Cross-border payments are broken. Companies still wait days for money to move between countries, pay hidden fees at every step, and struggle with compliance rules that change by jurisdiction.

We at Web3 Enabler see this friction firsthand. International payments in 2026 demand a better approach-one built on blockchain technology, real-time settlement, and systems that actually talk to your enterprise software.

Where Cross-Border Payments Stand Today

The cross-border payments market hit a turning point in 2025, and 2026 consolidates those gains. Blockchain payments are reshaping how enterprises handle settlement. This growth trajectory matters because enterprises no longer experiment with blockchain-they use it for real settlement. Meanwhile, traditional SWIFT infrastructure still dominates volume, but the economics punish organizations that rely on it. A typical SWIFT transfer costs around $25 per side plus a 1% transaction fee and a 2% currency bid-ask spread. Blockchain payments cut that to roughly 0.5% on and off-ramp with pennies in-network fees. For a company moving millions across borders monthly, that difference translates into millions annually.

Market Consolidation Rewards Direct Connections

Fewer players now handle more volume, which means organizations that lack connections to the right rails pay middleman margins. Direct access to domestic payment schemes reduces cost and improves settlement certainty. Financial institutions increasingly connect directly to local schemes rather than routing through correspondent banks, and that shift accelerates in 2026. Organizations that establish these direct connections gain competitive advantage through lower costs and faster settlement times.

Regulation Became a Runway, Not a Roadblock

Regulation stopped being a barrier in 2025 and opened new pathways. The GENIUS Act passed in the US in July 2025, positioning stablecoins as a regulated means of payment and settlement, with final rules expected by July 18, 2026. That deadline gives enterprises a clear path forward. Europe moved faster. The Instant Payments Regulation requires euro-denominated transfers to settle within ten seconds and be priced like standard payments.

Payee verification is now a day-to-day reality for Eurozone banks, and non-eurozone members must receive instant payments by January 9, 2027, and send them by July 9, 2027. ISO 20022 migration has a November 2026 deadline for international payments to use structured or hybrid address formats, improving efficiency, screening, and interoperability. These aren’t soft guidelines-they’re hard dates with real compliance consequences. Organizations that map their cross-border journeys now, prioritizing payee verification readiness and ISO 20022 migration, avoid integration headaches and regulatory friction later. Those that wait face scrambling and operational strain.

Speed Expectations Reshape Competitive Reality

Consumer and enterprise expectations shifted dramatically. About 79% of consumers expect cross-border payments within an hour. Small and mid-sized enterprises demand even faster delivery-76% expect global payments to reach recipients in under an hour. That speed expectation is no longer optional.

It’s table stakes. Companies like Upwork that partnered with blockchain-powered platforms report roughly 80% of global payments are instant and 88% are delivered within 24 hours. Banks that achieve high customer advocacy see tangible gains-roughly 1.7x faster revenue growth and a 17% increase in the number of products held per customer. Speed drives loyalty and revenue. Organizations that embed cross-border payments directly into core finance platforms (connecting to local domestic schemes and reducing intermediary links) preserve working capital and strengthen supplier and employee relationships. The competitive differentiation in 2026 isn’t about having a payments feature. It’s about having instant, transparent, embedded payments that feel native to the systems enterprises already use.

Integration With Enterprise Systems Becomes the Differentiator

For Salesforce customers, this means integrating blockchain payments directly into Financial Services Cloud, Commerce Cloud, or Revenue Cloud so that finance, sales, and operations teams move money and manage global transactions without switching between systems. Web3 Enabler brings this capability natively to Salesforce, enabling organizations to accept and send stablecoin payments while gaining real-time visibility into on-chain transactions for faster reconciliation and enhanced liquidity management. The organizations winning in 2026 treat these integration capabilities as competitive advantages, not add-ons. They connect blockchain settlement directly to their existing workflows, which means the next chapter explores how to actually build these integrations.

How Blockchain and APIs Reshape Enterprise Payment Infrastructure

Blockchain Adoption Reaches Production Scale

Blockchain adoption among financial institutions hit a real inflection point in 2025, and 2026 cements that shift. In 2024, blockchain-based B2B cross-border payments exceeded $4.4 trillion, representing roughly 11% of total B2B cross-border payments. That’s not experimental volume-that’s production settlement. The crypto market capitalization sits around $2.5 trillion and grows roughly 12.5% annually, underpinning sufficient liquidity for enterprises to move real value across borders without counterparty risk. Financial institutions now view stablecoins not as speculative assets but as operational infrastructure. The GENIUS Act in the US and Europe’s Instant Payments Regulation provide the regulatory clarity institutions needed. Stablecoins like USDC and RLUSD offer enterprises a way to settle instantly across borders while maintaining price stability, which matters far more to a treasurer than blockchain ideology.

