![Staying Ahead of Crypto Regulations in Business [Guide]](https://web3enabler.com/wp-content/uploads/emplibot/crypto-regulations-hero-1764184061.jpeg) Crypto regulations continue evolving rapidly across global markets, creating both opportunities and compliance challenges for businesses operating with digital assets.

Crypto regulations continue evolving rapidly across global markets, creating both opportunities and compliance challenges for businesses operating with digital assets.

At Web3 Enabler, we’ve seen companies struggle with fragmented regulatory requirements that vary significantly between jurisdictions. The cost of non-compliance can reach millions in fines and operational disruptions.

This guide provides actionable frameworks to build robust compliance systems that protect your business while enabling growth in the digital asset space.

Understanding Current Crypto Regulatory Landscape

Key Regulatory Bodies Shape Digital Asset Operations

The SEC Crypto Task Force launched in 2025 represents America’s shift toward structured digital asset oversight. The Financial Sector Conduct Authority in South Africa now treats stablecoins as regulated financial products, requiring specific compliance measures.

European businesses benefit from MiCA regulation implementation, which increased registered crypto providers by nearly 50% as companies prefer clear frameworks over regulatory uncertainty. The CFTC maintains jurisdiction over crypto derivatives and requires businesses that handle futures or options to register as commodity trading advisors.

Regional Compliance Requirements Create Complex Obligations

Nigerian businesses must report crypto transactions under updated Central Bank guidelines, while Kenya requires digital asset service providers to obtain licenses from the Capital Markets Authority. The UK Financial Conduct Authority demands daily reserve updates from stablecoin issuers, contrasting sharply with Hong Kong’s monthly requirements. South African companies face FICA compliance for customer verification and suspicious transaction reports, plus SARS taxation on all crypto gains (with rates varying based on transaction frequency and amounts). Companies that operate across multiple African markets need separate compliance frameworks for each jurisdiction, as regulatory harmonization remains years away.

Documentation Standards Determine Audit Outcomes

Businesses must maintain transaction records for seven years minimum under most jurisdictions, including wallet addresses, timestamps, and counterparty information. The IRS requires detailed cost basis calculations for every crypto transaction, which makes automated record systems essential for companies that process high volumes. Anti-money laundering protocols demand source-of-funds documentation for transactions that exceed local thresholds, typically $3,000 to $10,000 depending on jurisdiction. Companies that use platforms like Coinbase, Kraken, or Binance benefit from built-in compliance reports, though internal documentation systems remain necessary for complete audit trails.

These regulatory foundations create the framework within which businesses must build their compliance operations and risk management strategies.

Building a Compliance Framework for Crypto Operations

Transaction Documentation Forms Your Defense Foundation

Every crypto transaction requires immutable records that include wallet addresses, timestamps, counterparty details, and transaction purposes. The Financial Crimes Enforcement Network mandates businesses maintain these records for ten years minimum, while European MiCA regulations extend this to seven years. Smart businesses implement automated systems that capture transaction data in real-time rather than reconstruct records during audits. Companies that process over 1,000 monthly transactions need enterprise-grade solutions that integrate with existing accounting systems and generate compliance reports automatically.

