Global payments are broken. Banks charge outrageous fees, transfers crawl along for days, and compliance paperwork drowns businesses in red tape.

We at Web3 Enabler see blockchain flipping this script entirely. Payment optimization through distributed ledgers cuts costs by up to 80% while settling transactions in minutes, not days.

The revolution isn’t coming – it’s already here, transforming how money moves across borders.

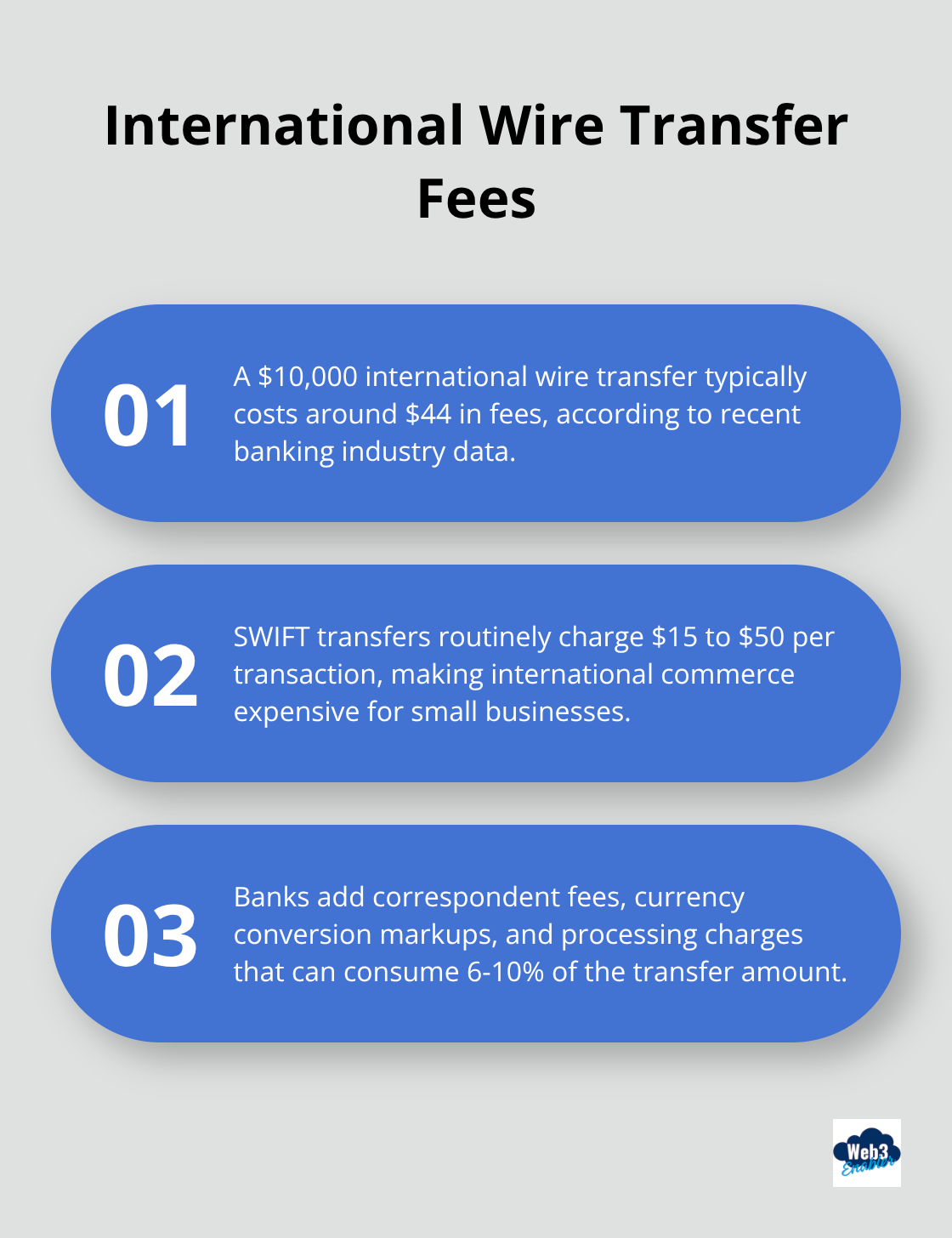

Why Traditional Payments Cost So Much

Traditional cross-border payments hit businesses with a brutal one-two punch of excessive fees and glacial processing times. SWIFT transfers routinely charge $15 to $50 per transaction, while banks layer on correspondent fees, currency conversion markups, and processing charges that devour 6-10% of your transfer amount. A $10,000 international wire costs around $44 in fees for international transfers (according to recent banking industry data). Small businesses get hammered the hardest – those $25 wire fees represent a massive percentage hit on smaller transactions, making international commerce prohibitively expensive for companies that want to grow.

