Finance teams waste hours every month chasing down payment discrepancies across disconnected systems. Manual reconciliation introduces errors, delays cash flow visibility, and creates compliance headaches that only grow worse at month-end close.

We at Web3 Enabler built Blockchain Payments for Salesforce to eliminate these friction points. With immutable transaction records and real-time audit trails, your team gets instant reconciliation without leaving your Salesforce workflow.

Why Payment Reconciliation Matters

Finance teams at mid-market and enterprise organizations spend 15-20 hours per week on manual data entry, invoice matching, and reconciliation. That time compounds quickly-a company processing around 100 invoices weekly loses hundreds of hours annually just matching transactions across disconnected systems. McKinsey’s Global Payments Report confirms that payment reconciliation ranks among the top finance pain points, alongside cash forecasting and invoice processing. The real cost isn’t just labor; it’s the operational risk that comes with manual matching. One missed deposit or incorrectly recorded payment cascades into inaccurate cash positions, delayed financial reporting, and compliance exposure that auditors scrutinize.

Manual Errors Destroy Financial Accuracy

Spreadsheets and email trails create inevitable errors when your team reconciles payments. Data entry mistakes, duplicate entries, and mismatched invoice numbers create gaps that grow harder to trace as transaction volumes scale. These discrepancies don’t resolve themselves-finance teams must stop productive work to hunt down the source, often discovering the issue only during month-end close when time pressure peaks. Automated matching against immutable transaction records eliminates this friction entirely. Your cash position updates as payments arrive, not weeks later. Subscription businesses with recurring invoices and multiple payment methods benefit most from automation; the efficiency gains and accuracy improvements compound with every additional revenue stream.