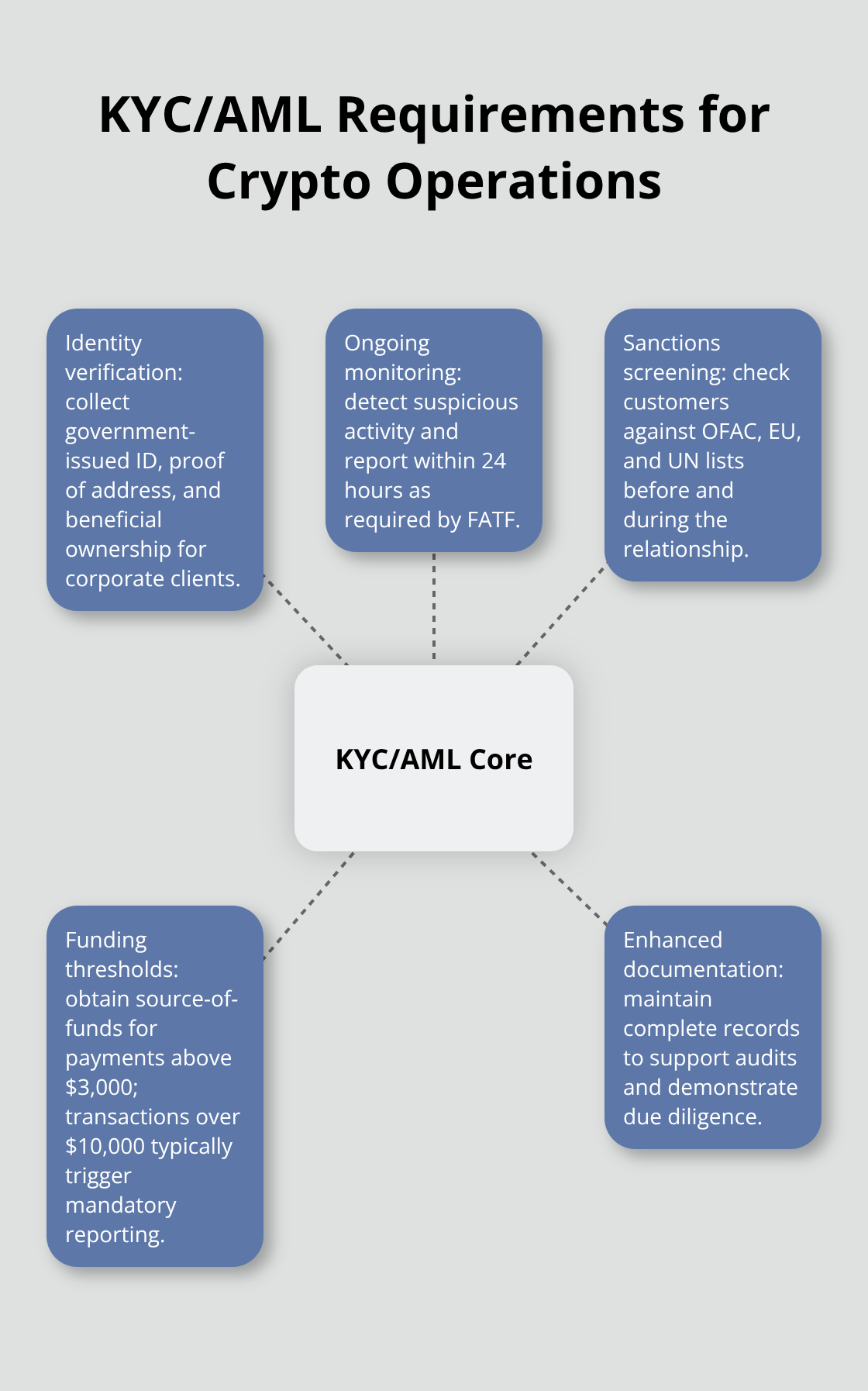

Customer Verification Prevents Regulatory Penalties

Know Your Customer protocols for crypto operations demand enhanced due diligence beyond traditional banking requirements. Businesses must verify customer identities with government-issued documents, proof of address, and beneficial ownership information for corporate clients. The Financial Action Task Force requires crypto service providers to conduct ongoing monitoring and report suspicious activities within 24 hours. Anti-money laundering systems must screen customers against global sanctions lists (including OFAC, EU, and UN databases).

Companies that process payments above $3,000 need additional source-of-funds documentation, while transactions that exceed $10,000 trigger mandatory reporting in most jurisdictions.

Risk Assessment Protects Business Operations

Effective compliance frameworks assess counterparty risks with blockchain analytics tools that trace fund origins and flag high-risk addresses. Companies must establish transaction limits based on customer risk profiles, with enhanced monitoring for jurisdictions with weak AML controls. Regulatory risk assessments should evaluate exposure across all operating jurisdictions and update quarterly as regulations evolve (given the rapid pace of regulatory changes). Businesses need incident response procedures that include immediate transaction suspension capabilities, regulatory notification protocols, and legal counsel engagement procedures for compliance violations.