Real-Time Settlement Eliminates Correspondent Bank Delays

Real-time settlement systems now compete directly against legacy SWIFT infrastructure, and the operational differences matter tremendously. Traditional correspondent banking introduces 3 to 5 intermediary hops per transaction, each adding delay and cost. Blockchain networks settle in minutes regardless of geography. The global blockchain market was valued at over $18 billion in 2023 and is projected to reach $470 billion by 2030, driven by enterprises recognizing that on-chain settlement eliminates correspondent bank delays and reduces total cost of ownership. For a financial institution or enterprise, this means mapping payment corridors to identify which routes benefit most from blockchain settlement-typically high-volume, cross-timezone transfers where speed directly improves working capital.

Native Integration Drives Competitive Advantage

Organizations that embed stablecoin settlement directly into their core finance systems gain immediate advantages: faster liquidity cycles, lower intermediary costs, and real-time visibility into transaction status without waiting for correspondent bank confirmations. API-first platforms integrate this capability directly into enterprise systems rather than forcing teams to manage separate wallets or blockchain interfaces. Organizations that integrate blockchain payments natively into Salesforce Financial Services Cloud, Commerce Cloud, or Revenue Cloud gain instant visibility into transaction status, automatic reconciliation, and compliance controls without switching between systems. Web3 Enabler brings this native integration to Salesforce, enabling organizations to accept and send stablecoin payments while gaining real-time visibility into on-chain transactions for faster reconciliation and enhanced liquidity management. The competitive advantage in 2026 belongs to organizations that treat blockchain settlement as a native capability within their existing software, not as a bolt-on tool that requires manual intervention or separate team expertise. This shift toward embedded payments infrastructure sets the stage for how finance teams actually operationalize these systems at scale.

Where Traditional Cross-Border Payments Still Fail

The Hidden Cost of Correspondent Banking

Organizations that rely on traditional correspondent banking networks face a reality that spreadsheets can’t hide. A single SWIFT transfer costs around $25 per side, plus a 1% transaction fee, plus a 2% currency bid-ask spread. For a mid-market company moving $10 million monthly across borders, that totals roughly $300,000 annually in pure overhead. Those costs hide in different line items-some captured in FX spreads, others buried in correspondent bank fees that nobody fully tracks.

