At Web3 Enabler, we’ve watched stablecoins move from fringe experiment to practical payment tool. The question isn’t whether to accept digital currency anymore-it’s how to do it without turning your operations upside down.

Why Your Business Needs Crypto Payments Right Now

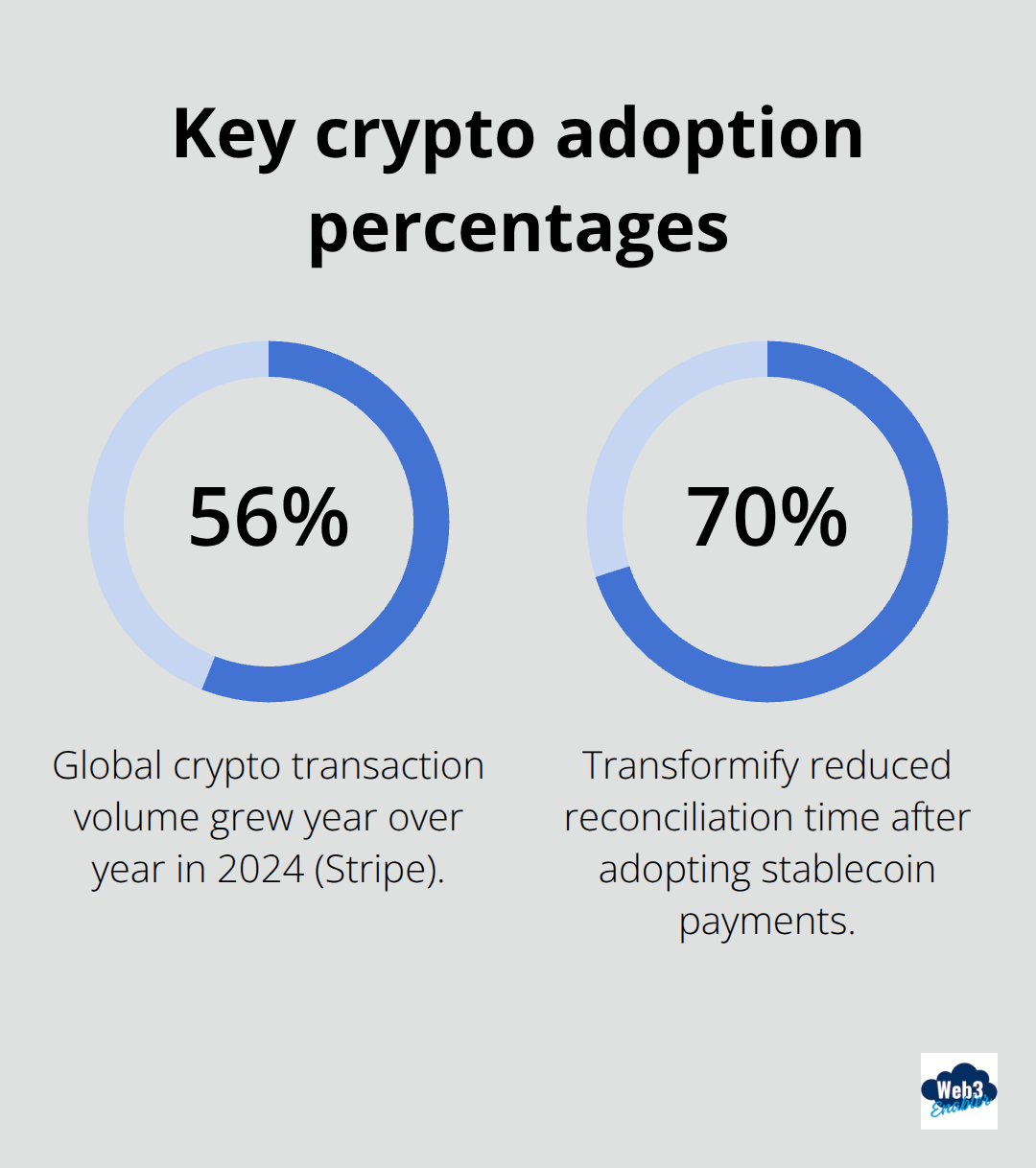

The numbers tell a story that’s hard to ignore. Global crypto transaction volume hit $10.6 trillion in 2024, up 56% year over year, according to Stripe. More than 15,000 businesses worldwide now accept crypto, and stablecoin payments specifically surpassed $5.8 trillion in transaction volume that same year. These aren’t niche players experimenting at the margins anymore. Your competitors are watching this happen, and some are already moving. The infrastructure has matured fast enough that accepting digital currency no longer requires a PhD in blockchain or a willingness to gamble on price swings.