Staff Training Strengthens Compliance Culture

Compliance teams require specialized training on digital asset regulations that differs significantly from traditional financial services training. Staff must understand blockchain transaction mechanics, wallet security protocols, and regulatory reporting requirements specific to crypto operations. Regular training updates become essential as regulations evolve monthly across different jurisdictions. Companies should establish clear escalation procedures for suspicious transactions and maintain updated contact lists for regulatory bodies in each operating market.

These compliance frameworks provide the foundation for implementing practical day-to-day procedures that keep your business compliant while maintaining operational efficiency.

Practical Steps for Regulatory Compliance

Automated Record Systems Prevent Audit Failures

Businesses that rely on manual record-keeping face significant audit challenges, particularly as crypto crime continues to evolve. Enterprise-grade solutions like Chainalysis KYT and Elliptic Navigator automatically capture wallet addresses, transaction amounts, timestamps, and counterparty details in real-time. Companies that process over 500 monthly transactions need systems that integrate directly with accounting platforms like QuickBooks or SAP to maintain synchronized records across all business functions. The most effective setups include automated backup systems that store transaction data across multiple geographic locations, which prevents data loss that could result in regulatory penalties exceeding $2 million per incident.

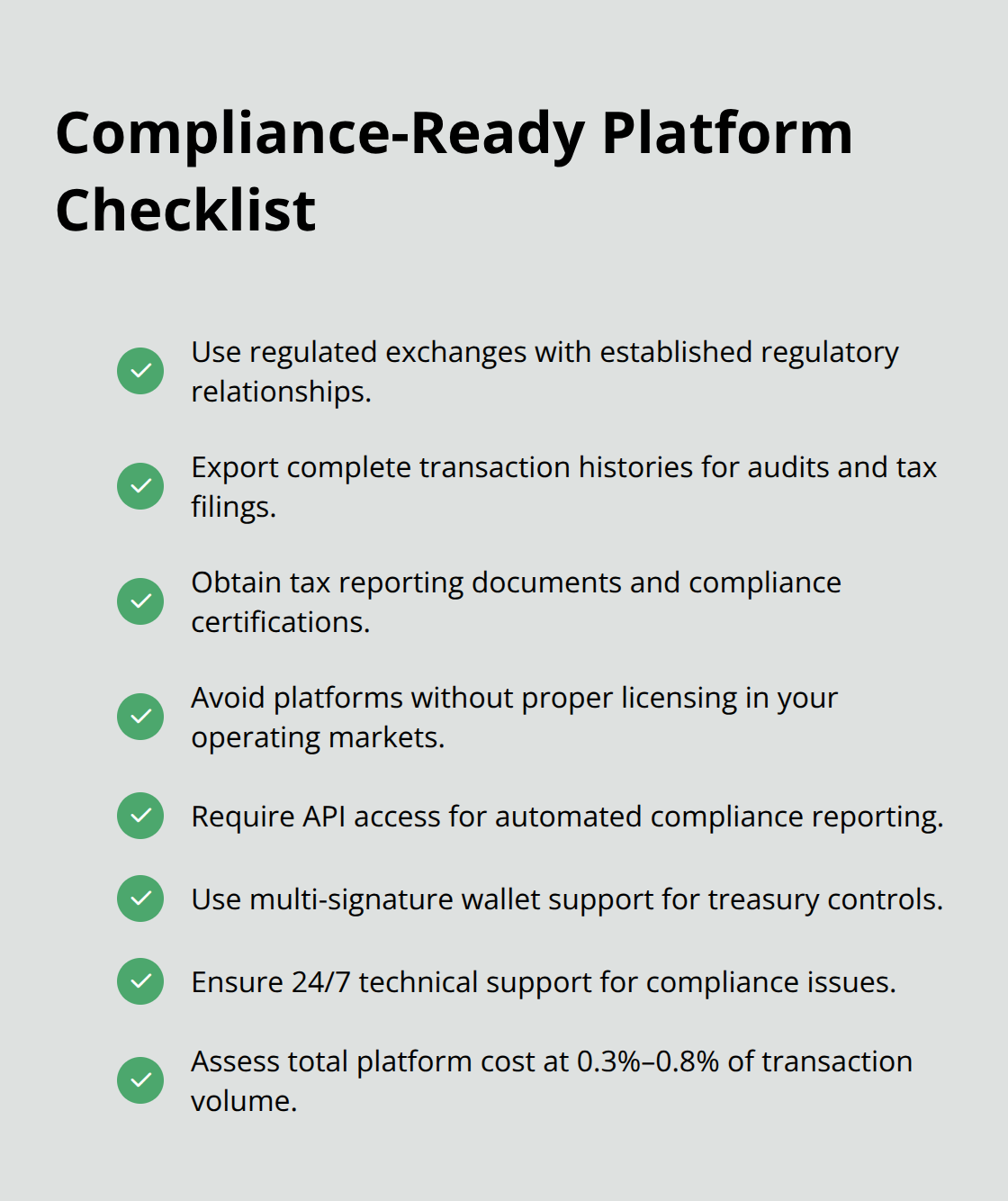

Platform Selection Determines Compliance Success

Regulated exchanges like Coinbase, Kraken, or Binance reduce compliance burden through built-in reporting features and established regulatory relationships. These platforms provide transaction history exports, tax reporting documents, and compliance certifications that satisfy most jurisdictional requirements. Businesses should avoid platforms without proper licensing in their operating markets, as this creates liability exposure that insurance policies typically exclude.

Companies need service providers that offer API access for automated compliance reporting, multi-signature wallet support for treasury operations, and 24/7 technical support for compliance-related issues. The total cost of compliance-grade platforms averages 0.3% to 0.8% of transaction volume (significantly cheaper than post-audit remediation costs).

Staff Training Programs Reduce Violation Risk

