Cross-border payments have long been a headache for businesses worldwide. High fees, slow processing, and lack of transparency plague traditional systems.

At Web3 Enabler, we’ve seen how blockchain technology is transforming global payments. This revolutionary tech is slashing costs, speeding up transactions, and bringing unprecedented clarity to international money transfers.

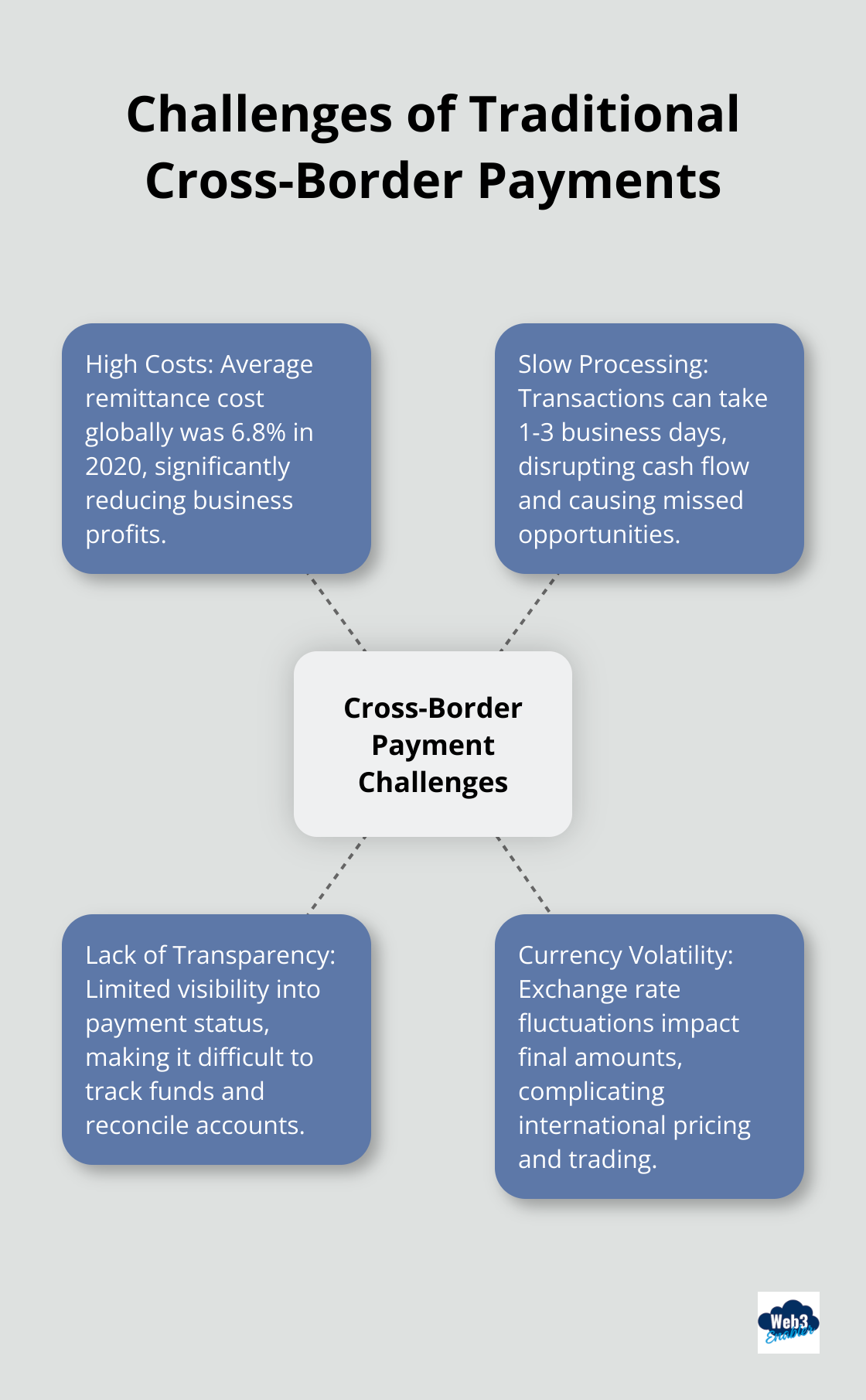

Why Cross-Border Payments Remain a Nightmare for Businesses

The Hidden Costs of International Transfers

Transaction fees for cross-border payments can be astronomical. A study by McKinsey found that the average cost of sending remittances globally was 6.8% in 2020. For businesses, these fees can significantly reduce profits. Worse still, many of these costs remain hidden, making it difficult for companies to budget accurately for international transactions.

Snail-Paced Processing in a Fast-Paced World

In an era where information travels at the speed of light, it’s baffling that cross-border payments can take 1–3 business days to process. This delay can disrupt cash flow and cause missed opportunities for businesses operating in a global marketplace.

The Black Box of International Transactions

Lack of transparency is another major issue that plagues cross-border payments. Once a payment starts, businesses often have no visibility into where their money is or when it will arrive. This opacity makes it challenging to track funds and reconcile accounts, leading to increased administrative overhead and potential errors.

Currency Volatility: A Constant Threat

Currency exchange rate fluctuations add another layer of complexity to cross-border payments. Foreign trading significantly increases future stock price volatility. This volatility can significantly impact the final amount received, making it difficult for businesses to price their products or services accurately in international markets.

These challenges affect businesses of all sizes, from startups to multinational corporations. The inefficiencies in cross-border payments not only cost companies money but also hinder their ability to expand globally and compete effectively in international markets.

As we move forward, it’s clear that the current system of cross-border payments is ripe for disruption. Blockchain technology offers a promising solution to many of these challenges, and in the next section, we’ll explore how this innovative technology is revolutionizing the way businesses handle international transactions.

How Blockchain Revolutionizes Cross-Border Payments

Blockchain technology transforms cross-border payments, addressing key pain points businesses face. This innovative technology revolutionizes international transactions in several ways:

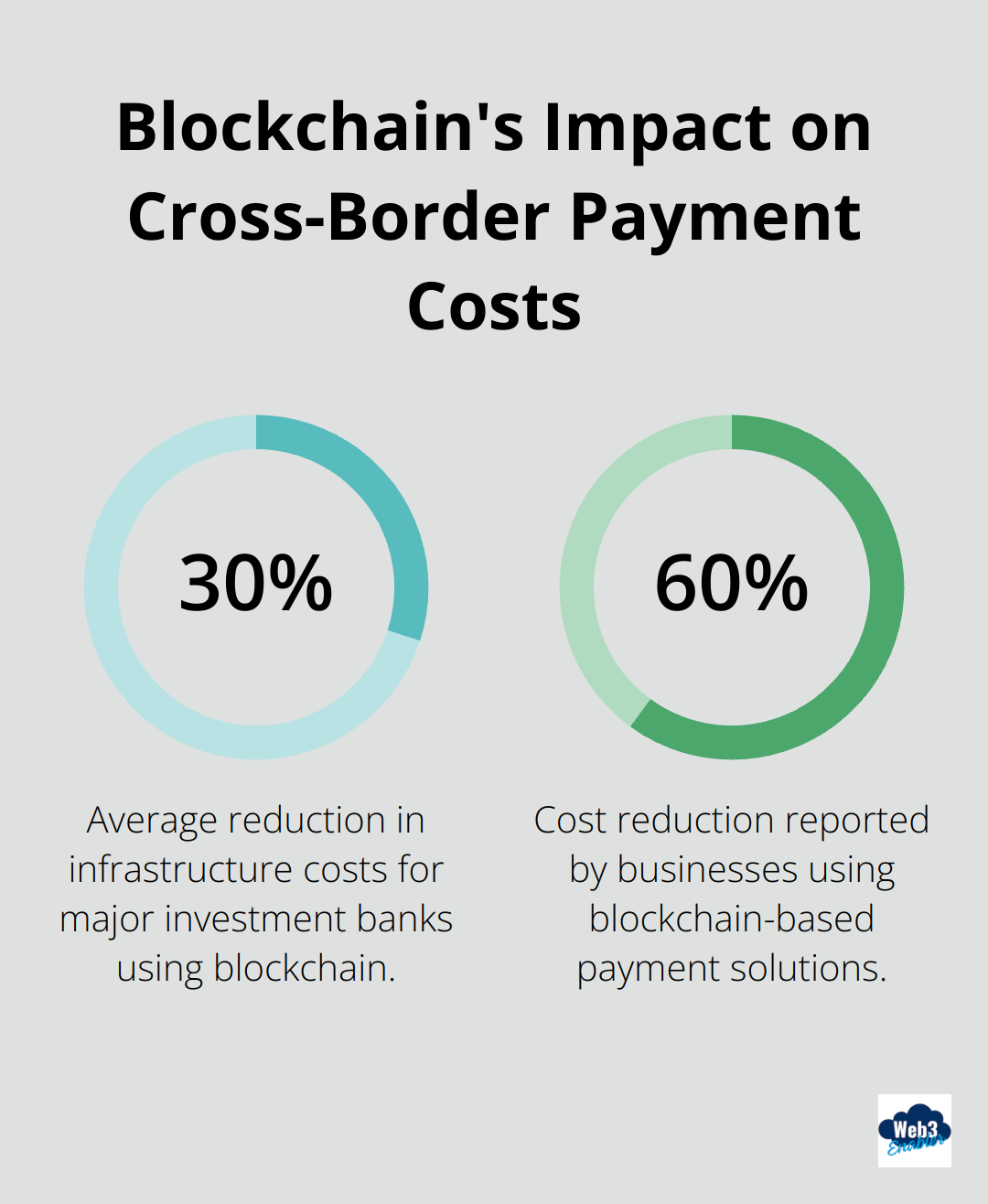

Dramatic Reduction in Transaction Costs

Blockchain technology in finance aims to increase transaction speed, improve security, and reduce costs. The trending technology enables more efficient processes by eliminating intermediaries.

A study by Accenture revealed that blockchain could reduce infrastructure costs for eight of the world’s ten largest investment banks by an average of 30% (translating to $8 billion to $12 billion in annual savings). For businesses, this translates to lower fees for international transfers.

Companies using blockchain-based payment solutions report cost reductions of up to 60%. This significant decrease allows businesses to allocate more resources to growth and innovation.

Near-Instantaneous Settlement Times

Blockchain enables lightning-fast settlement times, a stark contrast to the days-long wait associated with traditional banking systems. XRP transactions are completed in seconds, significantly faster than traditional banking methods.

This speed revolutionizes business operations. It improves cash flow management, reduces the risk of exchange rate fluctuations during the settlement period, and allows for more agile operations in international markets.

Unprecedented Transparency and Security

Blockchain’s inherent transparency solves the ‘black box’ problem of traditional cross-border payments. Every transaction is recorded on a distributed ledger, visible to all parties involved.

This transparency extends beyond payment tracking. It simplifies auditing and compliance processes. Companies using blockchain for cross-border payments report a 50% reduction in time spent on regulatory compliance tasks.

Furthermore, the immutability of blockchain records provides an unparalleled level of security. Once a transaction is recorded, it cannot be altered, which significantly reduces the risk of fraud.

Smart Contracts for Automated Currency Conversion

Blockchain and AI can transform cross-border payments with efficient, secure, and cost-effective solutions. They enable real-time transfers of digital assets, addressing the challenge of exchange rate volatility.

