Cross-border finance remains one of the most expensive and time-consuming challenges for global businesses. Traditional payment systems burden companies with fees reaching 6-8% per transaction and settlement delays spanning 3-5 business days.

Cross-border finance remains one of the most expensive and time-consuming challenges for global businesses. Traditional payment systems burden companies with fees reaching 6-8% per transaction and settlement delays spanning 3-5 business days.

We at Web3 Enabler see blockchain technology transforming this landscape entirely. Smart contracts and distributed ledgers eliminate intermediaries while providing transparent, near-instant settlements at a fraction of traditional costs.

Why Traditional Payments Cost Businesses Millions

The Hidden Cost Structure of Legacy Banking

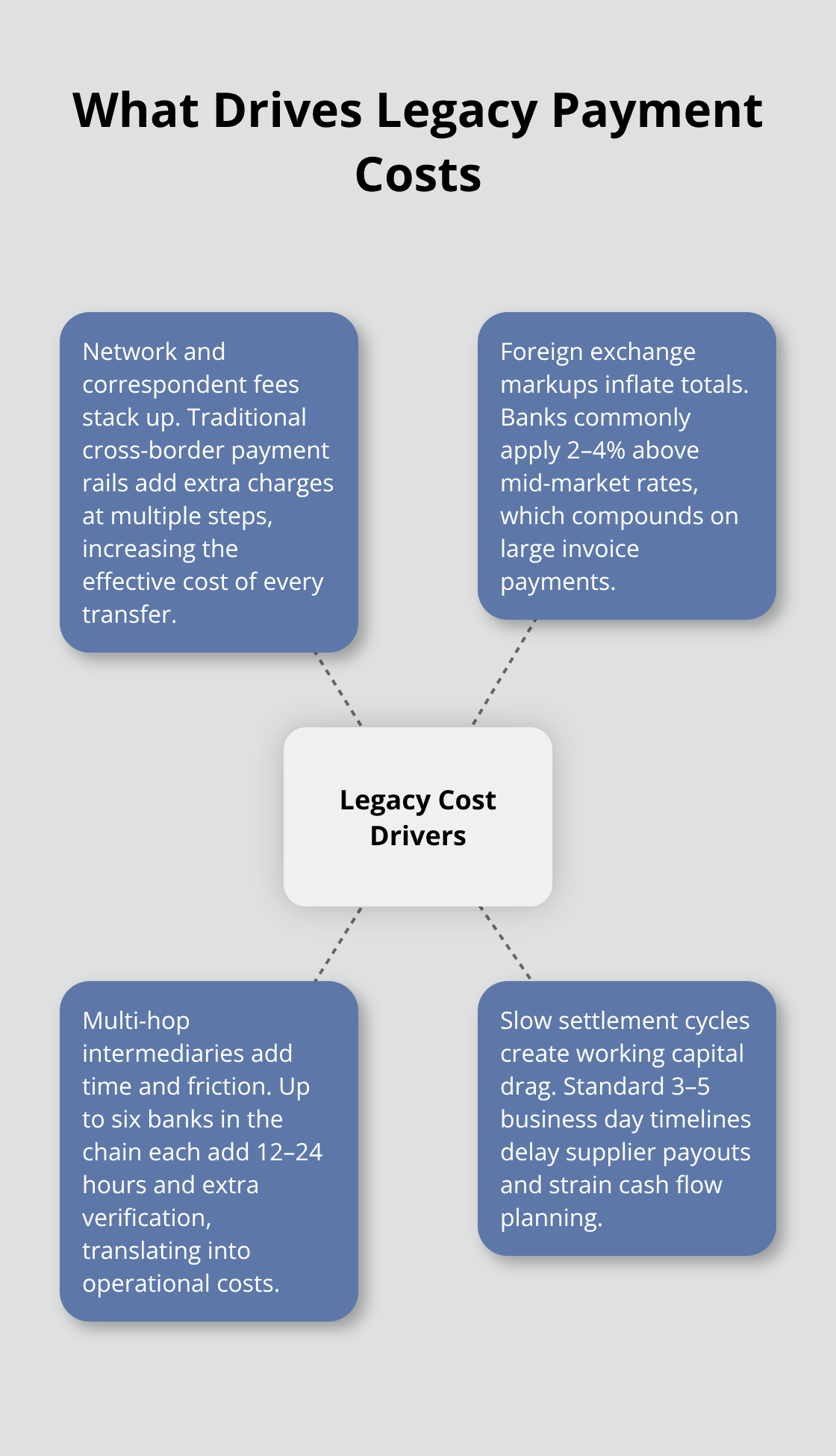

Cross-border payments through traditional banking networks impose a devastating financial burden that most finance teams underestimate. Traditional cross-border payments cost businesses between 4-6% in total fees while blockchain alternatives operate at just 0.5% for the same transactions. A $100,000 payment to suppliers in Southeast Asia costs your business up to $6,000 in total fees.

