Stablecoins are revolutionizing B2B transactions, offering a host of benefits that traditional payment methods can’t match.

At Web3 Enabler, we’ve seen firsthand how these digital assets are transforming the way businesses handle payments across borders.

From lightning-fast settlements to enhanced security, the advantages of stablecoin payments are reshaping the financial landscape for companies worldwide.

How Fast Are Stablecoin Payments?

Stablecoin payments redefine speed in B2B transactions. The era of waiting days for payments to clear is over. Let’s explore how these digital assets accelerate business operations.

Lightning-Fast Settlements

Traditional bank transfers often take days to clear, especially for international transactions. Stablecoins slash this time to mere seconds. This rapid settlement empowers companies to manage cash flow more effectively and minimizes payment delay risks.

Slashing Processing Fees

Stablecoin transactions typically cost a fraction of traditional payment methods. While credit card processors often charge 2-3% per transaction, stablecoin fees can be as low as a fraction of a cent.

For high-volume businesses, this difference translates into substantial savings. A mid-sized e-commerce company could save significantly by switching to stablecoin payments.

Always-On Global Transactions

Unlike traditional banking systems that operate on business hours and often close for holidays, stablecoin networks run 24/7, 365 days a year. This constant availability proves crucial for global businesses operating across different time zones.

Picture a US-based company needing to make an urgent payment to a supplier in Asia on a Sunday evening. With stablecoins, that transaction happens immediately, rather than waiting for banks to open on Monday morning.

Real-World Impact

Businesses that integrate stablecoin payments often see dramatic improvements in their payment processing times. This efficiency boost allows businesses to focus on growth and innovation rather than payment logistics.

The speed and efficiency of stablecoin payments offer clear advantages, but they’re just the tip of the iceberg. Next, we’ll examine how these digital assets enhance financial transparency and security in B2B transactions.

How Secure Are Stablecoin Transactions?

Stablecoin transactions offer a new level of security and transparency for B2B payments. This enhanced security stems from the blockchain technology, which increases accountability and allows for real-time monitoring, improving fraud detection.

Unalterable Transaction Records

Every stablecoin transaction is recorded on a blockchain, creating a permanent, tamper-proof record. This feature proves particularly valuable for businesses that deal with high-value transactions or operate in industries with strict regulatory requirements.