Stablecoin circulation reached $307 billion by November 2025, growing over 50% annually, which means the rails strengthen, accelerate, and stabilize every quarter. What used to feel like a risky experiment now looks like a practical decision about how you want to compete.

Speed Beats Everything Else

Traditional banking settlements take days. Crypto settlements take minutes. If you do business internationally or handle high-volume payments, that difference compounds into real money. Stablecoin transfers cost just a few cents per transaction regardless of where your customer sits on the globe, according to Stripe data. Your cash flow improves because you stop waiting for correspondent banks to shuffle money between accounts. Your accounting team stops pulling their hair out over currency conversion delays. For businesses with tight working capital or frequent cross-border transactions, this isn’t a nice-to-have feature. It’s a competitive advantage that affects your bottom line every single day.

Volatility Is a Problem You Can Actually Solve

Most business owners hear crypto and immediately think of wild price swings that make their CFO nervous. Stablecoins eliminate that concern entirely. They maintain a stable value pegged to fiat currency, which means you can price goods, settle invoices, and manage accounting without the headache of tracking crypto price movements. You’re not betting on Bitcoin going to the moon. You use digital currency as a payment method, nothing more. This distinction matters because it separates practical payment infrastructure from speculation. Your customers who want to pay in crypto get their preferred payment method. You get faster settlement and lower fees. Everyone wins without anyone taking on volatility risk.

The Real Competitive Edge

Accepting stablecoins signals something important to your market: you’re forward-thinking and you understand where payments are heading. Crypto users tend to be high-value customers-developers, creators, and international buyers who actively seek out businesses that accept their preferred payment methods. You’re not just adding a payment option. You’re tapping into a customer segment that traditional payment networks haven’t fully served. The infrastructure exists now to make this happen safely and simply, which means the businesses that move first gain visibility with customers who care about this capability.

How to Accept Stablecoin Payments Without Overcomplicating Your Business

Accepting stablecoins means choosing infrastructure that fits your existing business, not rebuilding everything from scratch. The right approach starts with a payment processor that handles the blockchain side while you keep operating normally. Stripe processes stablecoin payments and converts them to fiat currency at settlement, so your accounting team sees familiar bank deposits instead of crypto confusion. BitPay offers similar functionality with broader cryptocurrency support if you want options beyond major stablecoins. The key difference between these providers and others is that they manage compliance, handle wallet security, and deal with regulatory requirements so you don’t have to.

You pick USDC or EURC as your primary stablecoins-these dominate enterprise adoption because they’re widely trusted and integrated across payment networks-and your processor handles everything else. Integration takes days, not months. Most systems connect via API or pre-built plugins, meaning your engineering team can implement this without overhauling your entire stack. If you run Salesforce, Web3 Enabler provides native integration that keeps stablecoin payments and customer data in one system, eliminating manual reconciliation and data silos that plague most payment implementations.

Why Stablecoins Outperform Every Alternative for Business

Stablecoins solve the problem that makes most business owners reject crypto entirely: volatility. You price an invoice in USDC, the customer pays in USDC, and the value stays constant throughout the transaction. No currency conversion delays, no price swings between when you invoice and when you settle. Your accounting software recognizes the transaction instantly because the value is stable and predictable.

Compare this to accepting Bitcoin or Ethereum directly-your CFO would rightfully refuse because prices move 5–10% in a single day. Stablecoins also settle faster than traditional wires. For a business sending payments to vendors across multiple countries, this compounds into substantial savings. A single international wire might cost $25–50 and take three business days. The same payment in USDC costs pennies and settles in minutes. Do this fifty times a month and you’re saving thousands while improving cash flow.

Compliance becomes simpler too because stablecoins are explicitly designed for regulated financial use. Circle and Paxos, which issue USDC and USDP respectively, operate under strict compliance frameworks and work with regulators. You’re not dealing with unregulated assets-you’re using digital currency that major financial institutions trust.

Integrate Stablecoins Into Your Existing Workflow

Payment processors handle the compliance side, but you still need to think about how stablecoin payments fit into your actual operations. The practical approach is starting small: enable stablecoin payments for a specific customer segment or use case first. If you sell software internationally, offer stablecoin payment as an option for annual subscriptions. If you handle B2B payments, test it with one vendor who wants faster settlement. This gives you real operational experience without betting your entire revenue stream on new infrastructure.