Compliance violations drop significantly when companies implement quarterly training programs that cover current regulations, transaction monitoring procedures, and incident response protocols. Training must include hands-on practice with compliance software, suspicious activity identification techniques, and escalation procedures for high-risk transactions. Companies should maintain training completion records for all staff members who handle crypto operations, as regulators increasingly require proof of adequate staff preparation during audits. The most effective programs include monthly regulatory updates, role-specific training modules, and regular testing to verify knowledge retention across all compliance-critical positions.

Documentation Standards Protect Against Penalties

Proper documentation systems capture every transaction detail that regulators require during audits. Companies must record transaction purposes, counterparty relationships, and source-of-funds information for all crypto operations above regulatory thresholds. Digital asset businesses need systems that generate compliance reports automatically and maintain audit trails that span multiple years (as required by most jurisdictions). The documentation must include screenshots of wallet interfaces, email confirmations, and signed agreements that prove legitimate business purposes for all crypto payments.

Final Thoughts

Crypto regulations present both challenges and opportunities for businesses that operate in the digital asset space. Companies that implement comprehensive compliance frameworks protect themselves from penalties while they position for growth as regulatory clarity improves. The investment in proper documentation systems, staff training, and regulatory-compliant platforms pays dividends through reduced audit risks and operational efficiency.

Proactive compliance approaches deliver measurable benefits beyond risk mitigation. Businesses with robust frameworks access better banking relationships, attract institutional partners, and operate confidently across multiple jurisdictions. The cost of building compliance systems represents a fraction of potential penalties (which can reach millions for non-compliant operations).

The regulatory landscape will continue to evolve as governments refine their approaches to digital assets. Companies that establish adaptable compliance frameworks today position themselves to capitalize on future opportunities rather than scramble to meet new requirements. We at Web3 Enabler provide the infrastructure businesses need to manage digital assets compliantly within existing corporate systems.

![Navigating Compliance in the Blockchain Era [2025]](https://web3enabler.com/wp-content/uploads/emplibot/blockchain-compliance-hero-1761160171.jpeg)