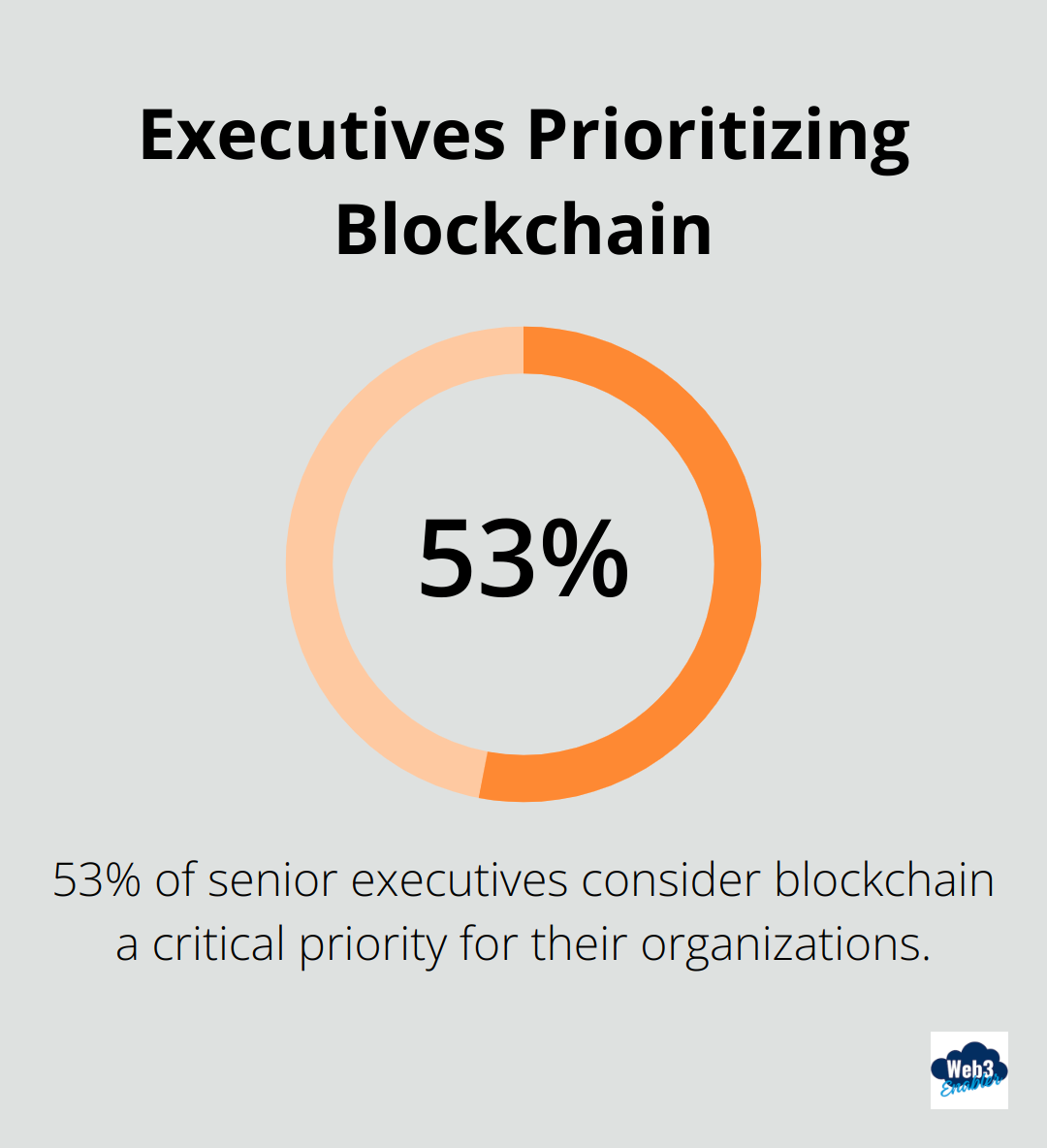

A study by Deloitte found that 53% of senior executives consider blockchain a critical priority for their organizations. Improved security and lower risk of fraud stand out as key drivers for this prioritization.

Fraud Prevention and Chargeback Elimination

Stablecoin transactions significantly enhance security, mitigating fraud and completely eliminating chargebacks. Once a transaction is confirmed on the blockchain, it cannot be reversed without the recipient’s consent. This feature protects businesses from chargeback fraud, a problem that costs merchants billions annually.

A report by Juniper Research estimated that merchants lost $20 billion to chargebacks in 2021 alone. Stablecoin payments could potentially save businesses a substantial portion of these losses (potentially in the billions).

Streamlined Compliance and Auditing

The transparent nature of blockchain technology simplifies compliance and auditing processes. Every transaction is traceable, which makes it easier for businesses to demonstrate regulatory compliance and conduct internal audits.

Enhanced Privacy and Data Protection

While providing transparency, stablecoin transactions also offer enhanced privacy. Unlike traditional bank transfers that require sharing sensitive banking information, stablecoin transactions only involve public wallet addresses. This reduces the risk of data breaches and protects sensitive financial information.

The combination of transparency and privacy makes stablecoins an attractive option for businesses that want to enhance their financial security while maintaining operational efficiency. This enhanced security sets the stage for our next topic: how stablecoins simplify cross-border payments and streamline international business operations.

How Stablecoins Simplify Global Payments

Stablecoins revolutionize international business transactions, offering a streamlined approach to cross-border payments. This digital solution addresses long-standing pain points in global commerce, making it easier and more cost-effective for businesses to operate on an international scale.

Elimination of Currency Conversion Fees

Stablecoin payments significantly reduce currency conversion costs. Traditional international wire transfers often involve multiple intermediaries, each taking a cut and adding to the overall cost. Stablecoins bypass this system entirely.