Real-Time Visibility Powers Better Decisions

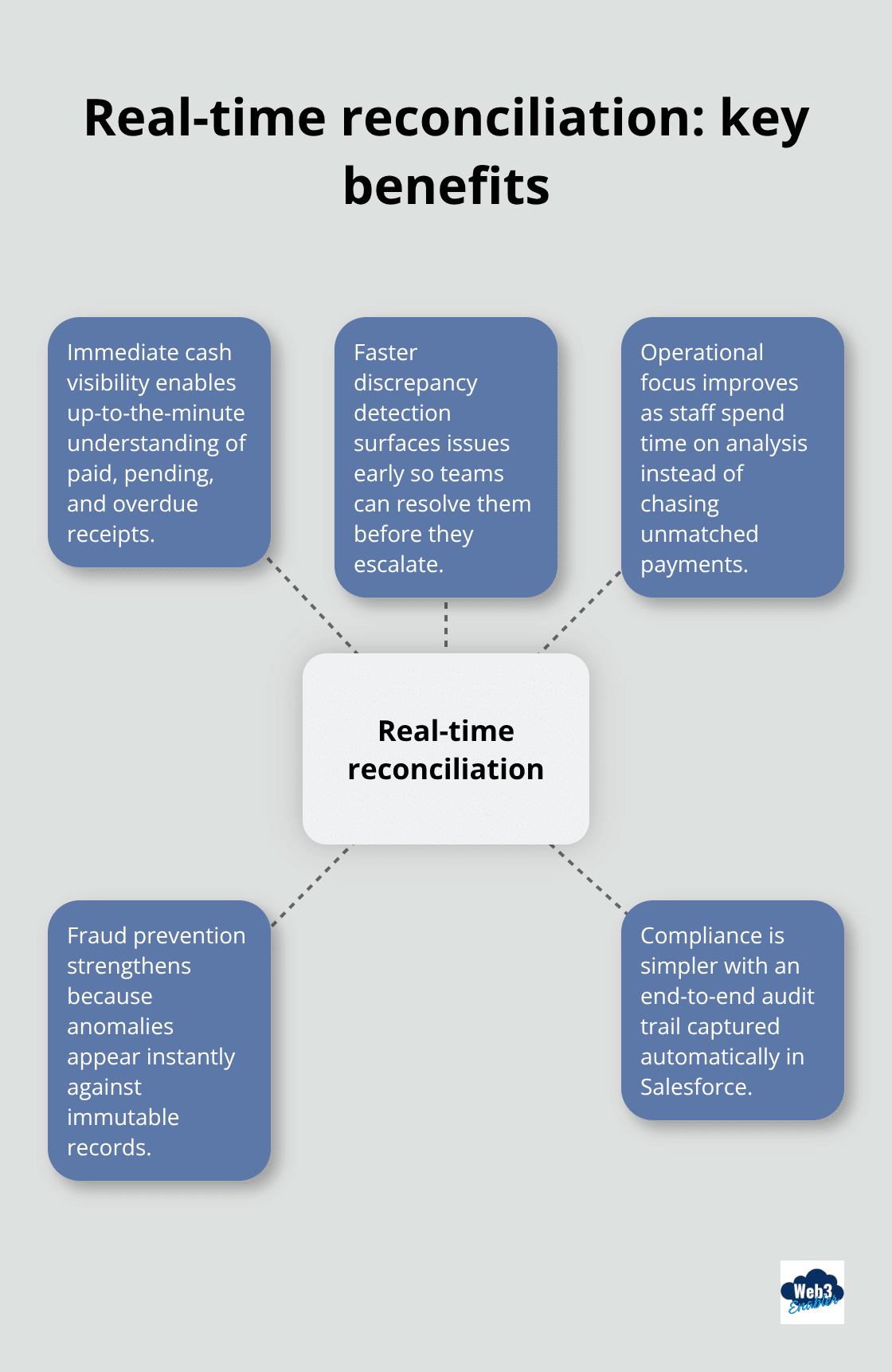

Finance leaders who move to real-time reconciliation gain something manual processes never deliver: immediate visibility into actual cash positions. Instead of waiting until month-end to understand what money arrived and what’s still pending, your team sees settlement status instantly.

This speed matters operationally. Faster issue detection means discrepancies surface before they become bigger problems. Unmatched payments get flagged immediately, not discovered three weeks later during close. For cash flow management, real-time reconciliation feeds live dashboards that show exactly which invoices are paid, partially paid, or overdue-enabling smarter decisions about inventory, payroll timing, and growth investments. Organizations using real-time reconciliation also strengthen fraud prevention because anomalies and suspicious patterns emerge immediately, not hidden in month-end pile-ups. A complete audit trail captured in real time supports regulatory compliance effortlessly, turning what was once a painful audit process into a straightforward demonstration of financial controls.

Blockchain Creates Immutable Records Within Salesforce

Immutable transaction records on blockchain networks eliminate the data silos that plague traditional reconciliation. Every payment settles with a permanent, transparent record that your team can verify instantly-no more chasing confirmations across email or banking portals. Web3 Enabler brings this capability directly into Salesforce, so your finance team stays in one workflow instead of toggling between disconnected systems. On-chain data flows seamlessly into your reconciliation process, reducing manual intervention and the errors that come with it. This integration matters because it keeps your team focused on analysis and decision-making rather than data entry and verification tasks.

How Blockchain Payments Eliminate Reconciliation Friction

Immutable Records Replace Manual Verification

Blockchain transactions create a permanent, cryptographically verified record that eliminates the guesswork finance teams face with traditional payment systems. When a payment settles on-chain, it becomes immutable and instantly verifiable-no more waiting for bank confirmations, chasing wire transfer receipts, or reconciling conflicting records across email threads and accounting software. With blockchain-backed payments flowing through Salesforce, reconciliation happens automatically. Your cash position updates in real time, discrepancies surface instantly, and audit trails are built into every transaction by design.