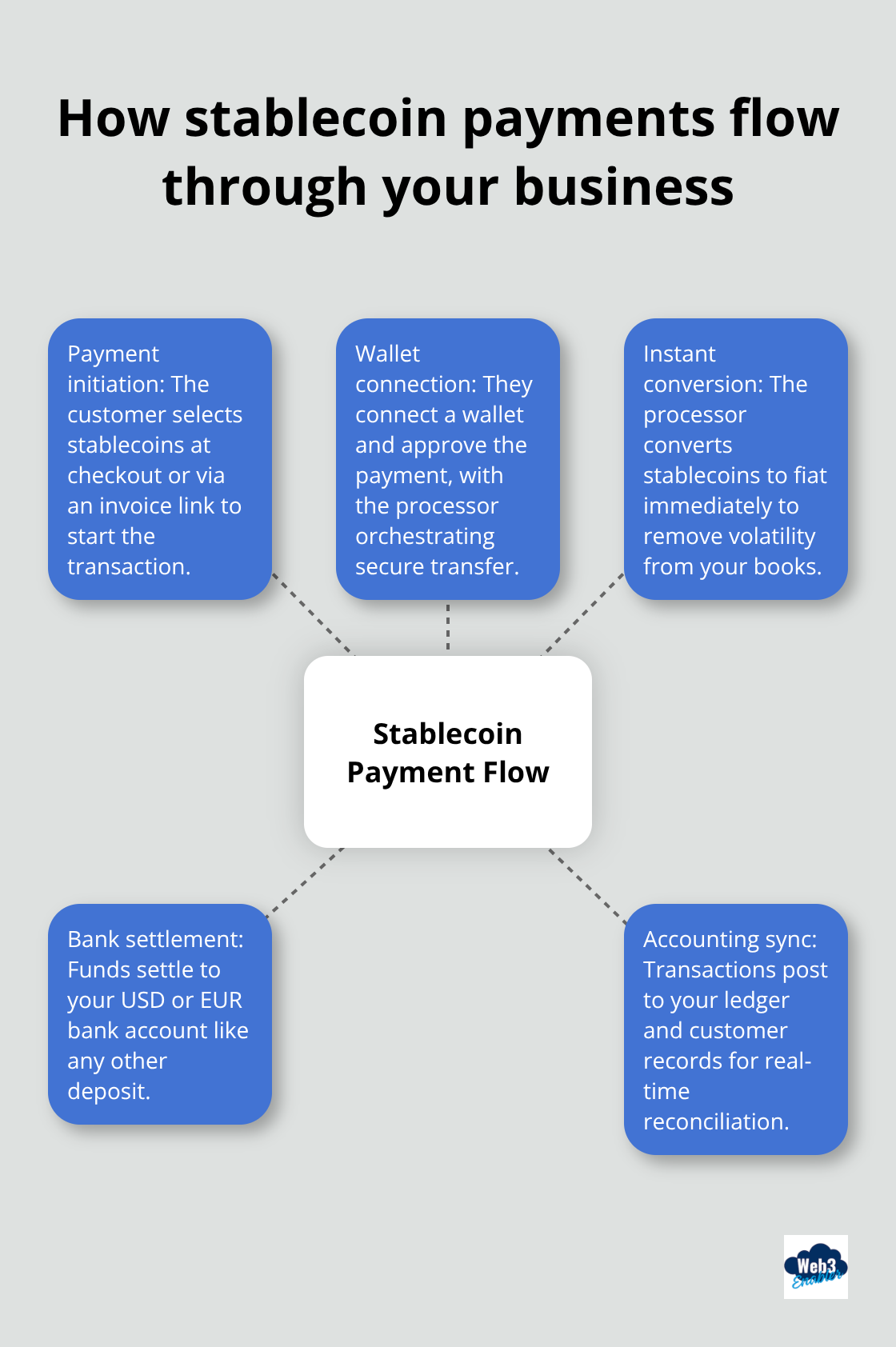

When a customer chooses to pay in stablecoins, the processor generates a payment link or QR code. They connect their wallet, approve the transaction, and your processor converts the stablecoin to fiat immediately. Your bank account receives USD or EUR as normal. Your accounting team records the transaction like any other payment. There’s no manual intervention, no special procedures, no crypto knowledge required from your staff.