Processing Speed That Kills Cash Flow

Settlement delays strangle business operations with 3-5 day processing windows that trap payments in banking limbo. Traditional systems shut down on weekends and holidays, creating payment dead zones that stretch a Tuesday wire transfer into the following week. These delays wreck cash flow management and force businesses to maintain larger working capital reserves just to cover payment gaps. UBS and other major banks scramble to solve this with blockchain pilots because they know the current system breaks down under modern business demands.

Compliance Chaos That Drowns Operations

Regulatory requirements create a paperwork nightmare that bogs down every international transfer. KYC documentation, AML checks, and cross-border reports turn simple payments into multi-step bureaucratic marathons. Each correspondent bank adds its own compliance layer, creating approval bottlenecks that freeze legitimate business payments for days or weeks. The regulatory maze gets worse when you deal with multiple jurisdictions – what works in Europe might trigger red flags in Asia (leaving businesses to guess which compliance hoops they need to jump through next).

Blockchain technology flips this entire broken system on its head, offering businesses a faster, cheaper, and more transparent alternative.

How Blockchain Fixes Payment Speed and Costs

Blockchain payments settle in seconds rather than days because they operate on networks that never sleep. Traditional banks process transfers during business hours only, which creates artificial delays that blockchain networks eliminate entirely. Swiss banks UBS, PostFinance, and Sygnum completed the first legally binding interbank payment via blockchain in September 2025, which proves that major financial institutions recognize blockchain’s superior speed capabilities. This milestone demonstrates real-world transaction volumes that dwarf traditional pilot programs.