Major banks like JPMorgan Chase and Citigroup impose additional correspondent banking fees that range from $15-50 per transaction, while their foreign exchange spreads typically add another 2-4% markup above mid-market rates. These hidden costs accumulate rapidly across multiple transactions, creating substantial overhead that directly impacts your bottom line.

Settlement Delays That Paralyze Operations

Traditional cross-border payments require 3-5 business days for settlement, with complex multi-hop routing through correspondent banks that creates unpredictable delays. McKinsey research indicates that 40% of international B2B payments experience delays that exceed one week due to compliance checks and manual processing requirements.

Your finance teams waste countless hours as they track payment status across multiple banking systems, while suppliers demand faster settlement terms that legacy infrastructure cannot deliver. Swift network processing involves up to six intermediary banks for emerging market destinations (each adds 12-24 hours of processing time and additional verification requirements that slow down business operations).

Compliance Complexity That Drains Resources

International payment compliance demands separate documentation for each jurisdiction, with banks that require extensive KYC verification, sanctions screening, and regulatory reporting across multiple frameworks. Finance teams spend 40-60% of their cross-border payment processing time on compliance tasks rather than strategic activities.

The complexity multiplies when you deal with emerging markets where regulatory requirements change frequently and documentation standards vary significantly between institutions. Each transaction triggers multiple verification steps that consume valuable resources and delay critical business payments.

These systemic inefficiencies create the perfect storm for blockchain solutions that eliminate intermediaries and streamline the entire payment process.

How Blockchain Transforms Payment Speed and Cost

Blockchain technology eliminates the multi-day settlement cycles that paralyze traditional cross-border payments through direct peer-to-peer transactions that complete in under 30 seconds. Smart contracts execute automatically when conditions are met and remove the need for manual verification processes that typically add 2-3 business days to international transfers. Major financial institutions like JPMorgan are using blockchain to cut costs, speed up settlements, and unlock liquidity with solutions that operate continuously without weekend delays or bank holidays.

Real-Time Settlement Changes Everything

Traditional correspondent networks require multiple intermediaries that each add 12-24 hours of processing time, while blockchain transactions bypass these bottlenecks entirely through direct wallet-to-wallet transfers. Ethereum-based payment networks process international transactions in 12-15 seconds during normal network conditions, compared to the 3-5 business day standard for Swift wire transfers. Your finance teams gain immediate confirmation of payment completion instead of waiting days for settlement verification through multiple systems.

Transparent Fees Eliminate Hidden Costs

Blockchain networks publish transaction fees transparently on public ledgers, with typical costs that range from $2-15 per transaction regardless of transfer amount. This represents a 90% cost reduction compared to traditional fees that average $45 per wire transfer plus 2-4% foreign exchange markups. Stablecoin payments eliminate currency conversion spreads entirely, as USDC or USDT transfers maintain consistent value without the 3-6% exchange rate markups that banks impose on international transactions.

Immutable Records Streamline Compliance

Blockchain transactions create permanent audit trails that satisfy regulatory requirements across multiple jurisdictions without additional documentation. Smart contracts automatically enforce compliance rules and sanctions screening (reducing manual review time from hours to seconds) while maintaining complete transaction history. Financial institutions report 60% faster compliance processing when they use blockchain records compared to traditional payment documentation that requires manual verification across multiple systems.

These technical advantages create the foundation for practical implementation strategies that transform how global businesses manage their international payment operations.