Real-Time Settlement Within Your Workflow

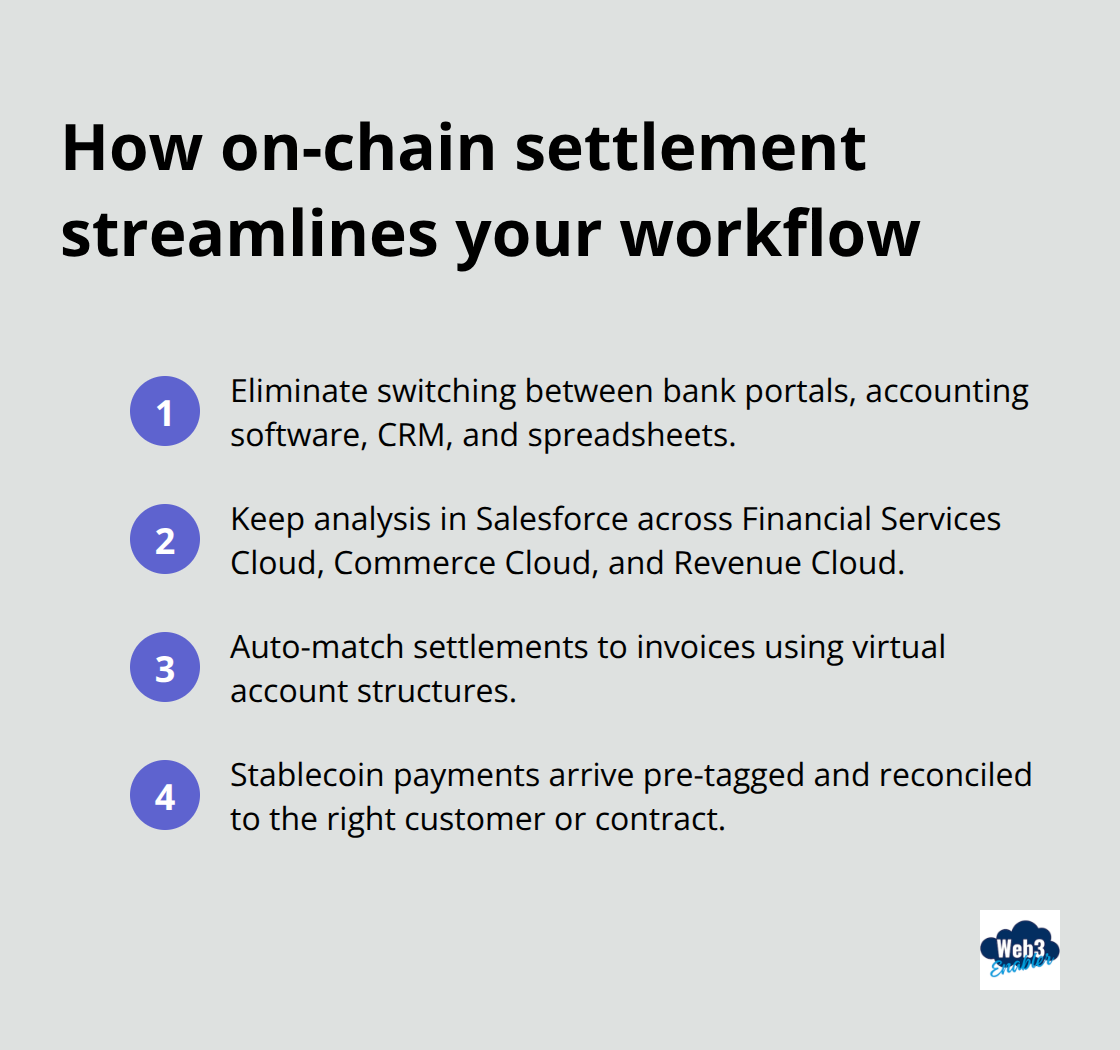

The real power emerges when on-chain data flows seamlessly into your existing Salesforce workflows without requiring manual data entry or system switching. Traditional payment reconciliation forces finance teams to toggle between their bank portal, accounting software, CRM, and spreadsheets-each handoff introduces delays and error opportunities. Blockchain payments integrated directly into Financial Services Cloud, Commerce Cloud, and Revenue Cloud keep your team focused on analysis and decision-making rather than data verification. On-chain settlement records match automatically against your Salesforce invoices using virtual account structures that link each payment to a specific customer or contract (eliminating the need for manual matching).