IBM’s Blockchain World Wire uses smart contracts to facilitate simultaneous clearing and settlement of cross-border payments. This automation speeds up the process and reduces the risk of human error in currency conversions.

Blockchain proves itself as a practical solution to long-standing problems in cross-border payments. It addresses issues of cost, speed, transparency, and currency conversion, paving the way for more efficient and accessible global commerce. As we explore real-world examples in the next section, you’ll see how businesses are already leveraging this technology to transform their international payment processes.

Real-World Blockchain Solutions Transform Global Payments

Blockchain technology has moved beyond theory and now reshapes how businesses handle cross-border payments. Several groundbreaking implementations are revolutionizing international transactions.

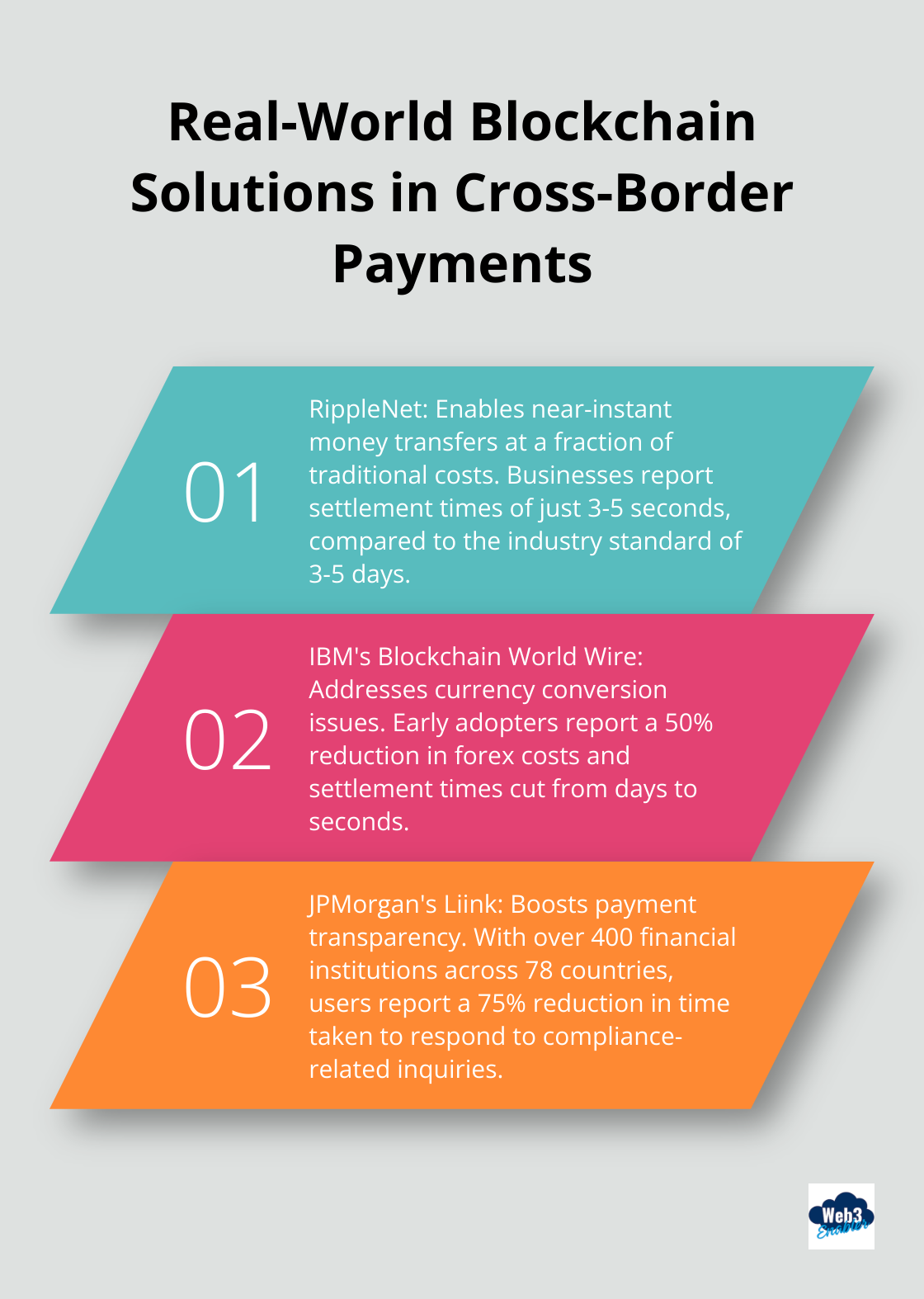

RippleNet: The Speed Champion of Global Transfers

RippleNet stands out as a game-changer in cross-border payments. This blockchain-based network connects financial institutions worldwide, enabling near-instant money transfers at a fraction of traditional costs.

Ripple plans to capture up to 14% of SWIFT’s current cross-border volume. Their partnership with MoneyGram reduced operating costs for cross-border payments by 10%. Businesses using RippleNet report settlement times of just 3-5 seconds (compared to the industry standard of 3-5 days).

Circle Payments Network: The USDC Based Competitor

Circle has recently created the Circle Payments Network as competitive payment network. Similar to RippleNet, it focuses on global settlement options. Newly released in 2025, we don’t have published numbers yet, but Circle’s network potentially allows them to catch up with Ripple quickly.

IBM’s Blockchain World Wire: Simplifying Currency Conversion

IBM’s Blockchain World Wire addresses the complex issue of currency conversion in cross-border payments. This platform uses digital assets as bridge currencies, eliminating intermediaries in the forex process.

Early adopters report a 50% reduction in forex costs and settlement times cut from days to seconds. For businesses dealing with multiple currencies, this translates to significant savings and improved cash flow management.

JPMorgan’s Liink: Boosting Payment Transparency