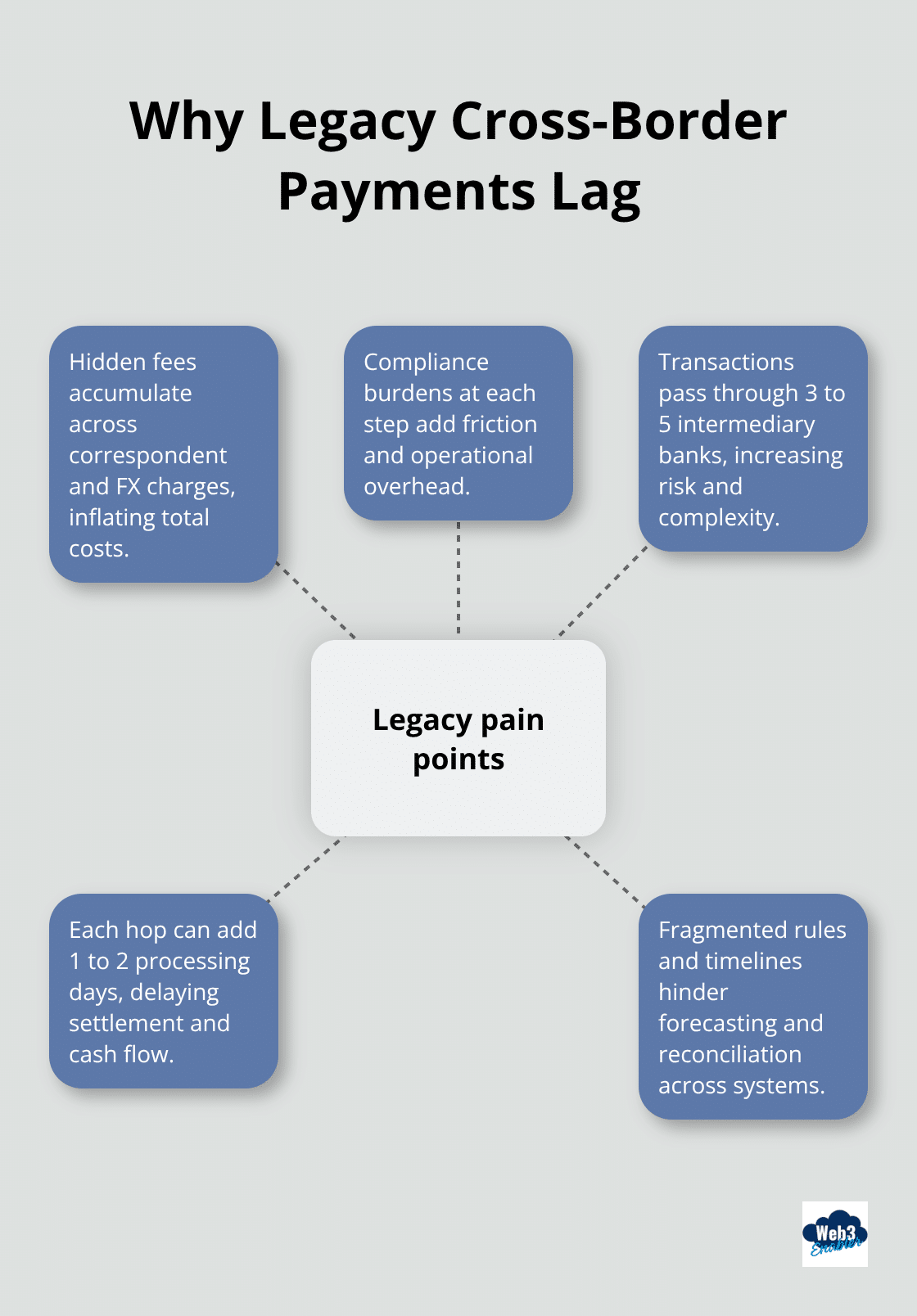

The real problem extends beyond visible fees. Compliance burdens make those fees feel justified, yet they compound the damage. When money crosses borders through traditional rails, it passes through 3 to 5 intermediary banks, each with its own compliance rules and each adding 1 to 2 days of processing time.

Regulatory Fragmentation Kills Liquidity Forecasting

A finance team managing payments across 12 countries faces 12 different regulatory frameworks, 12 different reporting requirements, and 12 different settlement timelines. A payment leaves your account on Tuesday, arrives at the correspondent bank on Wednesday, moves to an intermediary on Thursday, and finally lands in the recipient’s account on Friday-except the recipient’s bank takes another day to clear it. Your treasury team cannot forecast liquidity accurately because they don’t know when money actually settles.

This opacity kills working capital management, especially for SMEs where every day of float matters. Reconciliation becomes a nightmare because transaction status remains opaque across the payment chain. Finance teams waste hours tracking payments through multiple systems, each showing different information at different times.

Mapping Your Costliest Payment Routes

Blockchain payments eliminate most of these friction points, but adoption requires mapping exactly where your organization loses time and money today. Start by auditing your top 20 payment corridors-identify which routes carry the highest volume and longest settlement windows. Then calculate the true cost of each route, including all correspondent fees, FX spreads, and the opportunity cost of delayed settlement.

You’ll likely find that 60% of your volume moves through routes where blockchain settlement would cut costs by half and reduce settlement time to minutes. The compliance complexity doesn’t disappear with blockchain, but it simplifies dramatically when you embed payments directly into your enterprise systems.

Embedding Compliance Into Your Finance Platform

Organizations integrating stablecoin settlement into Salesforce Financial Services Cloud gain real-time visibility into transaction status, automatic compliance logging, and reconciliation that happens instantly rather than days later. That integration matters because compliance teams already work within Salesforce-adding blockchain settlement there means they control risk and oversight without creating parallel systems that eventually diverge. Web3 Enabler brings native blockchain capabilities to Salesforce, enabling your finance and compliance teams to track on-chain transactions, maintain audit trails, and manage regulatory reporting without switching between systems. Your teams gain instant visibility into settlement status, automatic reconciliation, and compliance controls that operate within the CRM environment where they already manage client relationships and financial data.

Final Thoughts

Stablecoins like USDC and RLUSD have moved from experimental assets to operational infrastructure for B2B settlement. Financial institutions now treat them as standard payment rails rather than alternatives, and the regulatory clarity from the GENIUS Act and Europe’s Instant Payments Regulation removed the last barriers to adoption. Organizations that move significant volume across borders in 2026 capture immediate cost and speed advantages by routing transactions through blockchain networks instead of correspondent banking.

Decentralized networks reduce intermediaries in payment chains far more effectively than traditional correspondent banking ever could. Where traditional systems require 3 to 5 hops per transaction, blockchain networks settle directly and cut both intermediaries and the delays they introduce. This shift translates into lower costs, faster settlement, and real-time visibility into transaction status-advantages that compound across high-volume payment corridors.

The competitive advantage in international payments 2026 belongs to organizations that embed blockchain settlement directly into their existing enterprise systems. Finance teams already work within Salesforce Financial Services Cloud, Commerce Cloud, or Revenue Cloud, so adding stablecoin capabilities there means they gain instant visibility into transaction status, automatic reconciliation, and compliance controls without switching between systems. Web3 Enabler brings native blockchain capabilities to Salesforce, enabling your teams to accept and send stablecoin payments while maintaining full auditability and control within the CRM environment where you already manage client relationships and financial data.