How Do You Implement Blockchain Payments Without Disrupting Operations

Start With Treasury Integration

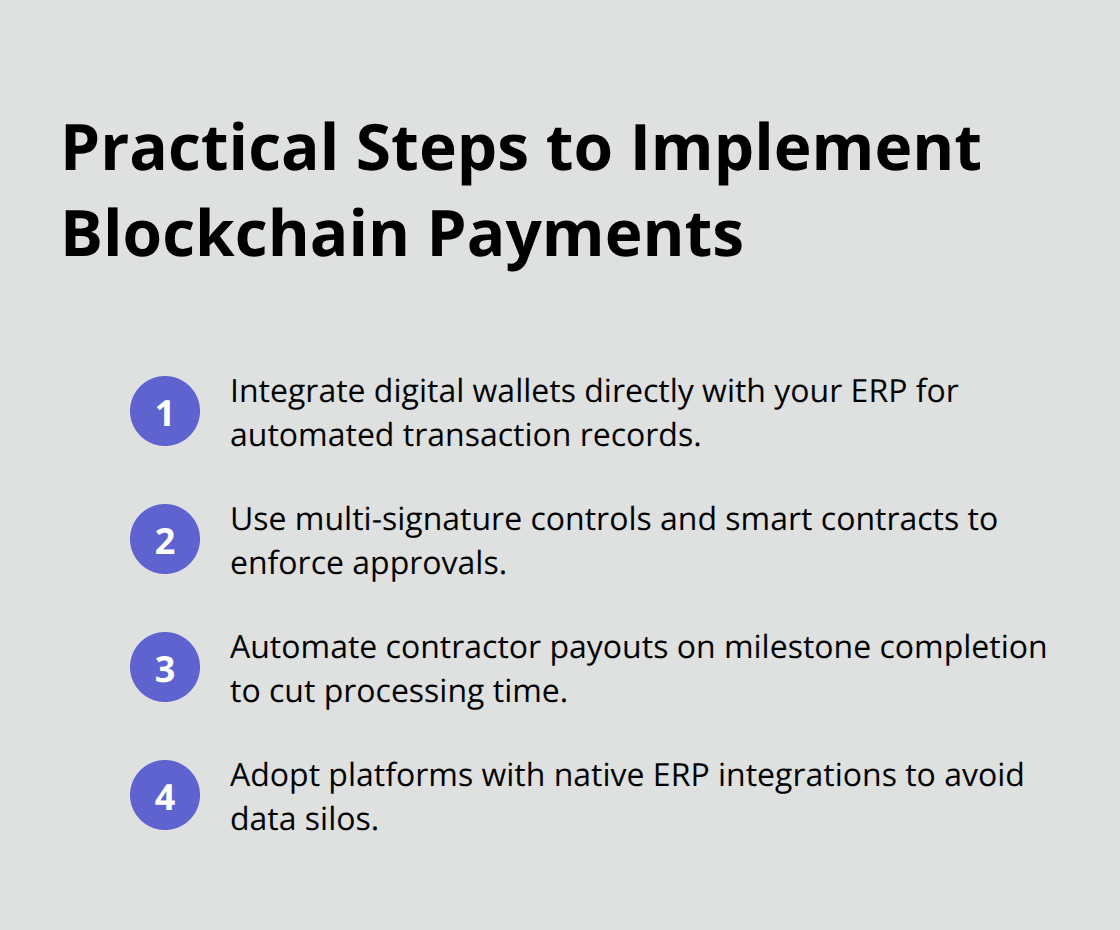

Finance teams must establish digital wallets that connect directly to existing ERP systems rather than run parallel payment processes that create reconciliation nightmares. Companies like Tesla and MicroStrategy maintain corporate treasuries with over $2 billion in digital assets. They integrate blockchain wallets with their SAP and Oracle systems through API connections that automate transaction records.

Your treasury operations require multi-signature wallet security with at least three authorized signatories for transactions above $50,000. Smaller payments can use automated smart contracts that execute based on predefined business rules. This approach eliminates manual approval bottlenecks while maintaining proper financial controls.

Master Multi-Currency Asset Management

Global businesses need stablecoin portfolios that match their international revenue streams instead of convert everything through volatile cryptocurrencies that create unnecessary complexity. The stablecoin market reached $300 billion in September 2025, representing a 75% increase from the previous year, while EURC provides euro-denominated stability for European operations and GBPT serves UK-based transactions.

Your finance team should maintain 60% USD-based stablecoins, 25% EUR equivalents, and 15% in local market currencies based on your revenue distribution patterns. This allocation minimizes conversion costs and reduces exposure to market volatility (particularly important for quarterly financial reporting).

Automate Contractor Payment Workflows

International contractor payments represent the highest-value use case for blockchain implementation. Companies like Shopify process over $1.2 billion annually through digital payment rails that eliminate traditional delays. Smart contracts automatically release payments when contractors submit verified deliverables through project management systems.

This automation reduces processing time from 7-10 business days to under 30 minutes. Your accounts payable team should configure payment schedules that release funds based on milestone completion rather than manual approval workflows. The result eliminates bottlenecks and accelerates critical project timelines while maintaining proper oversight controls.

Scale Operations Through Platform Integration

Enterprise blockchain adoption requires seamless integration with existing business systems rather than standalone solutions that create data silos. Modern platforms transform payment processing without disruption to existing systems, maintaining complete audit trails across all business processes. This integration approach allows finance teams to track digital asset movements alongside traditional accounting workflows.

Your implementation strategy should prioritize platforms that offer native support for existing corporate infrastructure. This ensures blockchain payments become part of standard business operations rather than separate processes that require additional training and oversight.

Final Thoughts

Cross-border finance transformation through blockchain technology delivers measurable competitive advantages that reshape how global businesses operate. Companies that implement blockchain payments reduce transaction costs by 90% while they achieve settlement times under 30 seconds compared to traditional 3-5 day processing cycles. The transparency of immutable ledgers eliminates compliance bottlenecks that typically consume 40-60% of finance team resources.

Strategic enterprise adoption requires integration with existing corporate infrastructure rather than standalone solutions that create operational silos. Finance leaders must prioritize platforms that connect blockchain capabilities directly to ERP systems and maintain proper audit trails across all business processes. Success depends on treasury integration first, then expansion through automated contractor payment workflows that eliminate manual bottlenecks.

We at Web3 Enabler provide seamless blockchain integration that connects digital asset management directly to your existing business systems. Our platform enables businesses to process international payments, track cryptocurrency transactions, and manage cross-border finance operations without separate blockchain tools (eliminating the complexity that typically slows enterprise adoption). Finance teams can evaluate their current payment volumes and identify high-value use cases where blockchain implementation delivers immediate ROI through reduced fees and faster settlement times.