When a stablecoin payment arrives on-chain, it’s already tagged and reconciled within Salesforce before your team even sees it.

Native Integration Eliminates Data Silos

This native integration removes data silos that plague traditional setups and reduces manual intervention dramatically. Your compliance team gains complete transparency into transaction flows, settlement status, and fund movement-all within the system they already use daily. Web3 Enabler brings blockchain payments directly into Salesforce as a certified ISV Partner, creating a unified environment where finance, compliance, and operations teams collaborate seamlessly. The platform enables your organization to accept and send stablecoin payments while gaining real-time visibility into on-chain transactions for faster reconciliation and enhanced liquidity management. An auditable record satisfies regulatory requirements without extra effort, transforming what was once a painful compliance process into straightforward verification of financial controls.

What Finance Teams Actually Gain from Real-Time Reconciliation

Compress Month-End Close and Free Your Team

Finance teams operating with blockchain-backed reconciliation inside Salesforce compress month-end close cycles dramatically. When payments settle on-chain and match automatically to invoices within Salesforce, your team stops hunting for missing transactions days after they arrive.

A company processing 100 invoices weekly spends 1-2 hours manually reconciling bank deposits; blockchain automation eliminates that work entirely. The reconciliation happens as transactions settle, not in a frantic scramble on the 28th of the month. Organizations moving to automated reconciliation report month-end close cycles compressed from five days to two or three, with zero manual matching errors.

This shift matters operationally because it frees your finance staff to focus on analysis, forecasting, and decision-making rather than mechanical data entry and verification. That speed translates directly into faster financial reporting, earlier visibility into actual cash positions, and the ability to make cash flow decisions based on real numbers instead of incomplete data.

Detect Fraud Faster with Immutable Records

Real-time reconciliation strengthens your ability to detect and prevent payment fraud because anomalies surface immediately within Salesforce rather than hiding in month-end piles of unmatched transactions. On-chain transaction records are immutable and instantly verifiable, so suspicious patterns emerge the moment they occur. Your compliance team gains complete transparency into settlement flows and fund movement without requiring separate reporting systems or manual audit preparation.

Eliminate Costly Correction Cycles

Manual reconciliation introduces costly errors that finance teams must investigate and correct, often discovering problems only during audit preparation. A single mismatched payment can trigger hours of investigation across email threads, bank portals, and accounting software. Automated reconciliation eliminates these correction cycles entirely because on-chain records are permanent and instantly verifiable within Salesforce.

Your compliance team maintains full audit trails automatically as transactions settle on-chain. This native integration means your compliance requirements are satisfied through the normal payment process, not through extra work after the fact. Regulators see complete, transparent records of every transaction with timestamps, amounts, and settlement confirmation embedded in your Salesforce audit trail. That auditability eliminates the scrambling that typically happens when auditors request payment documentation or question settlement timing.

Final Thoughts

Real-time audit trails transform how finance teams operate. When payments settle on-chain and reconcile automatically within Salesforce, your organization stops wasting hours on manual matching and month-end scrambles. The immutable records that blockchain creates eliminate guesswork, reduce fraud risk, and give your compliance team the transparent documentation auditors expect-all while your finance staff shifts from mechanical data entry to strategic analysis that moves your business forward.

Salesforce payments reconciliation powered by blockchain delivers immediate operational value. Your cash position updates as transactions settle, not weeks later. Discrepancies surface instantly instead of hiding until close cycles. Settlement records match automatically to invoices without manual intervention. These represent fundamental changes to how your finance function operates, not incremental improvements.

Organizations ready to modernize their reconciliation process should evaluate blockchain-backed payment solutions that integrate natively into their existing Salesforce environment. Web3 Enabler brings this capability directly to Financial Services Cloud, Commerce Cloud, and Revenue Cloud as a certified Salesforce ISV Partner, enabling your team to accept and send stablecoin payments while gaining real-time visibility into on-chain transactions.