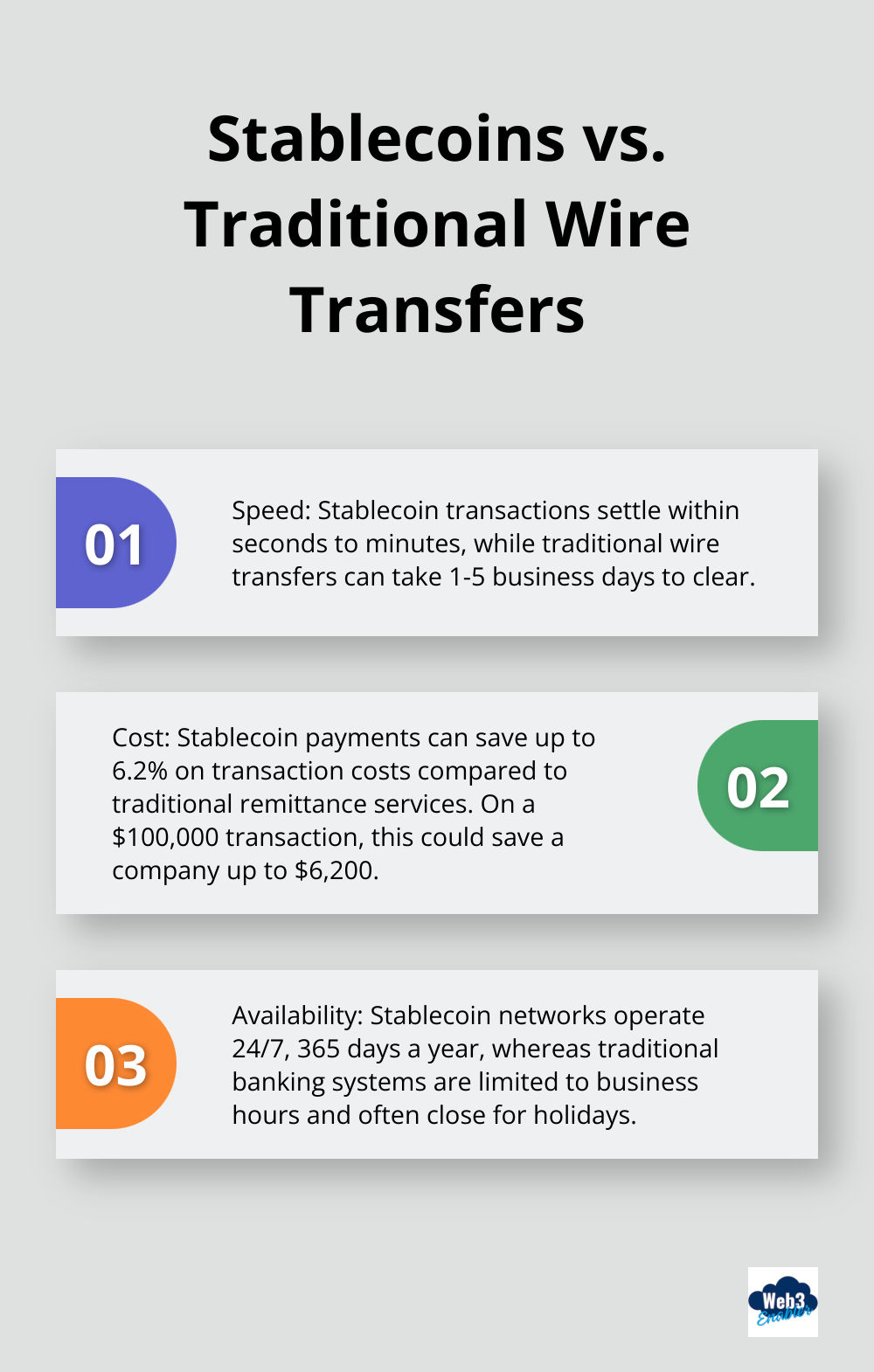

A US company paying a supplier in Europe using stablecoins avoids the typical 6.2% transaction cost charged by traditional remittance services. On a $100,000 transaction, this could save the company up to $6,200 (a substantial amount that impacts the bottom line over time).

Protection Against Exchange Rate Volatility

Exchange rate volatility concerns businesses engaged in international trade. Stablecoins, pegged to stable assets like the US dollar, provide a buffer against these fluctuations. This stability allows businesses to plan and budget more effectively, without constant worry about currency value changes affecting their profits.

Rapid International Transactions

Stablecoins dramatically reduce the time to complete international transactions. While traditional bank transfers take 1-5 business days to clear, stablecoin transactions typically settle within seconds to minutes, regardless of the countries involved.

This speed proves particularly valuable for businesses that rely on just-in-time inventory systems or need to make urgent payments to international partners. It allows for more agile operations and can improve relationships with suppliers and partners by ensuring prompt payments.

Enhanced Financial Transparency

Stablecoin transactions offer increased transparency in international payments. The blockchain technology underlying stablecoins provides a clear, immutable record of all transactions. This feature proves especially useful for businesses that need to maintain detailed financial records for compliance or auditing purposes.

Reduced Dependency on Banking Hours

Stablecoins operate 24/7, unlike traditional banking systems that adhere to specific business hours and often close for holidays. This constant availability proves crucial for global businesses operating across different time zones, allowing for seamless transactions regardless of the time or day.

Wrapping Up

Stablecoin benefits for B2B transactions transform global business operations. These digital assets offer lightning-fast settlements, reduced processing fees, enhanced security, and simplified cross-border payments. Stablecoins provide a compelling alternative to traditional methods, allowing transactions 24/7 and eliminating currency conversion fees.

Web3 Enabler stands at the forefront of this financial revolution. We help businesses integrate stablecoin payments into their existing systems seamlessly. As the only native blockchain solution on the Salesforce AppExchange, we provide tools and expertise to leverage stablecoins’ full potential in B2B transactions.

Stablecoins reshape B2B transactions, offering companies a competitive edge in the global marketplace. Early adopters of these digital assets unlock new levels of efficiency, security, and financial flexibility. The transition to stablecoin payments represents more than a technological shift; it opens doors to unprecedented growth and innovation in the business world.