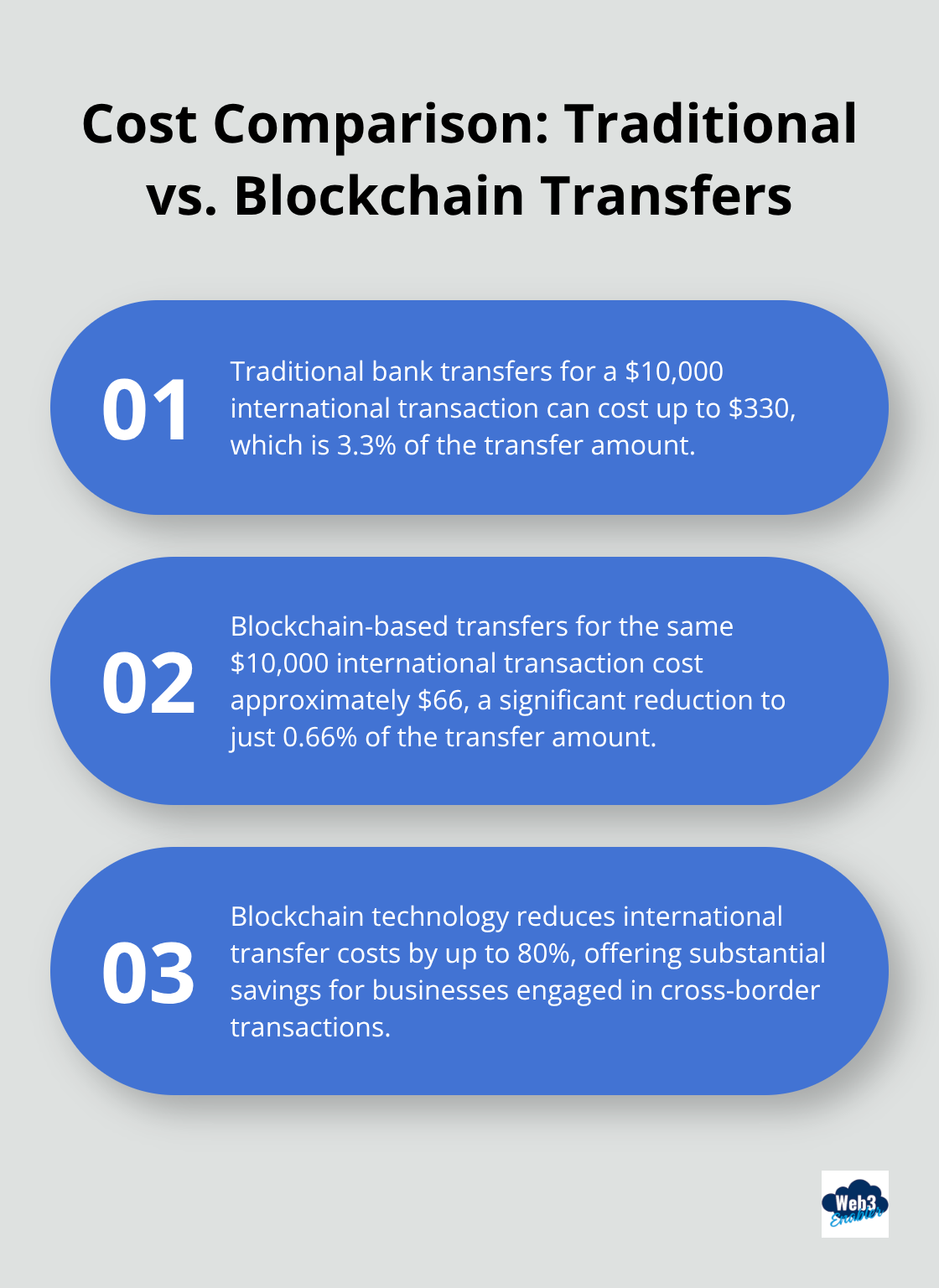

Transaction Costs Drop to Nearly Zero

Blockchain slashes payment fees from the typical $15-$50 SWIFT charges down to as little as $0.0002 per transaction. Traditional cross-border transfers that eat up 6-10% of your payment amount become flat-rate transactions that cost pennies regardless of transfer size. A $10,000 international transfer that costs $330 through traditional banks drops to approximately $66 on blockchain networks. Smart contracts automate payment execution when conditions are met, which eliminates intermediary fees and manual costs that banks layer onto every transaction.

Compliance Becomes Automatic and Transparent

Every blockchain transaction creates an immutable audit trail with timestamps that satisfy regulatory requirements without additional paperwork. KYC and AML checks integrate directly into blockchain payment systems, which streamlines compliance processes that traditionally require separate documentation at each correspondent bank. Transaction records remain permanently accessible for dispute resolution and regulatory audits (eliminating the reconciliation headaches that plague traditional payment systems). The transparent nature of blockchain ledgers provides real-time transaction tracking that compliance teams can monitor without requests for reports from multiple partners.

Real-World Implementation Proves the Technology Works

Major financial institutions have moved beyond pilot programs to actual implementation. Banks now process billions in blockchain payments annually, which validates the technology’s readiness for enterprise adoption. The stablecoin market (like USDC and USDT) continues growing rapidly, underscoring blockchain’s relevance in mainstream finance. These aren’t theoretical benefits anymore – they’re measurable improvements that businesses achieve today.

The technology works, the costs drop dramatically, and the speed improvements are undeniable. But how do businesses actually put blockchain payments to work in their operations?

