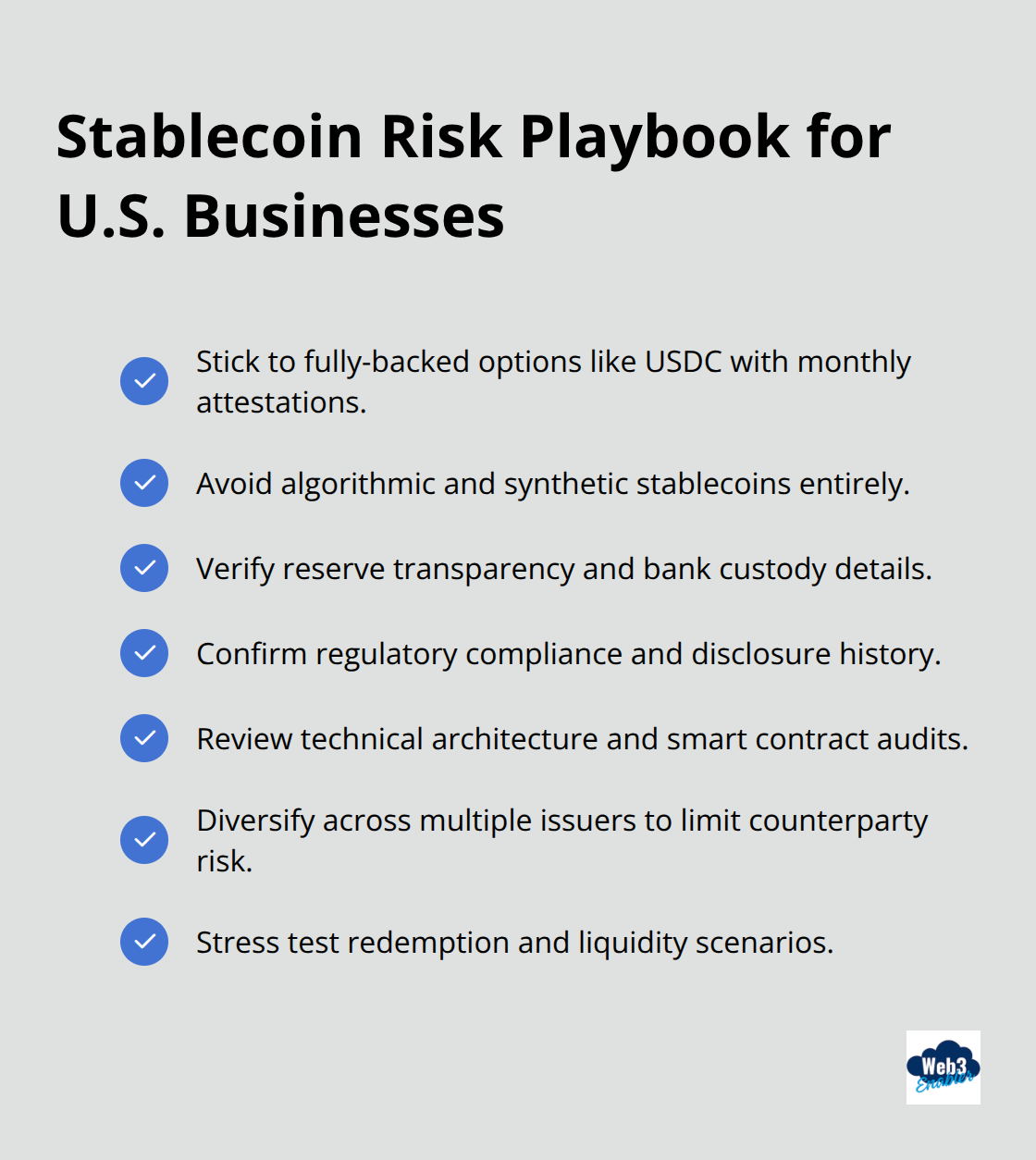

Stablecoins risk extends far beyond simple price volatility into regulatory chaos, technical meltdowns, and reserve management failures. The $60 billion TerraUSD collapse and USDe’s recent de-peg to $0.65 prove that even billion-dollar projects can crumble overnight when confidence evaporates. Smart businesses should stick to fully-backed stablecoins like USDC that provide monthly attestations from reputable firms.

Companies must avoid algorithmic and synthetic stablecoins entirely because they represent financial time bombs that explode without warning. The GENIUS Act’s 1:1 backing requirements offer some protection, but enforcement remains untested during major market stress. Treasury managers should never put more than 10% of assets into any single stablecoin issuer (regardless of market dominance or reputation).

The stablecoin market will likely reach $500-750 billion in coming years according to J.P. Morgan research, yet growth doesn’t eliminate fundamental risks. Companies need proper due diligence processes that account for reserve transparency, regulatory compliance, and technical architecture. We at Web3 Enabler help businesses navigate these complex waters through blockchain solutions that support compliant digital payments.