The processor handles all wallet management, private key security, and blockchain verification. Your responsibility is limited to monitoring transaction history and ensuring payments match invoices-work your team already does. If you use Salesforce, integration tightens this further. Payments appear in your customer records automatically, reconciliation happens in real time, and your financial dashboards stay current without manual data entry. This matters because most payment implementations fail due to operational friction, not technology problems. When stablecoin payments integrate seamlessly into existing workflows, adoption actually happens.

What Happens Next in Your Payment Stack

The real test comes when you move beyond the initial setup and start handling stablecoin payments at scale. Your team needs to understand how these transactions flow through your systems, what compliance documentation you need to maintain, and how to handle edge cases when they arise.

Companies Actually Using Stablecoins to Move Money Faster

Real Settlement Speed Changes Everything

Transformify reduced their financial reconciliation time by 70% after switching to stablecoin payments for international vendor settlements. They moved from three weeks of API integration work to processing payments in two days instead of the typical five-to-seven-day wire transfer cycle. This isn’t theoretical-it’s the difference between having cash available to reinvest in operations versus watching money sit in transit. Mastercard’s integration with the Paxos Global Dollar network now supports 3.5 million crypto-enabled cards, letting merchants settle transactions directly in USDC across Eastern Europe, the Middle East, and East Africa. That scale matters because it shows stablecoin infrastructure isn’t experimental anymore. When payment networks this large commit resources to crypto rails, it signals permanent infrastructure, not a temporary trend.

Major Payment Networks Are Building Stablecoin Infrastructure

Visa’s partnership with Bridge enables cardholders in Latin America to spend stablecoins for everyday purchases, and Visa Direct’s pilot lets financial institutions use pre-funded stablecoins to settle cross-border payments instantly. Fiserv launched FIUSD specifically for its banking and payments infrastructure, integrating with Circle and Paxos to speed domestic transfers and after-hours bank-to-bank settlements. These aren’t startups testing ideas in sandboxes. These are Fortune 500 payment networks building stablecoin functionality into their core products because demand exists and the economics work.

The Three Numbers That Matter Most

Settlement speed, cost, and cash flow determine whether stablecoin adoption makes financial sense. Klarna is testing KlarnaUSD with a public launch planned to reduce international payment costs for their user base. Stripe already lets merchants accept stablecoins with instant fiat conversion, meaning your accounting team sees familiar bank deposits while customers pay with digital currency.

Stablecoin transactions on networks like Tron and Solana settle in seconds, not days, which compounds into meaningful advantages when you manage recurring payments, vendor settlements, or subscription billing.

A business processing fifty international payments monthly saves thousands in wire fees alone-each stablecoin transfer costs pennies regardless of destination, compared to $25–50 per traditional wire. More important than the fee savings is the working capital improvement. Money that previously sat in transit for three-to-five days now settles immediately, giving you liquidity to meet payroll, purchase inventory, or invest in growth without external financing.

Why Companies Actually Implement This

The companies implementing stablecoin payments aren’t motivated by crypto enthusiasm. They implement this because faster, cheaper settlement directly improves their financial position. A vendor in Southeast Asia receives payment in minutes instead of waiting a week. A subscription business improves cash flow by days each month. A multinational corporation reduces the complexity of managing currency conversions across dozens of countries. These operational improvements compound across hundreds or thousands of transactions annually, turning stablecoin adoption from a nice-to-have feature into a legitimate competitive advantage.

Final Thoughts

The businesses winning right now recognize that stablecoins already are mainstream, and they build payment infrastructure around that reality. Accepting digital currency solves real operational problems your business faces today-faster settlement, lower fees, and borderless transactions that traditional banking simply cannot match. When you pay bills with crypto through stablecoin infrastructure, you eliminate the volatility concern that kills most crypto payment conversations before they start.

We at Web3 Enabler built our platform to connect blockchain technology directly to your Salesforce infrastructure, so you accept stablecoin payments, send global payments faster, and manage compliance without rebuilding your entire operation. Our integration makes payments appear in your customer records automatically, reconciliation happens in real time, and your team operates exactly as they do today. The infrastructure to pay bills with crypto safely and simply exists right now.

The only thing holding most businesses back is inertia. Move first, capture the customers who want this capability, and turn faster settlement into a genuine competitive advantage.