Where Blockchain Payments Work Best

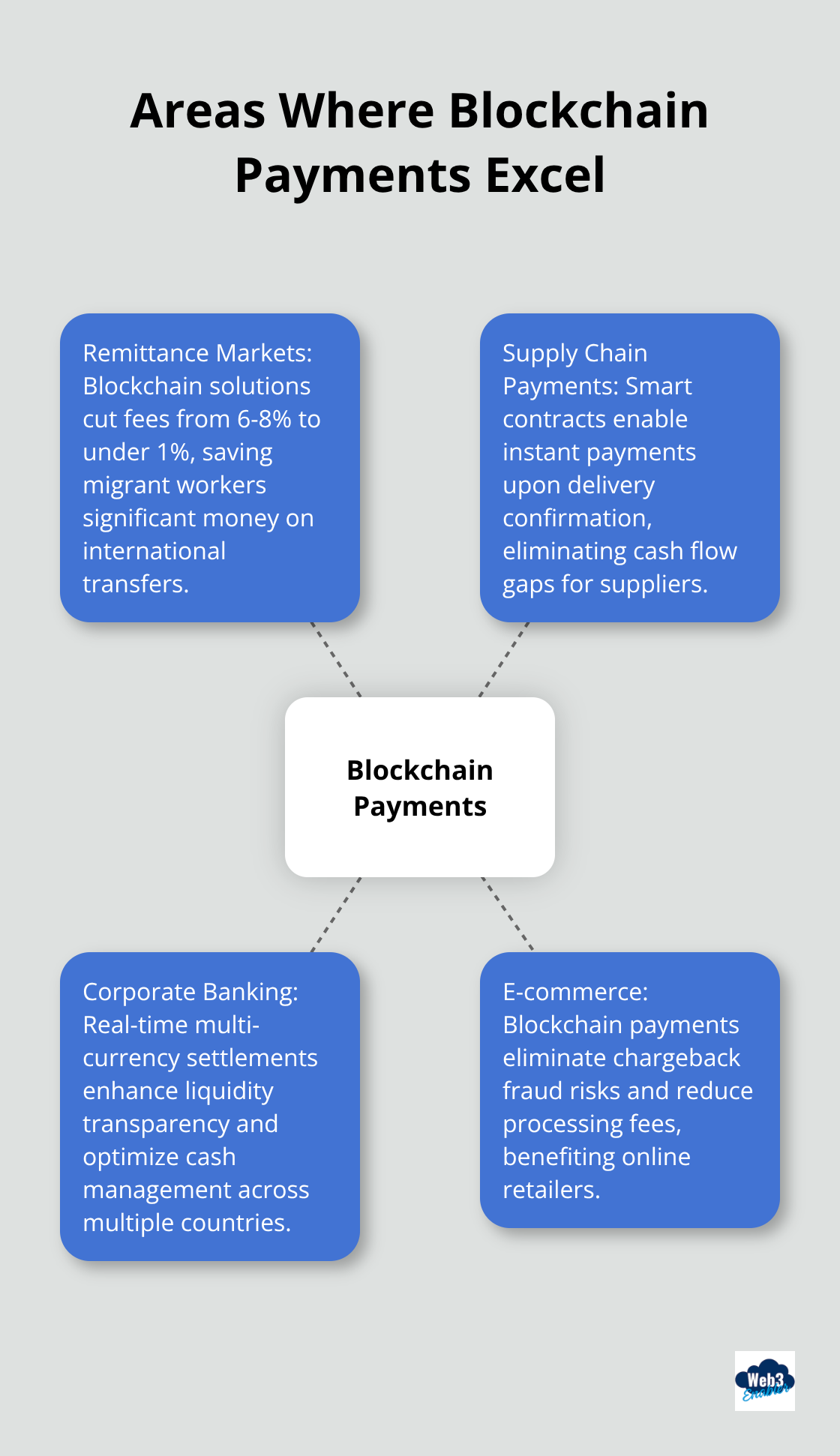

Remittance markets showcase blockchain’s power most dramatically. Migrant workers who send money home through traditional services lose 6-8% to fees, but blockchain solutions cut this to under 1%. Ripple’s On-Demand Liquidity processed over $1.3 trillion in quarterly volume in 2025, which proves that volume follows efficiency. Workers in the US who send $300 monthly to family in the Philippines save $200 annually when they switch to blockchain remittances. These aren’t marginal improvements – they’re life-changing cost reductions that put real money back in people’s pockets.

Supply Chain Payments Speed Up Business Operations

Trade finance transforms when payments settle instantly instead of waiting weeks for letters of credit. Suppliers receive payment immediately upon delivery confirmation through smart contracts, which eliminates the cash flow gaps that strangle small suppliers. A textile manufacturer in Bangladesh can ship goods to Germany and receive payment within minutes of customs clearance (rather than waiting 30-45 days for traditional trade finance processing). This speed advantage lets suppliers offer better prices because they don’t need to factor in lengthy payment delays. Container shipping companies now use blockchain to automate payments between ports, trucking companies, and customs authorities, which cuts administrative costs by 40% while eliminating payment disputes.

Banks Adopt Blockchain for Corporate Clients

UBS launched blockchain-based cross-border payments through UBS Digital Cash, which facilitates real-time multi-currency settlements on Ethereum for corporate clients. The bank’s private blockchain system enhances liquidity transparency for institutional clients who previously waited days for settlement confirmation. Corporate treasurers can now move millions between subsidiaries instantly (optimizing cash management across multiple countries without the delays that traditional correspondent banking creates). Swiss banks completed legally binding interbank payments on public blockchains, which demonstrates that regulatory approval follows proven technology performance.

E-commerce Platforms Eliminate Chargeback Fraud

Online retailers face $31 billion in chargeback losses annually, but blockchain payments eliminate this risk entirely. Cryptocurrency transactions can’t be reversed once confirmed, which protects merchants from fraudulent disputes that plague credit card processing. E-commerce businesses that accept stablecoin payments avoid the 2.9% credit card processing fees while gaining protection from chargeback abuse. International customers can pay instantly without currency conversion delays or foreign transaction fees that traditional payment processors add.

Final Thoughts

Blockchain transforms global payments and cuts transaction costs up to 80% while it settles transfers in minutes instead of days. Payment optimization through distributed ledgers eliminates the fee layers and delays that strangle traditional cross-border transactions. Businesses save thousands annually while they gain 24/7 processing capabilities that never shut down for weekends or holidays.

Implementation requires careful regulatory navigation and system integration planning. Companies must assess their existing infrastructure compatibility and work with experienced partners who understand both blockchain technology and compliance requirements. The regulatory landscape varies across jurisdictions (making expert guidance essential for successful adoption).

The future belongs to businesses that embrace blockchain payments now. Major banks have moved beyond pilots to full implementation and process billions in blockchain transactions annually. We at Web3 Enabler help businesses bridge this gap with Salesforce-native blockchain solutions that integrate seamlessly into existing corporate infrastructure.