JPMorgan’s blockchain-based Interbank Information Network (rebranded as Liink) tackles the lack of transparency in cross-border transactions. This network allows member banks to exchange information in real-time, reducing delays caused by compliance checks and errors.

Liink has onboarded over 400 financial institutions across 78 countries. Users report a 75% reduction in the time taken to respond to compliance-related inquiries. For businesses, this means fewer payment delays and a clearer view of their international transactions.

Web3 Enabler: Stablecoin Solutions for Direct Payments

While the aforementioned solutions offer significant improvements, they remain tied to traditional banking systems. Web3 Enabler’s stablecoin payment solutions provide a more direct approach for businesses seeking even greater efficiency and cost savings.

Web3 Enabler leverages blockchain technology and stablecoins to enable businesses to send global payments faster and cheaper. This approach operates without the constraints of traditional banking hours or intermediaries, offering a streamlined solution for cross-border transactions.

These real-world examples demonstrate that blockchain is actively transforming cross-border payments today. Businesses that adopt these solutions early position themselves for a significant competitive advantage in the global marketplace.

Final Thoughts

Blockchain technology revolutionizes global payments, addressing long-standing challenges in cross-border transactions. It reduces costs, enables instant settlements, and provides unparalleled transparency, reshaping how businesses operate internationally. The future of blockchain in international transactions looks promising, with greater efficiencies and cost savings expected as more institutions adopt this technology.

Businesses should act now to adopt blockchain for payments. We recommend educating your team about blockchain technology and researching solutions that align with your specific needs. Consider partnering with a blockchain integration expert to incorporate this technology into your existing systems seamlessly.

Web3 Enabler offers blockchain integration solutions for businesses using Salesforce (the only native blockchain solution on the Salesforce AppExchange). Our company empowers organizations to leverage blockchain for secure, efficient, and cost-effective payment processing, compliance, and automation. Embracing blockchain for cross-border payments positions businesses at the forefront of financial innovation, streamlining operations and opening new opportunities for global expansion.